[ad_1]

That is an opinion editorial by Wilbrrr Fallacious, a Bitcoin pleb and financial historical past fanatic.

On this article, I describe my expertise in utilizing bitcoin-collateralized loans, of the kind provided by Holdhodl or Unchained Capital. I employed these loans in the course of the bull run of 2020-2021, utilizing some basic guidelines of thumb, nevertheless lately I’ve made a examine which exhibits that they may very well be used with larger security if a extra systematic method is put in place.

I will make the caveat on the outset that my observe could be criticized as failing to “keep humble.” Actually many pundits would advise in opposition to these concepts, for instance on this “As soon as Bitten” episode with Andy Edstrom.

I’ve had a longstanding curiosity in the usage of modest quantities of leverage in monetary methods, and these concepts are offered solely to doc my expertise, and the way it may have been improved.

Motivations

The primary motivation for this technique got here from the wonderful e-book “When Cash Dies,” which particulars the step-by-step means of how Germany spiraled into hyperinflation in 1920-1923. One hanging story from this era is that many Germans turned wealthy, whereas the forex and nation have been going by means of hell. These traders took out deutschmark loans, and used them to purchase laborious property like actual property. Then after one to 2 years, they might repay their loans with deutschmarks that had turn out to be almost nugatory, and they might nonetheless be in possession of the true factor — a home, for instance.

The second motivation got here from desirous about Treasury administration methods. Managing a bitcoin stack appears analogous to the problems that Saudi Arabia faces, with their oil sources. Specifically — they’ve a beneficial useful resource, they usually have bills. They wish to use their sources to maximise their buying energy, and construct wealth for the long run. In fact, Saudi Arabia has different geopolitical issues as nicely, however typically, that is the problem confronted by any household workplace or wealth supervisor.

Earlier Expertise

I used the “deutschmark mortgage” technique to good impact within the bull market of 2020-2021, nevertheless I used to be not systematic. I went with subjective judgment for when to take out loans, and the way to measurement them. I had the overall guiding ideas:

- When initiating a brand new mortgage, attempt to preserve complete portfolio loan-to-value at 20%. In different phrases, attempt to preserve the USD worth of the mortgage e-book at 20% of the USD worth of the bitcoin that I had allotted to this technique. On this case, I’d have the ability to stand up to a 50% drawdown in BTC value.

- Strive to not promote. I had fairly nicely drank the Kool-Support that BTC would attain $200,000-plus, and I didn’t wish to get shaken out.

All loans have been bitcoin collateralized loans, of the kind provided by Hodlhodl or Unchained Capital. A primary function of those loans is that they get liquidated if the bitcoin backing the loans falls in worth — basically a margin mortgage. For instance: in case you take out a $50,000 mortgage, then you should over-collateralize, and put up $100,000 price of bitcoin. If the worth of the bitcoin falls to $70,000, then you definitely’re required to publish further BTC, or your collateral can be liquidated.

I did fairly nicely with these concepts. I survived the Elon/dogecoin drawdown, and held on for the This fall 2021 bull run. However then I held on too lengthy within the 2022 Federal Reserve-induced bear market. Following this expertise, I made a decision to check whether or not a extra systematic method would have improved draw back safety, whereas additionally permitting my stack to develop over time.

The Systematic Technique

With this modified technique, I performed a back-test over 2019-2021 which launched strict pointers for taking out new loans, and downsizing current balances. I selected pointers comparatively much like my 2020 technique, however with extra self-discipline. I began out with a loan-to-value (LTV) of 20%. For instance, with a take a look at BTC stack price $100,000, then the preliminary mortgage can be for $20,000, which might be used to buy extra BTC.

As soon as the mortgage is established, then my take a look at screens whether or not the BTC value falls. On this case, then LTV rises. Persevering with the earlier instance, if the worth of the bitcoin stack falls to $80,000, then LTV rises to 25%. (The mortgage worth of $20k is now divided by the up to date $80k worth of the stack.)

If LTV rises too excessive, then the take a look at liquidates some portion of the mortgage. In my research, I selected 30% as this degree. If LTV hits this degree, then it sells some BTC to repay a portion of the mortgage. On this method, I do not wish to over-react to momentary swings throughout a risky bull market, so I’d promote sufficient bitcoin to carry LTV again right down to 25%.

On the alternative aspect, if the BTC value rises, then LTV will fall. With the earlier instance: If the bitcoin stack rises to $120,000, then LTV is now 16.7% — the $20k mortgage is now divided by $120k. If LTV falls to fifteen%, then the technique decides that it’s protected to take out a brand new mortgage, and produce LTV again as much as 20%.

It ought to be famous that the actually troublesome a part of this technique is having the self-discipline to promote when LTV reaches 30%. All of us undergo from hopium, so an iron will is required to implement the suggestions spit out by a pc script.

Actual World Frictions

A private pet peeve is quantitative methods which look nice on paper, however which disintegrate when you account for actual world points like transaction prices, processing delays and taxes. With this in thoughts, I wrote a python script to back-test the systematic mortgage portfolio, and embrace the next results:

- Origination Charge. That is sometimes 1%. For instance, in case you apply for a $100,000 mortgage, then you’ll obtain $99,000 into your checking account.

- Processing Time. I set this at 14 days. The time from the mortgage utility till the time you get the USD or USDT. 14 days could also be too conservative, however it units a flooring for technique efficiency — you’re sometimes taking out new loans when the value is pumping.

- Taxes. That is the half that basically makes it painful to promote bitcoin when LTV rises. Nevertheless, BTC tax therapy permits for HIFO therapy — Highest In, First Out. This could reduce taxes paid — you rely your gross sales in opposition to the very best value you paid.

- Curiosity Charge. I set this excessive at 11%, which I’ve discovered to be typical for these loans.

- Sale Time. I had a someday sale time guesstimate. For instance, if LTV goes larger than 30%, then I will promote some bitcoin and produce my LTV again down inside someday. My expertise has been that the method of promoting BTC, and getting the USD with a wire switch might be carried out inside a day.

- Rollovers. All loans are assumed to have 12 month maturities. If a mortgage reaches its finish, then will probably be rolled over. The USD measurement of the mortgage will enhance so as to add the origination price for the brand new mortgage.

- Curiosity Bills. When taking out a brand new mortgage, I maintain again all wanted curiosity bills for the present and following quarter, for all loans. BTC is bought with the remaining quantity.

Information

Each day information got here from Coinmetrics. They’ve put quite a lot of thought into their numbers, and have carried out analysis to eradicate wash buying and selling. Their each day reference price additionally takes a time-weighted common over the hour main as much as the New York market shut. This time weighting is an effective proxy for slippage — while you purchase or promote, you by no means notice precisely the value listed proper on the shut. Their methodology is described right here, particularly beginning on the backside of web page seven, “Calculation Algorithm.”

The one drawback with Coinmetrics was that their low value for bitcoin in March 2020 was $4,993. I had a recollection of a cheaper price throughout that crash. Due to this, I additionally took some Yahoo! information, which confirmed $4,106 intraday, as an extra stress take a look at for the technique. With each units of information, the technique survived the stress and carried out nicely.

Outcomes

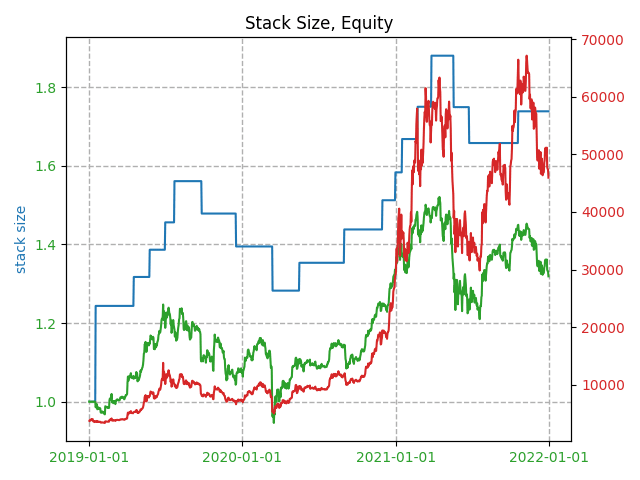

With all of the previous preamble, the outcomes got here out nicely, as proven within the graph:

A proof of the outcomes:

- The blue line is the dimensions of the stack. It begins at 1, and grows to about 1.75 by the top of 2021.

- The pink line is the bitcoin value, plotted with linear coordinates slightly than the standard log plot.

- The inexperienced line exhibits the fairness place — the worth of the BTC stack, minus the mortgage steadiness. That is proven in BTC phrases, in opposition to the left axis.

It is a promising consequence, because it exhibits that, over 2019-2021, this systematic technique may have been used to develop a BTC stack by about 32%, with conservative draw back safety.

The opposite constructive final result is that the technique dealt with market stress nicely, in March of 2020 and Might 2021. In each instances it maintained good collateral protection, and didn’t come near compelled liquidation. Even with the Yahoo! information exhibiting the decrease intraday degree, collateral protection by no means went under 240% within the excessive March 20 2020 occasion. Typical mortgage liquidation phrases are round 130-150%.

A destructive consequence was that the fairness place quickly fell under one in March 2020, to 0.96 BTC earlier than recovering. So the again take a look at confirmed that this technique, whereas conservative, does bear danger, and doesn’t current a “free lunch.”

Conclusions And Additional Work

This text particulars my earlier utilization of bitcoin collateralized loans, and the way it may have been improved with a extra disciplined method. Going ahead, I’ll experiment with completely different parameters within the technique, whereas guarding in opposition to overfitting to a particular time interval. I’ve additionally carried out preliminary work on including residing bills into the back-test, to finish the whole wealth administration image. The ultimate final result is extremely delicate to residing bills, so prudence is required. No Lamborghinis.

From a 30,000-foot view, the primary takeaway is that the approaching years will function great volatility, in addition to alternative for many who can steadiness optimism with self-discipline and conservatism. Nothing on this article is funding recommendation! Do your personal analysis, and take private duty to coronary heart. My private aim can be to proceed and enhance these mortgage methods, and to take calculated danger to be able to make it previous the good debt reset with as many sats as doable.

It is a visitor publish by Wilbrrr Fallacious. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]