[ad_1]

In instances of worry of a WWIII, inflation, recession and vitality scarcity many of the funding devices undergo substantial losses. Shares, gold and principally cryptocurrencies are significantly affected by the troublesome environment around the globe.

With Ether down roughly 64% year-to-date, adopted by Bitcoin down roughly 58% year-to-date, BestBrokers analyst workforce determined to look into blockchain transaction information and learn how this drop impacts crypto customers in reality.

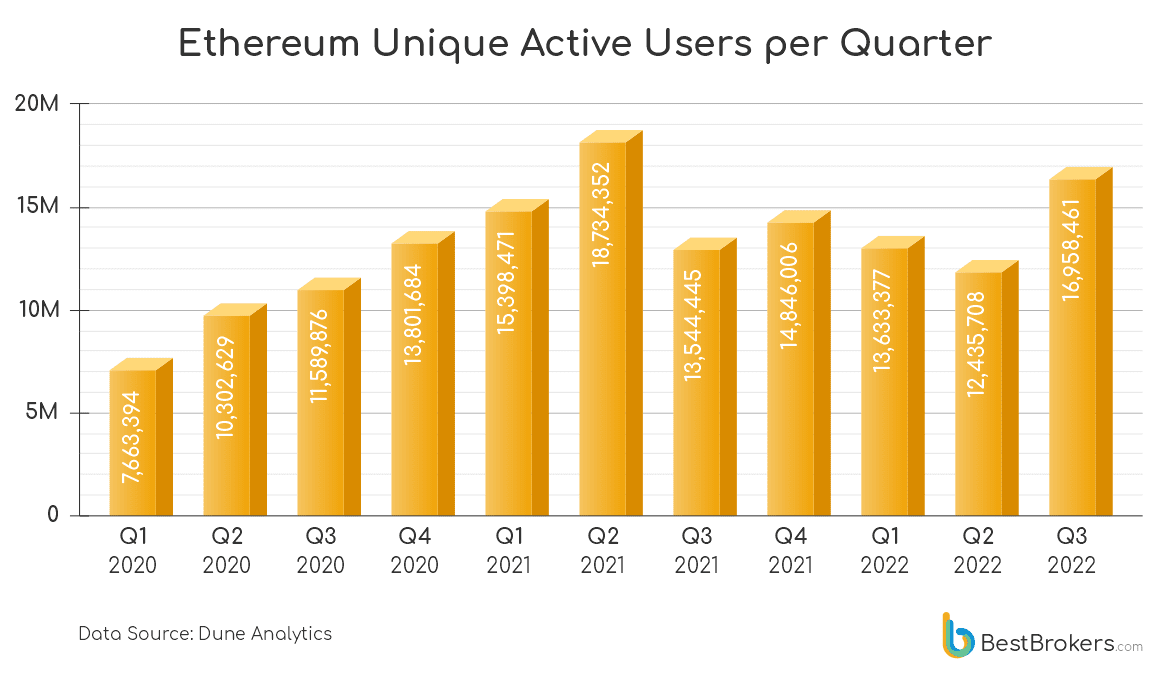

The uncooked information, queried from Dune Analytics clearly reveals a terrific improve in curiosity in Ether because the variety of lively Ethereum customers rose over 36% in Q3 2022, in comparison with Q2. Truly, that is the primary optimistic quarter since This fall 2021 when Ether’s value rose to a report all time excessive of simply over $4,890.

|

Alan Goldberg, analyst at BestBrokers feedback:

“The Ethereum 2.0 replace went dwell simply three weeks in the past. It certainly introduced extra curiosity within the Ethereum community but it surely can not justify such a terrific rise. Different elements should be taken under consideration, together with the truth that individuals really discover cryptocurrencies as an funding choice and the report lows of Q3 2022 appeared like a discount to lots of particular person traders.”

The long-awaited Ethereum 2.0 replace undeniably had a optimistic influence on Еthereum consumer depend. Nevertheless, it was accomplished so late in Q3 2022 that it’s undoubtedly not the one motive for the uptrend. The expectation and the information in mid July, confirming the ultimate replace date undoubtedly contributed to the inreased commerce, however we additionally should take into consideration the truth that Ether value dropped beneath the $900 mark in late Q2 2022 and that low value will need to have regarded like a discount low cost to optimistic traders. Since then the value went regular up with a couple of instances touching the $1,000 resistance however remodeled 100% rise to only over $2,000 in August 2022.

Regardless of the present value sitting at round $1,360 or someway round 33% decrease than the August heights, Ether had nice value swings, typical to many of the cryptocurrencies. In any case, the value volatility and excessive quantity are among the many elements which drive investor curiosity into the crypto markets and that’s precisely what Ethereum delivered in Q3, clearly exhibiting that the markets have potential to get again on a optimistic pattern.

Alan additionally provides that the 36% improve within the lively customers inside simply 3 months could very effectively be interpreted as an indication that the crypto markets are getting again on the optimistic pattern. He says, ”The truth that the variety of lively customers is over 14% greater than This fall 2021, when each Bitcoin and Ether costs have been at an all time excessive, solely reinforces crypto analysts’ expectations that the markets have a terrific potential to rise once more.”

[ad_2]