[ad_1]

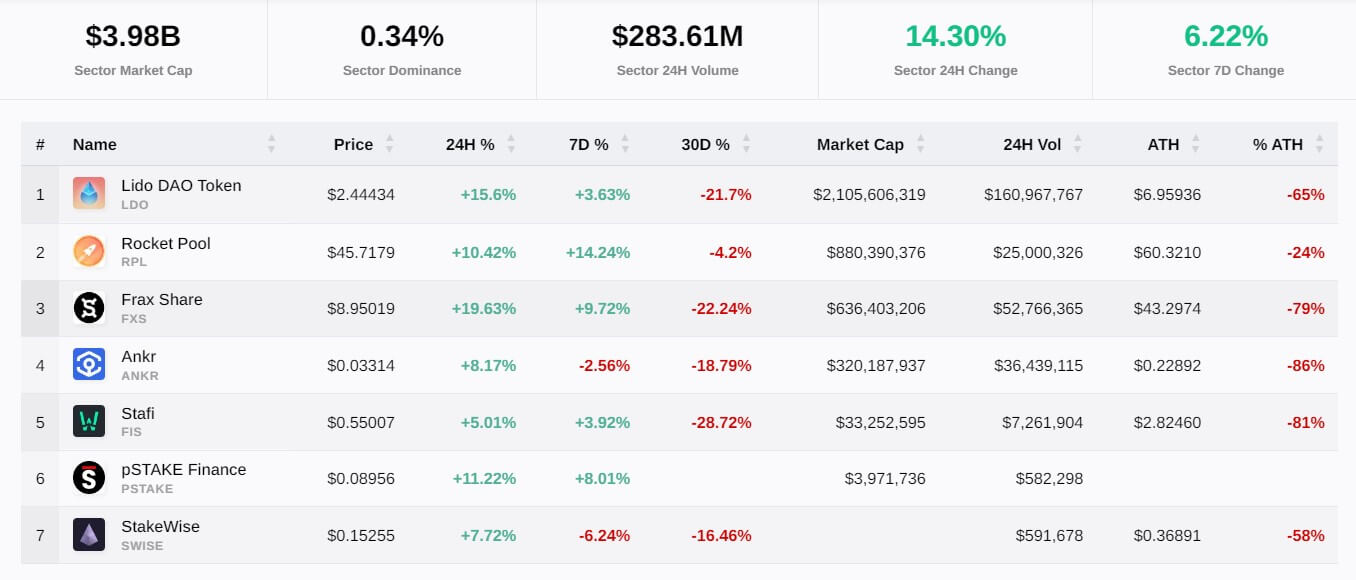

Liquid staking is the best-performing crypto sector within the final 24 hours after rallying by greater than 15%, in response to CryptoSlate knowledge.

In response to the information, all seven tasks within the area soared by greater than 5%, with two of them — Lido (LDO) and Frax Share (FXS) — among the many prime 5 gainers for March 29.

Liquid staking derivatives (LSD) platforms have loved renewed curiosity following information that the extremely anticipated Shapella community improve — enabling staked Ethereum withdrawals — will activate on April 12 at epoch 194048, in response to an Ethereum Basis assertion.

Frax Share leads friends

In response to CryptoSlate knowledge, Frax Share’s FXS is the best-performing liquid staking derivatives token over the reporting interval — up 19.63%.

FXS is the governance token of Frax Protocol and has seen its value enhance considerably after launching a liquidity staking program late final 12 months.

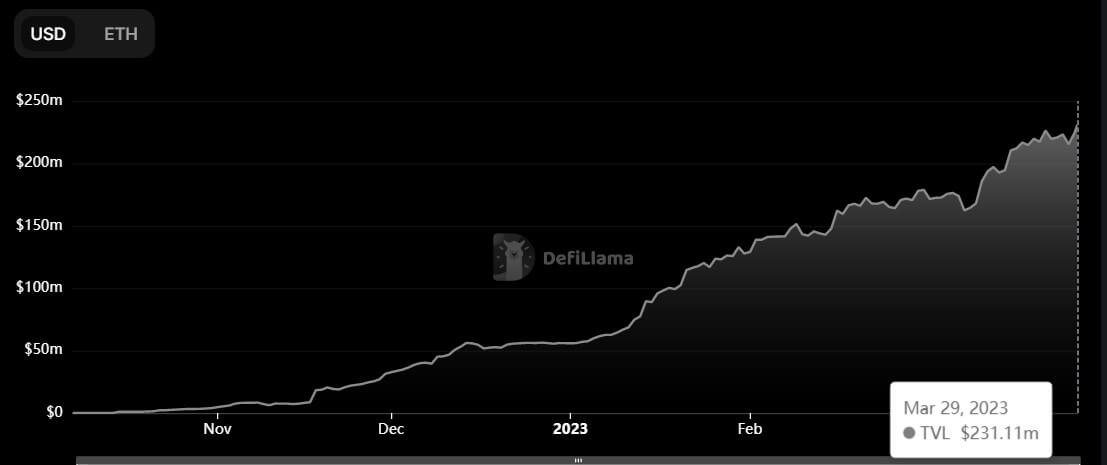

The entire worth of belongings locked (TVL) in Frax Ethereum (frxETH) surged 31.49% prior to now 30 days to an all-time excessive of $231 million — equating to 131,970 ETH tokens, in response to DeFillama knowledge.

In February, Blockchain analytical agency Nansen reported that frxETH’s provide grew by 70,000 ETH inside three months.

Lido stays dominant LSD

In the meantime, Lido stays the dominant staking platform within the crypto business. Its LDO token elevated by 15.57% prior to now 24 hours to $2.43 on the time of writing.

Regardless of Lido developer’s resolution to sundown its staking companies for Polkadot and Kusama, the protocol’s TVL rose 6.51% to $10.89 billion.

In response to Dune Analytics knowledge, the protocol accounts for roughly 32% of all staked ETH — translating to round 5.8 million tokens.

Moreover that, additionally it is essentially the most dominant decentralized finance protocol — with a 21.8% market dominance, in response to DeFillama knowledge.

In the meantime, different staking protocols like Rocket Pool (RPL), StakeWise (SWISE), ANKR, and Stafi (FIS) all recorded optimistic positive aspects within the final 24 hours. General, the market cap of the crypto tokens on this sector sits at $3.98 billion as of press time.

Within the final 24 hours, DeFillama knowledge exhibits that the highest 10 liquid staking protocols — besides Marinade Finance — noticed their TVL rise by a mean of 5%.

[ad_2]