[ad_1]

ChainLink value evaluation for March 29, 2023, reveals the market following an upward motion, displaying rising momentum, signifying positivity for the LINK market. The value of ChainLink has remained bullish over the previous few hours. On March 28, 2023, the worth reached $7 from $6.7. Nonetheless, the market elevated in worth quickly after and gained some worth. Furthermore, ChainLink reached an all-day excessive value of $7.26 and is presently valued at $7.25.

As of March 29, 2023, the worth of Chainlink is $7.25 with a buying and selling quantity of $664.08 million and a market cap of $3.74 billion. Its market dominance is 0.31%, and the worth has elevated by 5.51% within the final 24 hours.

Chainlink’s highest value was reached on Could 10, 2021, when it traded at an all-time excessive of $52.89, whereas its lowest value was recorded on September 23, 2017, at an all-time low of $0.126297. Since its ATH, the bottom value was $5.36 (cycle low), and the very best LINK value for the reason that final cycle low was $9.45 (cycle excessive). At the moment, the sentiment for Chainlink value prediction is bearish, and the Worry & Greed Index is displaying 57 (Greed).

The present circulating provide of Chainlink is 517.10 million LINK out of a most provide of 1.00 billion LINK. The yearly provide inflation charge is 10.73%, which means 50.09 million LINK have been created within the final yr. Chainlink is presently ranked #4 within the DeFi Cash sector and #7 within the Ethereum (ERC20) Tokens sector when it comes to market cap.

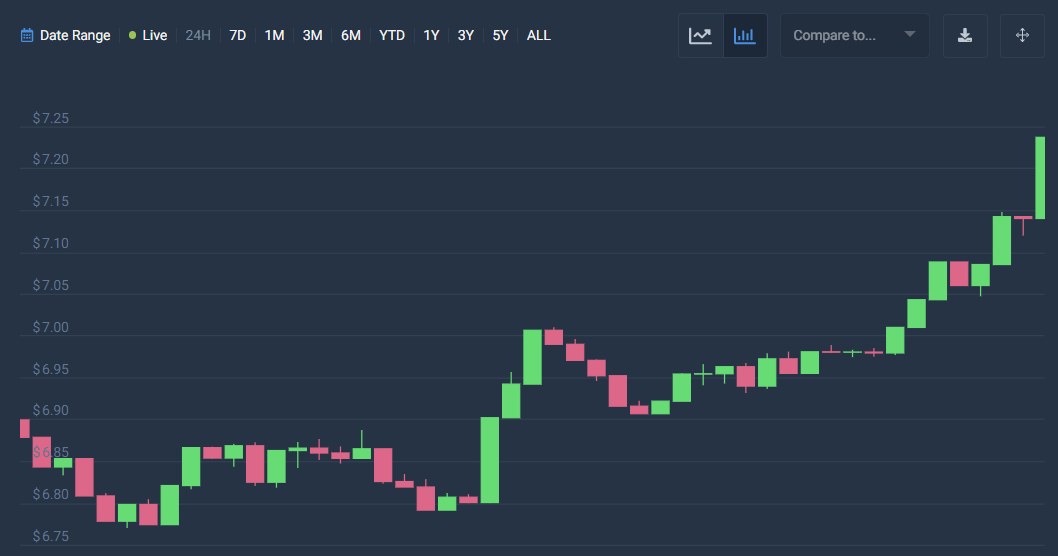

LINK/USD 1-day value evaluation: Newest developments

ChainLink value evaluation reveals the market’s volatility following a lowering motion. Which means the worth of ChainLink is turning into much less vulnerable to the motion towards both excessive, displaying dormant dynamics. The opening value is $7.14, whereas the excessive value seems to be $7.26. Conversely, the low value is current at $7.14, with a detailed value remaining at $7.23. ChainLink market is present process a change of 1.33%.

The LINK/USD value seems to be transferring over the worth of the Shifting Common, signifying a bullish motion. The market’s pattern appears to be dominated by bears, however not for lengthy. Furthermore, the LINK/USD value seems to be transferring upward, illustrating an rising market. The market seems to be displaying bullish potential. The value has nearly crossed the transferring common band; a reversal is imminent within the coming days.

ChainLink value evaluation reveals that the Relative Energy Index (RSI) is 53 displaying an rising cryptocurrency market. Which means cryptocurrency is within the central impartial area. Moreover, the RSI seems to maneuver upward, indicating an rising market. The dominance of shopping for actions causes the RSI rating to extend.

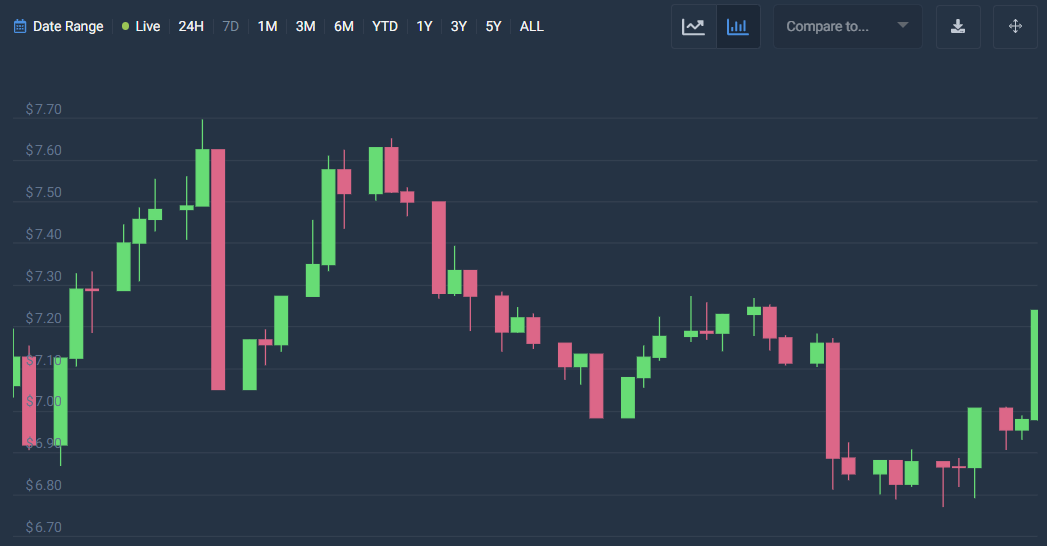

ChainLink value evaluation for 7-days

ChainLink value evaluation reveals the market’s volatility following an rising motion, which signifies that the worth of ChainLink is turning into extra vulnerable to expertise variable change on both excessive. The Opening value seems to be $6.98, whereas the excessive value is current at $7.26. Conversely, the low value is at $6.98, with a detailed value of $7.24, which is at a change of three.78%.

The LINK/USD value seems to be transferring over the worth of the Shifting Common, signifying a bullish motion. Nonetheless, the market’s pattern appears to have proven bullish tendencies in the previous few hours. Furthermore, the market has selected a optimistic strategy. Consequently, the motion path has shifted at this time, the worth began transferring upwards, and the market began opening its volatility.

Chainlink value evaluation exhibits the Relative Energy Index (RSI) to be 49, signifying a steady cryptocurrency. Which means the LINK cryptocurrency falls within the central-neutral area. Moreover, the RSI path appears to have proven an upward motion. An rising RSI rating additionally means dominant shopping for actions.

ChainLink Worth Evaluation Conclusion

Chainlink value evaluation reveals that the cryptocurrency follows an rising pattern with a lot room for exercise on the optimistic excessive. Furthermore, the market’s present situation seems to be following a impartial strategy, because it exhibits the potential to maneuver to both bullish excessive. The market exhibits a lot potential for improvement in direction of the rising finish of the market.

[ad_2]