[ad_1]

DeFi Alpha is a weekly e-newsletter revealed for our premium subscribers each Friday, contributed by Defiant Advisor and DeFi investor at 4RC, DeFi Dad, and our Degen in Chief yyctrader. It goals to teach merchants, buyers, and newcomers about funding alternatives in decentralized finance, in addition to present primers and guides about its rising platforms.

Two years in the past, DeFi buyers might simply identify each yield farming alternative with out a lot effort. It was a less complicated time, when solely a handful of groups had launched with any liquidity to commerce, lend, borrow, present liquidity, and even exhibit new primitives similar to no-loss financial savings by PoolTogether.

However instances have modified! Earlier than the present bear market took maintain, DeFi liquidity had grown to a whole bunch of billions of {dollars} throughout Ethereum with new burgeoning DeFi economies taking form on EVM-compatible chains similar to Polygon and Avalanche and non-EVM chains similar to Cosmos and Solana. Any given day, a brand new DeFi or NFT challenge is launched.

So, after writing and creating numerous DeFi guides and tutorials since 2019, we at The Defiant agreed it’s time we publish a extra detailed weekly information on all you want to know to maintain up with new alternatives.

That is DeFi Alpha by The Defiant.

Any data lined in DeFi Alpha mustn’t type the idea for making funding choices, nor be construed as a suggestion or recommendation to interact in funding transactions. Any point out of a token or protocol shouldn’t be thought-about a suggestion or endorsement.

Every week we’ll present choices to earn yield on ETH, WBTC, stablecoins, and different main tokens.

-

ETH -21% APR with wstETH/ETH LP staked in KyberSwap on Optimism

-

WBTC – 6.22% projected vAPR with Curve tBTC2 LP staked in Convex

-

This yield is accrued in CRV, CVX, and buying and selling charges.

-

To take part, one should first deposit tBTC, renBTC, sBTC and/or WBTC into this Curve tBTC2 pool after which stake the LP right here in Convex.

-

-

AVAX – 8.97% APR with AVAX in Vesper Develop Swimming pools

-

This yield is issued in 8.14% AVAX + 1.38% VSP.

-

To take part, one should deposit into the AVAX pool right here in Vesper

-

There’s a 0.6% payment on withdrawal from Vesper Develop swimming pools and a 15% platform payment on yield generated by the deposited property.

-

-

SOL – 11.02% APY lending stSOL on Tulip Protocol

-

This yield is backed by 5.35% APY paid by debtors on Tulip + 5.67% APY in staking rewards due to Lido.

-

To take part, one should deposit stSOL within the Tulip lending tab.

-

To acquire stSOL, one can commerce on a Solana DEX or mint it right here on Lido.

-

-

MATIC – 18.43% APY with 50/50 MaticX-WMATIC LP on MeshSwap

-

The yield is backed by validator rewards utilizing the MaticX liquid staking by-product + MeshSwap buying and selling charges + MESH rewards + SD rewards.

-

To take part on Polygon, I exploit the Stader MaticX dApp to mint MaticX.

-

Then, I deposit into the MaticX-WMATIC pool on MeshSwap and stake the LP.

-

-

ATOM – 18.6% APR staking ATOM with Keplr Pockets on Cosmos Hub

-

The yield earned is issued in ATOM.

-

To take part, one should arrange a Keplr Pockets, go to the Cosmos Hub validators on Keplr Dashboard, rank by APR, select a validator, and click on Delegate.

-

Then, I specify what number of ATOMs and comply with the prompts to Delegate.

-

-

FTM – 4.7% APY staking sFTMx liquid staking by-product by Stader

-

The yield is issued in FTM rewards, as sFTMX is incomes FTM by way of validator rewards to help Fantom’s PoS community.

-

To take part, one should deposit FTM to obtain sFTMX right here on Stader.

-

-

HBAR – 10.88% APY staking with HBARX liquid staking by-product by Stader

-

The yield is issued in HBAR rewards, as HBARX is incomes validator rewards.

-

To take part, one should deposit HBAR to obtain HBARX right here on Stader.

-

-

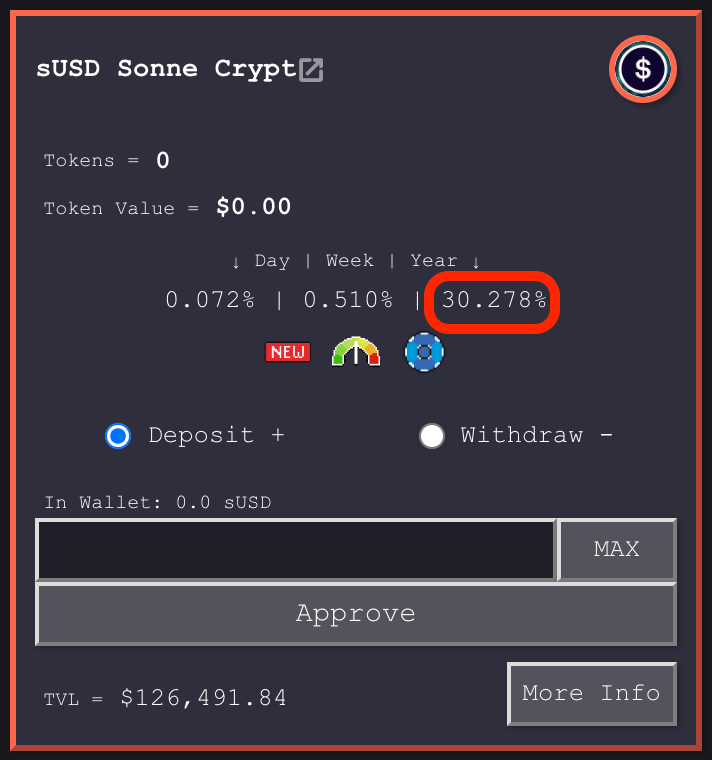

Stablecoins (USD) – 30.28% APY with sUSD in an auto-compounding vault technique on Reaper Farm on Optimism

-

This yield is accrued in sUSD.

-

To take part, one should deposit and stake within the sUSD Sonne Crypt.

-

Warning: This farm is in a better threat protocol that launched on Fantom in summer season 2021 and has since suffered a $1.7M exploit in August 2021.

-

In case you missed it, try the recording of this week’s name.

[ad_2]