[ad_1]

We’ve written plenty of Dailys, to not point out talked quite a bit in media, concerning the significance of the 23-month transferring common. Listed below are some previous feedback:

What has occurred within the final 2 years? A bullish run in 2021 primarily based on straightforward cash. Inflation operating hotter than most anticipated.

The banks have been caught off guard, and by 2022, the celebration was over.

So, that begs the query of why this 12 months’s 23-month transferring common is likely one of the most essential indicators for equities.

Usually, the enterprise cycle consists of 4 distinct phases: enlargement; peak; contraction; and trough. And it takes about 4.7-5 years to run by the cycle. Nonetheless, within the spirit of our new paradigm, or guidelines which can be sq. pegs becoming into spherical holes, we should ask:

- Was Covid the trough?

- Was the enlargement in 2021?

- The height January 2022?

- The trough in October 2022?

- And now, 2 years later, enlargement once more?

No have to stress about that, though–we simply want to observe the charts.

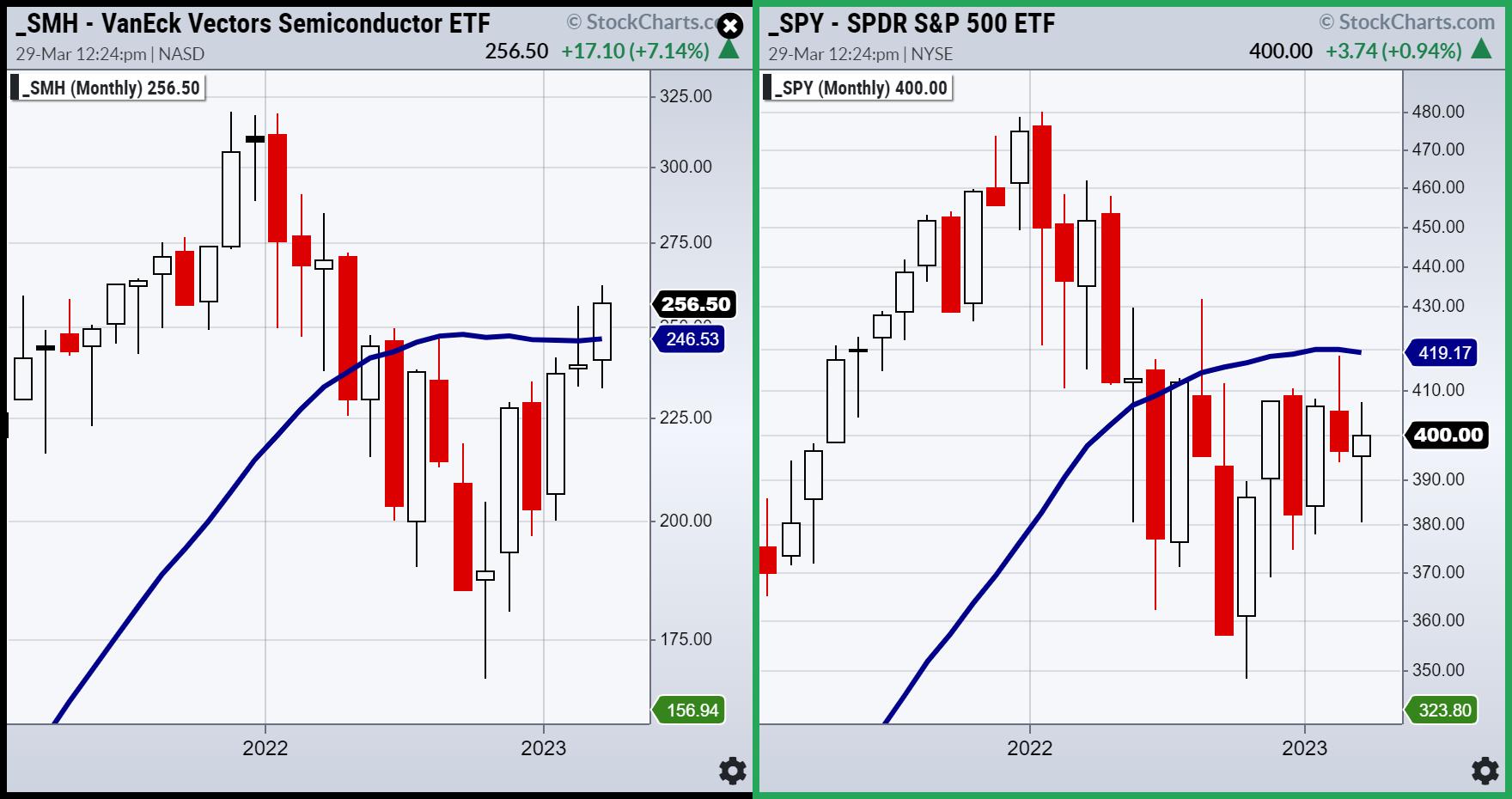

With solely 2 extra days till the tip of the month and the quarter, we see one space doubtlessly increasing additional, whereas the important thing index SPY, has extra to go. Plus, we now have discovered from the previous; chip shares can lead solely to this point earlier than they run out of fuel from pulling the financial boat all by themselves.

The 23-month transferring common, or simply shy of a 2-year enterprise cycle, speaks volumes. The Semiconductor ETF SMH is clearing the 23-month MA assuming it may possibly keep above that degree by the tip of the day this Friday. If SMH sells off from right here, failing the blue line, properly, that will be very informative, to not point out embolden the bears. Nonetheless, if SMH does certainly shut above the blue line, what is likely to be anticipated as we begin the 2nd quarter?

The SPY chart tells us a special story. SPY stays rangebound someplace between 380-405. Over 405, it may run to 420–the transferring common resistance.

Possibly SMH is at 265-270 if SPY will get to 420–but then what? For now, with yields larger, something is feasible. Nonetheless, I might respect how this month closes relative to the MAs.

Enlargement can start with tech and trickle all the way down to different sectors. Or tech may simply as simply reverse course in these skittish instances.

Register at no cost for Actual Imaginative and prescient’s Pageant of Studying! A treasure trove of specialists to reply your questions.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Advisor, to study extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

On this look on CMC Markets, Mish offers you clear actionable data to help why commodities look to go larger from right here.

Mish talks in search of inventory market alternatives on Enterprise First AM.

Mish discusses lengthy bonds, Silver to Gold and the Greenback on this look on BNN Bloomberg.

Mish sits down with Kristen on Cheddar TV’s closing bell to speak what Gold is saying and extra.

Mish and Dave Keller of StockCharts have a look at long run charts and talk about motion plans on the Thursday, March 17 version of StockCharts TV’s The Closing Bar.

Mish covers present market circumstances strengths and weaknesses on this look on CMC Markets.

Mish sees alternative in Vietnam, is buying and selling SPX as a spread, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole talk about particular inventory suggestions and Fed expectations on TD Ameritrade.

Coming Up:

March thirtieth: Your Day by day 5, StockCharts TV

March thirty first: Pageant of Studying Actual Imaginative and prescient “Portfolio Physician”

April 4th: The RoShowPod with Rosanna Prestia

April 24-26: Mish at The Cash Present in Las Vegas

Could 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): Good job SPY; 400 pivotal.

- Russell 2000 (IWM): 170 help, 180 resistance.

- Dow (DIA): 325 pivotal.

- Nasdaq (QQQ): 305 help, 320 resistance.

- Regional Banks (KRE): Weekly value motion extra contained in the vary of the final 2 weeks.

- Semiconductors (SMH): After testing 250, SMH sprouted Surprise Girl wings.

- Transportation (IYT): 223 now resistance with 219 key help.

- Biotechnology (IBB): Cleared the 200-DMA at 127, so now wants to carry it.

- Retail (XRT): Nonetheless weakest moreover KRE so far as Financial Trendy Household, so, if rally holds, it needs to be with Granny in it. 60 key help.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary data and schooling to hundreds of people, in addition to to giant monetary establishments and publications resembling Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the 12 months for RealVision.

Subscribe to Mish’s Market Minute to be notified at any time when a brand new publish is added to this weblog!

[ad_2]