[ad_1]

Investigative journalist James Corbett has lately referred to the continued international banking disaster involving SVB, Signature Financial institution, Credit score Suisse and others because the “Panic of 2023,” drawing comparisons to what he views as historic precedents, and pointing forward to an inevitable and bleak, technocratic surveillance future leveraging central financial institution digital currencies (CBDCs) ought to nothing be completed to cease it. The reply to the CBDC “complete nightmare of financial management,” as Corbett places it, is money, creativity, and to “select to tell ourselves about agorism and the countereconomy.”

James Corbett on Disaster, CBDCs, Money, and the Countereconomy

Investigative journalist and freedom activist James Corbett of The Corbett Report, a preferred different information supply primarily based on the “precept of open-source intelligence,” has weighed in lately on the present international banking debacle and its echoes throughout current historical past. Additional, he has been cautioning his followers for years concerning the risks of giving up their monetary freedom, and uncritically accepting burgeoning state-created monetary applied sciences equivalent to central financial institution digital currencies (CBDCs).

Bitcoin.com Information despatched Corbett some questions on the subject, asking for his views on the present disaster, its causes, and methods abnormal individuals can climate the present so-called banking contagion. Under are his responses.

Bitcoin.com Information (BCN): In your current work you’ve drawn similarities between the present banking debacle and the Panic of 1907 and the 2008 monetary disaster. How does what we’re witnessing unfold now with SVB, Signature Financial institution, Credit score Suisse, and others, evaluate to previous monetary crises?

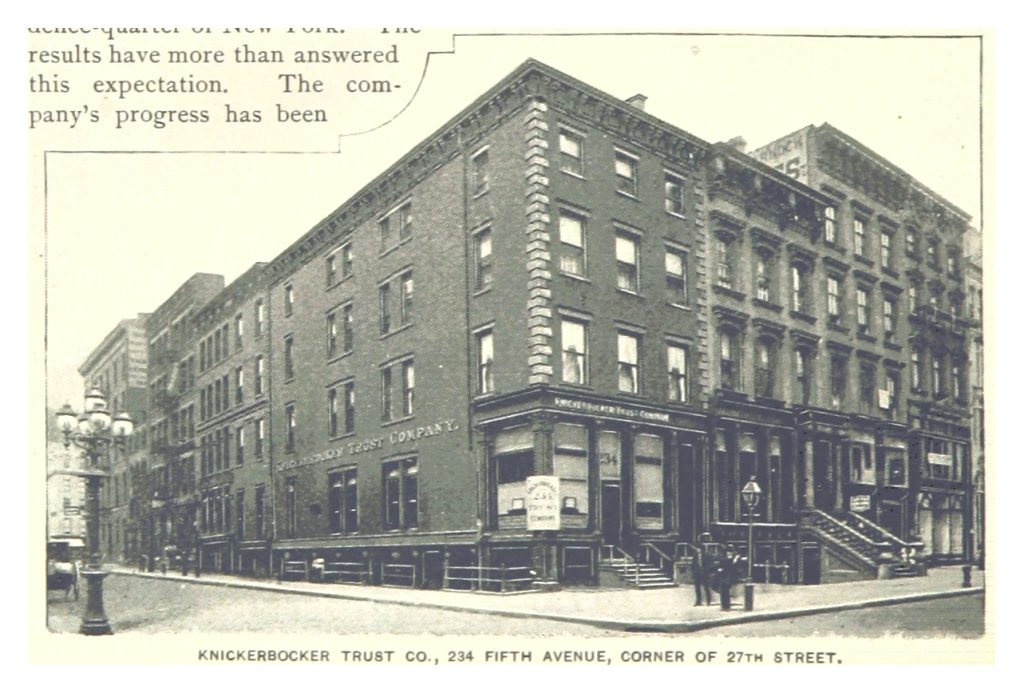

James Corbett (JC): In 1907, a run on Knickerbocker Belief, one in all New York’s greatest belief corporations, precipitated a financial institution run and a 50% drop on the New York Inventory Alternate. In its official web page on the occasion—dubbed “The Panic of 1907“—the Federal Reserve calls it the “first worldwide monetary disaster of the 20 th century.” In response to the Fed, the panic was brought on by rumours about Knickerbocker Belief’s insolvency and the disaster was finally averted by the “legendary actions” of J.P. Morgan, who personally oversaw the bailout of the banking system.

What the Federal Reserve doesn’t observe in its official historical past of the 1907 panic is that—as even Life Journal conceded many years later—the rumours that sparked the complete affair had been themselves planted by George W. Perkins, one in all J.P. Morgan’s enterprise companions. Additionally lacking from the Fed’s whitewashed historical past lesson is the truth that Morgan used it as an excuse to remove his banking competitors (the Knickerbocker Belief) and rescue his banking associates (the Belief Firm of America, which had in depth ties to lots of Morgan’s purchasers.)

Quick ahead to 2023 and it’s attention-grabbing to notice that even Bloomberg is reporting an eerily comparable sample of rumours and Morgan-as-saviour within the collapse of Silicon Valley Financial institution:

“Distinguished enterprise capitalists suggested their tech startups to withdraw cash from Silicon Valley Financial institution, whereas mega establishments equivalent to JP Morgan Chase & Co sought to persuade some SVB prospects to maneuver their funds Thursday by touting the protection of their belongings.”

And, as The Monetary Instances later confirmed, the fast impact of SVB’s hassle and the ensuing regional financial institution instability was to ship depositors flocking to the perceived security of the biggest banks, together with, in fact, JPMorgan Chase.

BCN: In your newest episode of New World Subsequent Week with James Evan Pilato, “Crypto Contagion Banks Get the Runs,” you allude to discrepancies within the official story surrounding the current collapse of Silicon Valley Financial institution, referencing audits of the establishment simply previous to its demise. Equally, Signature Financial institution board member Barney Frank stated lately he was stunned on the collapse of Signature financial institution as nicely, and that regulators had been making an attempt to ship an “anti-crypto message.” In your view, is what we’re seeing now engineered?

JC: Sure, this financial institution “contagion” is an engineered phenomenon. However with a view to perceive that phenomenon, we have to ask an extra query: On what degree has it been engineered?

Because it seems, though there are a number of elements that contributed to SVB’s downfall—together with its focus on ESGs and DEI and different types of “woke” investing—the fast proximal reason for the financial institution’s crash was its bizarre predicament: it had an excessive amount of money.

Because it seems, though there are a number of elements that contributed to SVB’s downfall … the fast proximal reason for the financial institution’s crash was its bizarre predicament: it had an excessive amount of money.

You see, banks generate income by lending out their prospects’ deposits . . . and after I say “generate income” I imply they actually generate income. Within the topsy-turvy world of banking, a excessive loan-to-deposit ratio (LDR) is seen as a great factor, with an 80-90% LDR held up as a really perfect determine. Nonetheless, SVB, with simply $74 billion in loans in opposition to $173 billion in buyer deposits, discovered it had an excessive amount of money sloshing round its coffers.

So it determined to park that cash within the most secure (however probably not protected), risk-free (however not really risk-free), good-as-gold (bur not actually good-as-gold) funding: long-term US Treasuries. In spite of everything, the one method it may probably lose cash in US Treasuries is that if the Fed began climbing charges like loopy, they usually haven’t completed that in many years! What may go improper?

Oh, wait…

So, lengthy story quick, SVB loaded up on almost $120 billion price of long-term Treasuries after they had been at 1.78% yield and the climb to five% yield meant SVB needed to ebook billions in losses. In reality, their 2022 Annual Report, which got here out in January, confirmed that the financial institution was sitting on $15 billion in “unrealized losses” from their unhealthy bond wager, which, for a financial institution with $16 billion in complete capital, is type of a foul factor.

So sure, the autumn of SVB was engineered . . . by the Fed. This disaster is the direct results of the Fed making an attempt to again out of the disastrous, decade-and-a-half-long synthetic bond bubble it blew to cease the International Monetary Disaster of 2008. And what triggered the International Monetary Disaster? The disastrous, nearly-decade-long synthetic housing bubble that the Fed blew to cease the dotcom bust and the 9/11 slowdown and the Enron/Worldcom fraud fallout.

BCN: You’ve famous that the present disaster may very well be used as an excuse to usher in central financial institution digital currencies extra rapidly. In your view, how may such an occasion play out and who can be the most important winners and losers?

JC: To reply this query, let’s ask one other query: Why is the Fed so all for The Panic of 1907, anyway? It’s as a result of, as they themselves assert, the disaster brought on by that individual banking panic “impressed the financial reform motion and led to the creation of the Federal Reserve System.”

In fact, like every little thing else that comes out of the banksters’ mouth, that assertion is a lie. Really, it’s two lies.

First, it’s a lie of fee: the financial reform motion—which grew to become a preferred political power after The Crime of 1873 and encompassed the Free Silver motion and bimetallism and William Jennings Bryan and the cross of gold and, sure, The Wizard of Oz—was most definitely not “impressed by” The Panic of 1907.

And secondly, it’s a lie of omission: the Fed conveniently leaves out the opposite a part of its creation story, not simply the Morgan-backed rumours that precipitated the panic within the first place, but in addition the notorious Jekyll Island assembly that really led to the creation of the Federal Reserve System.

These reservations however, the overall level stands: the generated disaster of The Panic of 1907 did result in an upending of the present financial order and the creation of the Federal Reserve.

Equally, it might be laborious to think about a full-scale revolution within the banking system at the moment that didn’t originate with some type of banking disaster. What’s past doubt is that governments the world over wouldn’t hesitate to make use of any such disaster as an excuse to implement their new digital financial order. In spite of everything, the Home Monetary Companies Committee tried to slide the creation of a digital greenback into the unique COVID stimulus invoice. Do we actually suppose that emergency laws for a brand new digital forex isn’t ready within the wings, able to be unleashed on the general public within the occasion of the following disaster?

When that disaster does result in the pre-planned CBDC “resolution,” we are able to count on that it’s going to play out in a broadly comparable vogue as The Panic of 1907 and the International Monetary Disaster of 2007—08. In each circumstances the fallout simply so occurred to learn sure pursuits. In 1907, Morgan managed to consolidate his banking pursuits, remove his competitors, act because the benevolent saviour of the financial system and persuade the general public of the necessity to hand the financial reins over to the banking cartel. In 2008, it was croney-connected establishments like AIG and (in fact) JP Morgan that benefited from the unprecedented banking “bailout,” and the disaster helped cement the rise of latest monetary giants like BlackRock. So it might not be stunning to seek out sure banking pursuits utilizing the chance of a generated banking disaster to remove their competitors and consolidate their management within the banking world.

And, as I’ve talked about earlier than, not each banker stands to learn from the implementation of a retail CBDC. In reality, to the extent that CBDCs lower the business banking middlemen out of the present financial circuit, it really goes in opposition to the pursuits of the business bankers.

However, in fact, the actual losers within the occasion of such a disaster, as all the time can be us: most of the people. Within the worst-case situation, the central banksters would seize the chance to implement the “programmable cash” nightmare of complete financial management.

BCN: If nothing is finished to verify the implementation of CBDCs and the monetary surveillance and spying they doubtlessly afford, when will we see them attain international ubiquity?

JC: I can’t provide you with a date. However I can say that if nothing is finished to verify their implementation, CBDCs will attain international ubiquity.

If I had been to make a forecast about their implementation, my prediction can be that we’ll not go from a zero-CBDC financial system to a 100%-CBDC financial system . CBDCs will co-exist alongside different types of fee for some time period, and they’ll look and performance otherwise in numerous jurisdictions. Some can be full retail and wholesale CBDCs, some will serve one operate or different, some retail CBDCs could also be administered instantly by the central financial institution, others will certify banks and different monetary establishments to behave as intermediaries, issuing wallets to the general public.

However in no matter kind they arrive and at no matter time they arrive, the preliminary CBDC implementation would be the proverbial camel’s nostril within the tent. From that time, it’s solely a matter of time earlier than CBDCs begin to change into devices of financial surveillance and management.

BCN: How can on a regular basis people assist keep and enhance their monetary privateness and financial sovereignty within the present chaotic local weather of so-called banking contagion?

JC: Are you prepared for some excellent news? We don’t want some elaborate plan or high-level entry to high-tech devices to thwart the CBDC agenda. The best software for preserving our financial independence is already in our wallets: it’s money.

As I stated above, CBDCs will nearly definitely co-exist with different types of fee when it’s first launched, so money will nonetheless be an possibility until and till the general public is conditioned to simply accept a totally cashless financial system.

The best software for preserving our financial independence is already in our wallets: it’s money.

In fact, the continued Battle on Money is already making it increasingly more tough to make use of money for conducting sure transactions and “coin shortages,” the worry of “soiled cash” and incentives for utilizing digital fee are additional attractive individuals away from utilizing money. That’s why we’ve got to make a acutely aware choice to assist companies that settle for money and commit ourselves to utilizing money regularly. Quite a few such concepts have been proffered lately, from agorist.market‘s “Black Market Fridays” to Solari.com‘s “Money Friday.”

That’s to not say that money is our solely (and even our greatest) possibility. I’ve lengthy advocated a “Survival Forex” strategy the place individuals experiment with totally different types of cash to seek out out what works for them. There are group currencies, barter exchanges, native trade buying and selling programs, valuable metals, crypto, The miracle of Wörgl and plenty of different examples of ways in which individuals can transact outdoors of the purview of the central bankers.

So long as you’re a part of a group of like-minded individuals which are prepared to take part in free trade, there can be no scarcity of financial concepts to check out.

BCN: And talking of contagion, there are some connecting the current banking turmoil with the World Financial Discussion board’s Nice Reset initiative, designed ostensibly to handle the so-called Covid-19 pandemic — basically asserting it’s all half of a bigger plan to arrange a world monetary surveillance grid. Is there any foundation for such concepts, in your view, or is that this simply the stuff of untamed conspiracy concept?

JC: On one degree, the extreme give attention to the World Financial Discussion board’s Nice Reset and its supposed risk that “You’ll personal nothing and you’ll be pleased” is misplaced. Sure, Klaus Schwab and his cronies are definitely power-hungry schemers, however the Nice Reset is solely the newest rebranding of a really outdated recreation of worldwide management, and the World Financial Discussion board is just one (comparatively minor) participant on the desk.

Name it the New World Order or the Worldwide Guidelines-Based mostly Order or the Worldwide Financial Order or The Nice Reset or no matter you need, and pin it on the Bilderbergers or the Trilaterals or the World Financial Discussion board or whoever you need, the risk is identical: a world wherein humanity is on the mercy of a clique of unaccountable technocrats.

I don’t invoke the identify of technocracy loosely. I imply it in the actual, historic sense of the time period, as “a system of scientifically engineering society” that’s predicated on an financial system wherein each transaction is monitored, calculated, databased, tracked, surveilled and allowed or disallowed by a central governing “technate” in actual time. Such a system will contain digital IDs for each citizen, and, in fact, a digital forex that may be programmed to operate on the whims of the technocrats.

That such a system of management is now technologically attainable is now plain. That there are pursuits just like the World Financial Discussion board which are working towards the implementation of such a system is just deniable by those that refuse to take heed to the technocrats’ personal pronouncements.

BCN: From the place you sit, is there a cryptocurrency white capsule in all this?

JC: The promise of cryptocurrency continues to be what it has all the time been: a cryptographically safe software for transacting within the countereconomy.

But when individuals don’t know what the countereconomy is (not to mention why they might need to be transacting in it), then what good is it? If it’s seen as simply one other get-rich-quick funding, simply one thing whose measure is to be valued in {dollars}, simply one other asset that needs to be regulated by the SEC and dutifully listed in your tax kind, then will probably be nothing greater than a handy stepping stone to the CBDC nightmare.

We are able to both select to tell ourselves about agorism and the countereconomy or we are able to proceed buying and selling within the bankster-approved mainstream financial system and settle for no matter financial order the banksters thrust on us.

The selection is ours. For now.

What are your ideas on James Corbett’s statements on the present banking disaster, the worldwide financial system, and the character of CBDCs? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Rokas Tenys / Shutterstock.com, corbettreport.com

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]