[ad_1]

Solana worth evaluation reveals rising indicators because the market reveals draw back danger. Consequently, the bears have obtained management of the Solana market, which could change the course of the marketplace for the more severe as bears collect to say no the value, and SOL now expects a constructive interval to take over within the subsequent few days. Consequently, the bears will do the whole lot they’ll to take care of management. Furthermore, the SOL worth has skilled lowering dynamics in the previous couple of hours.

The market reveals the value of Solana crashed yesterday to the $30.5 mark and additional elevated to $30.8. Solana continues a constructive motion. Furthermore, the subsequent day, Solana costs crashed and reached $30.5. SOL at the moment trades at $30.8; SOL has been down 1.20% within the final 24 hours with a buying and selling quantity of $671,937,970 and a reside market cap of $11,054,796,871. SOL at the moment ranks at #9 within the cryptocurrency rankings.

SOL/USD 4-hour worth evaluation: Newest developments

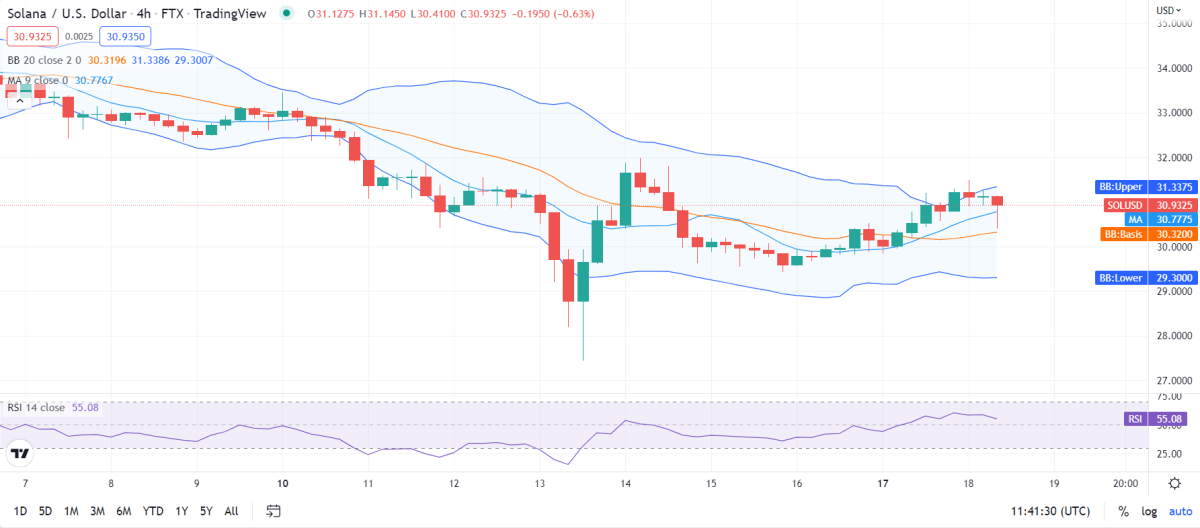

Solana worth evaluation illustrates that the current situation of the market demonstrates bearish potential as the value strikes downwards. Furthermore, the market’s volatility follows an rising motion, making the cryptocurrency extra prone to risky change on both excessive. Consequently, the higher restrict of Bollinger’s band rests at $31.3, serving because the strongest resistance level for SOL. Conversely, the decrease restrict of Bollinger’s band is current at $29.3, serving as a assist level for SOL.

The SOL/USD worth travels over the Shifting Common curve, indicating the market is following a bullish motion. Nonetheless, because the market experiences rising volatility as we speak, the Solana worth has extra room to shift to a constructive development; nevertheless, that additionally signifies that the cryptocurrency has extra room to maneuver to the constructive aspect. As well as, the SOL/USD worth appears to maneuver downward, signifying a lowering market with additional declining dynamics.

Solana worth evaluation reveals that the Relative Power Index (RSI) rating is 55 making the cryptocurrency lie within the central-neutral area. Moreover, the RSI rating strikes downward, indicating that the promoting exercise exceeds the shopping for exercise whereas transferring towards stability.

Solana worth evaluation for 24-hours

Solana worth evaluation has skilled a fluctuating motion in the previous couple of days. Nonetheless, with the volatility rising. Furthermore, because the volatility opens, it makes the worth of the cryptocurrency extra weak to alter. Consequently, the higher restrict of Bollinger’s band rests at $34.8, serving as essentially the most substantial resistance for SOL. Contrariwise, the decrease restrict of Bollinger’s band rests at $29.2, serving because the strongest assist for SOL.

The SOL/USD worth seems to be crossing over the Shifting Common curve, displaying bullish momentum. Nonetheless, the assist and resistance are opening up, indicating rising volatility with huge probabilities of acquiring a constructive development. Nonetheless, the value strikes downwards in the direction of lowering traits.

The Relative Power Index (RSI) rating seems to be 44, displaying the cryptocurrency’s stability. It falls within the lower-neutral area. Nonetheless, the RSI rating follows a downward motion signifying a lowering market and gestures towards lowering dynamics. The lowering RSI rating signifies promoting exercise exceeds the shopping for exercise.

Solana Value Evaluation Conclusion

Solana worth evaluation reveals bearish momentum and additional bearish potential. Furthermore, the bears have proven their deterrence and would possibly take management of the market quickly for the long run because the market reveals huge indicators of change. Due to this fact, in keeping with this evaluation, Solana is predicted to have a shiny future, with the bulls taking the bears fully out of the image, supplied the value breaks the market.

Disclaimer. The data supplied is just not buying and selling recommendation. Cryptopolitan.com holds no legal responsibility for any investments made primarily based on the data supplied on this web page. We strongly suggest impartial analysis and/or session with a certified skilled earlier than making any funding selections.

[ad_2]