[ad_1]

Final week, I tweeted:

I consider the #commodities costs in meals softs $DBA have bottomed. $GLD-well those that know me-that I identified bottomed months in the past. $SLV now outperforming. That tells you one thing. Perhaps even #oil. Prepare for the Commodities Tremendous Cycle.

In case you are not following me @marketminute on twitter, it’s best to take into account doing so, as I typically make such feedback or level out particular trades.

Technically, the charts have been already establishing for a purchase within the particular person grains. We determined to deal with DBA.

Basically, we now have geopolitical points, as we all know. I additionally speak about sugar, which nonetheless rocketing in value, so much. Now climate is turning into an extra issue. I learn at this time that Russia is refusing to promote wheat beneath $275 a ton, which, mixed with failing HRW wheat within the plains and Southwest US and heavy snowpack within the northern plains, means provide may get even tighter.

DBA tracks an index of 10 agricultural commodity futures contracts. It selects contracts based mostly on the form of the futures curve to reduce contango. Particularly, the underlying index contains corn, soybeans, wheat, Kansas Metropolis wheat, sugar, cocoa, espresso, cotton, dwell cattle, feeder cattle, and lean hogs. And there’s a Ok-1 to traders.

Mainly, you get nice publicity to numerous commodities.

Technical Evaluation:

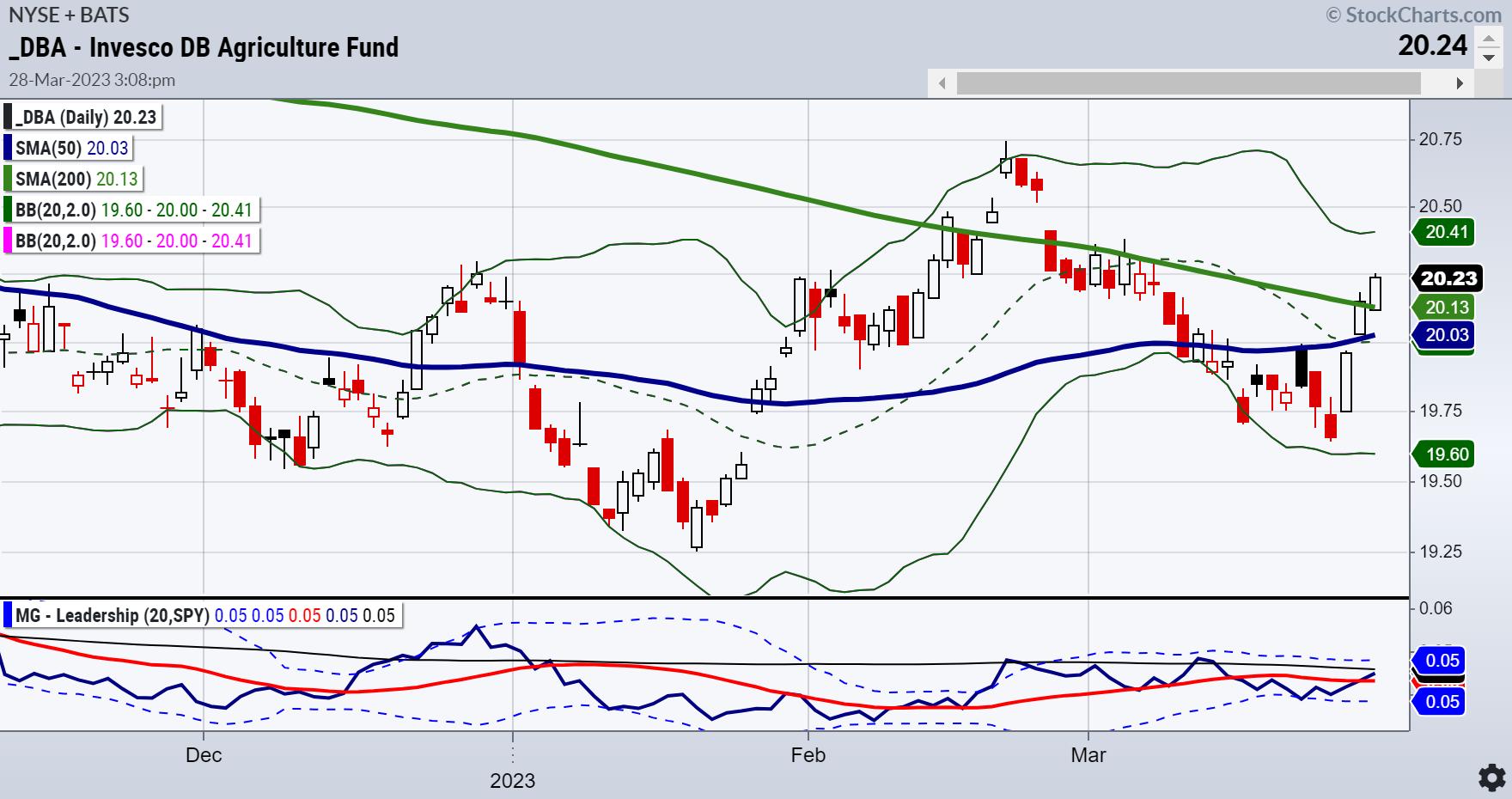

The primary chart reveals the Triple Play Management indicator, or how DBA is performing in opposition to the benchmark.

The value chart of DBA reveals the 200-DMA above the 50-DMA, or an accumulation part based on our six market phases. On Tuesday, the worth cleared the 200-DMA, closing .40% larger. On the Management charts, DBA poke its head out above the benchmark to point out it’s now outperforming the SPY.

The second chart reveals our Actual Movement Indicator or momentum. This is the place issues get actual fascinating.

The 50-DMA is ABOVE the 200-DMA. Momentum is in a bullish part. Moreover, the red-dotted line, or measure of momentum, cleared each MAs and the black horizontal line or zero level. Bullish momentum and a divergence with the worth chart displaying the 50-DMA beneath the 200-DMA.

What does this all imply? Seasonally, we’re coming into the make-or-break time for crops. Inflation-wise, meals costs proceed to escalate. Within the U.Ok., grocery inflation rose once more in March to a report 17.5%.

Disclaimer: We’ve a place.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Advisor, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish talks in search of inventory market alternatives on Enterprise First AM.

Mish discusses lengthy bonds, Silver to Gold and the Greenback on this look on BNN Bloomberg.

Mish sits down with Kristen on Cheddar TV’s closing bell to speak what Gold is saying and extra.

Mish and Dave Keller of StockCharts have a look at long run charts and talk about motion plans on the Thursday, March 17 version of StockCharts TV’s The Closing Bar.

Mish covers present market circumstances strengths and weaknesses on this look on CMC Markets.

Mish sees alternative in Vietnam, is buying and selling SPX as a variety, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole talk about particular inventory suggestions and Fed expectations on TD Ameritrade.

Coming Up:

March thirtieth: Your Each day 5, StockCharts TV

March thirty first: Pageant of Studying Actual Imaginative and prescient “Portfolio Physician”

April 4th: The RoShowPod with Rosanna Prestia

April 24-26: Mish at The Cash Present in Las Vegas

Could 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): Must clear 400 and maintain 390

- Russell 2000 (IWM): 170 held- 180 resistance

- Dow (DIA): 325 couldn’t hold-pivotal

- Nasdaq (QQQ): 305 help 320 resistance

- Regional Banks (KRE): Weekly value motion extra contained in the vary of the final 2 weeks

- Semiconductors (SMH): Comply with by means of on that key reversal decrease w/ 250 help

- Transportation (IYT): 219 is a degree that has been like a yo-yo value

- Biotechnology (IBB): Held key help at 125 area-127.50 resistance

- Retail (XRT): Granny holding 60-still within the game-especially since that’s the January calendar vary low.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has offered monetary info and training to 1000’s of people, in addition to to massive monetary establishments and publications equivalent to Barron’s, Constancy, ILX Programs, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the 12 months for RealVision.

Subscribe to Mish’s Market Minute to be notified each time a brand new submit is added to this weblog!

[ad_2]