[ad_1]

I hate to interrupt it to you, however true passive revenue will not be an in a single day miracle kind of deal. It takes years of sustainable, long-term investing to construct a large enough portfolio to pay out first rate month-to-month revenue.

That being mentioned, it isn’t inconceivable. By utilizing the best belongings and making prudent funding selections, any investor can flip constant $200 month-to-month investments into, say, $300 of month-to-month revenue.

Our instruments for this? A Tax-Free Financial savings Account, or TFSA, a low-cost, growth-oriented exchange-traded fund, or ETF, and a high-yield coated name ETF, and, say, 20 years of time.

Begin in a TFSA

We wish to preserve as a lot of our passive revenue generated in our pocket as attainable, so avoiding taxes (legally) is good. Subsequently, contemplate making your contributions in a TFSA.

Any dividends or capital beneficial properties earned inside the TFSA are tax free, as are withdrawals. Subsequently, maxing this account out early on is a good suggestion.

Should you turned 18 in 2009 and have by no means contributed, you’ll be able to put in $88,000 in 2023. Should you don’t have this a lot money available, making small, constant contributions like a month-to-month $200 works, too.

Make investments for development

We wish to get our $200 month-to-month contribution working for us and compounding as quickly as attainable. Investing for revenue at this stage isn’t supreme. An excellent choose right here is BMO S&P 500 Index ETF (TSX: ZSP), which is each low price and has excessive development potential.

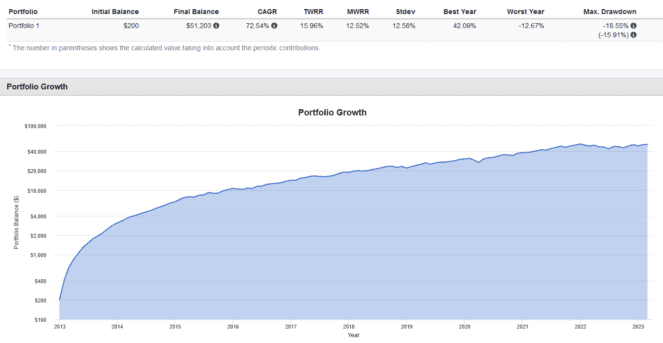

Traditionally, investing $200 each month into ZSP from 2013 to current would have netted you $51,203, assuming no commissions or taxes.

Remember the fact that should you’d held longer or made bigger month-to-month contributions, your ending portfolio worth would have possible been a lot greater. That is the facility of compounding and time at play!

Make investments for revenue

With $51,203, we are able to now spend money on an income-oriented asset for normal month-to-month funds. Dividend shares won’t be a good suggestion right here, given the excessive company-specific danger, quarterly dividend funds, and decrease yields normally.

The choice is an ETF like Harvest Healthcare Leaders Earnings ETF (TSX:HHL), which mixes a portfolio of defensive, high-quality, large-cap U.S. healthcare shares with a coated name overlay. Proper now, the ETF yields 8.93% because of the coated calls.

Assuming HHLâs most up-to-date month-to-month distribution of $0.0583 and present share worth on the time of writing of $7.83 remained constant shifting ahead, an investor who buys $51,203 price of HHL might anticipate the next payout:

| COMPANY | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| HHL | $7.83 | 6,539 | $0.0583 | $381.22 | Month-to-month |

The publish How I’d Make investments $200 Every Month to Goal a $380 Month-to-month Second Earnings appeared first on The Motley Idiot Canada.

Ought to You Make investments $1,000 In Harvest Healthcare Leaders Earnings Etf?

Earlier than you contemplate Harvest Healthcare Leaders Earnings Etf, you’ll wish to hear this.

Our market-beating analyst crew simply revealed what they imagine are the 5 greatest shares for buyers to purchase in March 2023… and Harvest Healthcare Leaders Earnings Etf wasn’t on the record.

The net investing service they’ve run for practically a decade, Motley Idiot Inventory Advisor Canada, is thrashing the TSX by 22 share factors. And proper now, they assume there are 5 shares which are higher buys.

See the 5 Shares

* Returns as of three/7/23

(perform() {

perform setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.contains(‘#’)) {

var button = doc.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.fashion[property] = defaultValue;

}

}

setButtonColorDefaults(“#5FA85D”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#43A24A”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘colour’, ‘#fff’);

})()

Extra studying

- How A lot Do You Must Make investments to Give Up Work and Dwell Solely Off Dividend Earnings?

- The place to Make investments $10,000 in March 2023

Idiot contributor Tony Dong has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

[ad_2]