[ad_1]

Polkadot value evaluation reveals a severely declining strategy at present; the value has misplaced most of its misplaced worth. In the previous few days, the price of DOT has acquired a lot damaging consideration and has decreased to a slight diploma. On October 20, 2022, the value all of the sudden decreased from $6.2 to $6 Nonetheless, the value began to achieve additional optimistic momentum the identical day and regained a price of as a lot as $6.1. On October 20, 2022, the value noticed crashing lows and reached an all-day low of $5.93. Furthermore, the forex value of the cryptocurrency stays round $5.96.

Polkadot trades at $5.96 proper now; Polkadot is down 4.06% within the final 24 hours, with a buying and selling quantity of $209,763,043 and a dwell market cap of $6,672,751,773. Polkadot ranks at #12 within the cryptocurrency market.

DOT/USD 4-hour value evaluation: Current updates

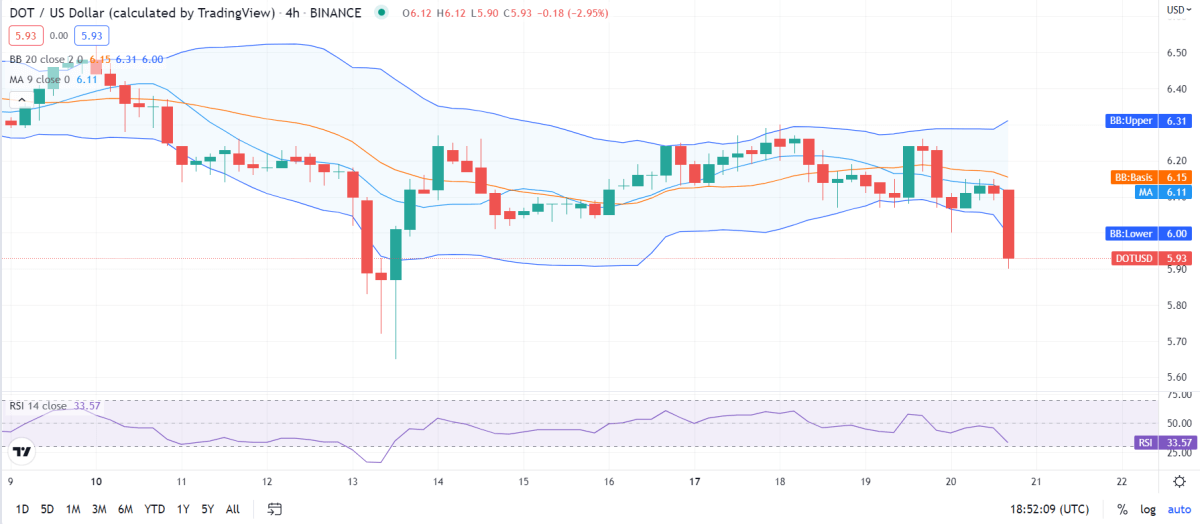

Polkadot value evaluation reveals the market volatility to observe an unsure opening motion, which causes the DOT costs to develop into extra inclined to unstable change. In consequence, Bollinger’s band’s higher restrict is $6.31, performing because the strongest resistance level for DOT. Conversely, the decrease restrict of Bollinger’s band is at $6, representing one other help level for DOT.

The DOT/USD crosses underneath the Shifting Common curve indicating a bearish motion available in the market. Moreover, as a result of current breakout, the value seems to maneuver additional downward with a robust chance of breaking the help as soon as once more. The breakout has induced the volatility to extend as properly considerably, and make approach for a whole reversal.

Polkadot value evaluation reveals the Relative Power Index (RSI) rating to be 33, which falls within the undervalued area. The RSI rating follows a downward motion within the undervalued area, signifying future devaluation. The DOT/USD value has discovered an especially low place inside the market and has anchored itself there. The dominance of promoting exercise causes the RSI to lower.

Polkadot value evaluation for 1-day

Polkadot value evaluation reveals the market volatility to enter a slight growing motion; it’s starting to open up because the resistance and help bands transfer farther one another. The cryptocurrency value will observe the volatility and develop into extra inclined to unstable change. The Bollinger’s band’s higher restrict is $6.52, performing because the strongest resistance level for DOT. The decrease restrict of Bollinger’s band is current at $5.94, representing one other help level of DOT.

The DOT/USD value seems to cross underneath the Shifting Common curve signifying a bearish motion. The value strikes downward in direction of damaging dynamics. Evidently the bears have claimed the marketplace for themselves and are on their strategy to sustaining this dominion for the subsequent few weeks. The value has crossed the help band and induced a breakout, and the volatility bands appear to pose a menace to the present regime.

Polkadot value evaluation reveals the Relative Power Index (RSI) to be 36, indicating that the cryptocurrency is undervalued. Polkadot falls within the lower-neutral area. Nonetheless, its place is certain to vary because the RSI rating follows a downward motion indicating dominant promoting exercise.

Polkadot Worth Evaluation Conclusion

Polkadot value evaluation concludes that the cryptocurrency packs huge potential for additional declining motion; nonetheless, for now, the market appears to favor a breakout, which could show to be advantageous to the bulls. They may reverse the market and declare the marketplace for themselves.

Disclaimer. The knowledge supplied just isn’t buying and selling recommendation. Cryptopolitan.com holds no legal responsibility for any investments made primarily based on the data supplied on this web page. We strongly suggest impartial analysis and/or session with a professional skilled earlier than making any funding choices.

[ad_2]