[ad_1]

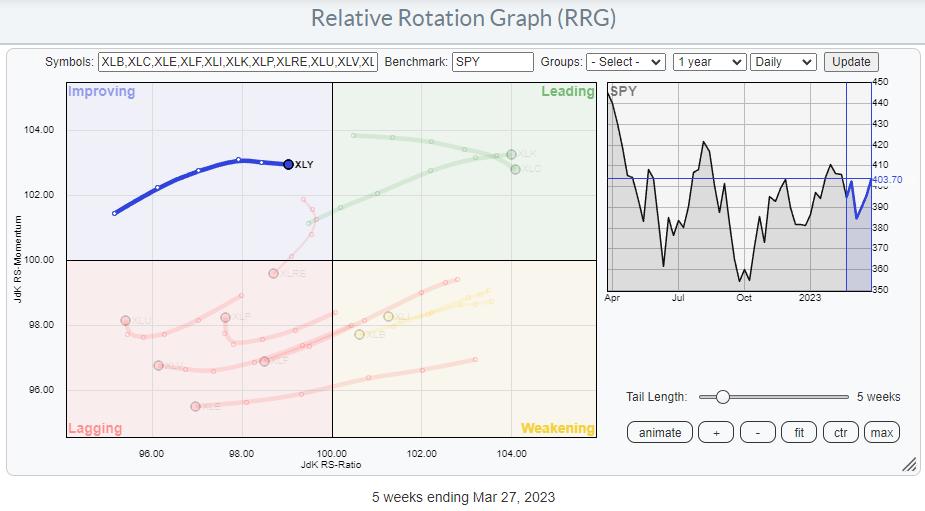

On the weekly RRG, the tail for XLY, Client Discretionary, is contained in the bettering quadrant and heading at an RRG-Heading of roughly 90 levels. Not ultimate; Someplace between 0-90 is stronger because it signifies that the development continues to be choosing up velocity, however not unsuitable both.

With solely two sectors contained in the main quadrant, XLK and XLC, it is smart to see if we are able to determine the subsequent main sector. Client Discretionary appears to be a great candidate.

Drilling into particular person shares

Once we dive into the members of the Client Discretionary sector and use XLY because the benchmark, an fascinating picture exhibits up. Not considered one of these particular person shares is positioned contained in the main quadrant. That is due to the sturdy rotation of TSLA just lately, which is pushing all different shares in the wrong way.

This distortion might be prevented by switching to RCD, the equal-weight sector ETF for the Discretionary sector.

On this RRG, you may see a way more evenly unfold universe. I’ve zoomed in to visualise higher the rotations which push TSLA off the grid, however we all know the place it’s.

this picture, fairly quickly, a number of thrilling tails might be recognized. These are highlighted within the RRG under.

Inside LEADING: MGM, LEN, NVR, ULTA, TSCO

Inside IMPROVING: TSLA, AMZN, F, CMG, GM, HLT, MAR

Inside LAGGING: MCD, ORLY, DRI

Going over the charts of those firms, these three popped up as notably fascinating.

ULTA – ULTA BEauty Inc.

After breaking out of its vary in the direction of the top of 2022, ULTA began transferring in a pleasant rising channel and this week managed to take out its earlier excessive. This confirms the energy of the underlying development, as it’s seen within the collection of upper highs and better lows.

The current break of resistance is a transfer into uncharted territory, opening up way more upside potential for ULTA. On the similar time, the draw back is nicely protected by the earlier resistance stage round 530 and the rising assist line that marks the channel’s decrease boundary barely under that 530 space.

The RS line and the RRG-Strains within the chart above use RCD because the benchmark, identical to on the RRG. The steady relative uptrend and the current flip again up in each the JdK RS-Ratio and RS-Momentum strains counsel a brand new up-leg on this relative development is underway.

AMZN – Amazon.com

THE largest inventory contained in the Client Discretionary sector is Amazon at virtually 25%. So it’s secure to say that “When Amazon strikes, the sector strikes.”

Wanting on the chart above, we are able to see how Amazon actually halved in worth from 180 again in November 2021 to 80 on the finish of 2022. The uncooked relative energy for AMZN towards RCD has already began transferring in a downtrend for the reason that begin of 2021.

This resulted within the RS-Ratio line remaining under 100 for over two years. The value decline appears to have halted after the low set in December, and enhancements are beginning to develop into seen from that trough.

A primary larger low is now in place round 90, and the chart is now pushing for a break above double resistance supplied by the horizontal stage that strains up a number of highs and lows going again so far as 2018 and the falling resistance line that runs over the worth peaks since late 2021.

A break above 103-105 can be a major sign, confirming that the downtrend has ended and signaling the beginning of a brand new uptrend. It should undoubtedly assist the uncooked RS-Line to show round and get again into its, nonetheless, barely falling channel and transfer to the higher boundary of that channel.

When Amazon turns round, that may very possible even be a driver for the additional motion of the S&P 500.

MCD – McDonald’s Corp

The third chart is for MCD. Though the tail continues to be contained in the lagging quadrant, it has made a pleasant flip again up and into an RRG-Heading between 0-90 levels.

These rotations into a powerful RRG-heading are at all times an indication of energy, no matter which quadrant they happen. However what makes this one additional fascinating is the break of worth to new highs, new All-Time-Highs, into uncharted territory.

In October 2022, MCD pushed above horizontal resistance round 260, however shortly after that break began to maneuver in a barely down-sloping vary whereas utilizing 260, the previous breakout stage, as assist.

These weeks’ bounce above the higher boundary of that consolidation and above the earlier highs at 278 is signaling a brand new section on this uptrend. There is no such thing as a overhead resistance anymore, and the draw back is protected across the 270 space, the place the previous higher boundary of the buying and selling vary can now be anticipated to supply assist.

Total, it’s fascinating to see that the Client Discretionary sector is displaying a mixture of shares which are both, very near, breaking to new all-time highs or near finishing very giant basing patterns after extended downtrends. Each are sturdy contributors to general inventory market well being once they materialize.

#StayAlert and have an important weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll definitely learn them and, the place moderately doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra

Subscribe to RRG Charts to be notified each time a brand new publish is added to this weblog!

[ad_2]