[ad_1]

Pepperstone is a foreign exchange dealer that’s based mostly in Australia. As you will note on this Pepperstone evaluate, the dealer affords CFDs, too, and is thought for opening an workplace in London to raised serve its purchasers in Europe. Loads of new purchasers that registered after Brexit have been served by the dealer’s German and Cyprus workplaces. General, the picture of the corporate is sweet and is taken into account secure due to its regulation. Within the elements of the Pepperstone foreign exchange dealer evaluate beneath, we’re exhibiting you extra particulars it is advisable know in regards to the firm.

For these of you who don’t know, Pepperstone is regulated by seven completely different authorities, together with three top-tier monetary authorities just like the UK’s Monetary Conduct Authority (FCA), the BaFin in Germany, in addition to the Australian Securities and Investments Fee (ASIC).

The CFD buying and selling at Pepperstone is strong, regardless of the advanced nature of the devices. There’s a excessive threat of shedding cash on account of leverage, which is why the vast majority of retail investor accounts are cautious. If you’re studying this Pepperstone dealer evaluate hoping to be taught extra in regards to the dealer and CFDs, know that you just want a bit of data and talent to afford and take the excessive threat of shedding your cash.

Pepperstone Dealer Overview: What’s It All About

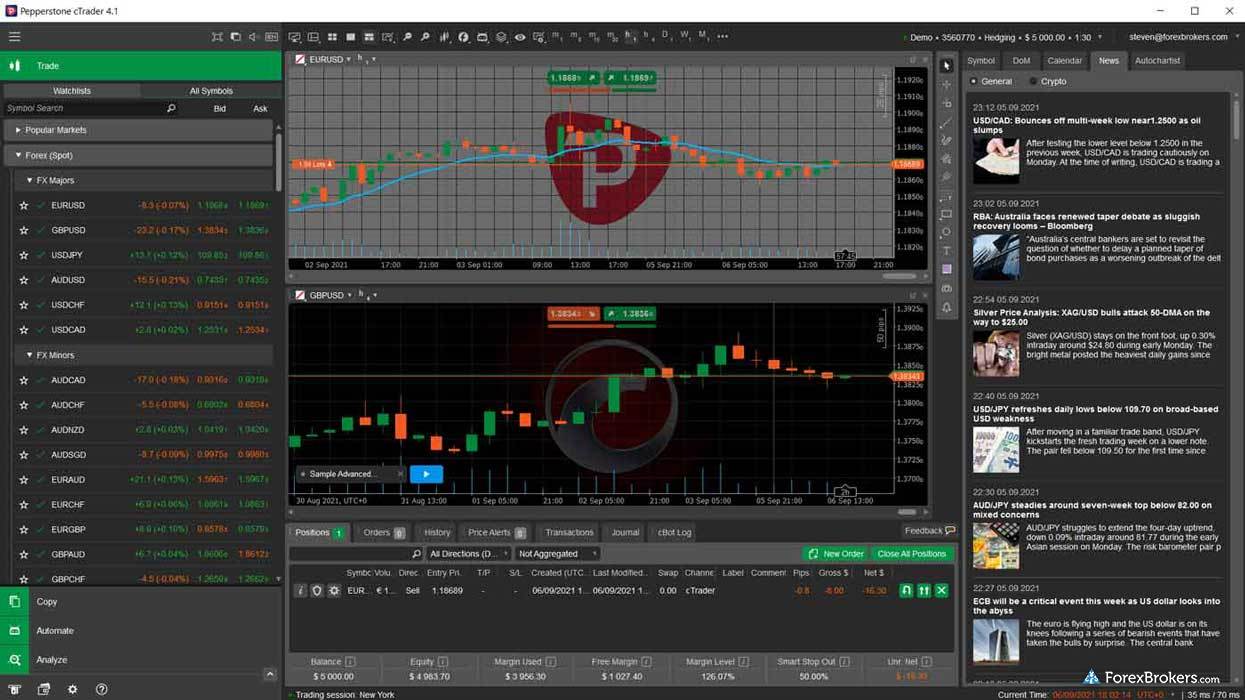

Opening an account on Pepperstone is a comparatively fast course of which is simple with out too many hurdles. It’s fully digital, and the options are user-friendly. On the adverse aspect, there are solely foreign exchange, crypto, and CFDs and the MetaTrader platform for buying and selling, which is slightly primary.

One other factor price noting is the low foreign exchange and non-trading charges, which make this dealer engaging for newbie merchants. There are not any inactivity or account charges, however the CFD financing charges are excessive for just a few property. Beneath is an in depth Pepperstone evaluate with all of its options.

|

Nation of regulation |

UK, Germany, Cyprus, Australia, United Arab Emirates, Bahamas, Kenya |

|

Buying and selling charges class |

Low |

|

Inactivity payment charged |

No |

|

Withdrawal payment quantity |

$0 |

|

Minimal deposit |

|

|

Time to open an account |

1 day |

|

Deposit with financial institution card |

Obtainable |

|

Depositing with digital pockets |

Obtainable |

|

Variety of base currencies supported |

9 |

|

Demo account offered |

Sure |

|

Merchandise provided |

Foreign exchange, CFD, Crypto |

As an illustration, you may safely commerce the S&P 500 CFD, Europe 50 CFD, EURUSD property with low charges, particularly with the upper tier accounts. In comparison with different brokers, this one is spectacular – and in our Pepperstone foreign exchange dealer evaluate, the corporate scores nicely. Now, let’s speak extra in regards to the foreign exchange charges on the platform.

The corporate additionally gives instruments that provide help to grasp buying and selling and improve the effectivity of all trades. General, it’s appropriate for each newbie and skilled merchants, having all the things you want for comfy buying and selling, equivalent to favorable situations, reliability, loads of buying and selling devices, plus a fantastic academic part.

Pepperstone Foreign exchange Dealer Overview: Charges & Construction

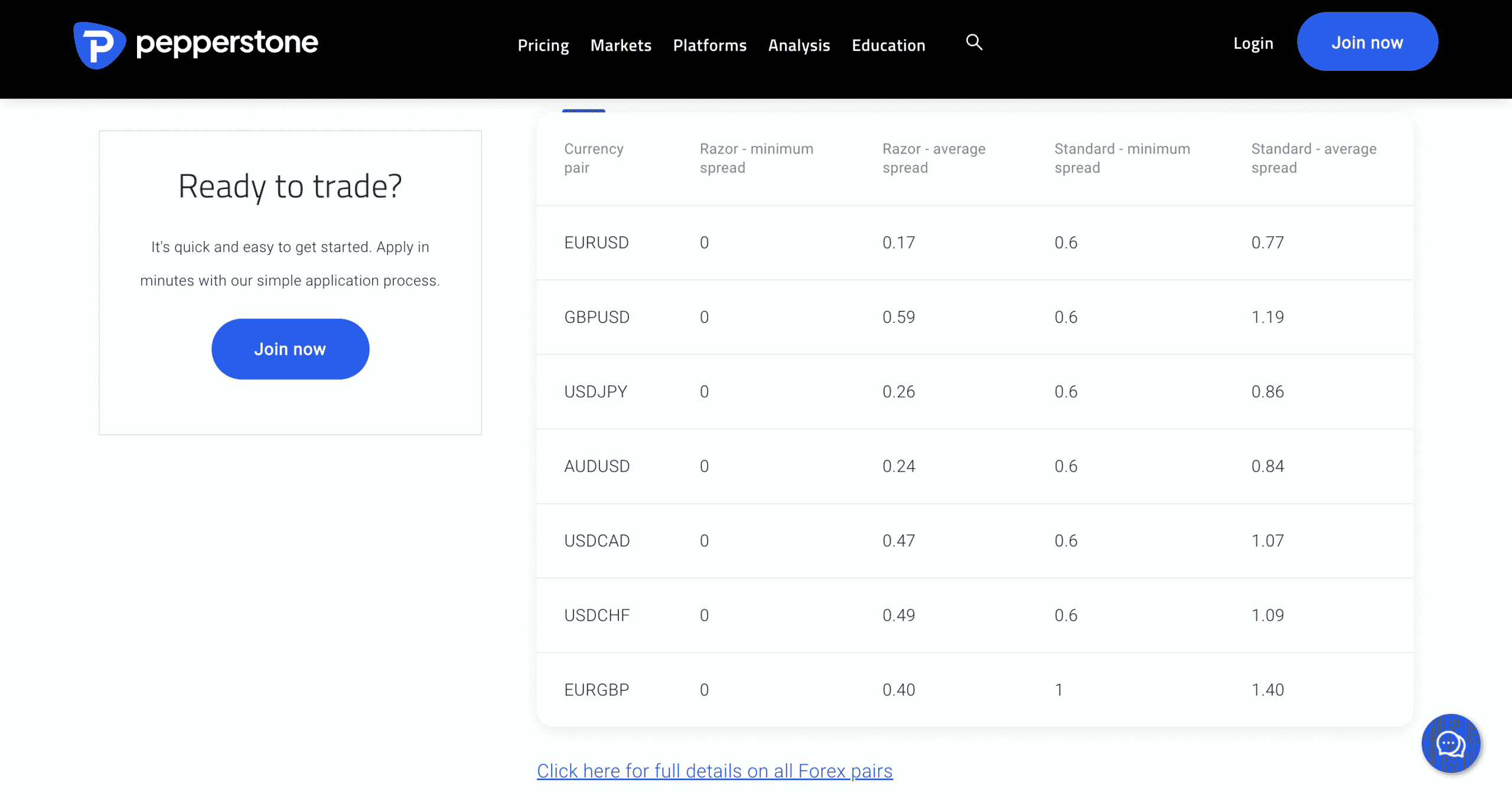

The foreign exchange charges at Pepperstone present that there are low charges in comparison with a number of different brokers. As an illustration, the FX fee per lot is $3.50 per lot per commerce, whereas the payment on a EURUSD unfold is 0.8. Equally, AUDUSD spreads have a payment of 0.2, and GBPUSD spreads are at 0.4, exhibiting that the charges for foreign exchange pairs are a bit greater in comparison with the perfect foreign exchange brokers on the market. A EURCHF unfold has a payment of 0.7 that’s an excessive amount of in comparison with its opponents, much like the EURGBP unfold at 0.4.

Additionally, charges are charged by means of commissions and spreads, the place the fee varies relying on the buying and selling platform used. Due to this fact, our Pepperstone dealer evaluate exhibits that the fee for opening and shutting $100,000 positions is $7 for MetaTrader 4 and MetaTrader 5, in addition to $6 for cTrader.

What About Inventory Index CFD & Inventory CFD Charges?

Much like foreign exchange, the Pepprstone evaluate exhibits that the charges for CFD are comparatively low and similar to primary opponents equivalent to Axi and IC Markets. The charges are low, if not equivalent, to the providing of those rivals within the CFD area. Plus, fairness index CFD charges are constructed into the spreads, and the leverage is 2:1 for crypto and as much as 20:1 for commodities, relying on the precise instrument.

The non-trading charges are additionally low – withdrawal is free for credit score/debit playing cards and e-wallets, aside from Skrill and Neteller. Australian purchasers additionally profit free withdrawals with financial institution transfers; nonetheless, different nations cost from $20 per switch.

So, Is Pepperstone A Rip-off?

No. Pepperstone just isn’t a rip-off. In truth, it’s a dependable dealer that provides CFDs, crypto, and foreign exchange pairs and an internet site the place you may open an account quick with no limits set in your first deposit. The dealer accepts prospects from all around the world, and our Pepperstone foreign exchange dealer critiques half above confirmed why it’s particularly good for merchants.

[ad_2]