[ad_1]

Fast Take

Current macroeconomic knowledge highlights important occasions within the worldwide fiscal panorama. The European Central Financial institution (ECB) held its gun, sustaining the rate of interest on the anticipated 4.5%.

This resolution, extensively anticipated by the market, maintains a establishment in Europe’s financial coverage. Notably, the European forex remained comparatively secure towards the DXY (US greenback index), hovering across the 1.05 mark, unaffected by the ECB’s resolution.

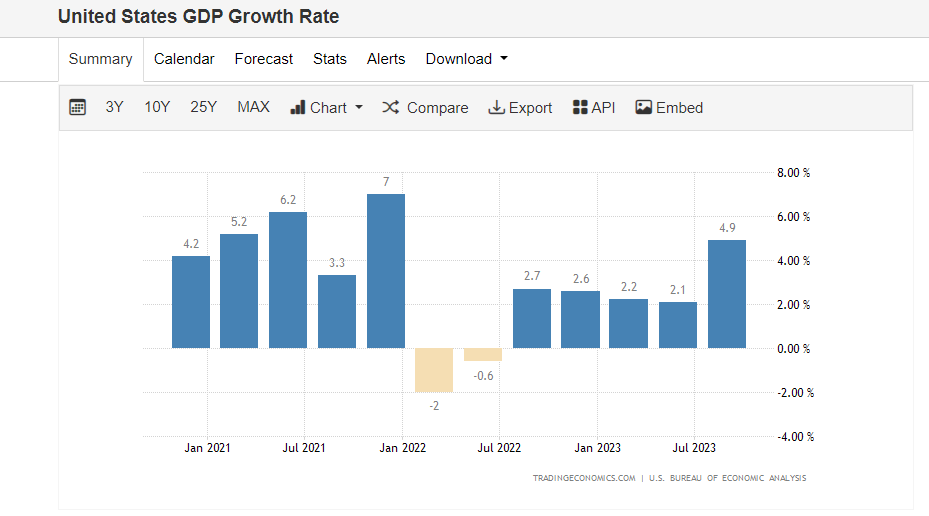

Nonetheless, the actual shock got here from throughout the Atlantic with the discharge of the Q3 US GDP figures. Whereas expectations had been set for an encouraging 4.3% rise, the sturdy American economic system surpassed these forecasts, posting a stellar 4.9% development charge. This surge, considerably greater than the earlier quarter’s 2.1%, underlines the resilience and energy of the US economic system.

These knowledge factors not solely current a snapshot of the prevailing financial situations but additionally doubtlessly foreshadow the trajectory of the worldwide monetary markets. With the US economic system outperforming expectations and the ECB’s regular stance, the interaction between these financial powerhouses will possible proceed to form the worldwide monetary narrative.

The submit US Q3 GDP development beats expectations as ECB holds regular appeared first on CryptoSlate.

[ad_2]