[ad_1]

It’s been 5 months because the Terra ecosystem collapsed as tens of billions of {dollars} in worth disappeared from the crypto financial system in a matter of days after Could 7. Terra’s new Phoenix blockchain managed to restart the ecosystem to some extent and because the finish of June, Terra’s whole worth locked (TVL) in decentralized finance (defi) has elevated from $350,174 to immediately’s $41.55 million.

A Take a look at Terra’s Blockchain Ecosystem Over the Final 5 Months Because the Collapse

The Terra ecosystem fallout was a darkish day for the crypto neighborhood when Terra’s stablecoin terrausd (UST), now generally known as UST traditional (USTC), depegged from the token’s $1 parity. Earlier than the collapse, Terra’s luna, now generally known as luna traditional (LUNC) was a prime ten crypto asset by market capitalization and Terra’s stablecoin additionally held a prime ten place. Previous to the fallout, luna held the seventh place when it comes to crypto market caps, and on April 28, Terra’s native crypto asset was buying and selling for $88 per coin.

Exactly in the future earlier than Terra’s stablecoin depegged, USTC made it into the highest ten crypto asset positions by market capitalization. Moreover, when it comes to TVL in defi, Terra had the second largest TVL underneath Ethereum (ETH) with roughly $29.29 billion held on April 29, 2022. In the present day is a very totally different story and the Terra ecosystem is a shell of what it was once 5 months in the past.

As an example, LUNC is buying and selling for lower than a U.S. penny at $0.00025948 per unit which is quite a bit decrease than the $88 per coin recorded on April 28, and far decrease than the coin’s all-time excessive at $119 per unit recorded two week’s prior. By way of the brand new Terra Phoenix blockchain’s native asset which now leverages the identify luna (LUNA), it’s down 86.2% decrease than the $18.87 all-time excessive recorded 5 months in the past. The Terra Phoenix chain’s defi TVL, nonetheless, has seen development over the last 5 months because it has swelled by 12,151% because the finish of June.

At the moment, the TVL was $350,174 and since then it has grown to $41.55 million. Whereas the Terra traditional chain held $29.29 billion final April, it’s now slightly below $10 million immediately at roughly $9,493,635. Whereas Astroport and Terraswap have roughly $3.5 million, the defi lending protocol Anchor has round $1.6 million.

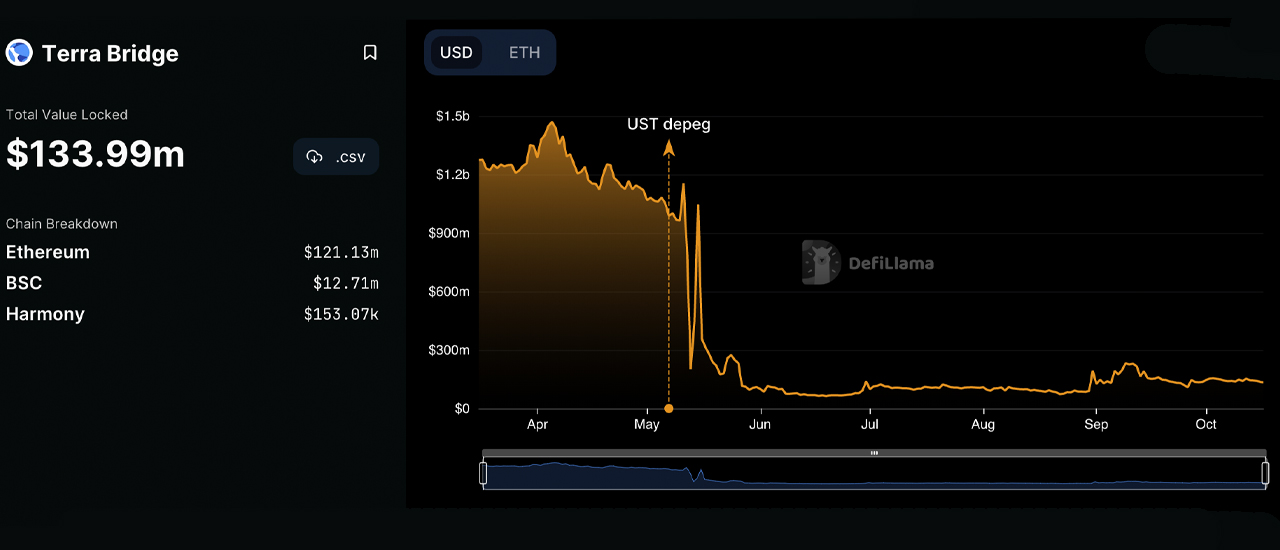

On the Phoenix chain, when it comes to TVL held in defi, the decentralized change (dex) app Astroport holds round $27.55 million, adopted by Threat Harbor’s $14.76 million. Stader, Spectrum Protocol, and Eris Protocol observe Astroport and Threat Harbor respectively when it comes to TVL statistics. Moreover, whereas the Terra Bridge as soon as held $1.4 billion in the course of the first week of April, immediately the Terra Bridge holds round $132 million in worth.

By way of non-fungible token gross sales, the brand new Terra chain’s gross sales knowledge just isn’t documented in addition to the traditional chain’s NFT gross sales earlier than the collapse. Regardless of the extraordinarily low variety of gross sales, Terra Phoenix chain is supported by greater than a half dozen NFT marketplaces. By way of the overall worth between the 2 native cash LUNC and LUNA, Terra’s blockchain belongings between the traditional and Phoenix chain is roughly $2.18 billion on October 16, 2022, at 3:00 p.m. (ET).

Terraclassicusd (USTC) is buying and selling for greater than a U.S. penny immediately, at $0.03 per unit on October 16, 2022, with a market valuation of round $378.49 million. The statistics present that not less than for immediately, the crypto market values USTC, LUNA, and LUNC at roughly $2.558 billion, and all three of those crypto belongings are included into the TVL held on each chains.

Whereas $2.558 billion is quite a bit for a blockchain ecosystem that collapsed, it’s nonetheless a shell of the $49.26 billion in worth LUNC and USTC was once price previous to the blockchain’s fallout on Could 7, 2022. In reality, the USD worth of LUNA, LUNC, and USTC immediately is 94.82% lower than LUNC’s and USTC’s U.S. greenback worth earlier than Terra’s market crash.

What do you concentrate on the present state of Terra blockchain ecosystem 5 months after the stablecoin depegging incident and the traditional ecosystem’s collapse? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]