[ad_1]

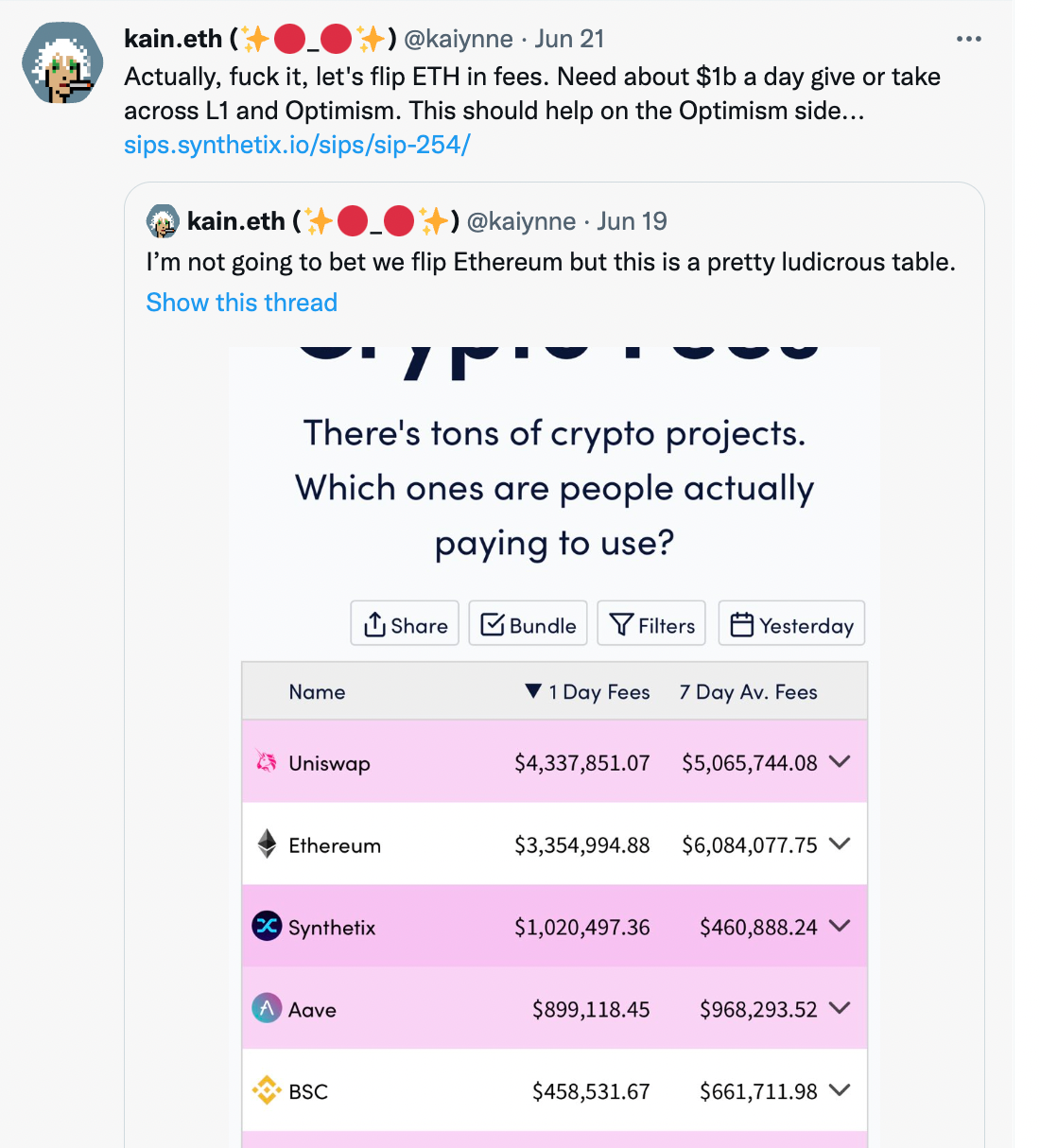

We have reached the yr’s midway level, so it is a good time to revisit key milestones for 2022. It has been an thrilling six months to this point with a number of extremely anticipated options hitting mainnet and driving $100-200m in each day buying and selling quantity via the Synthetix protocol. As Kain talked about on Twitter, sights have been set excessive and the group is working laborious to ship on these expectations. 👇

A number of upcoming milestone’s will assist Synthetix attain this aim.

Cross Asset Swaps (launched mid-June) have been an enormous driver of quantity recently, and there are nonetheless plenty of optimizations and integrations that may direct a bigger share of on-chain spot quantity via Synthetix. Moreover, Synthetix perps have seen respectable natural (and non incentivized) quantity, and the upcoming launch of Perps V2, mixed with different releases from ecosystem companions like Kwenta and Polynomial, will proceed to drive adoption on Optimism. Lastly, V3 goals to perform what Synthetix got down to do a few years in the past by reworking the protocol right into a permissionless derivatives platform.

Extra detailed overviews of the affect every of those milestones can have on the protocol can be launched within the coming weeks. The Synthetix group believes that the completion of those milestones will set the protocol on a path to additional development as a constructing block of DeFi derivatives.

Releases Delivered in H1 2022

Synthetix Futures – March 2022

Essentially the most anticipated function of all of them! Synthetix’s perpetual futures allow a a lot expanded and capital-efficient buying and selling experience by permitting leveraged lengthy and shorts on Optimism with low charges and prompt execution.

For SNX stakers, perps present an extra supply of buying and selling charges from trade charges and funding charges.

Atomic Swaps and Integrations – Might 2022

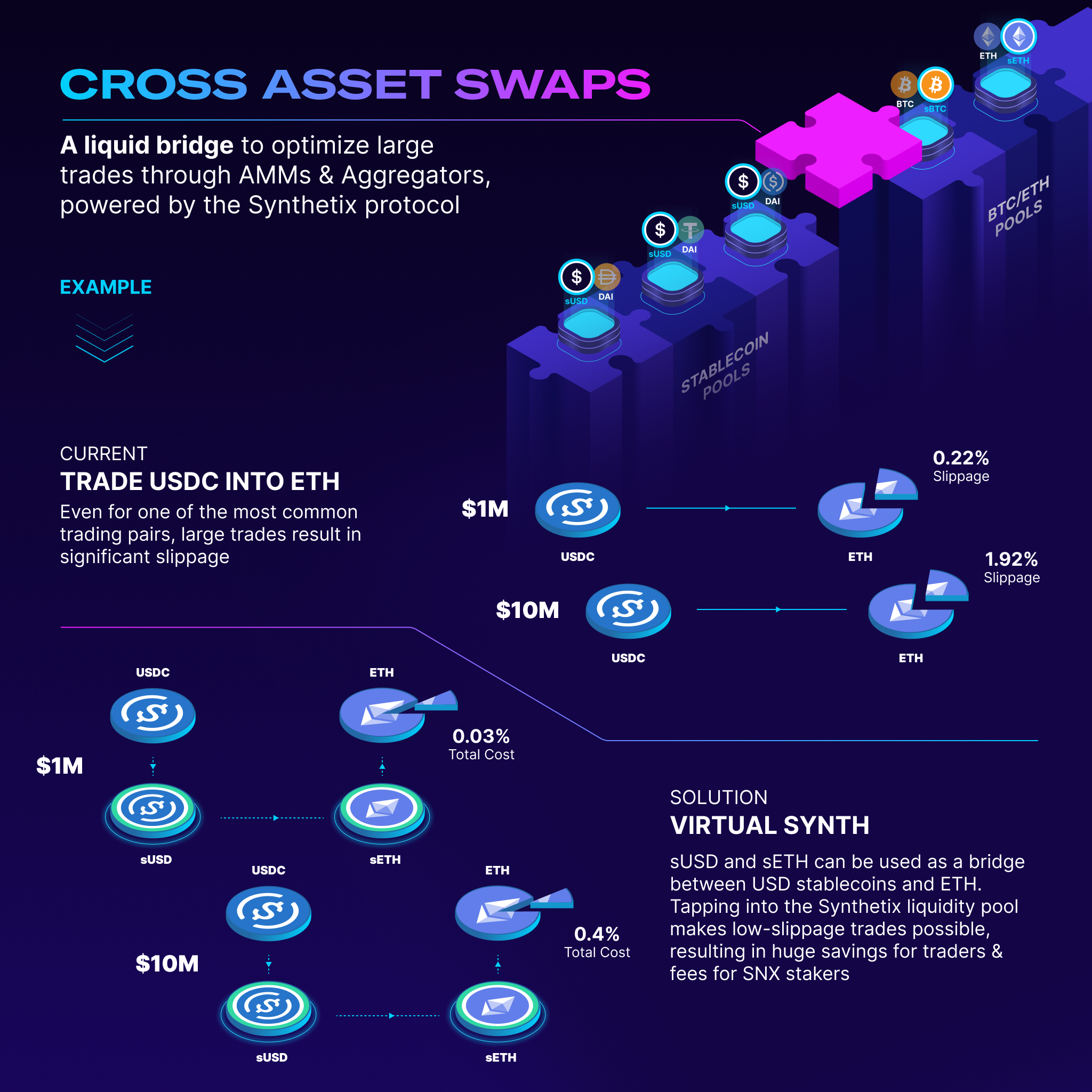

What are Atomic Swaps?

Atomic Swaps are a brand new trade operate permitting customers to atomically trade belongings with an inexpensive charge by pricing synth exchanges through a mixture of Chainlink and DEX oracles (Uniswap V3) This helps to allow seamless buying and selling between artificial belongings like sETH, sUSD, sBTC, and so forth. A novel property of that is that for giant commerce sizes, it tremendously reduces the general price for merchants on account of slippage.

The place is that this product built-in?

1inch and Curve are at the moment the first quantity sources for these. But, there’s nonetheless an extra diploma of integration that must be enabled via 1inch. Members of the group are in touch with different main aggregators to combine cross-asset swaps. A number of aggregators have groups actively engaged on finishing integrations.

Atomic Swaps & Synthetix’s Quantity Increase

Synthetix’s buying and selling quantity has vastly elevated in current weeks on account of 1inch integrating with Atomic Swaps. 1inch merchants acquire entry to a different path of liquidity, with low slippage and costs, and SNX stakers obtain buying and selling charges from as much as a whole bunch of tens of millions in buying and selling quantity per day.

These contracts are processing a whole bunch of tens of millions in each day quantity whereas additionally producing as much as $1M in each day charges for SNX stakers and Curve LPs

What’s the way forward for Atomic Swaps?

- Accomplished integrations – Whereas 1inch generates the vast majority of aggregator quantity, extra quantity might be captured by tapping into all remaining aggregators. Additional, 1inch is simply partially built-in. Because it stands, customers want to finish two separate transactions for USDC > ETH. They should do USDC > sUSD > sETH in a single tx, after which sETH > ETH in a second tx. As soon as that is mixed right into a single transaction for the end-user, the UX can be tremendously improved and extra usually accessible.

- Market quantity – On the time of publication, DeFi is in a interval of declining swap quantity via aggregators as measured right here. When on-chain swap quantity picks up once more, Synthetix can be ready to seize this quantity.

- Giant merchants – As consciousness of the effectivity of Synthetix cross-asset swaps unfold, and the parameters of cross belongings swaps are improved, the group anticipates that buying and selling quantity will additional improve, creating extra charge quantity for Synthetix and integration companions.

- Layer 2 Liquidity Development – Liquidity on Optimism is at the moment low however rising. Within the coming yr as extra liquidity strikes to Optimism, there can be bigger commerce volumes being executed on Optimism which might additionally result in extra demand for cross-asset swaps via Synthetix.

- Observe – Atomic Swaps are at the moment attainable on L2 and might at the moment be routed via Curve/1inch/Velodrome, however elevated liquidity is required to enhance the utility

- Multi-Layer – As Synthetix V3 contracts are deployed and ongoing works with Chainlink to deploy CCIP progresses, there can be a possibility for synth swaps to be supported on different Ethereum L2s and EVM chains.

Debt Pool Synthesis – March 2022

Debt swimming pools on mainnet and Optimistic Ethereum have been merged, which helps to offer most liquidity and permits synths to be fungible throughout chains.

New Liquidation Mechanism – Might 2022

Ensures the system is correctly collateralized and liquidated customers that fall beneath the collateralization necessities. Liquidated SNX is distributed to customers alongside their liquidated debt.

This redesigned liquidation mechanism creates higher incentive alignment inside the system by offering choices for stakers to restore their c-ratio with a minimal penalty if they’re unable or unwilling to purchase synths in the marketplace to revive their c-ratio.

V3GM Election Module – June 2022

Synthetix elections have gone FULLY ON CHAIN! No extra discord nominations, google sheets, and so forth. Customers nominate and vote via an election module which incorporates pitches for candidates, their socials, and so forth.

Circuit Breakers and Dynamic Alternate Charges – Feb/March 2022

Two adjustments to restrict frontrunning:

Circuit Breakers – Oracle pauses Synthetix markets when on-chain costs deviate from off-chain costs by over a sure threshold.

Dynamic Alternate Charges – Charge added on prime of exchanges which can be triggered when volatility is excessive and decays as volatility subsides.

Automated SNX Claiming – June 2022

Synthetix collaborated with Gelato to permit stakers to mechanically declare SNX staking rewards on Optimism. As of proper now, the mixing permits stakers to assert their weekly rewards as soon as their C-Ratio is above the goal C-Ratio.

No extra ready to be above the goal, simply set and (kinda) neglect!

Automated debt pool hedging by dHEDGE and Toros – June 2022

One-click debt mirror index for SNX stakers on Optimism. Continually checking and rebalancing your debt is a factor of the previous, dHEDGE has you lined!

Product Releases – H2 2022

sUSD Bridge – SIP 229 by DB

Permits customers to maneuver sUSD backwards and forwards from Optimism and mainnet Ethereum. This may drastically improve the community’s capital effectivity and pave the way in which for debt migration.

Synthetix Futures Perps V2

Perps V2 will assist to scale the Synthetix Perpetual Futures and makes it extra accessible to extra merchants. However earlier than we dive into V2, let’s first overview the present state of Synthetix Perps and the way a lot quantity and costs it generates.

The Present state of Synthetix Perps

The beta launch of Synthetix Perps has been a hit, it has generated upwards of $2.8b+ in quantity since launch and $10m in trade charges for stakers. That is from 4000 distinctive merchants making approx 26,000 trades.

Synthetix hasn’t supplied any to incentivize buying and selling, all the development is from utterly natural utilization of the product. With incentivizes like SIP-254 by Kain, which proposes to divert 20% of inflation to buying and selling incentives, buying and selling quantity will certainly improve alongside charges for stakers.

Perps V2 and The Way forward for Perps

Perpetual futures can be up to date drastically to enhance on the next targets:

- Considerably enhance person expertise with decrease charges and extra predictable funding charges

- Improve open curiosity limits and increase assist for extra markets.

Observe: A follow-on impact of improved person expertise for perps can be elevated charges captured by the Synthetix protocol.

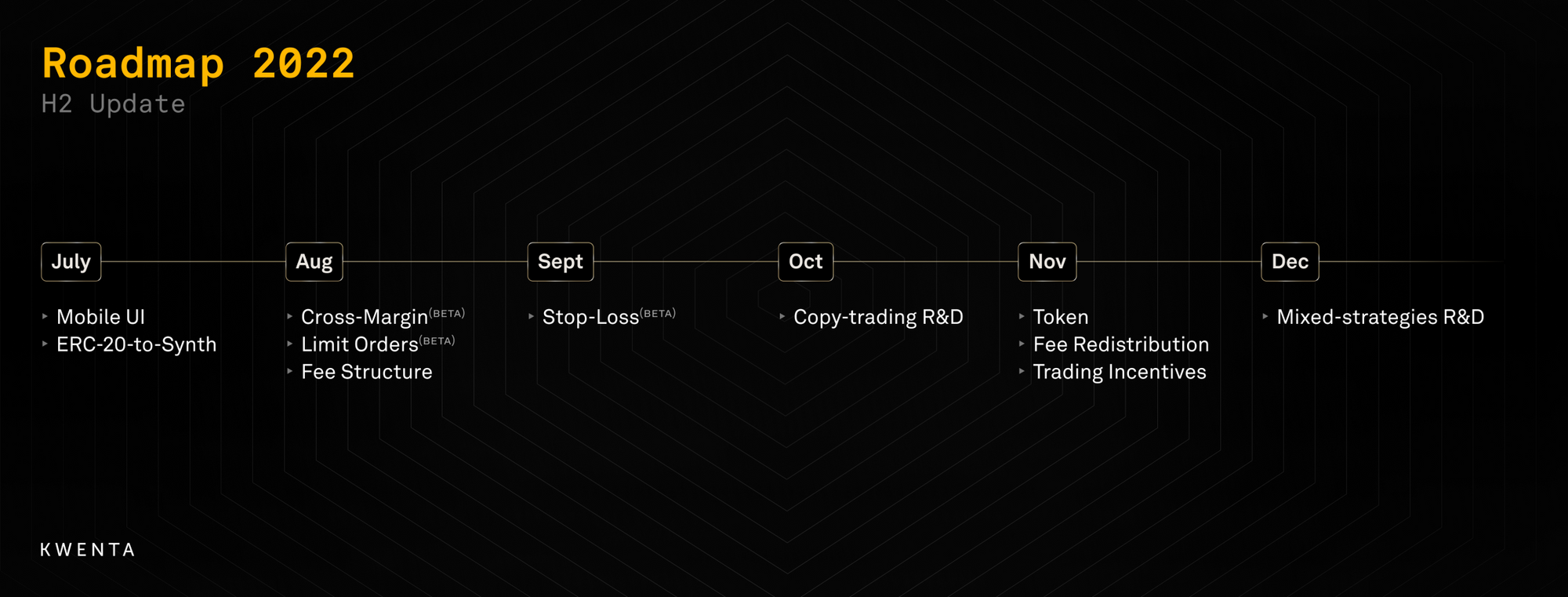

Ecosystem companions are additionally laborious at work to enhance the buying and selling expertise, a snippet from Kwentas for roadmap breaks down a few of their futures-related releases.

Highlights from Kwenta Updates:

- Cell UI assist

- Cross Margin

- Restrict Orders

- Cease-Loss

- Copy Buying and selling

- Launch of the KWENTA token and buying and selling incentives

Kwenta isn’t the one one constructing ontop of futures, Polynomial can be constructing a foundation buying and selling vault to generate charges for customers by capturing the inconsistencies between the spot market and its corresponding perpetual futures. On this technique, they’ll attempt to accumulate funding charges by going lengthy on the spot market and an equal quantity quick on the perpetual futures market.

Twitter Hyperlink – Polynomial Submit

These vaults from Polynomial are anticipated to go stay by the top of July.

Synthetix V3

V3 goals to perform what Synthetix got down to do a few years in the past by reworking the protocol right into a permissionless derivatives platform.

Full rebuild of Synthetix as a extra versatile protocol on a way more environment friendly structure. Redesigns all the protocol from the bottom as much as facilitate growth of novel DeFi purposes.

What are the advantages for the Synthetix protocol, customers, and builders?

Lengthy Time period Imaginative and prescient

- Permissionless asset creation – Any monetary by-product might be constructed on prime of Synthetix V3.

- Higher management of credit score – Stakers can decide and select which belongings they’d prefer to collateralize. It improves the hedging expertise and permits new belongings to extend their liquidity with out being authorized by the Spartan Council.

- “Liquidity as a Service” – Synthetix is not going to simply be a protocol to route buying and selling via b/c of its debt pool and belongings; it will likely be a protocol you construct on prime of in the event you’re seeking to improve liquidity for any monetary by-product on-chain quickly.

Why Builders will love V3

- Create a pool to assist [nearly] any monetary by-product you wish to construct

- Something you’ve got ever dreamed of, from conventional monetary markets to extra unique markets comparable to no-loss lotteries and even supporting liquidity for friends protocols.

- Present (perceived) rivals might, in idea, supply, and route liquidity via Synthetix to extend their accessible markets.

- Solves the Chilly Begin liquidity drawback – helps experimentation by simplifying provisioning of liquidity for early markets

- Clear and easy to know: Integrating with Synthetix will take days not weeks.

Why Stakers will love V3

- Simplified Staking: Staking SNX is so simple as another protocol

- Differentiated Debt Pool: provide collateral to, and obtain charges from, particular asset swimming pools with out having to be uncovered to each asset the Spartan Council helps (as is the case in V2x)

- Inflation Weighting: veSNX gauges

- Staking Incentives: lock for higher rewards

- Far simpler staking expertise for brand spanking new customers who solely wish to hedge sure belongings.

Listed below are a few of the in progress SIP’s to be taught extra concerning the present state of Synthetix V3 and the way it will evolve:

Debt Migration – SIP 237 by Kain Warwick

One-click migration of staking debt place from Ethereum to Optimism with out requiring customers to burn their debt.

Because the final V2x SIPs are finalized and V3 preparations start, SNX staking could should migrate from Ethereum to Optimism. This may enable the brand new V3 staking system to be deployed solely to Optimism initially, decreasing the migration overhead, after which expanded to different networks as wanted.

WIP and Proposed SIPs

Along with the product launch schedule, some adjustments and additions to the system are being reviewed and debated. Core contributors have proposed some, and group members have proposed others. The Spartan Council will decide if and when these SIPs are carried out.

To supply enter, please be part of us on Discord or weekly Spartan Council <> Core Contributor syncs.

Liquidation of SNX Escrow – SIP 252 by Kaleb

Up to date the Liquidation Mechanism to incorporate SNX tokens held in an account alongside SNX tokens which can be in escrow to be liquidated till the goal issuance ratio of an SNX staker is restored. At present, accounts can circumvent the intention of the SIP-148 by not vesting their tokens. With the adjustments proposed on this sip, that debt can be cleaned, permitting the protocol to be extra resilient and higher capitalized in the long term.

If the self-liquidate technique known as, a person’s account is liquidated with solely the snx accessible in his account (escrow can’t be utilized to repay debt with the self-liquidation technique). This ensures that accounts aren’t in a position to bypass escrow with a self liquidation.

Perps Buying and selling Incentives – SIP 254 by Kain Warwick

Proposes to divert 20% of weekly inflation to buying and selling incentives on perpetual futures markets.

Every day at UTC, 0 buying and selling quantity and open curiosity can be measured for the prior 24h interval. A mix of cumulative open curiosity and buying and selling quantity can be calculated for every lively deal with to assign a buying and selling reward rating.

Redistribute sUSD Charges to L2 – SIP 255 by DB

Modifications the sUSD charge distribution to ship extra sUSD to L2. With the rise of sUSD charges on mainnet, there has to nonetheless be an incentive for customers to stake on Optimism. To fulfill this, this SIP proposes sending an extra quantity of sUSD from L1 to L2 upon charge pool closure.

Debt-ratio futures market – SIP 257 by Arthur

Creates a Synthetix futures marketplace for Synthetix debt share worth (debt ratio) for capital-efficient debt-hedging. A Chainlink oracle for the debt ratio is already a part of the debt system (SIP 165). A futures market will create a extra environment friendly debt hedging market and maintain extra of the hedging charges within the protocol.

Extra Crypto and Commodities Futures Markets

There are at the moment three SIPs excellent concerning including new futures markets; they’re as follows:

[ad_2]