Embedded Finance is remodeling the way in which monetary companies are delivered to clients. In recent times, embedded finance has allowed non-financial suppliers to effortlessly combine monetary merchandise into their consumer journeys, growing the affect of fintech in our lives.

The ascendance of unicorns within the buy-now-pay-later house like Klarna and the dominance of fee options within the fintech agenda level to the overarching embedded finance pattern. The time period was first used within the funds trade which is now making its approach as much as the worth chain of economic companies like lending, wealth, playing cards and different associated areas. The recognition of embedded finance has drawn consideration to an unexplored marketplace for embedded wealth.

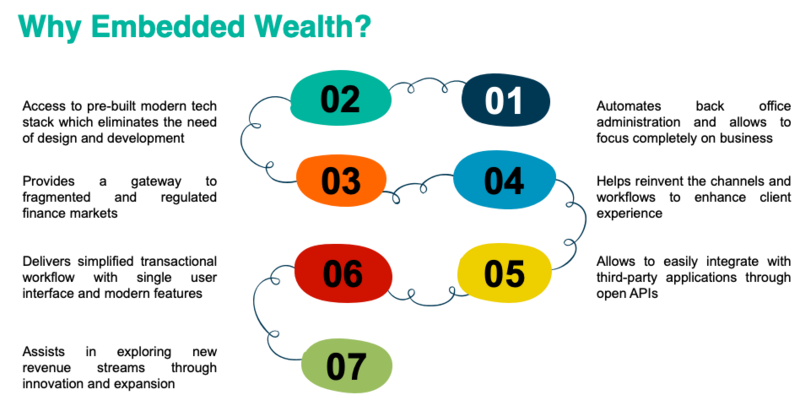

It permits platforms to effortlessly incorporate funding services and products into present affords or create new propositions based mostly on an investing stack given by way of API.

API-enabled wealth expertise is now extensively accessible at a decrease, extra reasonably priced value for a lot of. Along with serving to firms to achieve new and beforehand underserved clients with their items and companies, embedded wealth suppliers are additionally enabling improved entry to capital markets, decrease value entry to portfolio administration, and robo-advisor expertise. Additionally, initiatives like PSD2 and open banking are popularising the creation and use of APIs fostering higher legal guidelines and innovation.

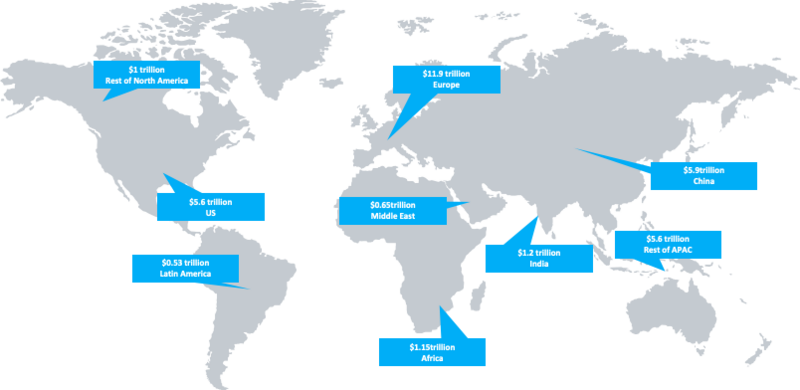

The embedded wealth market has the potential to carry as much as $33 trillion in belongings. As per the analysis by Additiv, embedded wealth options would possibly generate $100 billion in charges. It couldn’t be lengthy till you should purchase shares and shares collectively along with your meal deal of crisps, a sandwich, and a drink as a result of built-in wealth expertise is spreading its wings to broaden the affect to the smaller particulars of life.

Including Embedded Wealth To Your Procuring Cart

As shoppers get accustomed to utilizing monetary merchandise offered by well-known manufacturers, there’s a real alternative to extend entry to investing by way of embedded wealth.

Firms like Drivewealth and Alpaca are revolutionising the funding trade each domestically and internationally. They supply B2B wealth platforms with modular options for fractional shares which might be accessible utilizing APIs. They now have non-financial gamers among the many tons of of companies which have built-in into their platforms.

The event of this open funding infrastructure facilitates enterprise product growth and client entry to the monetary markets. Drivewealth has tens of millions of subscribers within the UK and round 15 million buyer base worldwide regardless of not but being a family title. Drivewealth additionally empowers the UK-based powers Tulipshare, the primary activist inventory brokerage that debuted in 2021.

A wide range of low-cost, mass-market brokerage companies that weren’t accessible ten years in the past at the moment are in demand – facilitated by embedded wealth. Analysts foresee that monetary establishments, challenger banks, extra funds companies, and even companies like Walmart contemplate getting into the embedded wealth market. With the arrival of banking-as-a-service (BaaS), monetary and non-financial firms can simply combine banking companies into their ecosystem. A number of the BaaS suppliers reminiscent of Railsbank, Solarisbank, Treezor, Inexperienced Dot, and many others. are disrupting the normal wealth administration choices by empowering fintech to innovate wealth choices for varied buyer teams.

Nevertheless, challenger banks appear to be keen in embedding wealth as in comparison with conventional banks that are transferring slowly to adapt to the adjustments introduced in by monetary expertise. A variety of wealth merchandise will probably be provided by way of these platforms in direction of the top of 2022. A challenger financial institution finds it straightforward to combine an API into its banking app to supply a streamlined expertise stack and the power to design monetary merchandise swiftly. The product providing of a banking app could thus be simply expanded by way of embedded wealth, which ought to improve consumer retention and probably entice new customers to the platform. A variety of merchandise and ongoing new options could also be each a key differentiation and a technique to defend the price of the service in a market the place many service suppliers use a freemium mannequin.

For a enterprise (the vast majority of fintech) trying to monetize its clients by way of subscriptions or recurring funds, including new items and companies will make the deal extra alluring and sticky for members that are essential for enhancing subscriber development. Most significantly, funding has lifetime durations, thus this could present subscribers with long-term sustained worth.

Monetary companies have all the time had higher margins than different companies. For companies that perceive the chance, billions of {dollars} await in earnings. New-age firms should not undervalue the extent of competitors and the regulatory complexity concerned in dealing with cash and belongings.

Existential points would possibly emerge if legacy monetary establishments lose market dominance and relevance within the new embedded panorama if they continue to be unaware of the risk.

In gentle of this, a change is imminent and our notion of wealth and cash will change drastically.

Three Profitable Enterprise Alternatives for Embedded Wealth

The totally different use circumstances throughout the bracket of embedded wealth open the doorways to the excessive greenback worth market and spotlight the expertise that could possibly be influential in driving embedded wealth options to the market.

The initially use case entails the combination of non-public finance administration options into purchasing and subscription administration experiences. Integrating options of non-public cash administration into purchasing and subscription administration experiences is the primary and most obvious use case. The inclusion of non-public finance administration parts would possibly actually help the consumer by controlling their spending, in distinction to buy-now-pay-later programs that capitalise on emotions of urgency and promote impulsive purchases. The service provider would additionally profit because the built-in wealth options would possibly help them in demonstrating to clients that buying the product will save them cash by illustrating its high quality, sustainability, and longevity. Likewise, private finance administration options may stimulate the purchasers to pick the subscription fashions that are acceptable for his or her utilization – that would permit the service provider a chance to achieve secure money flows repeatedly.

Pension planning as a part of the job expertise is one other intriguing alternative/enterprise mannequin for embedded wealth options. The incorporation of pension planning toolkits into an organization’s intranet could profit the model recognition of the employer, the effectivity of the treasury’s pension accounting, and the proactive and productive retirement planning for workers. The worker could also be successfully guided by way of the nuances of the retirement financial savings alternative by trendy interactive pension planning programs, they usually can then be assisted in selecting the choice that most closely fits their distinctive circumstances. Despite the fact that the accounting departments usually deal with the preparations for the staff’ retirement, growing worker data of pensions isn’t seen as a technique to increase happiness amongst employees.

The third alternative focuses on offering seamless monetary administration for small companies. Smaller companies may battle with liquidity administration of their each day operations whereas bigger companies can afford to make use of expert groups of accountants. For example, combining company credit score and funds helps assure the environment friendly and easy payback of small enterprises’ curiosity funds and loans. The plan is to make use of a portion of the proceeds from gross sales to repay the debt straight away. For example, if a pizzeria spends €10,000 on a brand new range, they assure that 10% of every pizza bought would go in direction of repaying the credit score. On this state of affairs, embedded wealth would possibly help enterprise homeowners in guaranteeing the viability of their operations by simplifying the mortgage phrases and payback schemes.

Embedded wealth has the potential so as to add important worth to the prevailing system. Fintech is re-designing finance companies fostering innovation and altering the normal finance system. Evolving buyer expectations have offered beneficial circumstances for this new probability to grow to be extensively accepted. Adoption of this market will remodel the old-rooted set-up and make it helpful for everyone- conventional banks, challengers and shoppers. It should empower each retailers and clients with revolutionary decisions and alternatives within the embedded wealth space.