[ad_1]

Macro Overview

Recap of essential occasions, week commencing Oct. 10

As CryptSslate attended Bitcoin Amsterdam, there was no weekly MacroSlate report for the week commencing Oct. 10. Key macro subjects that occurred have been;

On Oct. 13, the U.S. CPI inflation report confirmed a worrying leap in costs excluding meals and vitality for September, pushing the ten-year treasury to a excessive of 4.08%.

Whereas Oct. 14 noticed the U.Okay expertise U-turn after U-turn on fiscal coverage. BOE jumbo-sized gilt purchases have been finalized, which stabilized yields. This leaves Japan as the one G7 central financial institution nonetheless supporting its authorities debt, whereas the ten-year treasury was above 25 bps and the yen in opposition to the greenback saved making contemporary highs.

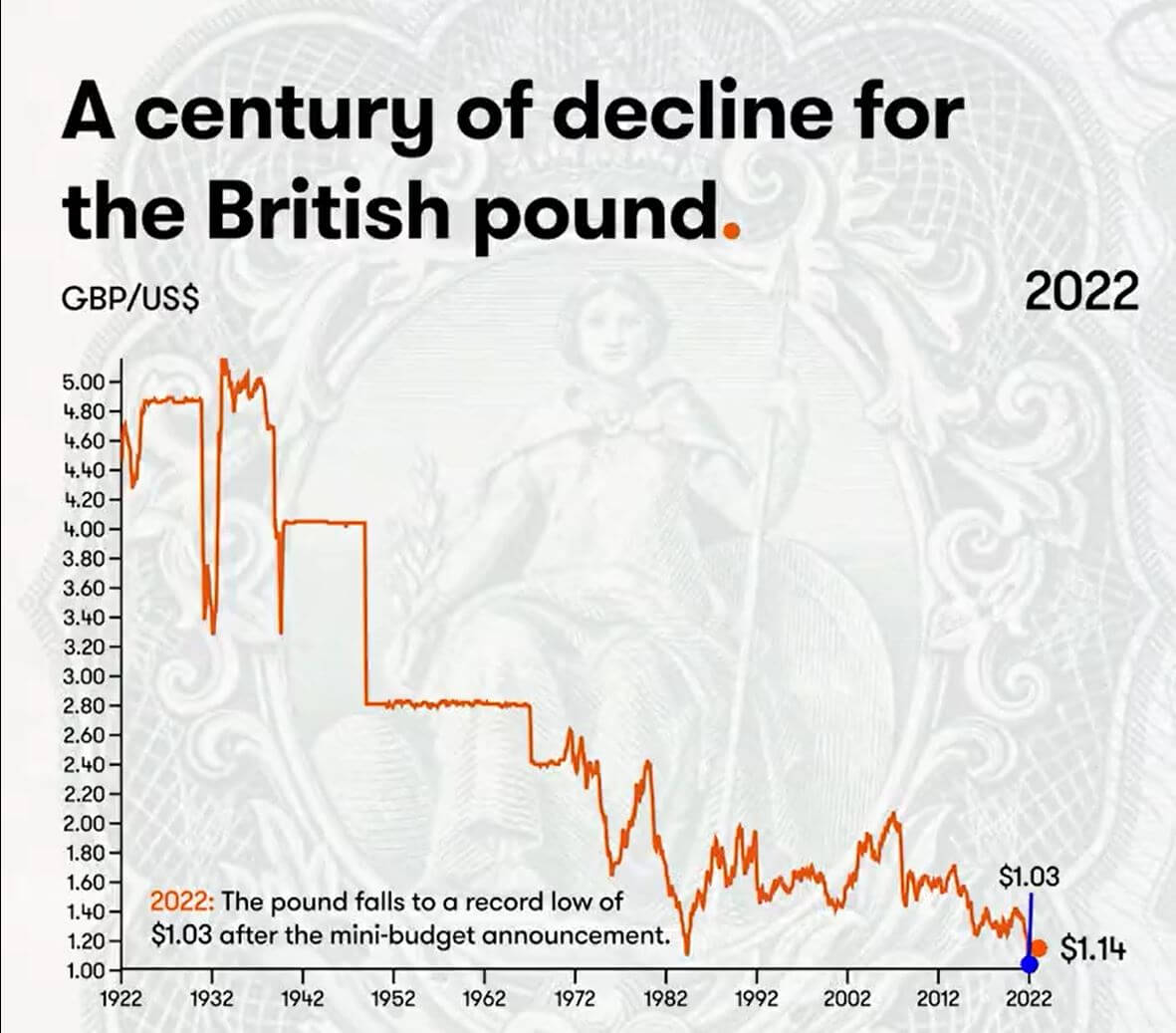

A century of decline for the British pound

The yr 2022 has seen new lows for the British pound, with a authorities in disarray, the gilt market unstable, and the BOE appearing as a backstop. The affect of poor financial and monetary coverage selections as its long-term bond yields convulsed and threatened the solvency of over-leveraged pension funds.

Nevertheless, many buyers imagine this can be a cycle, and the pound will return. If it’s low cost to purchase, buyers will purchase it. Nevertheless, this might not be the case; the U.Okay. is dealing with acute vitality shortages and minimal fx reserves to defend the foreign money.

The final century has seen an enormous decline within the British pound, and it doesn’t appear like it’ll get higher quickly.

Since the united statesdollar got here into existence in 1791, the free market price was $4.55 to £1. Quick ahead to 1925, and the pound has been sliding down in opposition to the greenback.

- 1925 – Winston Churchill returns sterling to the gold customary on the pre-war price of $4.86.

- 1931 – The sterling comes off the gold customary, and the pound drops significantly. £1 is equal to $3.28.

- 1940 – Sterling drops with the outbreak of WWII. The British authorities pegs the worth at £1 to $4.03.

- 1949 – The British authorities devalues the pound to $2.80 to help exports and rebalance the financial system.

- 1967 – An financial disaster strikes. The British authorities devalues the pound to $2.40

- 1976 – Excessive unemployment and inflation pressured Britain to request an IMF mortgage. Sterling is allowed to drift.

- 1985 – Ronald Regan’s tax cuts boosted the united stateseconomy and led to immense greenback energy.

- 1992 – the U.Okay exits the Trade Fee Mechanism, and the pound drops to $1.48.

- 2001 – The pound falls to $1.40 after the dot-com bubble.

- 2008 – International monetary crash sees the greenback act as a haven foreign money.

- 2016 – Brexit referendum sees the pound fall to $1.23.

- 2022 – The pound falls to a document low of $1.03 after the mini-budget announcement.

(In case you are curious, from 1861 – 1864, the £ surge to $~9 was US cash fleeing the Civil Warfare.)

Correlations

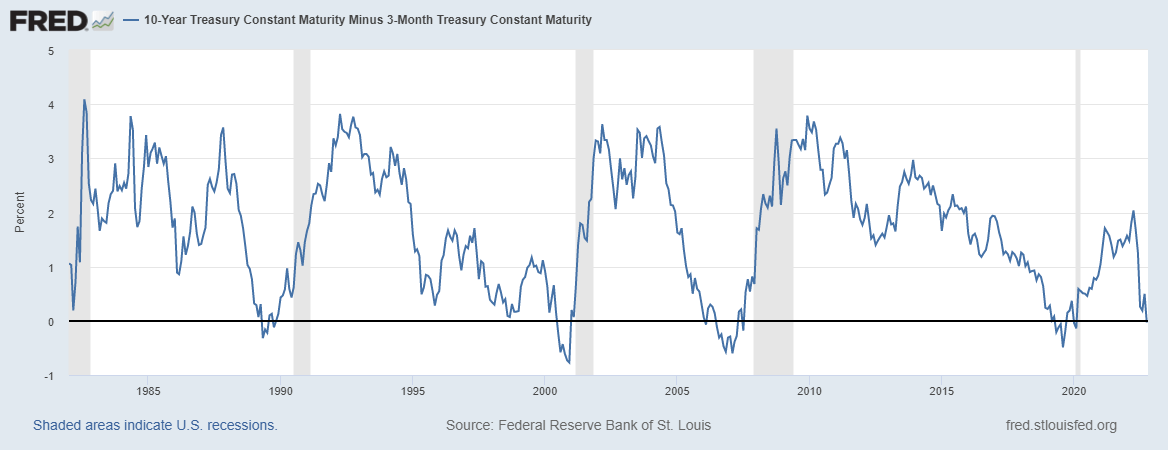

10 Yr minus three-month treasury inverts has preceded each recession since WWII

When the 10-year and 2-year treasury word unfold inverts, it’s usually thought of a warning of extreme financial weak point; In distinction, when the credit score spreads widen throughout occasions of economic stress, the flight to safe-haven belongings such because the DXY, or the fast want for greenback redemptions to satisfy funds.

The ten- year-three month unfold inverted on Oct. 18, at the moment at -0.03bps, as many economists imagine that is the correct recession sign. The inversion of every yield curve has presaged each recession going again greater than 40 years, and a recession often happens throughout the subsequent six-twelve months.

Equities & Volatility Gauge

The Normal and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 giant corporations listed on exchanges in the US. S&P 500 3,753 2.14% (5D)

The Nasdaq Inventory Market is an American inventory trade based mostly in New York Metropolis. It’s ranked second on the record of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Trade. NASDAQ 11,310 2.48% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Traders use the VIX to measure the extent of threat, worry, or stress out there when making funding selections. VIX 30 -8.33% (5D)

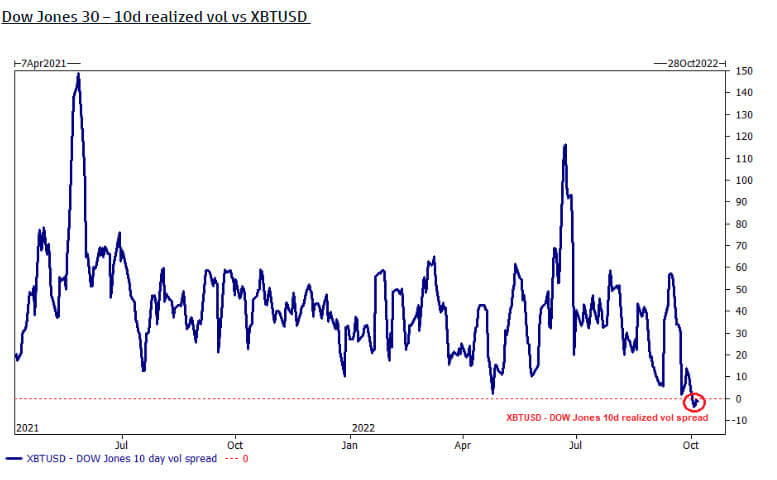

Bitcoin is much less risky than the Dow Jones

The Dow Jones (30 largest industrial shares) is formally extra risky than Bitcoin, in line with the ten-day realized vol unfold. Nevertheless, it is because Bitcoin over Q3 has stayed comparatively flat when it comes to USD value.

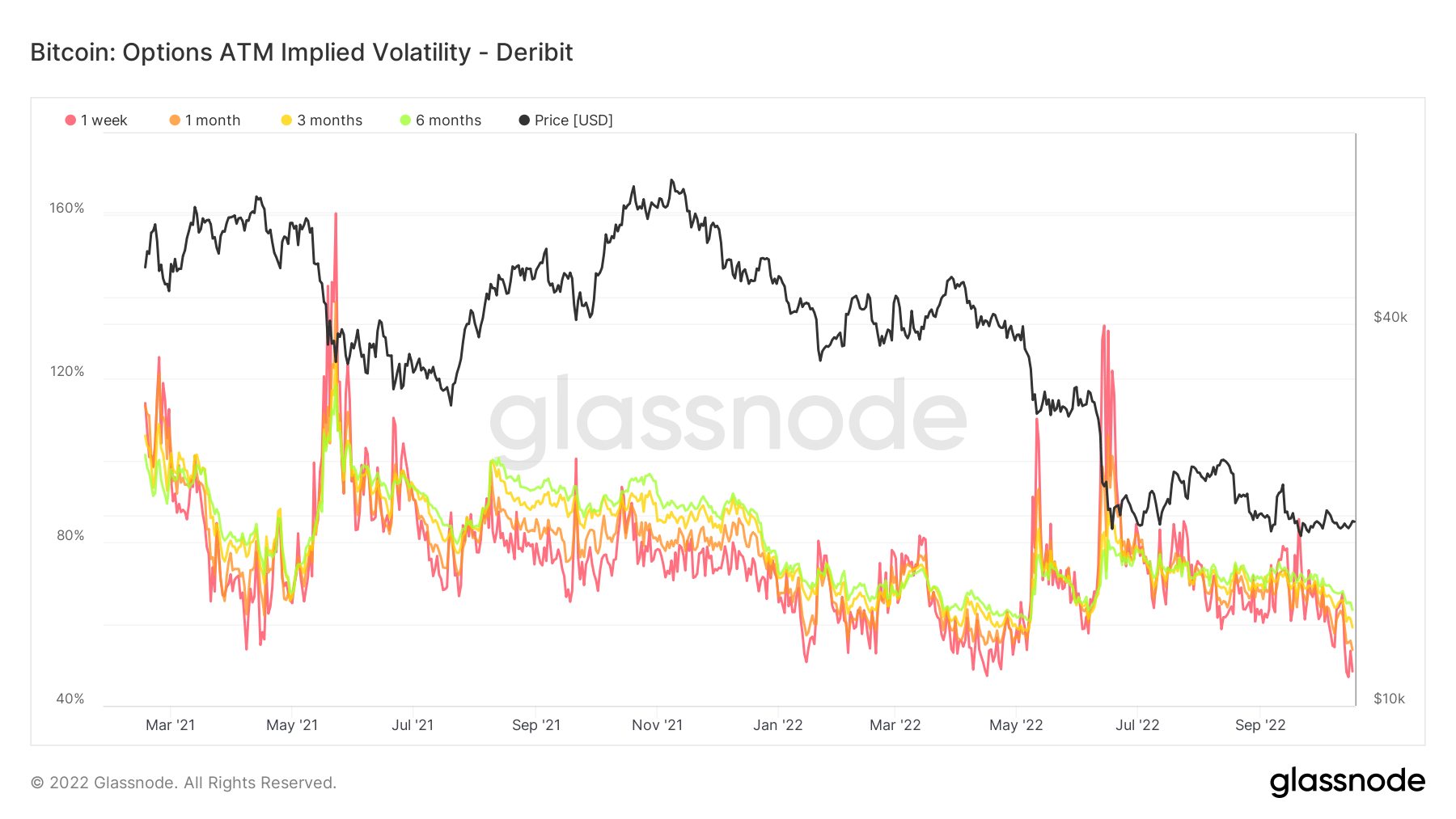

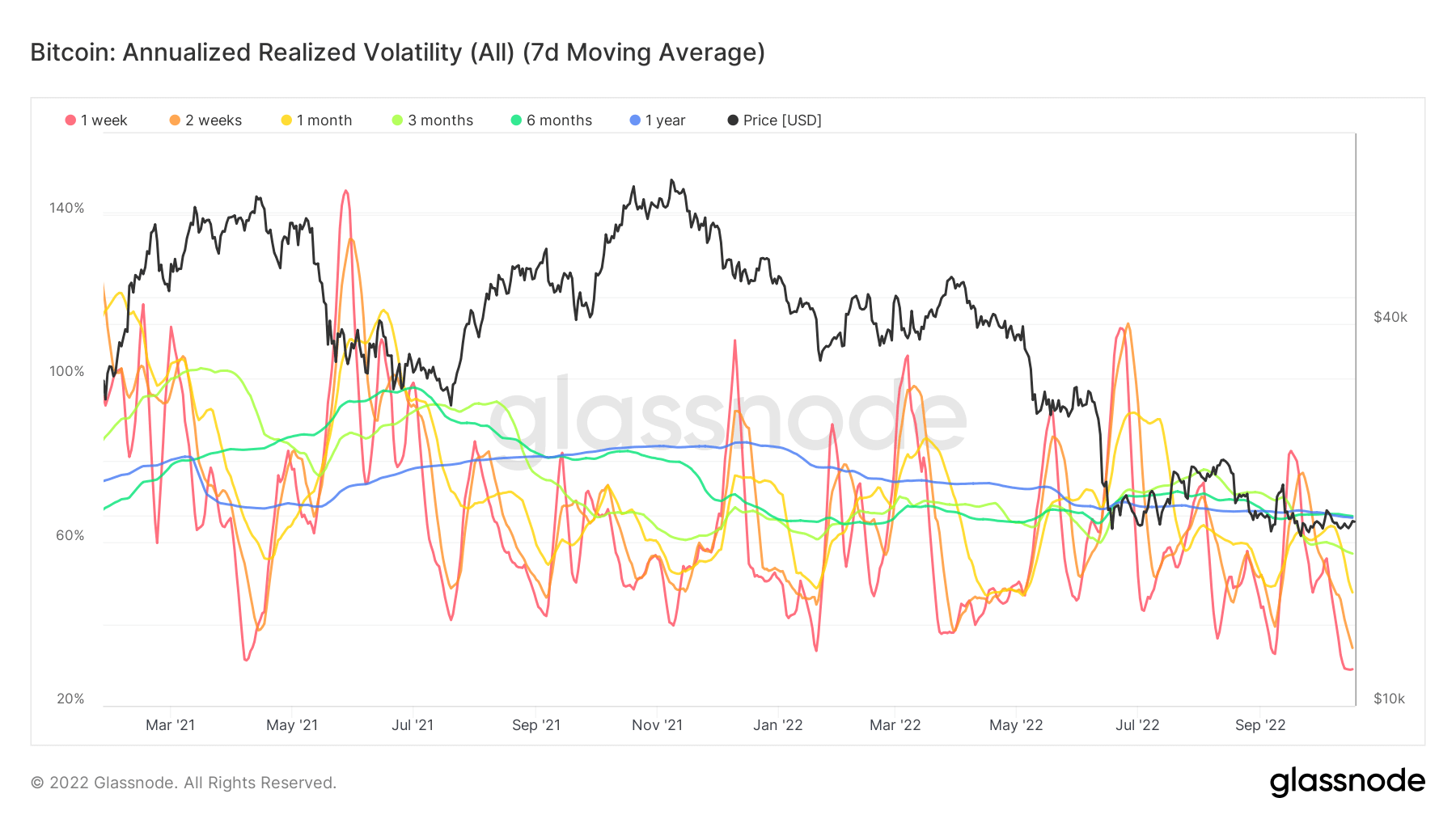

Bitcoin volatility at year-to-date lows

On-chain analytics reveals the annualized realized volatility at an all-time low, slightly below 50% this week. Since March 2021, choices implied volatility has been underneath 50% 4 occasions and has seen violent swings in value shortly after.

Whereas implied volatility refers back to the market’s evaluation of future volatility, realized volatility measures what occurred prior to now. Insinuating that volatility has been at extraordinarily low ranges is encouraging, whereas conventional monetary belongings and currencies are as risky as they arrive.

Commodities

The demand for gold is set by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the will to carry gold as a hedge in opposition to inflation and foreign money devaluation, all assist drive the worth of the valuable metallic. Gold Value $1,658 0.61% (5D)

Just like most commodities, the silver value is set by hypothesis and provide and demand. It is usually affected by market situations (giant merchants or buyers and quick promoting), industrial, industrial, and shopper demand, hedge in opposition to monetary stress, and gold costs. Silver Value $19 5.52% (5D)

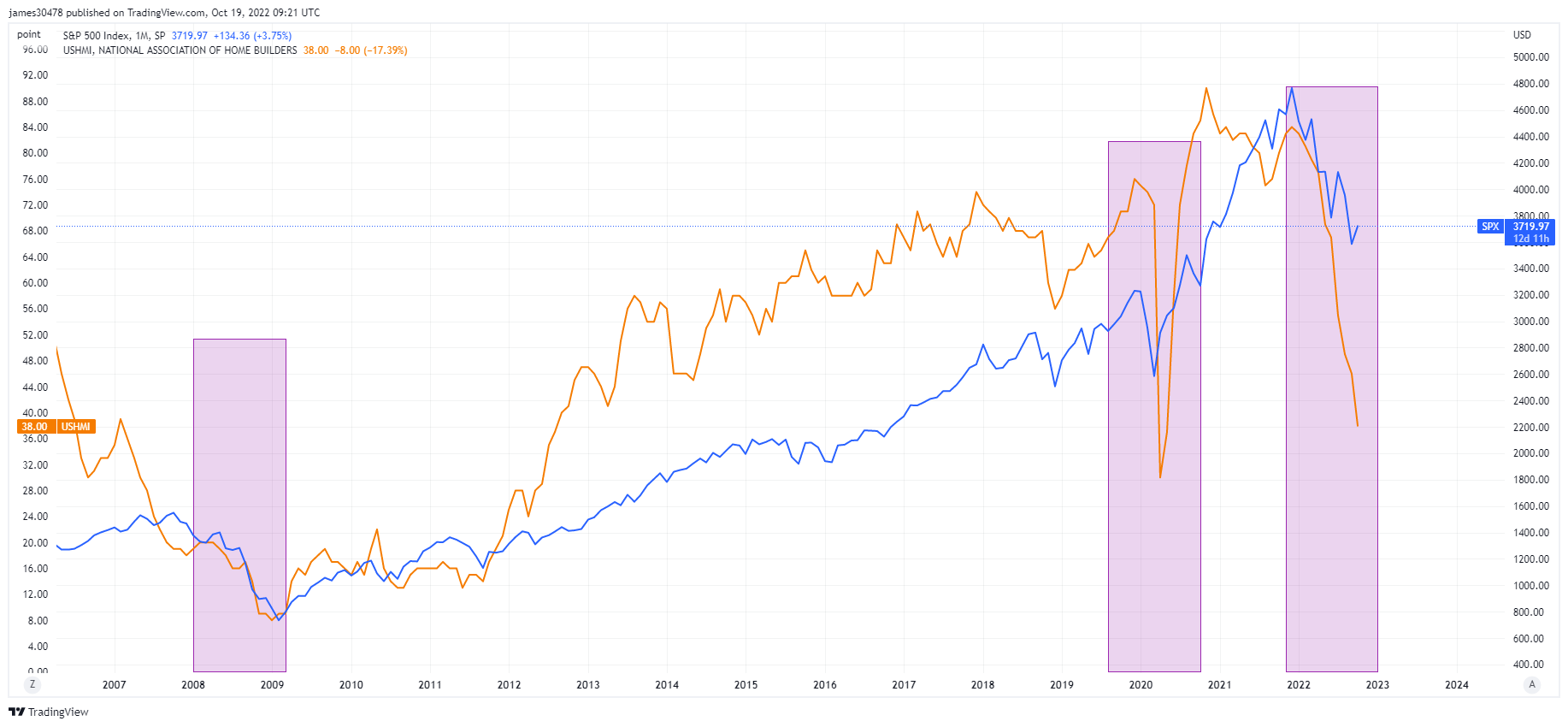

U.S. homebuilders’ sentiment hits a brand new low

The Nationwide Affiliation of Home Builders, housing market index sank one other 8 factors to 38 in October, going again to lows final seen in 2012, simply after the GFC restoration. Mortgage charges approaching 7% have considerably weakened demand.

Overlaying the NAHB and S&P 500, with the previous two recessions in 2008 and 2020, doesn’t bode properly for what’s coming on the finish of this yr and into 2023; equities might proceed to plunge additional to the draw back if the pattern continues to be your good friend.

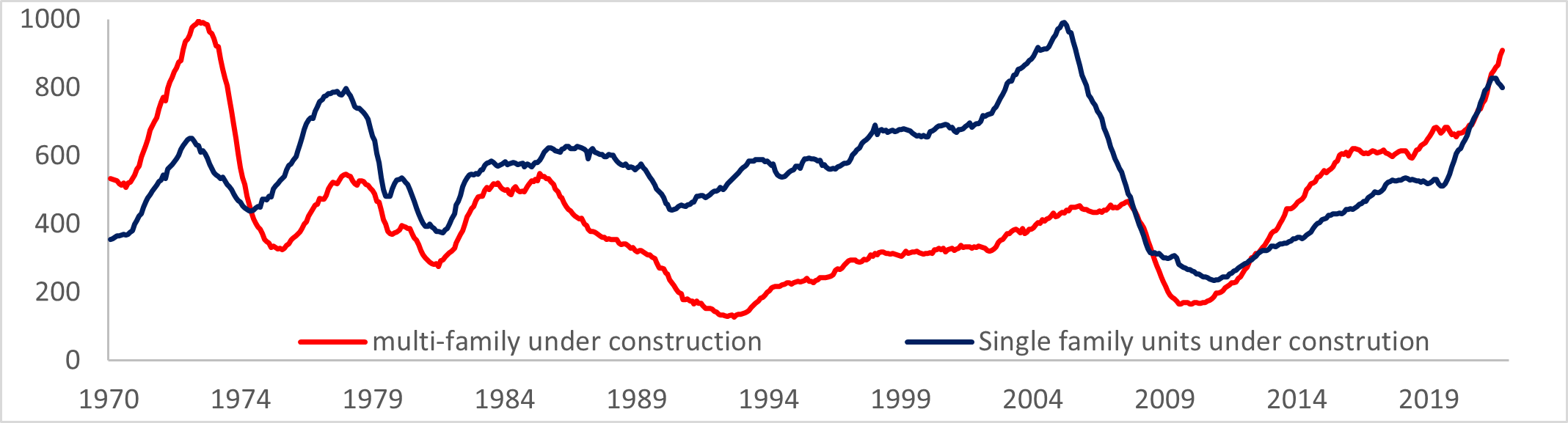

U.S. Building constructing an even bigger drawback

Based on MBA, the common 30- yr mortgage price rose 6.92%, and mortgage functions for residence purchases fell significantly, virtually 4%.

Improve in permits following continued sturdy demand for rental items, whereas single-home household permits declined to the bottom because the pandemic. Extra items are at the moment underneath development than at any time since 1974; this doesn’t appear to bode properly for multifamily development.

Charges & Forex

The ten-year Treasury word is a debt obligation issued by the US authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury word pays curiosity at a set price as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 4.221% 4.95% (5D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign currency echange. DXY 111.875 -1.12% (5D)

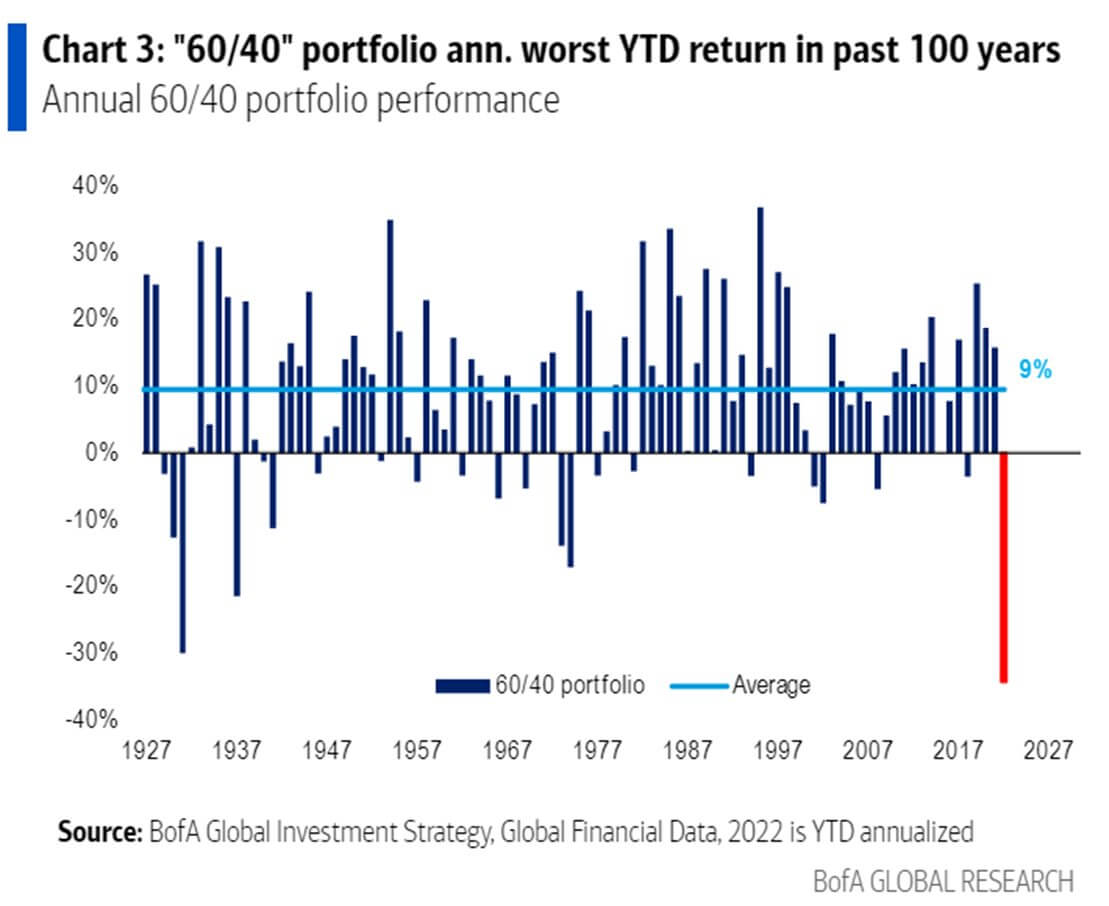

Unparalleled strikes within the fixed-income market

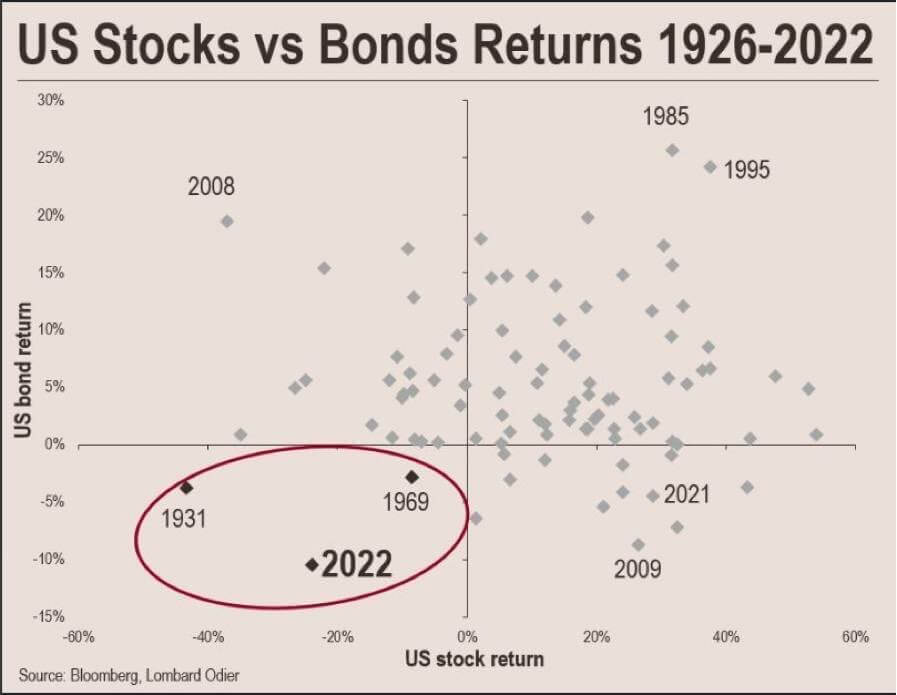

2022 has been an unprecedented yr for asset efficiency; the 60/40 portfolio yr up to now is the more severe efficiency in 100 years, in line with BofA, even worse than the worldwide despair of 1929.

Up to now, in 2022, the united statesstock and bond market has misplaced a mixed worth of practically $60 trillion. The final time the U.S. markets confronted a drawdown of this severity, the U.S. authorities defaulted its gold peg throughout the subsequent two years.

In 1933, govt order 6102 required all individuals to ship gold bullion to the Federal Reserve for $20.67 per troy ounce. The ushad been on a gold customary since 1879, however the Nice Melancholy within the Thirties frightened the general public into hoarding gold.

Second, in 1971, through the Nixon shock, President Nixon closed the gold window 1971, the convertibility of U.S {dollars} into gold, to deal with the nation’s inflation drawback and to discourage overseas governments from redeeming extra {dollars} for gold.

Bitcoin Overview

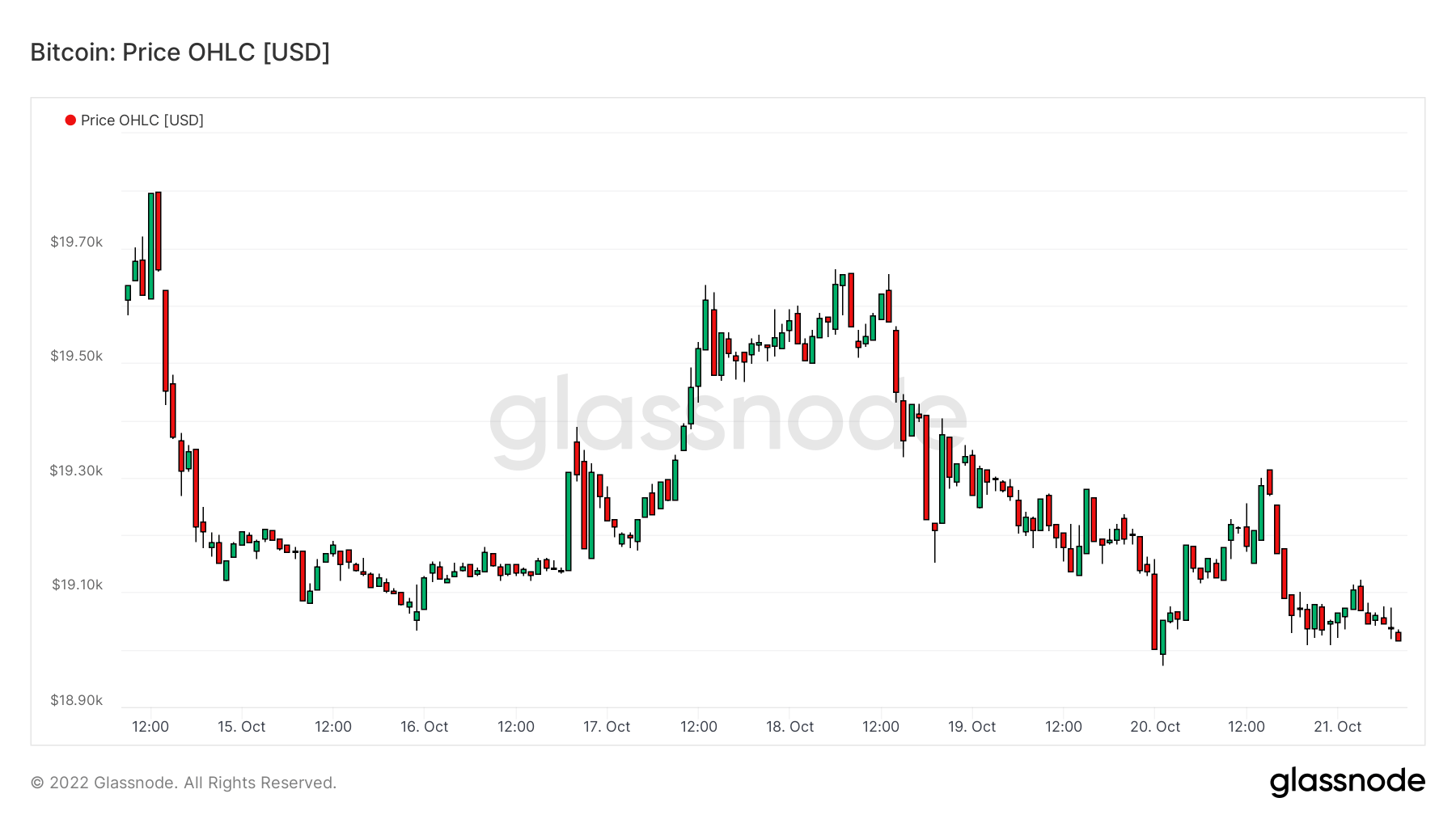

The value of Bitcoin (BTC) in USD. Bitcoin Value $19,160 -1.93% (5D)

The measure of Bitcoin’s complete market cap in opposition to the bigger cryptocurrency market cap. Bitcoin Dominance 41.93% 0.36% (5D)

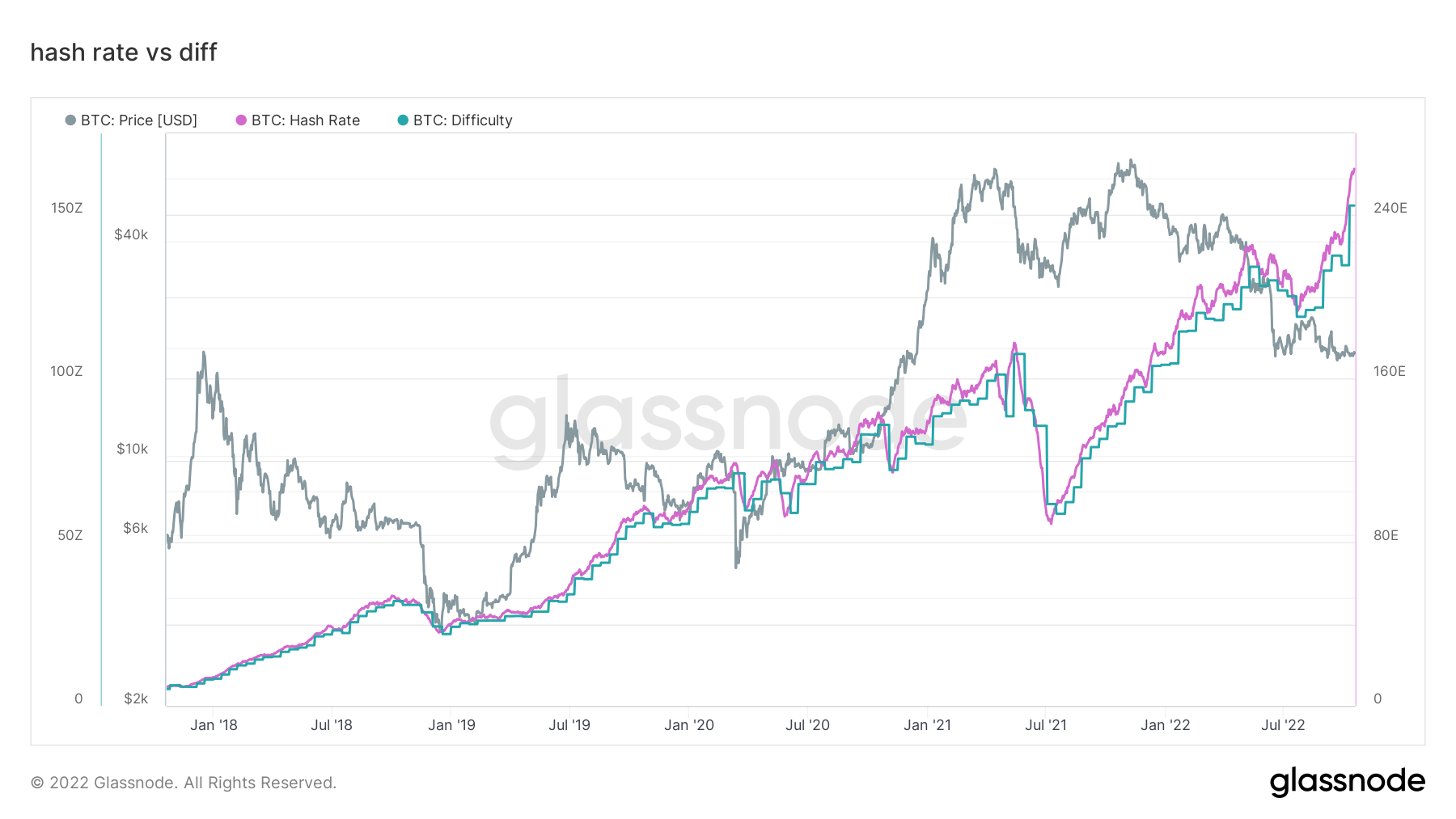

- Bitcoin hash price continued to soar – 260 EH/S

- Futures open curiosity denominated in BTC hits 650k

- Issue projected to extend by 3%

- Asia commerce premium at its highest because the final bear market in 2019-2020

Addresses

Assortment of core deal with metrics for the community.

The variety of distinctive addresses that have been lively within the community both as a sender or receiver. Solely addresses that have been lively in profitable transactions are counted. Lively Addresses 889,323 3.64% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 406,205 1.97% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 908,988 0.40% (5D)

The variety of distinctive addresses holding at the least 1k BTC. Addresses with Steadiness ≤ 1k BTC 2,128 0.52% (5D)

Internet accumulation for the primary time since July

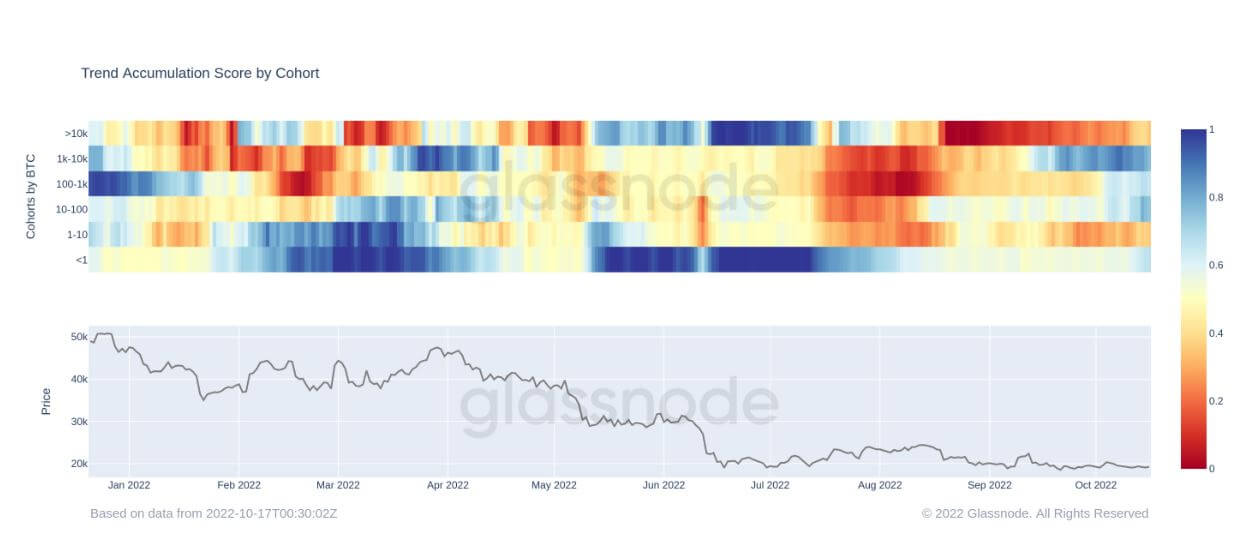

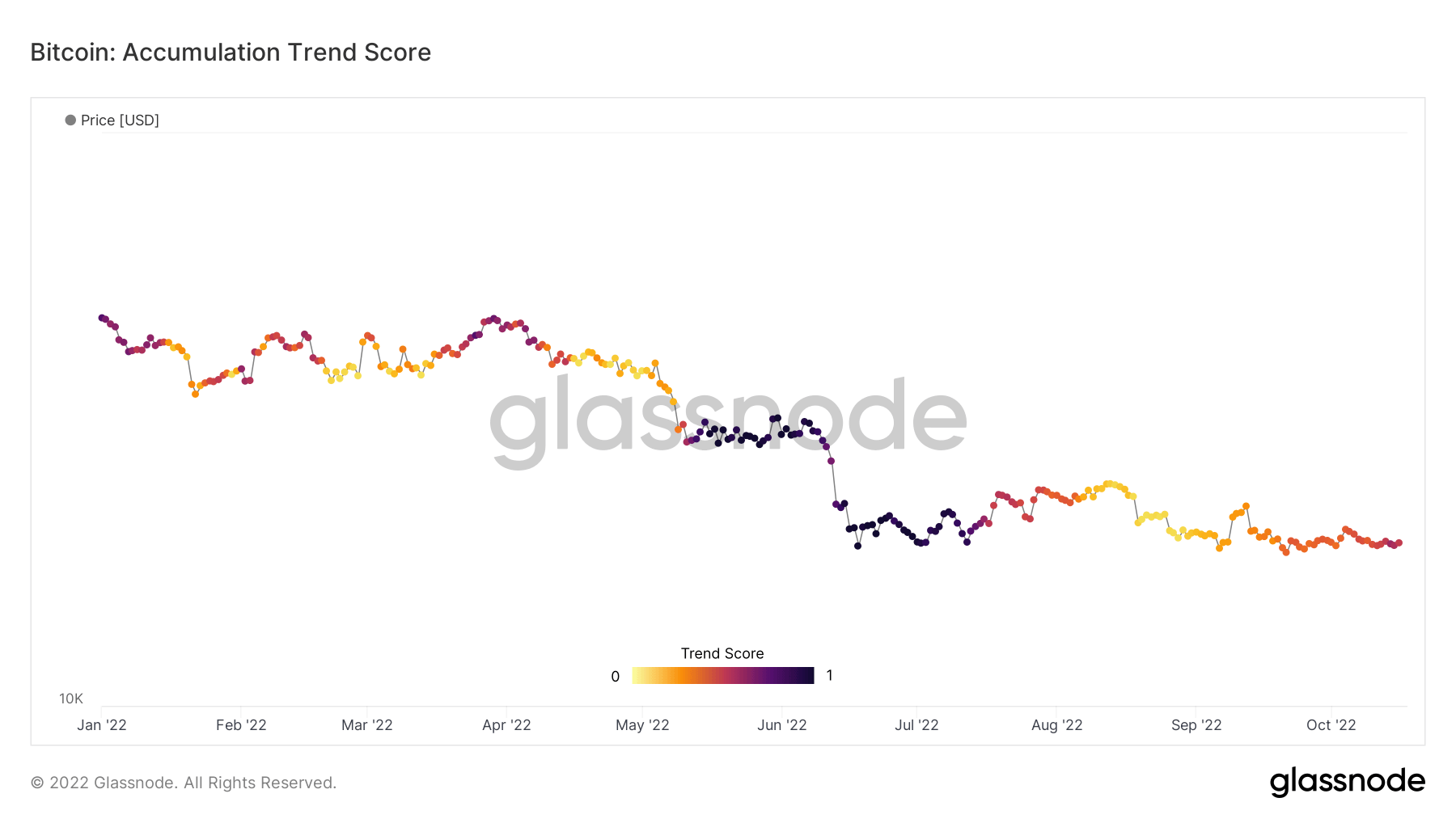

The Accumulation Pattern Rating is an indicator that displays the relative dimension of entities which might be actively accumulating cash on-chain when it comes to their BTC holdings. The dimensions of the Accumulation Pattern Rating represents each the scale of the entities steadiness (their participation rating) and the quantity of latest cash they’ve acquired/offered over the past month (their steadiness change rating).

An Accumulation Pattern Rating of nearer to 1 signifies that, on mixture, bigger entities (or a giant a part of the community) are accumulating, and a price extra relative to 0 means they’re distributing or not accumulating. This gives perception into the steadiness dimension of market contributors and their accumulation conduct over the past month.

For the reason that starting of August, the Bitcoin ecosystem has seen internet distributors as a result of worry across the macro uncertainty with conventional finance belongings getting hammered. Nevertheless, since then, BTC has stayed comparatively flat, hovering across the $20k mark, which has been encouraging to see and has more than likely alerted wall road that this asset is right here to remain.

By trying on the cohorts beneath, quite a lot of them are accumulating once more, comparable to whales between 1k-10k BTC and retail with lower than 1 BTC. Whales that maintain 10k BTC or extra are nonetheless internet sellers however have changed into extra of an orange than a purple, which reveals their distribution is being lowered and fewer promoting strain has occurred.

Dervatives

A spinoff is a contract between two events which derives its worth/value from an underlying asset. The most typical kinds of derivatives are futures, choices and swaps. It’s a monetary instrument which derives its worth/value from the underlying belongings.

The overall quantity of funds (USD Worth) allotted in open futures contracts. Futures Open Curiosity $12.68B 5.20% (5D)

The overall quantity (USD Worth) traded in futures contracts within the final 24 hours. Futures Quantity $24.35B $153.29 (5D)

The sum liquidated quantity (USD Worth) from quick positions in futures contracts. Complete Lengthy Liquidations $42.01M $0 (5D)

The sum liquidated quantity (USD Worth) from lengthy positions in futures contracts. Complete Brief Liquidations $42.01M $3.25M (5D)

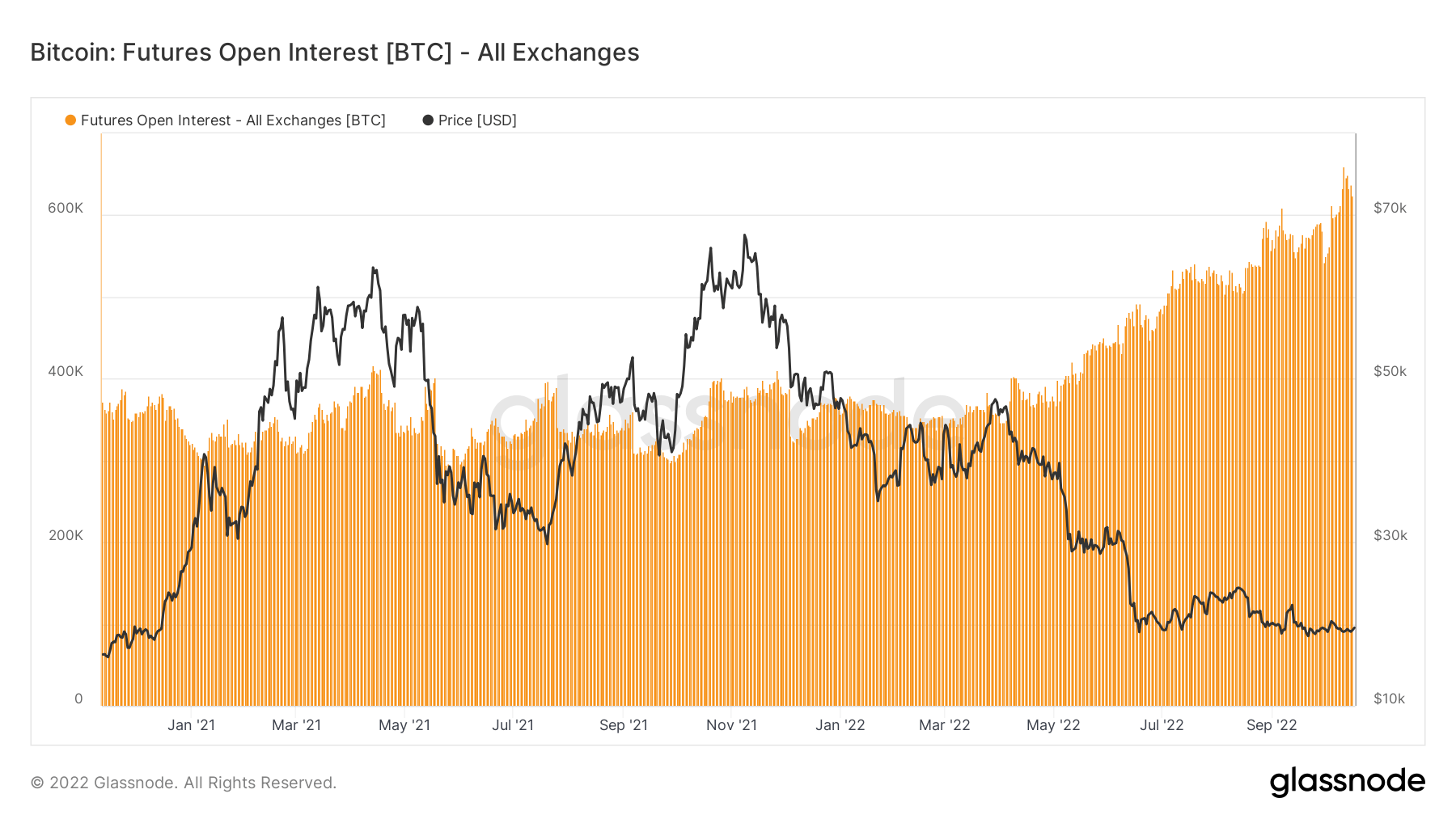

Futures open curiosity at all-time highs denominated in Bitcoin

Futures’ open curiosity, the entire quantity of (USD worth) allotted in accessible futures contracts, has hit an all-time excessive. This tells us that ranges of hypothesis throughout the market are growing, regardless of Bitcoin falling over 70% from its all-time excessive.

Futures open curiosity has stayed comparatively flat from January 2021 to Might 2022, roughly 350k BTC however has soared to 640k denominated in Bitcoin futures open curiosity.

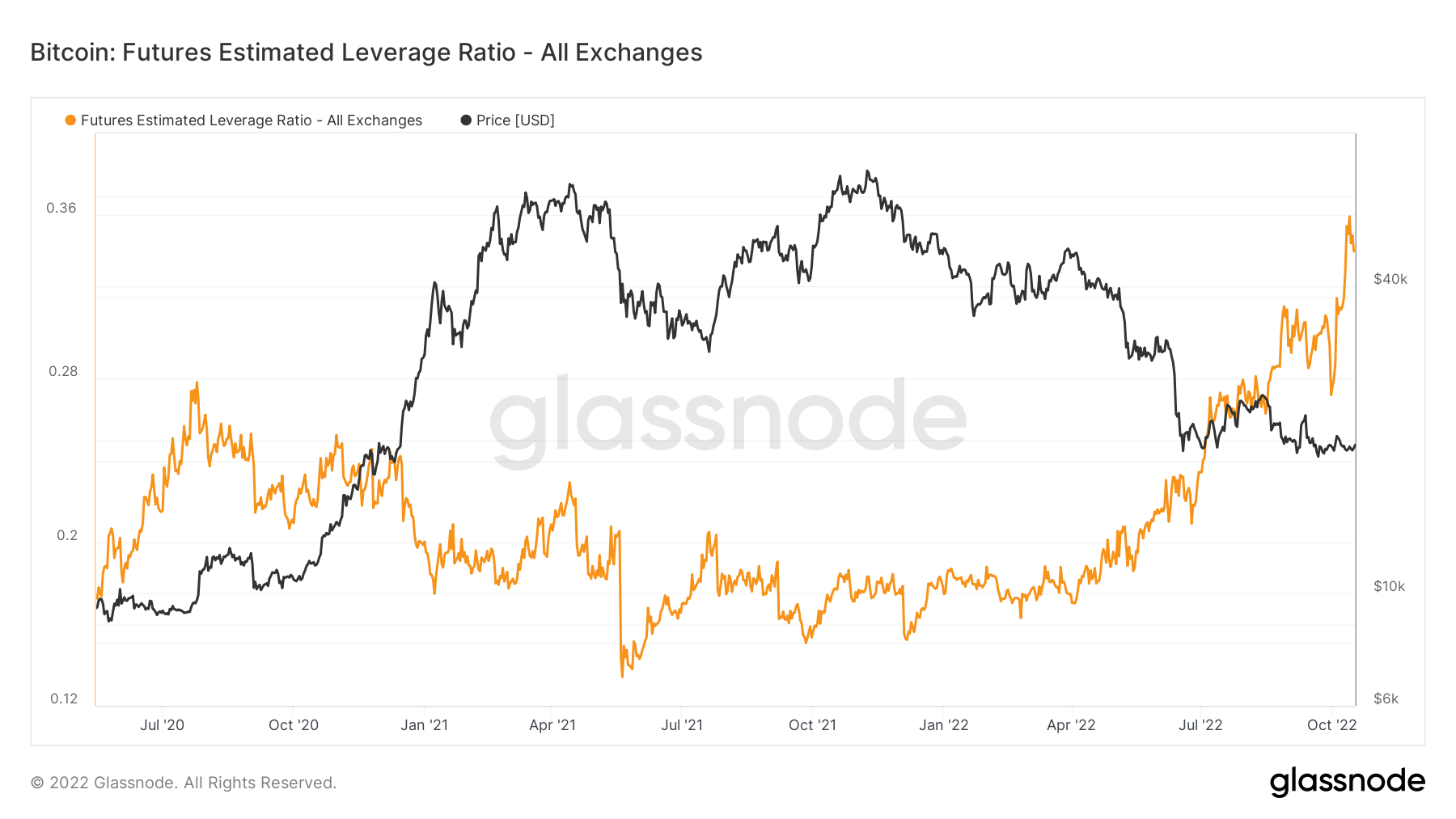

Leverage continues to extend

The Estimated Leverage Ratio is outlined because the ratio of the open curiosity in futures contracts and the steadiness of the corresponding trade.

From Might 2020 to Might 2022, the ELR has stayed in a relentless vary of round 0.17 to 0.25; nonetheless, since June 2022, the ELR has seen a outstanding climb. The ELR is at an all-time excessive, and a big quantity of leverage must be unwound. The BTC ecosystem has low liquidity proper now as a result of being in a bear market whereas a considerable amount of money stays on the sidelines; count on to see this leverage begin to come down.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

The typical estimated variety of hashes per second produced by the miners within the community. Hash Fee 262 TH/s 2.34% (5D)

The present estimated variety of hashes required to mine a block. Observe: Bitcoin issue is commonly denoted because the relative issue with respect to the genesis block, which required roughly 2^32 hashes. For higher comparability throughout blockchains, our values are denoted in uncooked hashes. Issue 152 T 13.43% (14D)

The overall provide held in miner addresses. Miner Steadiness 1,830,490 BTC -0.20% (5D)

The overall quantity of cash transferred from miners to trade wallets. Solely direct transfers are counted. Miner Internet Place Change -23,592 BTC -14,681 BTC (5D)

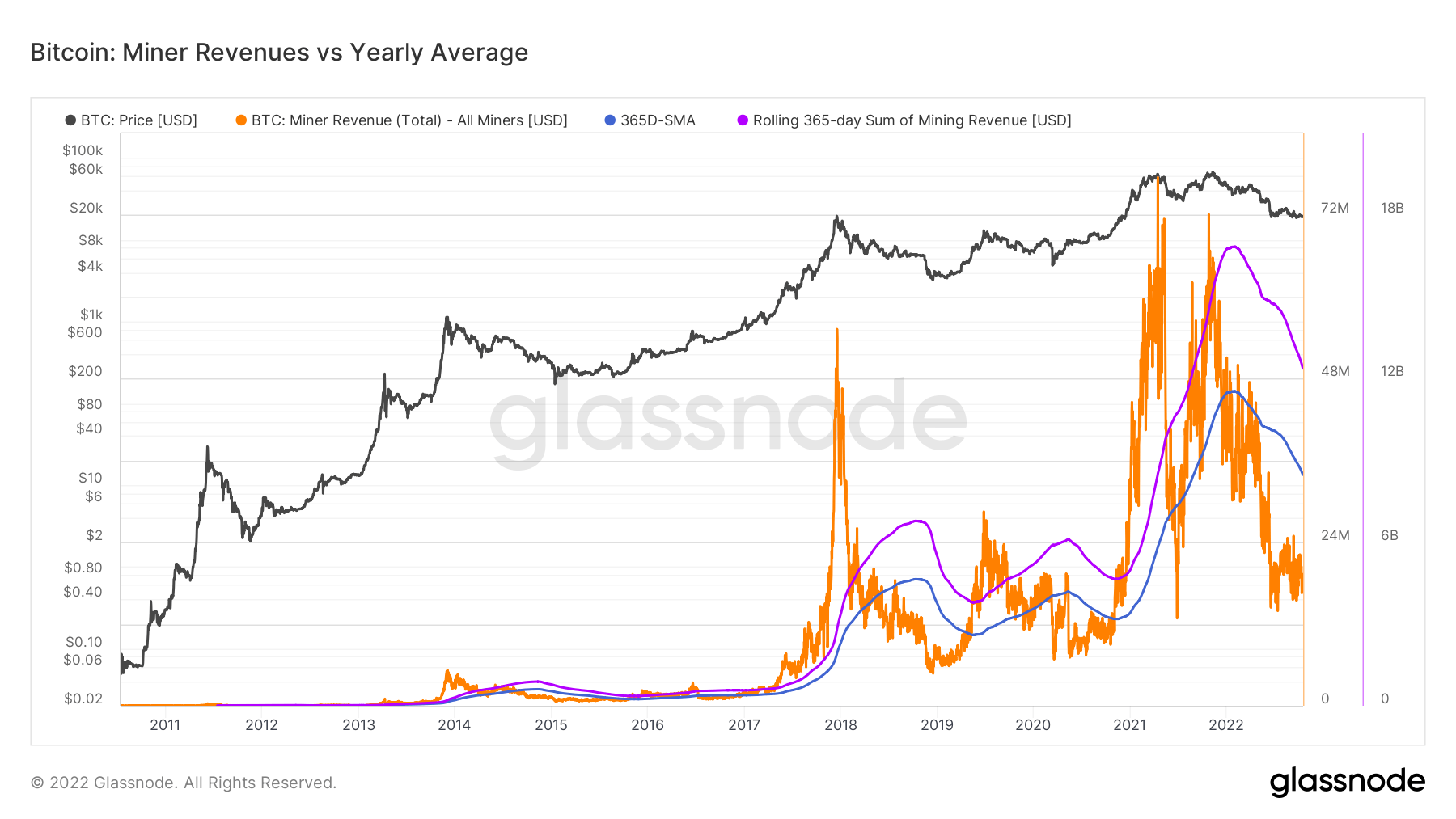

Miners proceed to get squeezed

All through August to October, the hash price has gone exponential, from 220 EH/S as much as 260 EH/s, that is unprecedented throughout a bear market, and issue is enjoying catch up, which can be at an all-time excessive, persevering with to squeeze miner income. When the following issue epoch is accomplished, it’s projected to regulate one other 3% to the upside. A distant reminiscence of Might 2021, when China banned mining and noticed the community drop to 84 EH/S.

To contextualize the stress miners are underneath and the dearth of income they’re incurring is the metric beneath miner income vs. the yearly common. Demonstrates the every day USD income paid to BTC miners in orange and evaluate it to the 365-day shifting common. Whereas additionally observing the combination trade earnings on a rolling 365-day sum of miner revenues.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized trade exercise.

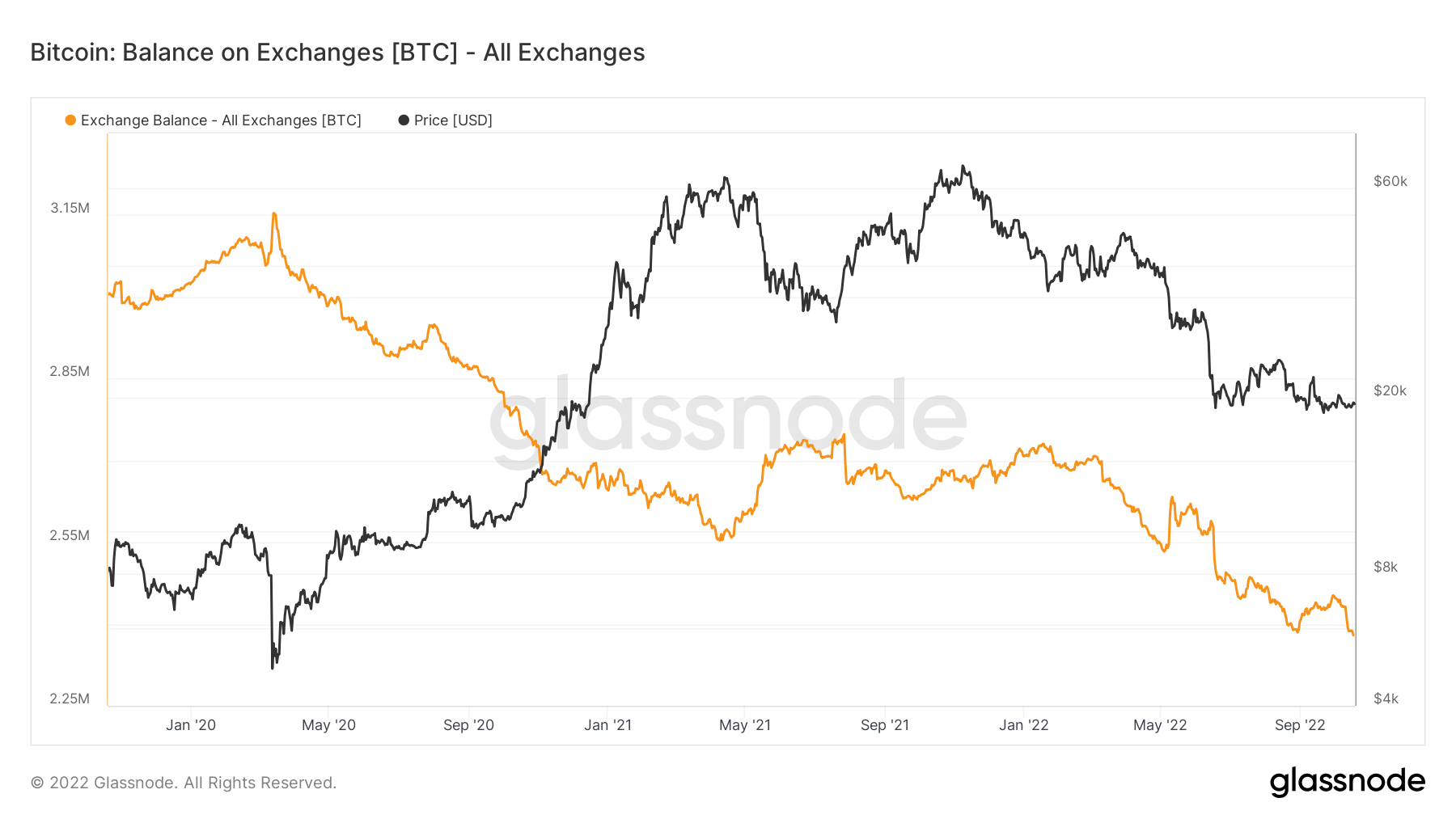

The overall quantity of cash held on trade addresses. Trade Steadiness 2,343,473 BTC -57,299 BTC (5D)

The 30 day change of the availability held in trade wallets. Trade Internet Place Change 281,432 BTC -395,437 BTC (30D)

Bitcoin held on exchanges reached its lowest in 4 years

Bitcoin held by exchanges has reached its lowest in 4 years. Presently, the Bitcoin quantity held by exchanges is slightly below $2,4 million, which is represented by the orange line within the chart beneath.

Over 300,000 Bitcoins have been faraway from the exchanges throughout winter, indicating a bullish pattern amongst buyers. This lowered the availability held by exchanges to its 4-year lowest. The final time the Bitcoin steadiness on exchanges was round $2,4 million was in late 2018.

The present $2,4 million held inside exchanges equate to roughly 12% of all Bitcoin provide out there.

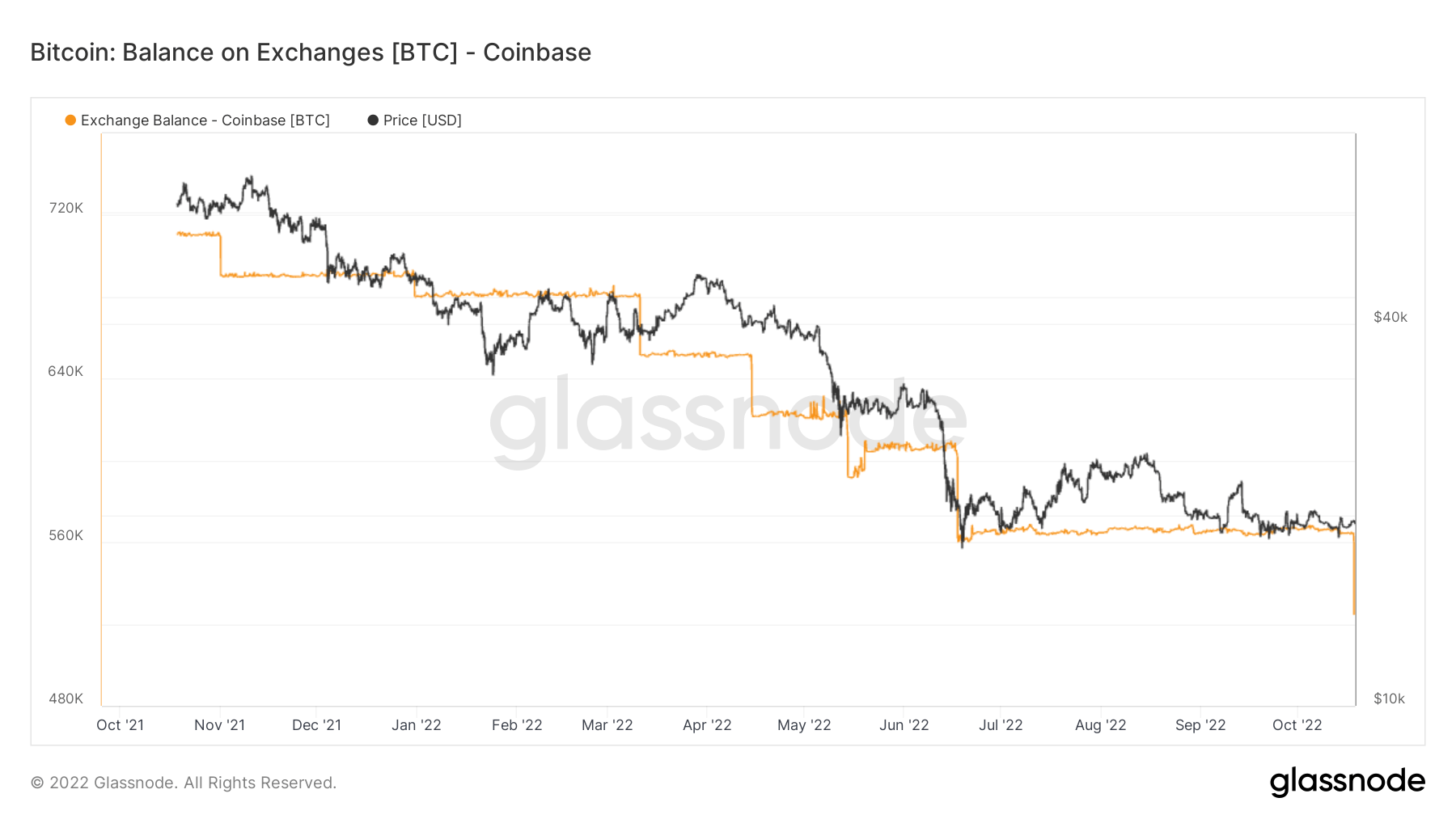

For the reason that November 2021 bull run, a minimal quantity of Bitcoins have been launched again onto the trade. On the time, Coinbase held virtually 4% of the entire Bitcoin provide. The trade misplaced 1% of complete Bitcoin in practically a yr and has slightly below 3% of it.

Coinbase is primarily utilized by giant establishments within the U.S., that are identified for his or her tendency to purchase and maintain. As can be demonstrated by the chart above, the trade misplaced important quantities of Bitcoin after the bear market hit.

Coinbase had practically 680,000 Bitcoins at first of the yr, and that quantity had fallen to 560,000 in eight months in August. The trade misplaced one other 50,000 Bitcoins on Oct. 18, which dropped the entire quantity held by Coinbase to 525,000.

Geo Breakdown

Regional costs are constructed in a two-step course of: First, value actions are assigned to areas based mostly on working hours within the US, Europe, and Asia. Regional costs are then decided by calculating the cumulative sum of the worth modifications over time for every area.

This metric reveals the 30-day change within the regional value set throughout Asia working hours, i.e. between 8am and 8pm China Normal Time (00:00-12:00 UTC). Asia 3,724 BTC -2,159 BTC (5D)

This metric reveals the 30-day change within the regional value set throughout EU working hours, i.e. between 8am and 8pm Central European Time (07:00-19:00 UTC), respectively Central European Summer season Time (06:00-18:00 UTC). Europe -3,464 BTC 4,093 BTC (5D)

This metric reveals the 30-day change within the regional value set throughout US working hours, i.e. between 8am and 8pm Jap Time (13:00-01:00 UTC), respectively Jap Daylight Time (12:00-0:00 UTC). U.S. -3,445 BTC 5,721 BTC (5D)

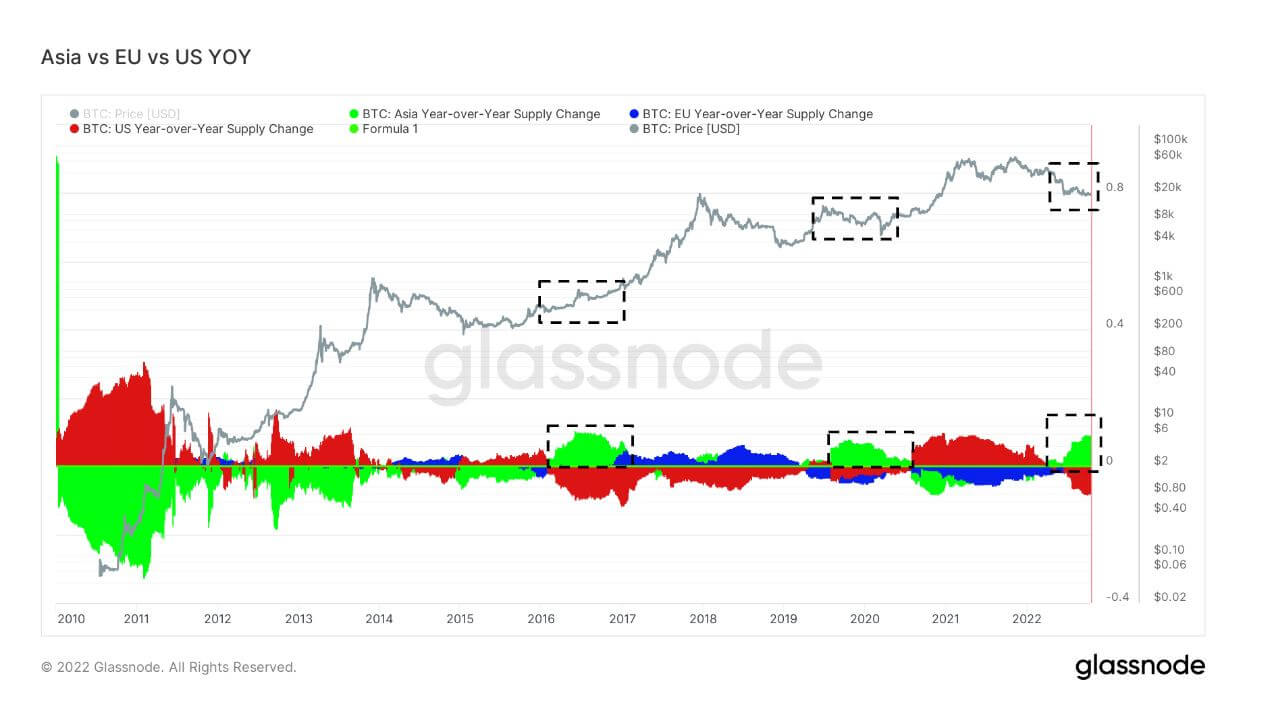

When Asia buys Bitcoin, it’s often time to purchase Bitcoin

The final three bear markets, 2016-2017, 2019-2020, and 2022, have seen Asia’s share of BTC possession go up. That is at the moment probably the most important Asia premium for a number of years. Cryptoslate has talked about Asia changing into the sensible cash within the ecosystem. Taking a look at earlier bear markets, it’s obvious that Asia scoops up low cost BTC.

Cohorts

Breaks down relative conduct by varied entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: value offered / value paid. Lengthy-term Holder SOPR 0.50 -16.67% (5D)

Brief Time period Holder SOPR (STH-SOPR) is SOPR that takes into consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of quick time period buyers. Brief-term Holder SOPR 0.99 -1.00% (5D)

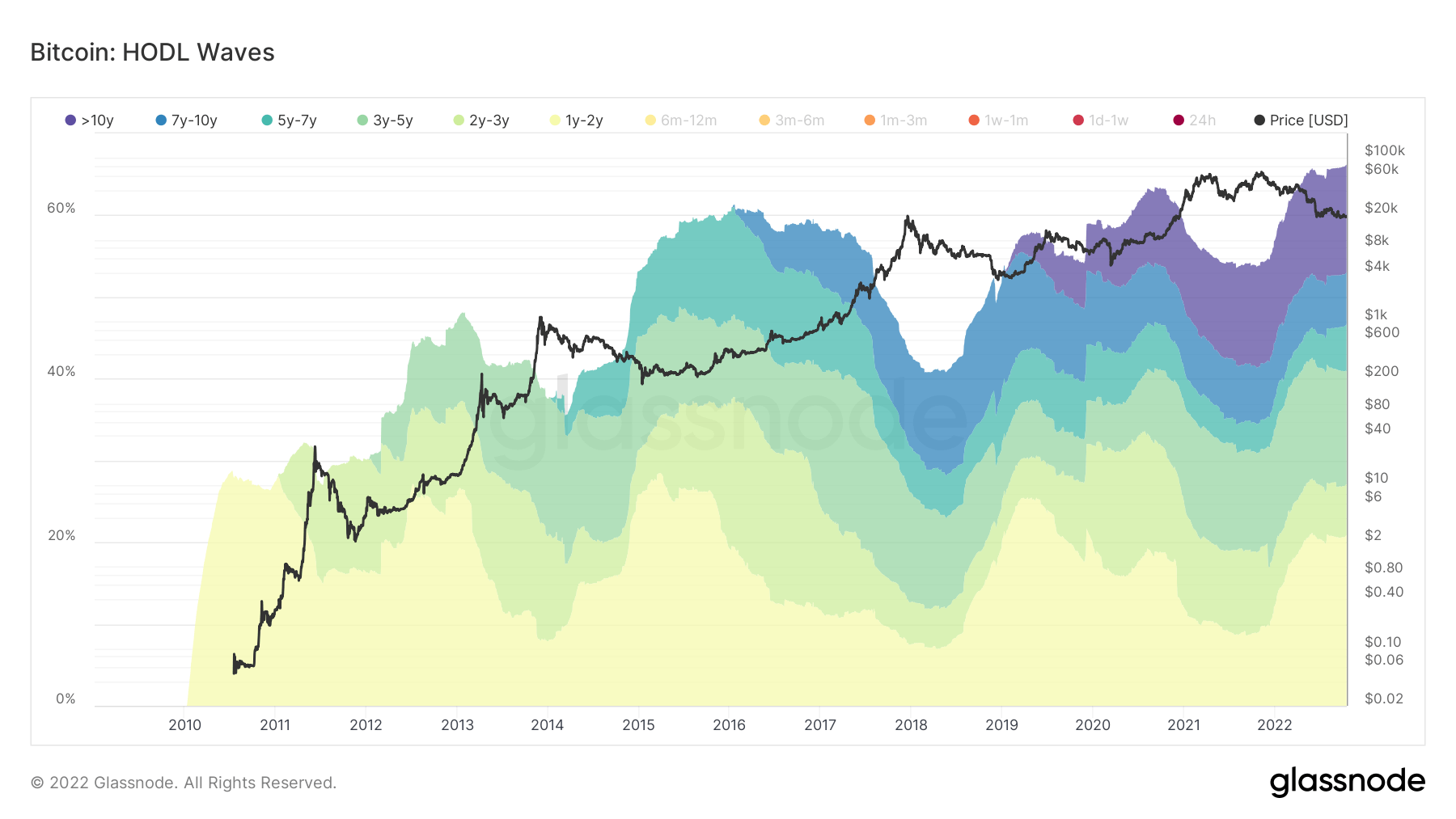

Lengthy-term holders holding down the fort

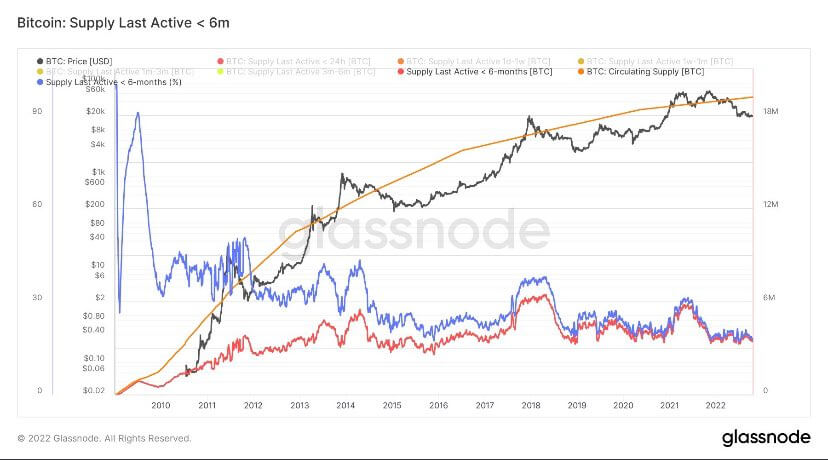

Lengthy-term holders are outlined as a cohort that has held Bitcoin longer than 155 days and is taken into account to be the sensible cash of the ecosystem. As BTC’s all-time excessive got here in November 2021, one-year cohorts have been chosen over six months to indicate this cohort has held from a 75% drawdown and continues to be hodling.

Throughout bear market cycles, LTHs accumulate whereas the worth is suppressed after STHs have left the ecosystem as they entered for value hypothesis. Presently, 66% of the availability is held by LTH, which is probably the most quantity ever; throughout bear markets, LTH’s assortment portion grows, forming the brand new base for every bear market cycle.

Brief-term holders are at bear market lows

Brief-term holders (6 months or much less) are holding Bitcoin at extraordinarily low ranges, much like earlier bear market cycles. STH’s at the moment have round 3 million of the availability; through the 2021 bull run, this cohort bought as much as 6 million, and the identical might be seen with the final bull run of 2017. Not all STH’s offered for worry of value; a migration occurred from STHs to LTH, which noticed a rise of 10 million of the availability to 13 million throughout the again finish of 2021.

Stablecoins

A kind of cryptocurrency that’s backed by reserve belongings and subsequently can supply value stability.

The overall quantity of cash held on trade addresses. Stablecoin Trade Steadiness $40.14B -0.05% (5D)

The overall quantity of USDC held on trade addresses. USDC Trade Steadiness $1.82B -23.87% (5D)

The overall quantity of USDT held on trade addresses. USDT Trade Steadiness $17.09B -0.05% (5D)

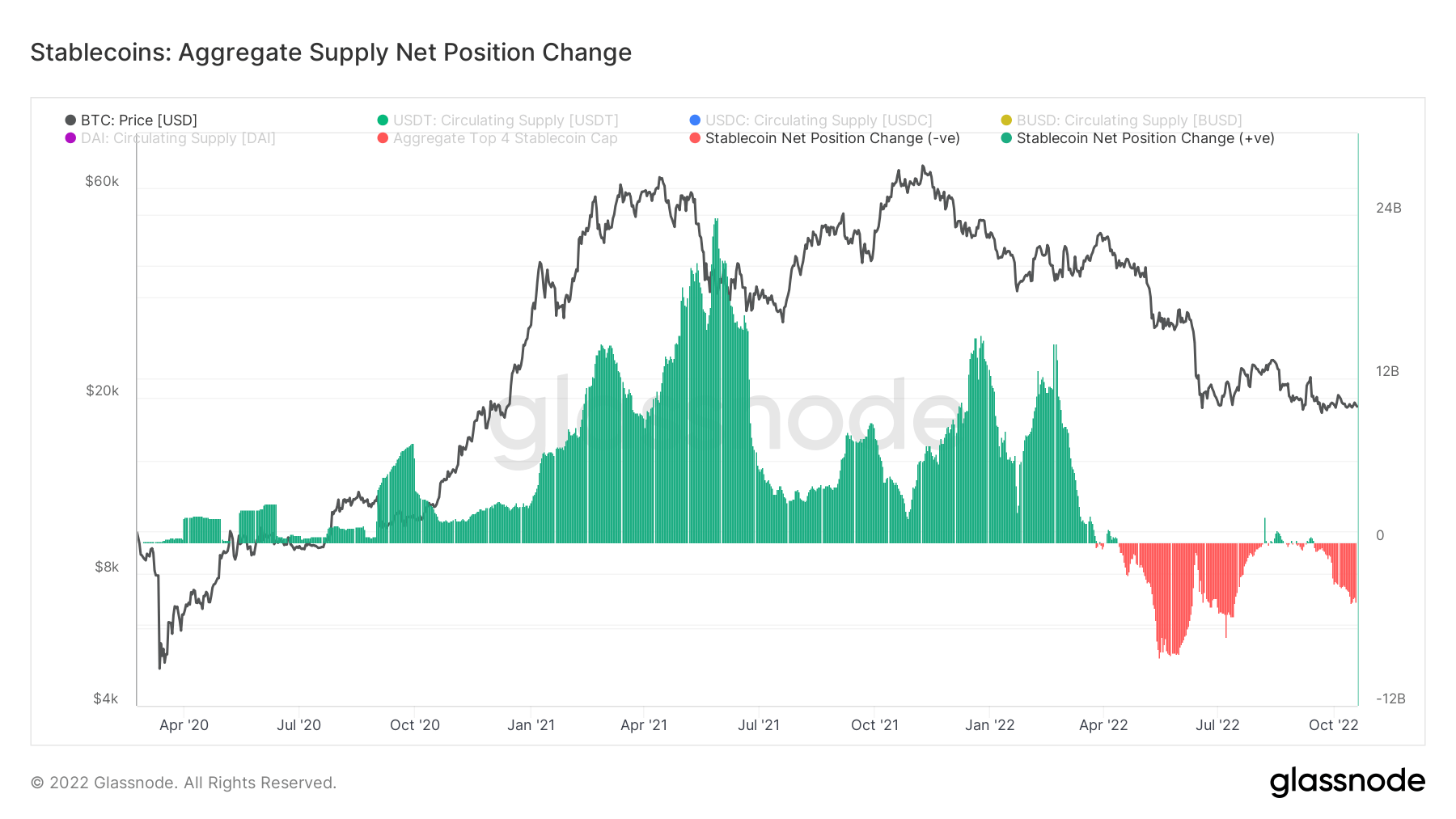

Change of regime for stablecoins

2021 was a monumental yr for stablecoins, and going into 2022, the market cap of simply the highest 4 stablecoins alone was upwards of over $160 billion. Fairly evidently, 2021 was a bubble propped up by futures and unsustainable yields. Through the bull run of 2021, virtually $24 billion of stablecoins have been being put onto exchanges and more than likely utilized in defi.

Nevertheless, because the luna collapse, with Bitcoin dropping from $40k to $20k, distribution has been the central regime of stablecoins, at its peak of $12 billion of promote strain. In a worldwide deleveraging occasion within the macro world, promoting happens from stablecoins to fiat to make debt obligations; count on this regime to proceed.

[ad_2]