[ad_1]

Featured SpeakerAlex Thorn

Head of Firmwide AnalysisGalaxy

Hear Alex Thorn share his tackle “Bitcoin and Inflation: It’s Difficult” at Consensus 2023.

A lesser-known however traditionally dependable bitcoin worth indicator has flipped constructive, signaling the onset of a serious bull market.

Bitcoin’s reserve threat a number of has crossed above zero, turning constructive for the primary time since October 2021, in line with blockchain analytics agency Glassnode.

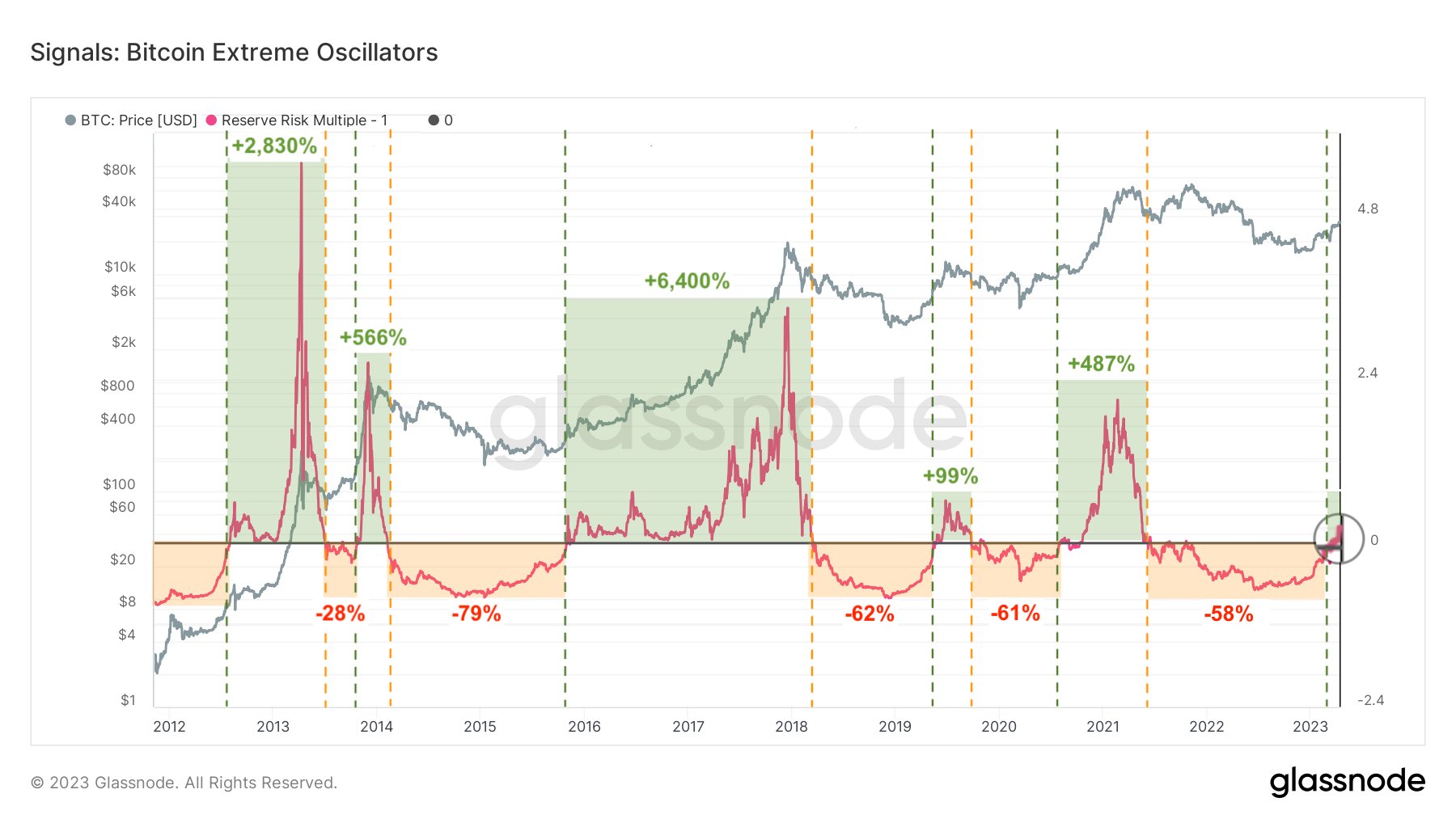

The earlier crossovers above zero paved the way in which for parabolic worth rallies. “In 2012, 2013, 2015, 2019, and 2020, it resulted in positive aspects of two,830%, 566%, 6,400%, 99%, and 487%, respectively,” on-chain analyst Ali Matrinez tweeted Monday.

Glassnode defines reserve threat as a long-term cyclical indicator, evaluating the inducement to promote on the going market worth to long-term holders resisting the temptation to liquidate. A decrease studying signifies robust conviction amongst HODLers – slang for long-term crypto traders – and vice versa.

The reserve threat a number of is calculated by dividing the every day indicator worth by its 365-day transferring common.

Earlier crossovers above zero paved the way in which for sharp worth rallies. (Glassnode, Ali Martinez) (Glassnode, Ali Martinez)

The reserve threat a number of’s earlier crossovers above and under zero precisely predicted main bullish and bearish traits.

If historical past is a information, the most recent constructive crossover means the cryptocurrency’s 80% year-to-date rally to ten-month highs above $30,000 could also be solely the primary milestone in its upward journey.

The bullish implication is in keeping with bitcoin’s tendency to chalk up outsized rallies in months main as much as the mining reward halving. This programmed code reduces the tempo of the cryptocurrency’s provide growth by 50% each 4 years. Bitcoin’s fourth reward halving is due in April subsequent yr.

[ad_2]