[ad_1]

The cryptocurrency trade has traditionally been extra risky than both equities or foreign exchange markets. Nevertheless, since COVID, there was elevated volatility throughout most investible belongings. Curiously, the pound fell at certainly one of its sharpest charges in historical past following the latest mini-budget, whereas Bitcoin has remained comparatively secure across the $19,000 market.

Equities correlation will increase

The correlation between equities akin to S&P 500 and Bitcoin is thought to have been rising drastically all through 2022. The chart beneath exhibits that the correlation is close to all-time highs and virtually double that of 2020.

Whereas the correlation has been falling between the S&P500 and Bitcoin since early October, it’s nonetheless at round 0.57. Nevertheless, how has Bitcoin carried out towards currencies just like the Greenback, Pound, Euro, Yen, and different main currencies?

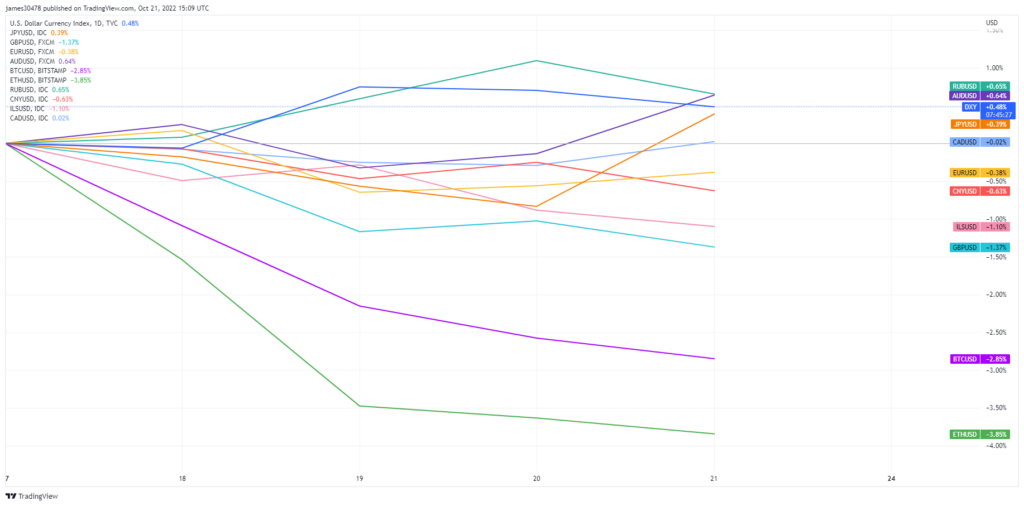

October comparisons with world fiat currencies

Since October 7, each Bitcoin and Ethereum have seen a 2.85% to three.85% decline, respectively. Whereas the British Pound, Euro, Chinese language Yuan, and Israeli shekel additionally fell to 1.37%, the U.S. Greenback, Australian Greenback, Japanese Yen, and Canadian Greenback rose to 0.65%.

The information thus exhibits that the volatility within the crypto markets is barely outdoors that of the legacy forex market however not by as huge a margin as some would possibly anticipate. For a world fiat forex to lose 1.37% of its worth in 14 days is alarming, however for Bitcoin, a 2.85% decline is gentle to what many are used to seeing.

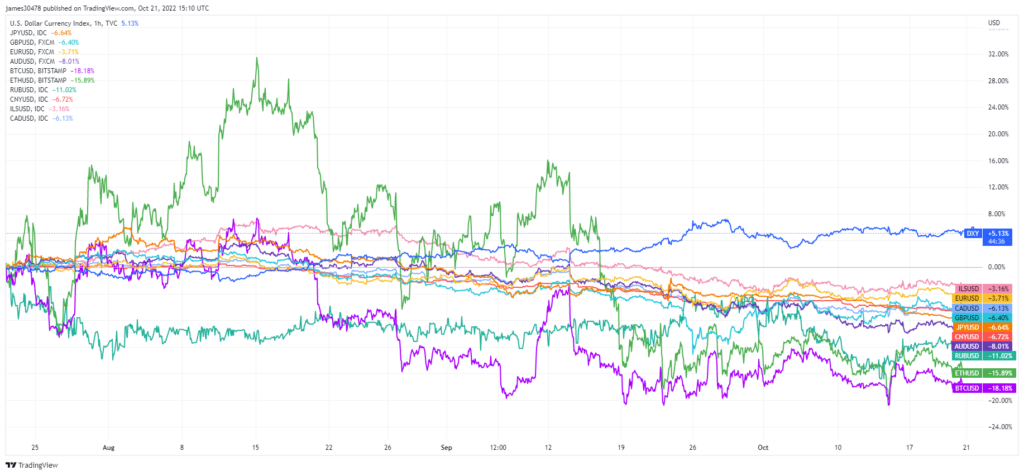

Quarterly comparisons with world fiat currencies

The chart for the final quarter of 2022 (since August) paints a broader image of the state of affairs. Ethereum has seen probably the most volatility in Q3, whereas the U.S. Greenback has remained comparatively flat and persistently strengthened since late August.

Bitcoin has seen a extra important drawdown than Ethereum over the interval however much less volatility. The volatility of all different currencies has adopted the same development since mid-September.

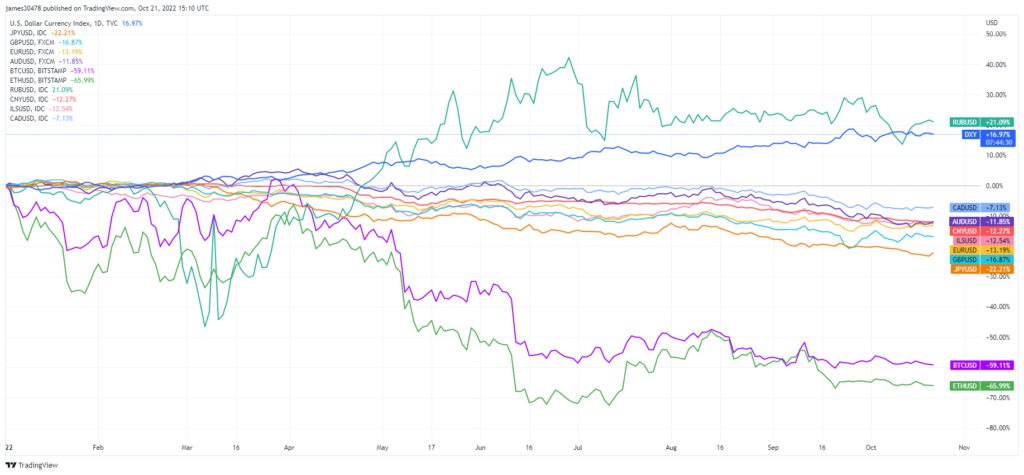

12 months-to-date comparisons with world fiat currencies

When your entire 12 months is taken into account, the stand-out winner is the U.S. Greenback which has seen a 16.97% enhance in worth with a gentle enhance in worth with out a lot volatility. The Russian Ruble recorded a 21.09% achieve on the 12 months up to now after declining as a lot as 45% in March. The Ruble has had an especially risky 12 months however is ending Q3 solidly within the inexperienced.

Bitcoin and Ethereum each recorded heavy losses since January, with the pair down 56.11% and 65.99%, respectively. An much more exact image of the lower in volatility inside crypto might be seen within the year-to-date chart. Mid-September onwards has two of the smoothest traces on the chart for Bitcoin and Ethereum.

Yearly drawdowns in crypto are far worse than conventional currencies. Of the basket inspected, the largest losers had been the British Pound, down 16.87%, and the Japanese Yen, down 22.21%. Nevertheless, all currencies bar the U.S. Greenback and Russian Ruble are following a 6-month downtrend in worth.

What the discount in volatility may imply is up for debate; the maturity of the crypto markets, a bear market backside, and the calm earlier than the storm – all are affordable theories. Nevertheless, the correlation between crypto, inventory, and world fiat currencies markets has by no means been so aligned. Previous efficiency is unlikely to information merchants by such an unknown interval, so CryptoSlate publishes analysis studies like these day by day. Readers can discover extra analysis studies right here.

[ad_2]