[ad_1]

When somebody sends me a ticker to assessment, the very first thing I do is deliver up my normal two-year every day chart on StockCharts. And the very first query I ask myself is at all times the identical: is that this chart in an accumulation section or a distribution section?

Now that could be a considerably subjective query to make certain, however the technical toolkit offers some ways to quantify tendencies and measure pattern energy. For me, “accumulation” means that patrons are pushing costs greater, thus the inventory is in an uptrend. And “distribution” means basically an absence of patrons, that means the value tendencies decrease over time.

The StockCharts SCTR rankings are primarily based on a simplistic worth momentum mannequin. Mainly, the stronger the pattern, as outlined on three totally different time frames, the upper the SCTR. As I assessment the highest ten massive cap shares primarily based on their SCTR rankings, I am struck by the constant uptrends of shares very a lot in an accumulation section.

Listed below are the top-ten ranked massive cap shares primarily based on their SCTR scores, together with feedback for every. Be aware three constant options: greater highs and better lows, sturdy momentum traits and enhancing relative energy!

1. Petrobras (PBR/A)

2. Petrobras (PBR)

These first two are totally different share courses of the identical Brazilian oil firm, Petrobras. It is exhausting to think about a chart like this exists in a yr when the most important fairness averages are in constant downtrends!

Be aware the latest breakout to new highs after a pullback to the 50-day shifting common, which is a traditional bullish sample.

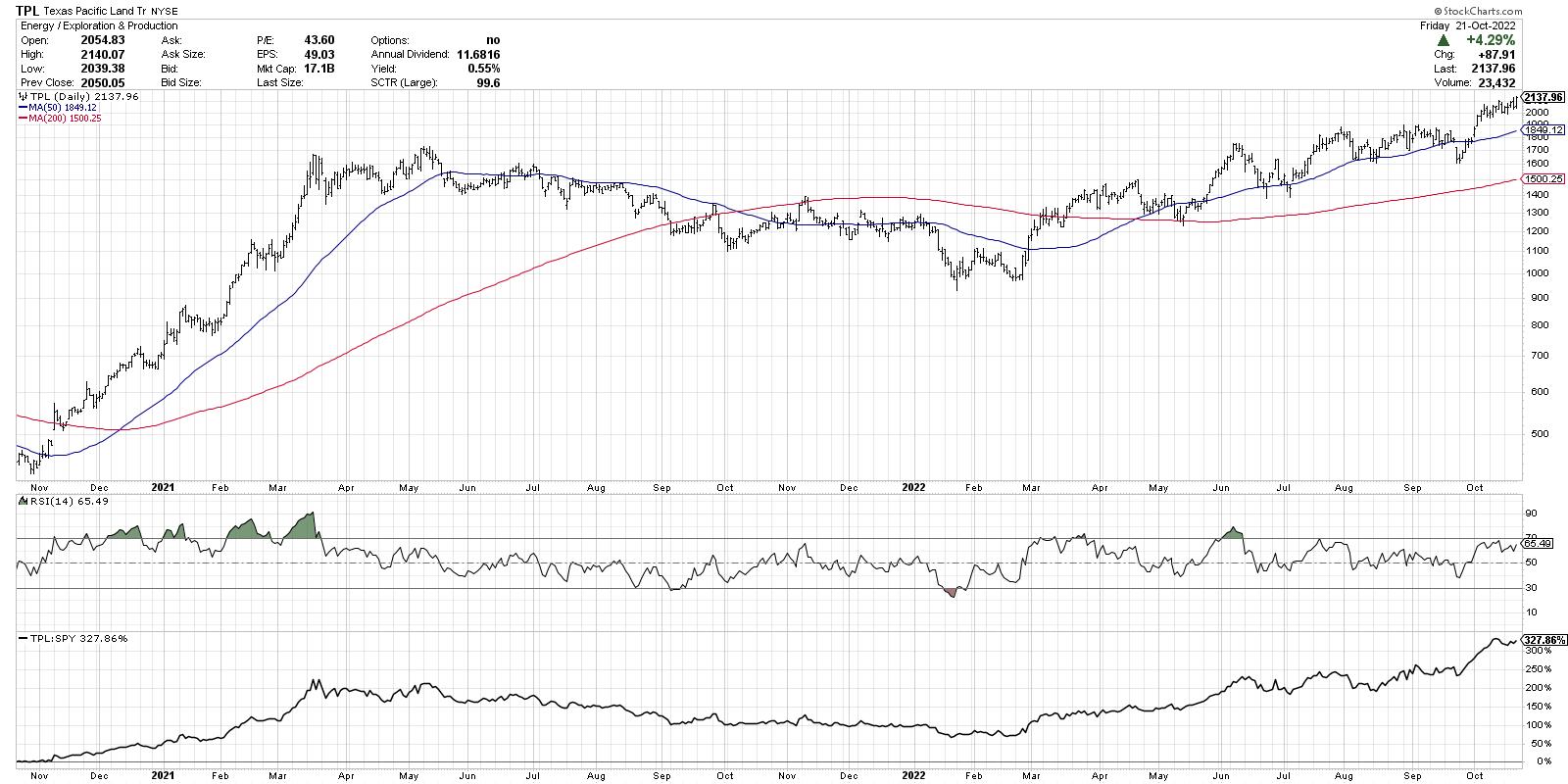

3. Texas Pacific Land Belief (TPL)

A uncommon identify that has doubled since January, TPL simply broke above the $2000 degree for a brand new all-time excessive. Discover how the RSI has remained above 40 on latest pullbacks, which is widespread in bull phases.

4. HF Sinclair Company (DINO)

Now this one has a cup-and-handle look to it, with a rounded consolidation section from the June peak into late August, adopted by a shallower pullback in September. The latest break to new highs completes the sample and suggests additional upside potential.

5. Schlumberger (SLB)

SLB pulled again with the remainder of power in June, however the greater low in October set the stage for a profitable retest of the June excessive. The inventory is now overbought with an RSI over 70, however that isn’t at all times a foul factor! Try the RSI in January.

6. Aspen Know-how (AZPN)

What? A expertise inventory truly made it into the highest ten?!? AZPN has been fairly an outlier in its sector, up 67% year-to-date whereas the XLK is down about 28%. Right here, we discover a very constant uptrend of upper highs and better lows. When the value is above two upward-sloping shifting averages, the pattern is powerful.

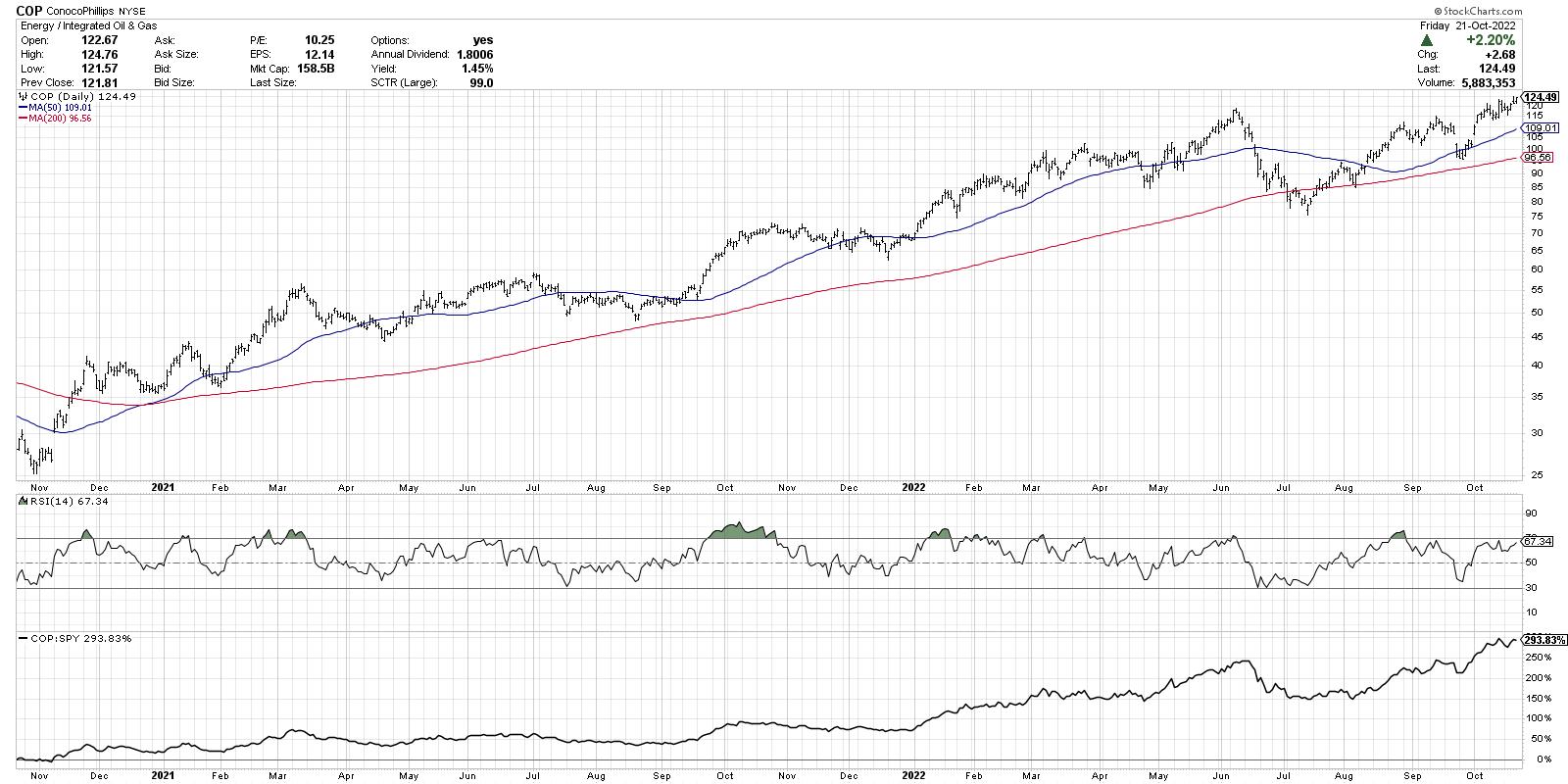

7. ConocoPhillips (COP)

COP has a good higher cup-and-handle sample than DINO, with a clearly outlined “rim” to the cup and a sound breakout above resistance in early October. Considerably weaker momentum for the reason that overbought circumstances in August, which can be one thing to look at.

8. First Photo voltaic (FSLR)

Now we go from “outdated power” to “new power” with a bounce to the photo voltaic shares. That is an intriguing chart for a lot of causes. Look how FSLR examined worth assist round 60-65 quite a few instances, earlier than gapping greater in July and by no means wanting again.

The value broke above the 2021 excessive in late August and has now pulled again to the breakout degree round $120. Can FSLR maintain this key assist degree?

9. Devon Power (DVN)

DVN has been a favourite identify in 2022, notably within the first half of the yr, when it was usually within the SCTR high ten. Together with the remainder of the power house, we’re seeing renewed upside stress and a retest of all-time highs. Does this pattern proceed to a lot greater highs? I’d suspect the reply is more than likely sure.

10. Hess Corp (HES)

And we might have saved the most effective for final. HES has been in a basing sample for the final 4 months and, simply this week, made a decisive transfer above the $130 degree. And the relative energy exhibits that this has been a constant long-term outperformer.

So what’s per all of those charts? They’re within the accumulation section. They’re displaying proof that patrons are pushing costs greater as resistance ranges are met and eclipsed.

Whereas this spherical is dominated by power shares, that’s actually not at all times the case. However in case you repeatedly assessment the top-ranked SCTR shares, you’ll discover that, whatever the broader market setting, some shares someplace will likely be within the accumulation section.

As Paul Montgomery as soon as mentioned, “Essentially the most bullish factor the market can do is go up.”

Yet another factor… My newest YouTube video solutions a latest query, “Are you able to focus on the position of time within the formation of technical patterns?” Test it out:

RR#6,

Dave

P.S. Able to improve your funding course of? Try my YouTube channel!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator, and don’t in any method signify the views or opinions of every other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers reduce behavioral biases via technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor resolution making in his weblog, The Aware Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing danger via market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra

Subscribe to The Aware Investor to be notified each time a brand new put up is added to this weblog!

[ad_2]