[ad_1]

Shanghai, Capella, Shapella, 0x01, execution layer, consensus layer – whereas the web3 group undoubtedly boasts spectacular technical competence, Ethereum’s newest replace had even one of the best of us confused at occasions.

A Nansen report on Ethereum withdrawals reviewed by CryptoSlate shone a light-weight on all the things that’s happening, utilizing knowledge derived from Nansen’s Shapella dashboard.

Sha-nghai Ca-pella

The Shapella Improve, efficiently executed on April 13, marked a major milestone in Ethereum’s multi-stage roadmap by enabling the withdrawal of staked Ethereum (ETH) on the Beacon chain. This extremely anticipated improve reduces the liquidity threat related to staking, encouraging elevated participation.

The title comes from combining the 2 simultaneous upgrades, Shanghai and Capella. Shanghai upgraded the execution layer, and Capella upgraded the consensus layer. The upgrades differed solely when it comes to the a part of the community they focused, because the objective of each upgrades was to open withdrawals.

Ethereum staking

In contrast to different Proof-of-Stake (PoS) techniques, Ethereum requires validators to stake a set quantity of 32 ETH, with rewards primarily based on this quantity. Validators might have greater than 32 ETH as a result of accrued rewards or much less if slashed or penalized. To allow withdrawals, validators should set their withdrawal credential prefixes from 0x00 to 0x01.

Because the Shapella improve, the variety of validators with the 0x01 credential has elevated from 40% to 83.3%, in accordance with Nansen’s knowledge.

Moreover, Ethereum’s staking system entails two forms of withdrawals: partial and full.

Partial withdrawals embody withdrawing accrued rewards whereas conserving the minimal 32 ETH required for validator operation, processed periodically by means of an automatic course of in roughly 2-5 days.

Furthermore, full withdrawals contain withdrawing a validator’s total stability voluntarily or following a slashing occasion. Full withdrawals take longer than partial withdrawals, involving a number of steps: the exit queue, a “minimal validator withdrawability” delay of 256 epochs (27.3 hours), and the automated withdrawal course of (2-5 days).

Why do stakers have to attend in a queue?

The exit queue serves as a protecting measure to keep up the safety of the Ethereum community. Its major perform is to regulate the speed at which validators can exit the community, stopping numerous them from leaving concurrently. If too many validators exited shortly, the community might develop into weak to assaults as a result of a decreased variety of lively validators securing it.

The 27.3-hour delay (equal to 256 epochs) imposed on the exit course of is an extra safety measure designed to offer the community with enough time to detect and reply to any dangerous actions. This delay acts as a safeguard, guaranteeing that unhealthy actors can not negatively influence the community after which exit with out consequence. Primarily, the exit queue and the related withdrawal delay work collectively to keep up the soundness and safety of the Ethereum community in the course of the validator exit course of.

Liquid staking

Liquid Staking Spinoff protocols (LSDs), reminiscent of Lido, ship capital effectivity by leveraging liquidity and, thus, might affect validator selections. There was a slight enhance within the quantity of ETH staked in LSDs for the reason that Shanghai improve. Though no dashboard presently tracks if this enhance is primarily pushed by restaking, a correlation is probably going because of the advantages of LSDs. Nansen is reportedly engaged on a dashboard to trace this metric.

Understanding upcoming withdrawals is important for assessing Ethereum’s staking ecosystem. Kraken, one of many high withdrawers, is commonly misconceived as one of many high sellers. Nevertheless, in accordance with the report, their “full exits haven’t materially impacted whole withdrawal numbers,” as most withdrawals have been rewards and validators are nonetheless within the exit queue or pending the automated withdrawal course of. Moreover, validators might produce other causes to request withdrawals, reminiscent of switching validator setups or transferring to LSD protocols.

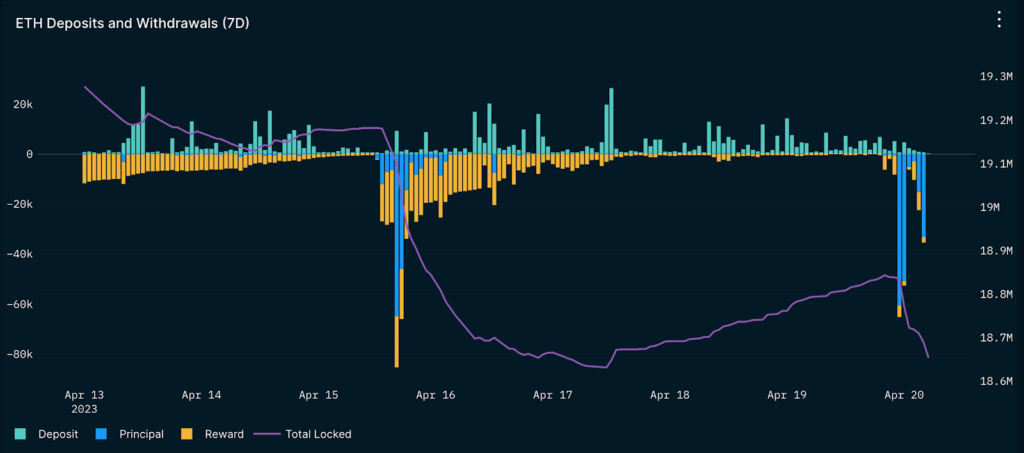

Nansen’s knowledge on deposits vs. withdrawals presents useful insights into the stream of ETH between locked and unlocked states, with the cumulative sum used to estimate modifications within the liquid provide of ETH.

Nansen knowledge analyst Martin Lee commented,

“Whereas the chart offers a great overview of the change in liquid provide, it lacks nuance when making inferences on the implications of the withdrawals. With a purpose to acquire correct insights into the withdrawal knowledge, realizing the cut up between partial and full withdrawals is important.”

Insights on Shapella

Lee’s speculation on Shapella suggests there will probably be a rise in participation and the general quantity of ETH staked within the community now that Ethereum withdrawals are dwell. If that’s the case, it might convey Ethereum’s staking ratio nearer in keeping with different main L1s.

The speculation is predicated on the remark that Ethereum had one of many lowest staking ratios amongst main L1s and was the one chain with out withdrawals enabled till the Shanghai improve. Because the improve approached, there was a fast enhance within the quantity of ETH staked, indicating a powerful curiosity in staking ETH.

Nevertheless, Lee additionally highlighted Ethereum’s staking ratio won’t attain as excessive as another chains, primarily because of the massive NFT ecosystem and the rising DeFi ecosystem. The assorted use instances for ETH set it aside from different main L1 tokens, which might influence its staking ratio. Lee believes it is very important contemplate that the introduction of withdrawals might not essentially result in mass promoting strain, as many components can affect the selections of validators and customers

Lee in the end argued that the next occasions have had individuals “leaping to conclusions too early.’

- Kraken unlocks = mass promoting strain

- The general development within the quantity of staked ETH primarily based on present withdrawal knowledge

- Kraken being pressured to unwind their staking service within the US doesn’t essentially imply they (or their prospects) are promoting. It simply means they should exit as validators. What customers do with the ETH is but to be seen.

- The quantity withdrawn now will probably be extremely risky, with spikes right here and there primarily based on partial and full exits. It’s solely been 4 days, and a baseline has not but been established.

In conclusion, the Shapella improve has unlocked new potentialities for Ethereum staking and introduced extra flexibility to validators. Understanding the nuances between partial and full withdrawals, the influence of LSDs, and key metrics like deposits vs. withdrawals will assist crypto fans navigate this new panorama.

The submit Every part it’s essential find out about ETH Shapella withdrawals appeared first on CryptoSlate.

[ad_2]