[ad_1]

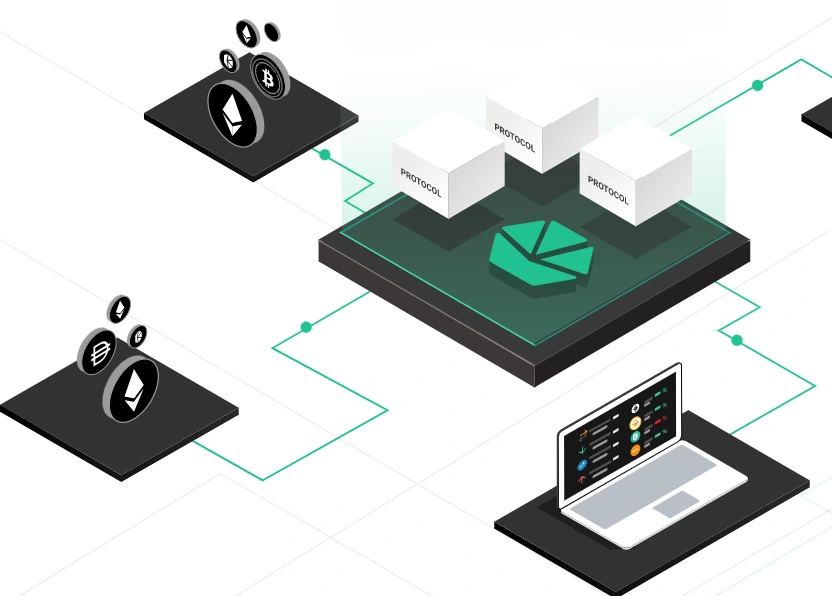

Kyber Community is a multi-chain crypto buying and selling and liquidity hub that connects liquidity from totally different sources to allow trades at the most effective charges. As a decentralized protocol, Kyber Community facilitates cryptocurrency exchanges with out KYC or a intermediary and allows on-chain transactions which might be fully clear and verifiable.

KyberSwap, the community’s flagship product, is a next-gen DEX aggregator that permits customers to swap, earn, and seamlessly take part in DeFi on every of the 13 supported chains. As a DEX aggregator, KyberSwap sources liquidity not solely from its personal swimming pools but in addition from over 70 DEXs throughout its supported networks and is provided with yield optimization protocols to make sure the most effective charges and returns.

This Kyber Community assessment will look into the Kyber Community, its companies, merchandise, buying and selling charges, and so forth., and assess the KNC tokens’ long-term adoption potential and use instances.

Let’s get proper to it!

What Is Kyber Community

Kyber Community’s aim is to make Decentralized Finance accessible, low-cost, quick, and safe for all customers.

A pioneer within the DeFi area, Kyber Community launched in 2017 underneath Vitalik Buterin’s mentorship with a profitable ICO elevating $52 million. Kyber Community has developed to a mission dedicated to creating DeFi simple and accessible for all – together with KyberSwap, essentially the most superior DEX & Aggregator in DeFi, KyberDAO, the governance neighborhood on the forefront of DeFi, and Kyber Ventures, Kyber’s funding arm supporting Web3 founders to construct the way forward for decentralized applied sciences.

Over the previous 5 years, Kyber Community has been pushed by innovation and dedication to turn out to be one of many prime DEXs within the DeFi area. Their core product, KyberSwap, is a next-gen DEX aggregator offering the most effective charges for merchants and maximizing returns for liquidity suppliers in DeFi.

As a decentralized trade, KyberSwap connects merchants to liquidity swimming pools quite than an order e book. The protocol’s good contracts present liquidity and allow customers to finish transactions with out intermediaries.

Presently deployed on 13 chains, together with Ethereum, Polygon, BNB, Avalanche, Fantom, Cronos, Arbitrum, BitTorrent, Velas, Aurora, Oasis, and Optimism, KyberSwap aggregates liquidity from over 70 DEXs to offer customers the greatest charges potential for his or her swaps.

For liquidity suppliers, KyberSwap has a collection of capital-efficient protocols designed to optimize rewards. KyberSwap Traditional’s Dynamic Market Maker protocol (DMM) is DeFi’s first market maker protocol that dynamically adjusts LP charges primarily based on market circumstances, whereas KyberSwap Elastic is a tick-based AMM with industry-leading liquidity protocols and concentrated liquidity, customizable payment tiers, reinvestment curve and different superior options specifically designed to offer LPs the pliability and instruments to take incomes methods to the subsequent stage with out compromising on safety. Liquidity suppliers can add liquidity to KyberSwap swimming pools and earn charges and incentive rewards.

Thus far, KyberSwap powers 100+ built-in initiatives and has facilitated over US $11 billion in transactions for hundreds of customers since its inception.

Regardless of its similarities with different exchanges, Kyber gives a novel platform to customers enabling them to simply commerce one token for one more by a liquidity pool by combining a number of cryptocurrencies.

What Makes KyberSwap Distinctive

The introduction of decentralized exchanges bridged shortcomings in centralized methods’ operations, similar to elevated bills and taxes, sluggish transaction charges, indiscriminate pockets locking, elevated publicity to insecurity, and so forth.

Nevertheless, decentralized exchanges even have vulnerabilities, together with vital bills for commerce modifications so as books and lack of liquidity, a key element within the DeFi ecosystem. Kyber Community Crystal introduces the KNC and develops liquidity swimming pools by gathering liquidity from numerous digital tokens.

The Community makes the liquidity swimming pools at all times out there to traders. Because of this, traders who don’t have reserving orders can commerce immediately from their wallets. Nevertheless, merchants will preserve custody of their tokens all through the method.

KyberSwap facilitates swapping cryptocurrencies on the lowest potential price for every protocol transaction.

Kyber Community can also be suitable with different protocols and known as a developer-friendly mission by the crypto neighborhood. The protocol that needs to attach with KNC should function on a blockchain-powered by good contracts.

A number of firms, DApps, and wallets have already built-in the Kyber platform into their initiatives or companies, similar to InstaDApp, MetaMask, SetProtocol, bZx, AAVE, Coinbase, and so forth. Based on the Kyber Community web site, the mission has already acquired over 100 integrations.

Kyber Community Options

The Kyber Community isn’t just a decentralized cryptocurrency trade but in addition a digital asset switch platform. It facilitates the trade course of by permitting customers to transmit tokens and obtain any token they select. Let’s have a better take a look at its options.

KyberSwap

The KyberSwap mechanism allows the moment swapping of cryptocurrencies with out utilizing order books, deposits, or wrapping. The trade always routes queries by way of quite a few centralized exchanges and liquidity swimming pools to get the most effective value. Shoppers can optimize their swaps for both the bottom gasoline costs or the best returns. Variable slippage tolerance and important pre-trade data similar to minimal returns and predicted USD worth are additionally out there.

Kyber Developer

This developer-friendly mechanism gives builders with the instruments and documentation to combine new apps, wallets, exchanges, and platform enhancements into the DeFi ecosystem.

Kyber Community Charges

KyberSwap Charges

Not like some DEXs, KyberSwap doesn’t cost any aggregator, administration, or platform charges. Liquidity suppliers earn 90% of their charges, whereas the remaining 10% goes to the KyberDAO for governance rewards. These rewards are paid out in KNC and are distributed to KNC holders who stake and vote on governance proposals primarily based on the proportion of their stake.

Kyber Community doesn’t cost any withdrawal charges, which makes it a extremely aggressive providing. Nevertheless, it ought to be famous that there are additionally exchanges that pay the community charges for the merchants’ benefit, i.e., their withdrawal charges are 0. However, the community charges are quite insubstantial; subsequently, charging the community charges solely can also be a trader-friendly payment association.

Shopping for & Storing KNC

You should buy KNC tokens by numerous cryptocurrency exchanges, similar to Coinbase, Binance, and so forth. The previous is headquartered in america, whereas the latter is an offshore trade. There’s a ramification within the buying and selling quantity of the digital asset at these exchanges, which signifies that KNC’s liquidity has no dependence and focus on a single trade. Furthermore, each trade e book offers you excessive liquidity. For instance, the Binance BTC/KNC books are numerous and have a excessive turnover leading to sooner order execution.

KNC is an ERC20 token that may be saved in any Ethereum-compatible pockets, together with MyEtherWallet, MetaMask, and CoinStats Pockets.

KyberSwap Staff

The crew has an skilled and expert advisory board comprising Vitalik Buterin, the Ethereum founder.

The protocol’s testnet grew to become operational in August 2017. The Community’s preliminary coin providing (ICO) raised $60 million, the equal of 200,000 ETH, in September 2017.

The mainnet was launched in February 2018 and was solely accessible to whitelisted customers. In March 2018, the KyberSwap platform launched the mainnet as a public beta. The community quantity elevated by over 500% by the top of the second quarter of 2019.

Kyber Community (KNC) Token

KNC is the Kyber Community’s native token, launched in 2017. The KNC value through the Preliminary Coin Providing (ICO) was $1 per token. Solely 61% of the 226 million KNC raised for the ICO have been offered, and the remaining share was break up 50/50 between the founders/advisors and the corporate. The lockup time period for this management is one 12 months, whereas the vesting interval is 2 years.

On the time of writing, the full provide of KNC was 223 million, with over 102 million tokens in circulation and a market capitalization of $116.5 million, as per the information out there on CoinStats.

The token successfully helps the Community by connecting liquidity seekers and liquidity suppliers.

KNC can also be the Kyber Networkecosystem’s governance token. Token holders can stake KNC tokens on KyberDAO to vote on platform updates, enhance their worth, and enhance adoption charges. This can even improve the mission’s performance and worth. The tokens are staked in cycles referred to as “epochs,” that are measured in Ethereum block timings and have a time span of two weeks. Holders are entitled to a portion of the charges generated by the protocol’s liquidity swimming pools.

KNC can also be a deflationary token, i.e., a share of the token generated by charges is burned to lower the cryptocurrency’s complete provide. Deflation has a useful impact on the asset’s financial circulate.

Notice: Presently, the KNC provide is fastened till the KyberDAO votes to burn or mint extra.

The protocol burned its first 1 million KNCs in Could 2019 and the second 1 million KNCs in August 2019. Whereas the primary burning occurred 15 months after the launch, the second was solely after three months following the primary, demonstrating the protocol’s speedy progress and acceptance.

Regularly Requested Questions

What Is the Kyber Community Crystal Token

KNC has a number of functions because the blockchain’s native token, similar to staking for passive revenue rewards, platform governance, and so forth.

Is the Kyber Community Protected

As Kyber Community is a non-custodial, decentralized trade, customers have to hyperlink their wallets to start buying and selling whereas preserving anonymity and full management of their crypto belongings.

Kyber Community’s codebase has been audited by prime audit corporations Chainanalysis and Hacken and is offered for public document.

Conclusion

Kyber Community goals to turn out to be a frontrunner within the DeFi neighborhood for facilitating reserve liquidity by its performance and operations. It presents liquidity by aggregating liquidity from a number of sources and is powered purely by code, a distributed community of software program customers, and the Ethereum blockchain.

To achieve its aim, the Kyber Community gives a protocol for decentralized trade, an software programming interface (API) for token swaps, and the KNC cryptocurrency. The Community’s progress trajectory is sturdy, notably by fast token trades.

The protocol will improve buying and selling quantity, and KNC token demand because the Community’s utility in DeFi grows.

We hope our Kyber Community assessment has been useful on your crypto buying and selling!

You’re additionally welcome to go to our CoinStats weblog to find a broader perspective on decentralized finance and the way it seeks to empower individuals.

You can too learn our articles, similar to What Is DeFi, and discover our in-depth guides on numerous subjects, similar to What Is PanCakeSwap, What Is SushiSwap, Prime 10 Metaverse NFT Initiatives, Greatest NFT Video games, Tips on how to Purchase Cryptocurrency and be taught extra about wallets and exchanges, portfolio trackers, and so forth.

Funding Recommendation Disclaimer: The knowledge contained on this web site is supplied to you solely for informational functions and doesn’t represent a suggestion by CoinStats to purchase, promote, or maintain any securities, monetary product, or instrument talked about within the content material, nor does it represent funding recommendation, monetary recommendation, buying and selling recommendation, or another kind of recommendation.

PROS

- Non-custodian, nameless construction

- Suitable with all apps, decentralized functions, and protocols

- Helps over 20,000ERC20 tokens

- Wide selection of crypto companies

- Aggressive charges

- Options for sooner cryptocurrency trade

CONS

- No Cellular App

- Lacks an intuitive consumer interface

[ad_2]