[ad_1]

After taking help close to the important thing ranges on the charts, the NIFTY lastly resumed its up transfer because it ended the weak on a decently optimistic observe. The final three weeks had seen the index taking help at its 20-Week MA; lastly, following the strikes that it has seen over the previous weeks, the NIFTY is now above all the important thing shifting averages. The previous 5 periods noticed the Index buying and selling in a spread of 571.60 which was wider than what was seen over the previous few weeks. Whereas staying and shutting above key helps, the headline index ended with a internet acquire of 390.60 factors (+2.27%) on a weekly foundation.

From a technical perspective, NIFTY is now buying and selling above all the important thing shifting averages; nonetheless, it’s but to offer a clear breakout on the weekly charts. If this occurs, we might be heading in direction of 18000-levels once more. Then again, the US Markets, which have been a key supply of world weak spot, have additionally managed to defend the important thing helps. The S&P500 Index, whereas persevering with to indicate bullish divergences, has efficiently defended the 200-Week MA of 3605 ranges. As long as the SPX defends 200-DMA, we’re unlikely to see any main drawdowns from the present ranges. On the most, we could consolidate at larger ranges and commerce with an outlined trajectory. We now have 16950 as a serious degree to defend on a closing foundation to keep away from any main weak spot.

Markets have a 3-day quick buying and selling week; Monday can have only a symbolic Mahurat buying and selling session and Wednesday is a buying and selling vacation once more. The approaching week is more likely to see ranges of 17650 and 17930 performing as potential resistance factors. The helps are available in at 17300 and 17210 ranges. The buying and selling vary could not get this huge as indicated by the technical help and resistance ranges, however there could also be some good quantity of volatility to cope with in the course of the week.

The weekly RSI is 56.28; it stays impartial and doesn’t present any divergence in opposition to the worth. The weekly MACD is bullish and trades above the sign line. A robust white-bodied candle emerged; this mirrored the directional bias of the market contributors on the upside.

We can have some quantity of volatility to cope with within the coming week attributable to virtually two market holidays. Monday, which has a mahurat buying and selling session, is mostly a symbolic one; no main decisive strikes are often seen. Nevertheless, when the markets open on Thursday as soon as once more after a vacation on Wednesday, it should discover itself adjusting to the worldwide commerce setup. The US markets are secure; if this stability is sustained, we’ll discover ourselves comfortably inching larger. Any consolidation within the US markets or a battle to take care of stability will infuse some unstable strikes within the home markets as properly. On the home entrance, all we have to do is maintain our heads above the 16980-17100 zone to keep away from any weak spot from creeping in.

Sector Evaluation for the approaching week

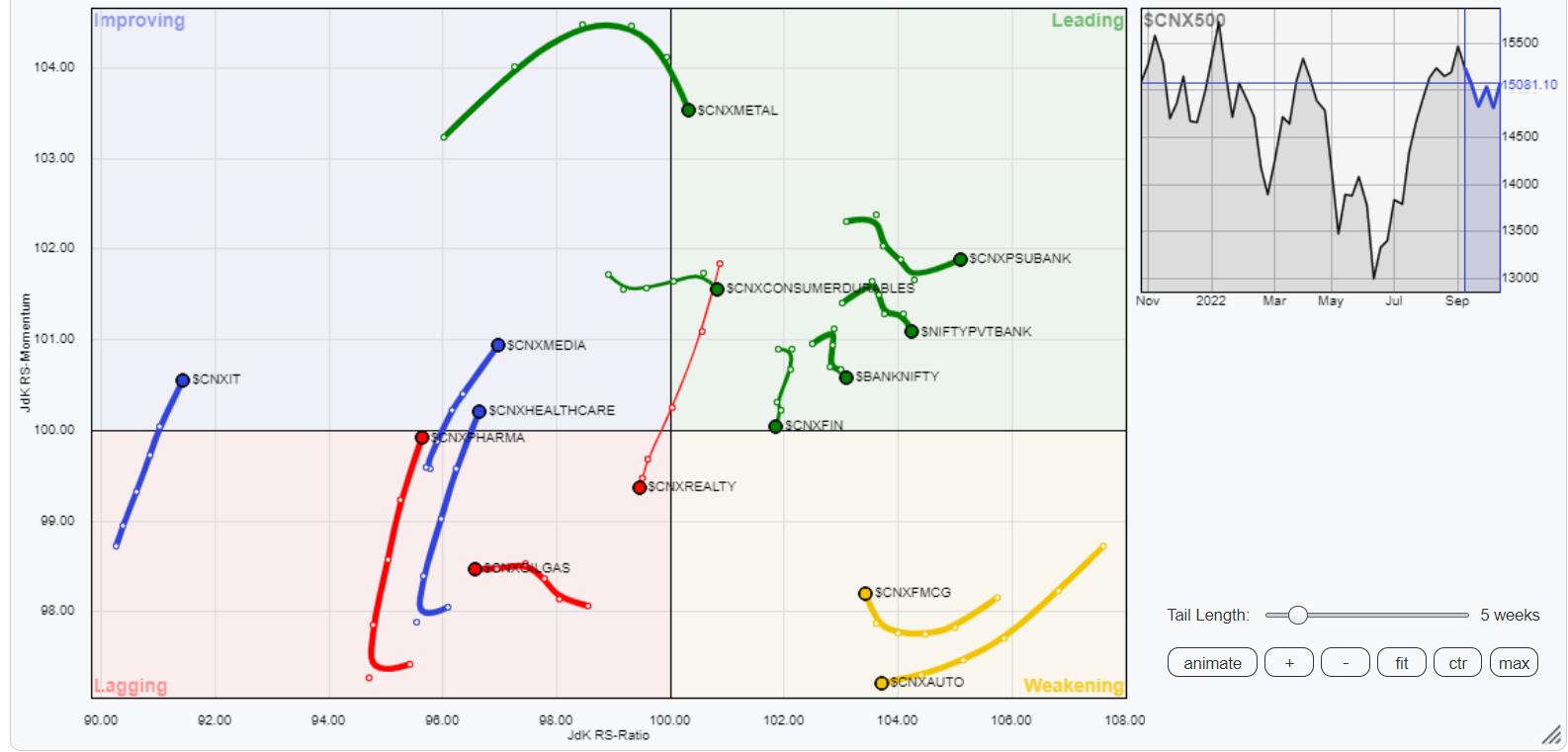

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) exhibits that there is no such thing as a main change within the sectoral setup as in comparison with the earlier week. The NIFTY Midcap and Monetary Companies Index proceed to surrender on their relative momentum in opposition to the broader markets. Apart from this, NIFTY PSU Financial institution and Banknifty are additionally positioned contained in the main quadrant and are anticipated to comparatively outperform the broader markets regardless of some minor lack of momentum within the Banknifty.

NIFTY Metals has rolled contained in the main quadrant. Together with the above teams, Metallic Index can also be set to comparatively outperform the broader markets.

NIFTY Consumption and FMCG indexes are contained in the weakening quadrant; nonetheless, the FMCG index is seen sharply enhancing on its relative momentum in opposition to the broader NIFTY500 Index. The NIFTY Auto continues to slip additional contained in the weakening quadrant.

The NIFTY Realty Index continues to languish contained in the lagging quadrant and it’s more likely to comparatively underperform the broader NIFTY500 Index. Together with NIFTY Vitality Index which can also be positioned contained in the lagging quadrant. The NIFTY Pharma and Infrastructure Index are additionally contained in the lagging quadrant however they’re seen enhancing on their relative momentum.

The NIFTY PSE Index is contained in the enhancing quadrant together with the commodities, IT, and the Media Index.

Vital Word: RRG™ charts present the relative power and momentum for a bunch of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a certified Impartial Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Companies in Vadodara, India. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes each day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly E-newsletter, at the moment in its fifteenth 12 months of publication.

Milan’s main obligations embrace consulting in Portfolio/Funds Administration and Advisory Companies. His work additionally includes advising these Purchasers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas conserving their actions aligned with the given mandate.

Study Extra

Subscribe to Analyzing India to be notified at any time when a brand new publish is added to this weblog!

[ad_2]