[ad_1]

Day Buying and selling with Order Circulation (Step by Step)

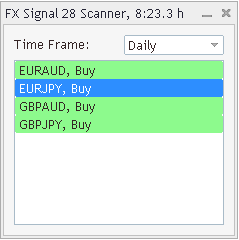

1. Launch the FX Sign 28 Scanner on the Every day Time Body

2. Click on on the pairs listed on the dashboard to open a chart

3. Search for a Breakout supported by Order Circulation

4. Apply the Cease Order Technique

- Place a Purchase Cease Order on the excessive of the breakout candle

- Place a Cease Loss on the low of the breakout candle

- Take Revenue when order circulation is now not current

4. Recognise the development, is that this the primary leg, second or third?

Listed here are some Normal Guidelines for Development Evaluation:

- A development is outlined by three to 4 legs.

- The primary leg highlights the start of a development: with a definite V-Form.

- If the second leg is bigger than leg one: count on a 3rd leg.

- If the second leg is smaller than leg one: don’t count on a 3rd leg.

- If the third leg is bigger than leg two: count on a fourth leg.

- If the third leg is smaller than leg two: don’t count on a fourth leg.

- Order circulation that happens on the finish of the development (third/fourth leg) is harmful to commerce!

- The second leg is the very best to commerce as a result of it’s usually the longest.

Within the image beneath we are able to see that EUR/JPY is at the moment within the progress of making “Leg 2”.

I’ll replace this weblog publish later this week when there’s extra data on EUR/JPY…

[ad_2]