[ad_1]

Fabio Panetta, a member of the chief board of the European Central Financial institution (ECB), has acknowledged that corporations growing their revenue margins could possibly be serving to to gas inflation. In an interview with the New York Instances, Panetta warned in regards to the impact that corporations growing such margins may have on inflation ranges in the long run.

ECB’s Panetta Hyperlinks Revenue Margins With Inflation

Fabio Panetta, a member of the chief board of the European Central Financial institution (ECB) and former deputy governor of the Financial institution of Italy, has introduced consideration to the impact that the rising revenue margins of varied corporations may have over inflation ranges. In an interview given to the New York Instances on March 31, Panetta talked about these earnings and price-setting practices, and their doable hyperlink with the excessive inflationary ranges in Europe.

The present headwinds the world economic system is going through could lead on corporations to boost their revenue margins if they’re anticipating an increase of their prices, which may come from totally different sources, in keeping with Panetta. He acknowledged:

“We’re most likely paying inadequate consideration to the opposite element of earnings — that’s, earnings. The state of affairs which prevails within the economic system, there could possibly be perfect situations for companies to extend their costs and earnings.”

Nevertheless, Panetta defined that his statements didn’t indicate that the European bloc would act to manage these costs. As an alternative, he clarified that he needed to look at all of the elements that had been affecting the inflation ranges.

Inflation Ranges Falling, however Far From the Purpose

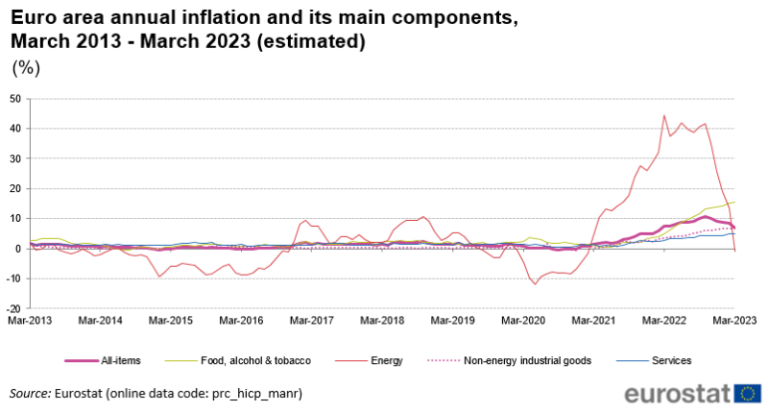

Preliminary numbers issued by the European Union point out that March completed with a 6.9% inflation charge, cooling down from the 8.5% reached in February. That is because of the sharp decline in vitality costs throughout Europe. Nevertheless, the costs of the core components of European inflation, which exclude vitality and meals, have continued to surge, reaching an all-time excessive of 5.7% throughout March.

Which means the ECB will probably preserve elevating rates of interest within the foreseeable future, because it embraces its data-dependent strategy. That is the opinion of Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics, who acknowledged:

Policymakers on the ECB gained’t learn an excessive amount of into the drop in headline inflation in March and can be extra involved that the core charge hit a brand new document excessive.

On March 16, the ECB raised rates of interest by 0.5%, with President Christine Lagarde stating that inflation was “projected to stay too excessive for too lengthy,” with ranges being nonetheless very removed from the two% purpose proposed by the establishment.

What do you concentrate on Fabio Panetta’s tackle the rise of revenue margins and its impact on inflation? Inform us within the remark part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Alexandros Michailidis / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]