[ad_1]

Regardless of the inflow of considerable capital into these new spot Bitcoin ETFs, with CoinShares reporting $1.18 billion in inflows into digital asset ETFs globally final week, the anticipated optimistic impression on Bitcoin’s worth hasn’t materialized. This raises questions concerning the underlying mechanics of those ETFs and their affect on Bitcoin’s worth.

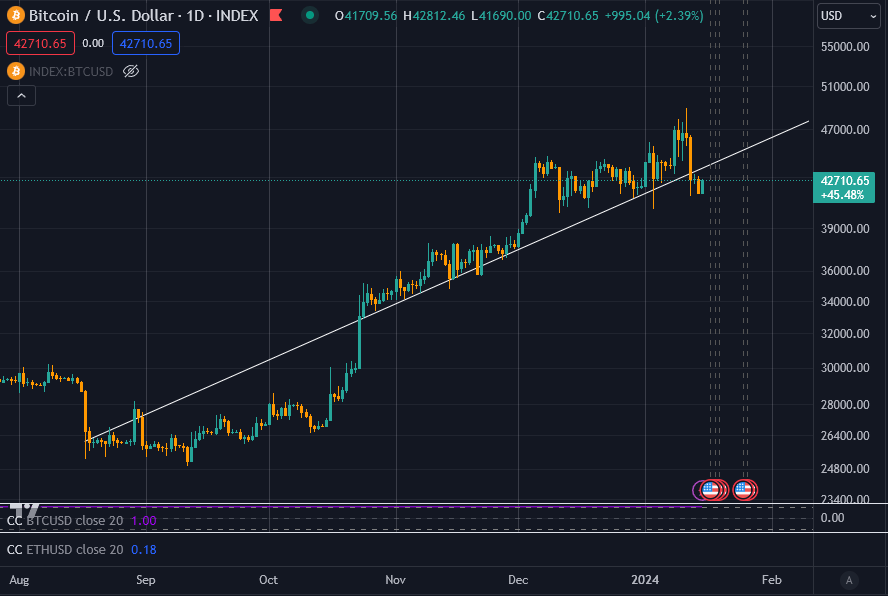

Let’s first guarantee we appropriately body the state of affairs. The latest worth run-up picked up steam when BlackRock introduced their submitting for a spot Bitcoin ETF on June 15, 2023. At the moment, Bitcoin’s worth was round $25,000. Subsequently, there was a 70% enhance to round $42,000, the place it primarily traded sideways.

Because the ETFs launched, Bitcoin spiked to $49,000 however offered off quickly to round $42,000. Trying on the chart, it’s rational to recommend that maybe Bitcoin was overbought at above $44,000 for this level within the cycle.

With that in thoughts, let’s have a look at how Bitcoin purchases work in relation to the spot Bitcoin ETFs that have been just lately sanctioned.

How Bitcoin is valued for ETF functions.

The operation of spot Bitcoin ETFs is extra advanced than it seems. When people purchase or promote shares of an ETF, just like the one provided by BlackRock, Bitcoin just isn’t purchased or offered in actual time. As a substitute, the Bitcoin that represents the shares is bought at the least a day earlier.

The ETF issuer creates shares with money, which is then used to purchase Bitcoin. This oblique mechanism signifies that direct transfers of Bitcoin between ETFs don’t happen. Due to this fact, the impression on Bitcoin’s worth is delayed and doesn’t replicate real-time buying and selling exercise.

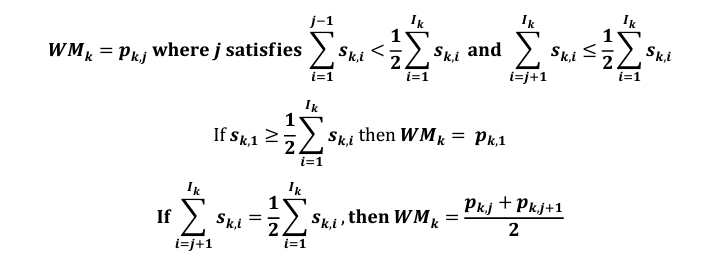

Basically, with an ETF like BlackRock’s, the share worth on any given day is supposed to symbolize the typical worth for Bitcoin throughout customary buying and selling hours, not the dwell worth of Bitcoin at any given time. Most ETFs use ‘The CF Benchmarks Index’ to calculate the worth of Bitcoin for any given day; the CF Benchmarks web site describes it as;

“The CME CF Bitcoin Reference Price (BRR) is a as soon as a day benchmark index worth for Bitcoin that aggregates commerce knowledge from a number of Bitcoin-USD markets operated by main cryptocurrency exchanges.”

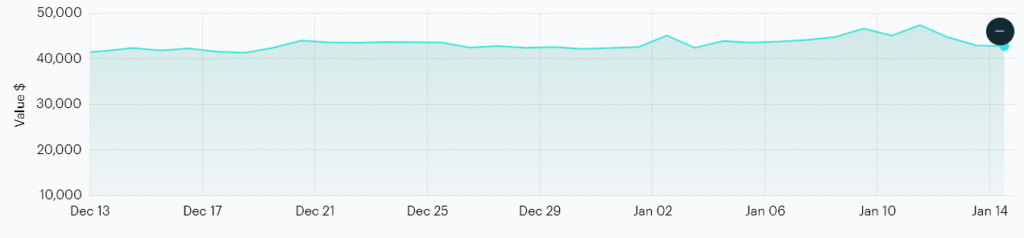

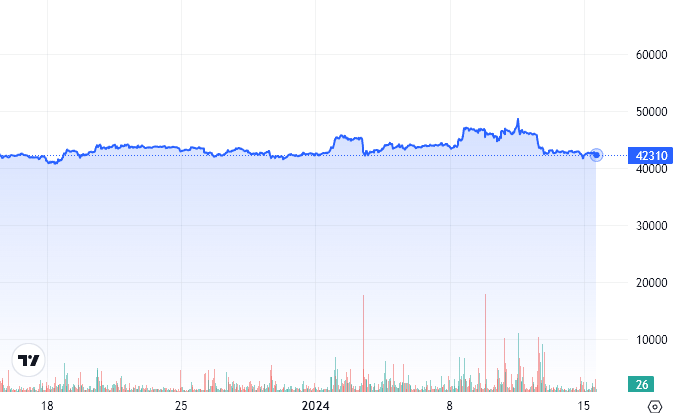

It makes use of a mean worth throughout Bitstamp, Coinbase, Gemini, Itbit, Kraken, and LMAX Digital. In response to CF Benchmarks, that is what the worth of Bitcoin seems like. Discover its latest excessive was $47,525 on Jan. 11.

Right here is similar interval and Y-axis scale utilizing CryptoSlate knowledge on a 1-hour timeframe. As of press time, Bitcoin is price $42,594.27, based on CF Benchmarks, whereas CryptoSlate has it at $42,332.35 in real-time. This implies the spot ETF, which isn’t accessible at the moment as it’s a public vacation within the U.S., is buying and selling at a reduction to identify Bitcoin ETFs.

I’ll be sincere: I didn’t suppose this was what would occur when the ETFs launched. I humbly believed that the ETFs would truly monitor the worth of Bitcoin, and establishments would purchase and promote BTC relative to the traded ETF shares. How improper and naive I used to be.

I learn by means of the S1 filings in depth however didn’t take into account that the underlying Bitcoin can be purchased doubtlessly days later by way of closed-door trades for common costs. I took it as a right that the CF Benchmark Index worth can be a dwell mixture worth. Notably, that does exist, and it’s referred to as the BRTI. Nevertheless, that is solely used for ‘reference’ functions, to not calculate commerce costs.

How Bitcoin will get into an ETF.

That is how Bitcoin is mostly traded throughout the totally different spot Bitcoin ETFs.

Approved Individuals similar to Goldman Sachs, Jane Road, and JPMorgan Securities place their creation orders for baskets of shares with a ‘Switch Agent, Money Custodian, or Prime Execution Agent’ by a set time on any customary enterprise day. That is 2 pm for Grayscale, whereas BlackRock has a 6 pm cut-off time.

Following this, the Sponsor (ETF) is chargeable for figuring out the full basket Web Asset Worth (NAV) and calculating any charges. This course of is usually accomplished as quickly as practicable; for instance, with Grayscale, it’s 4 pm; for BlackRock, it’s 8 pm, New York time. Exact timing right here is important for making certain the correct valuation of the hampers primarily based on the day’s closing market knowledge.

You will have seen phrases similar to T+1 and T+2 floating round regarding ETFs. The time period “T+1” or “T+2” refers back to the settlement dates for these transactions. “T” stands for the transaction date, the day the order is positioned. “T+1” means the transaction shall be settled the subsequent enterprise day after the order is positioned, whereas “T+2” signifies settlement occurring two days later.

With the spot Bitcoin ETFs, a liquidity supplier transfers the full basket quantity in Bitcoin to the Belief’s vault stability on both the T+1 or T+2 date, relying on the precise prospectus. This reportedly ensures the transaction aligns with customary monetary market practices for settling trades.

The execution and settlement of the Bitcoin buy and its switch into the Belief’s buying and selling pockets sometimes occur on T+1, not when the ETF shares are bought.

OTC Buying and selling and its implications

A vital facet of this mechanism is the Over-The-Counter (OTC) buying and selling concerned. Trades are performed between institutional gamers in a non-public setting, away from public exchanges. Whereas indirectly influencing market costs, these transactions set a precedent for trade costs.

Suppose establishments, similar to BlackRock, agree on a lower cost for Bitcoin throughout these OTC trades. In that case, it could not directly affect the market worth if that info turns into accessible to the general public or market makers. It doesn’t, nonetheless, have an effect on the dwell worth of Bitcoin as these trades aren’t added to the worldwide mixed order e-book. They’re primarily peer-to-peer non-public trades.

Additional, primarily based on the CF Benchmark Index pricing methodology, if Bitcoin have been to commerce at, say, $42,000 all day however then rally into near $50,000 within the closing minutes of the day, the CF index worth would doubtless be nicely beneath the present spot worth relying on quantity (and different difficult calculations made by CF Benchmarks.)

This may then imply the NAV can be calculated primarily based on a lower cost than the spot worth, and any creations or redemptions for the next day would happen OTC, aiming to be as near NAV as doable.

Any market makers who’ve entry to those OTC desk trades are then unlikely to need to commerce Bitcoin on the present spot worth of $50,000, doubtlessly eradicating liquidity at these increased costs and thus bringing the spot worth again consistent with the NAV of the ETFs. Within the quick time period, the ETF NAVs may play a way more important position in defining the spot Bitcoin worth and, due to this fact, cut back volatility towards a smoother common worth.

Nevertheless, these trades should nonetheless happen on the blockchain, necessitating the switch of Bitcoin between wallets. This motion, particularly amongst institutional wallets, will turn out to be more and more important for market evaluation.

For instance, Coinbase Prime’s scorching pockets facilitates trades, whereas establishments’ chilly storage wallets are used for longer-term holding and may be analyzed on platforms like Arkham Intelligence.

I imagine the extra clear these OTC trades can turn out to be, the higher for all market members. Nevertheless, the visibility of those actions is at the moment considerably opaque, one thing the SEC seemingly believes is ‘greatest’ for buyers.

[ad_2]