Abstract:

- The common variety of 56 business consultants count on ETH to hit end 2023 above $2,000 and hit $6,000 by 2025.

- Finder’s panelists additionally opined that Ethereum might flippen Bitcoin as the most important crypto by market cap by 2024.

- 56% of Finder’s consultants mentioned now could be the time to purchase Ether and 60% imagine ETH is underpriced at its present ranges.

A report from Finder on crypto’s largest altcoin Ether (ETH) mentioned that the token might skyrocket to $6,000 by 2025 because the markets get well following a murky 12 months in 2022. Finder’s evaluation in January engaged 56 business consultants on what they imagine the longer term holds for Ethereum and its native asset ETH.

Ether (ETH) Value Predictions

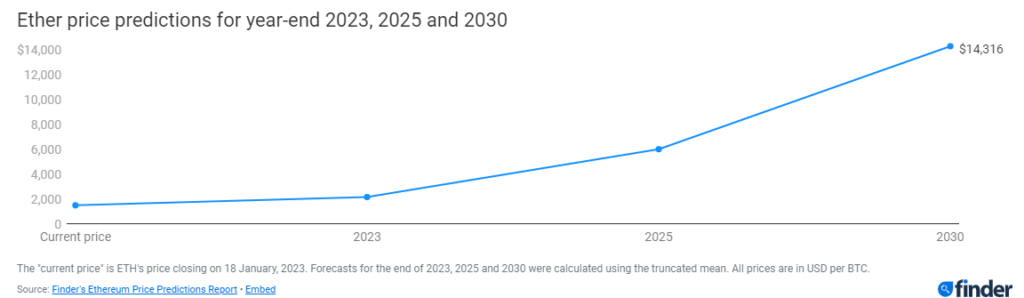

The panel common predicted key value ranges for the most important altcoin by 2023, 2025, and 2030. Amid uncertainty throughout the broader monetary business, tightening financial insurance policies from the fed, and international inflation ranges, most panelists count on ETH to shut 2023 at round or simply above $2,000. At present, the token trades at round $1600 after crypto costs rallied in January.

Finder’s panelists flip extra bullish down the road, predicting that ETH is about to succeed in $6,000 by 2025 and $14,000 by 2030. Founding father of Seasonal Tokens Ruadhan O famous that transaction prices on Ethereum will rise as international economies get well, and this may incentivize customers to purchase extra tokens. The elevated shopping for stress will propel ETH to greater costs as extra validators and customers flock to the community, Ruadhan mentioned.

Ben Ritchie, Managing Director of Digital Capital Administration AU, opined that Ethereum will energy via harsh market situations and “dominate the market because the main good contract platform”. Ritchie added that this could increase ETH’s value as extra companies develop decentralized functions (dapps) on Ethereum and community exercise will increase.

Origin Protocol co-founder Josh Fraser hailed Ethereum as the bottom layer of innovation for many of DeFi and NFTs. DefiLlama knowledge confirmed that Ethereum boasts over $29 billion in complete worth locked (TVL), the very best of any DeFi chain. Among the most distinguished NFT tasks like Bored Apes, Azuki, and CryptoPunks additionally run atop Ethereum’s chain. Fraser believes these elements will put ETH on monitor for $14,000 by 2025.

CEO of Customary DAO Aaron Rafferty expressed bullish sentiment on ETH with a long-term viewpoint. Rafferty famous that ETH provide will drop, inflicting asset shortage and hiked token costs.

The final 2 years have been extraordinarily optimistic basically for Ethereum from EIP 1559 to the Merge, [which] when mixed, triggered a deflationary impact to the protocol. As extra firms like Mastercard and Visa use the protocol and extra scaling options are built-in over the subsequent few years, we should always see on-chain provide cut back exponentially in the long run to the purpose that it will likely be practically unimaginable to purchase [ETH] from an open change in 2030.

Certainly, not all of the panelists reached a consensus on ETH’s future costs and a few consultants predicted extra ache available in the market earlier than customers expertise upward momentum. AskTraders’ senior analyst for crypto and foreign exchange, Nick Ranga, foresees “extra draw back within the quick time period”. Ranga argued that geopolitical tensions coupled with greater power costs might stifle markets till 2024.

Jeremy Cheah echoed the same bearish view on ETH as a consequence of an absence of regulated safety for crypto retail buyers. Cheah who’s an affiliate professor of DeFi at Nottingham Trent College predicted that ETH will finish 2023 at $1000. Cheah added that the token may solely attain $2000 by 2025.

ETH Underpriced? When flippening?

60% of the consultants agreed that ETH is presently underpriced at $1600. 56& of the panelists additionally chimed that now could be the time to stockpile ETH. About 12% of the 56% specialists opined that ETH is overpriced and 16% advocate offloading Ether tokens now, anticipating one other downturn in crypto asset costs within the quick time period.

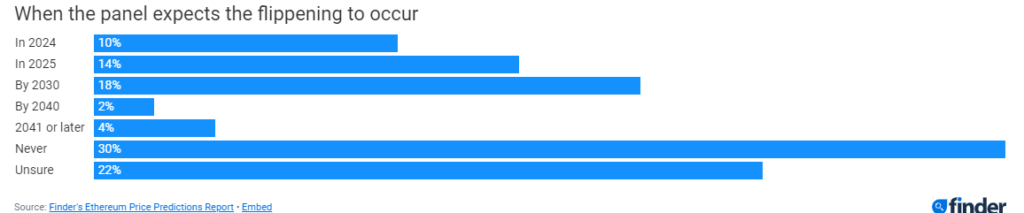

Maybe probably the most distinguished bone of competition all through Finder’s report revolved round whether or not Ethereum can flippen Bitcoin to change into the most important cryptocurrency by market cap. Ethereum’s market cap presently sits round $194 billion, whereas Bitcoin boasts a large $445 billion regardless of heavy slumps in crypto costs since market highs in November 2021.

18% of business consultants predicted that the flippening might arrive by 2030. 30% of Finder’s specialists suppose the flippening won’t ever occur.

Regardless of opposite opinions concerning Ethereum flippening Bitcoin, some consultants imagine ETH’s chain holds extra promise in comparison with Bitcoin.

Ethereum seems to be extra attention-grabbing than Bitcoin. The long-term charts spotlight the power to set ever-higher lows from June 2022. Additionally, Ether has returned above the 200-week common, one thing Bitcoin can not but boast of.

– Alexander Kuptsikevich, senior market analyst for FxPro.

Whereas not all 56 panelists agreed on value ETH value ranges within the quick time period and long run, the overall sentiment amongst business consultants suggests bullish motion for Ethereum and its native asset because the mud settles and the broader crypto markets get well.