[ad_1]

Decentralized finance (DeFi) has been one of many focal factors of the crypto business. That is solely getting extra true as years go by, with an increasing number of tasks, people, and funds coming into the area.

It’s clear that DeFi has grown exponentially in virtually all of its metrics prior to now couple of years, from the variety of protocols that function within the area, by the whole worth locked (TVL), and all the best way to the variety of customers benefiting from varied platforms.

This report will cowl the efficiency of DeFi within the bearish yr of 2022, in addition to decipher what the area has to supply within the coming months and years. Let’s get into it!

The Development of DeFi

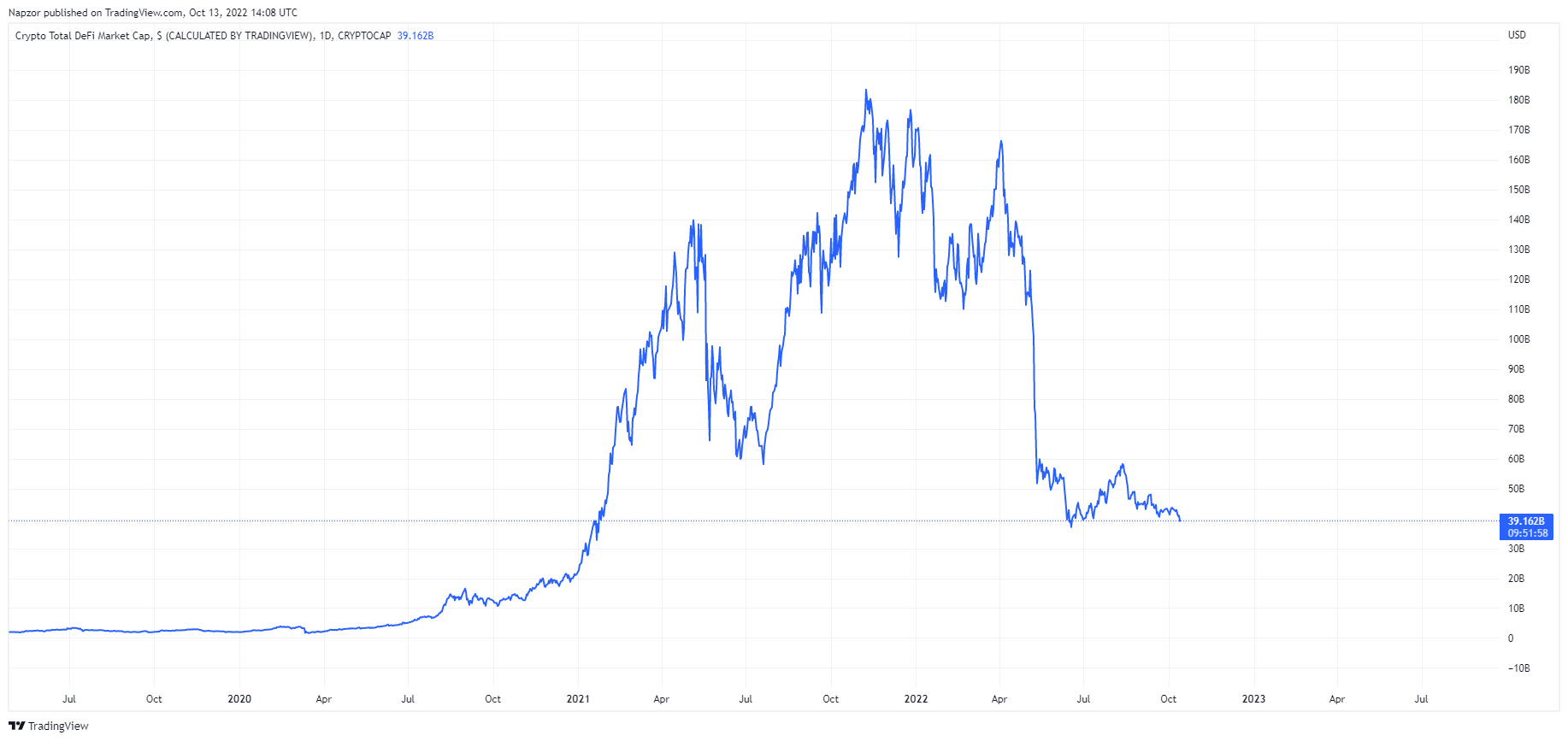

Market Capitalization

Since early 2020, the DeFi ecosystem has exploded in progress, with its market cap reaching over $26 billion by the top of 2020. This progress has continued all through 2021, with the best level reaching as excessive as $199 billion.

Nevertheless, as 2022 got here with plenty of financial unrest and a crypto bear market, DeFi has pulled again towards the $40 billion mark.

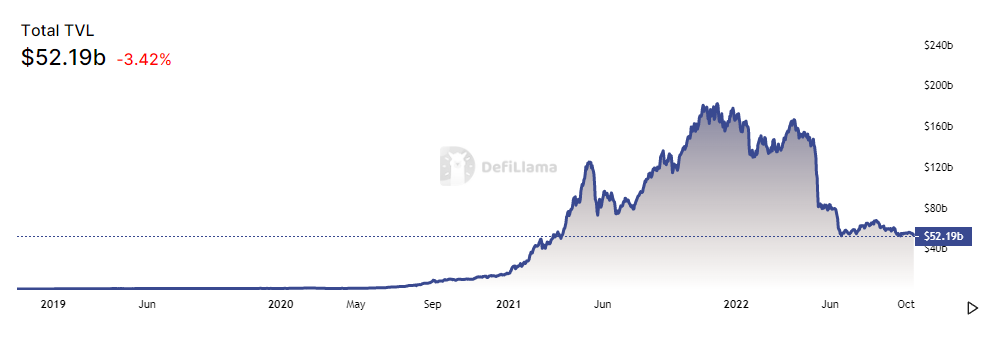

Complete Worth Locked (TVL)

After we take a look at the complete worth locked in varied protocols, we may even see practically the identical picture as earlier than – however the chart could idiot you!

As a matter of reality, whereas the greenback worth of tokens locked inside DeFi protocols has been following the DeFi ecosystem market cap, if we issue out the value fluctuations, we may even see that the variety of precise cryptocurrencies locked remained just about the identical. Actually, the greenback worth of DeFi in TVL is now bigger on a per-dollar foundation than it was virtually ever was. Because of this, through the bear market, individuals have been nonetheless locking their property in DeFi protocols – they have been simply doing so with inexpensive cryptocurrencies.

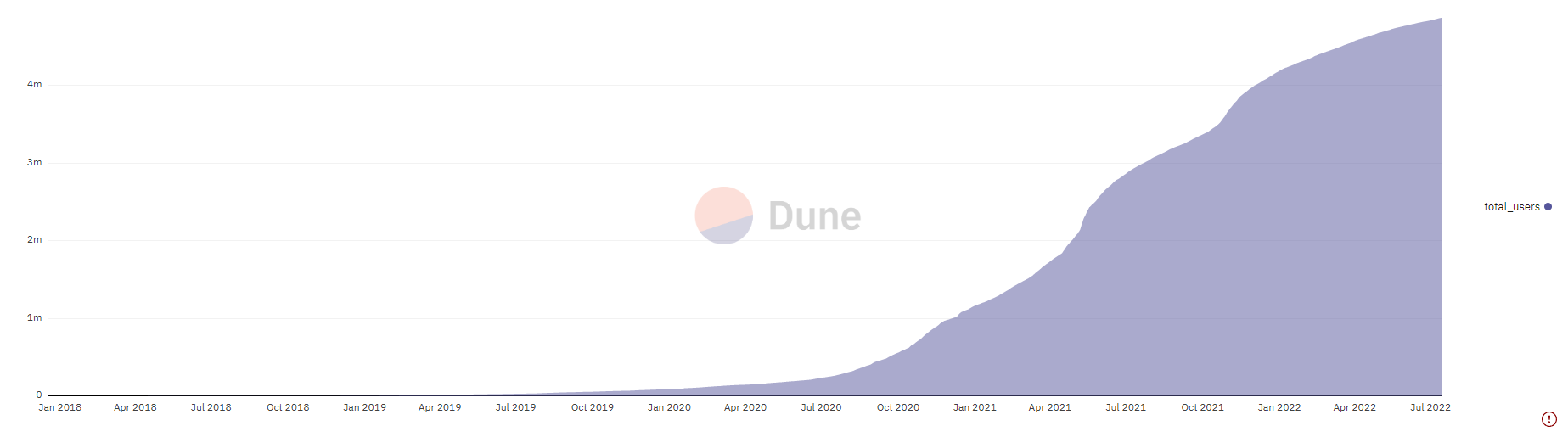

Addresses Collaborating in DeFi

We may even see a unique story if we take a look at the variety of addresses collaborating in varied protocols. The information as soon as once more exhibits a gentle enhance all through 2020 and early 2021, but additionally all through 2022 regardless of the bear market setting in.

This upward-facing pattern appears to proceed, probably attributable to the truth that lots of the early adopters and energy customers of DeFi protocols are nonetheless collaborating, whereas new customers will slowly coming again because the market turns into extra secure.

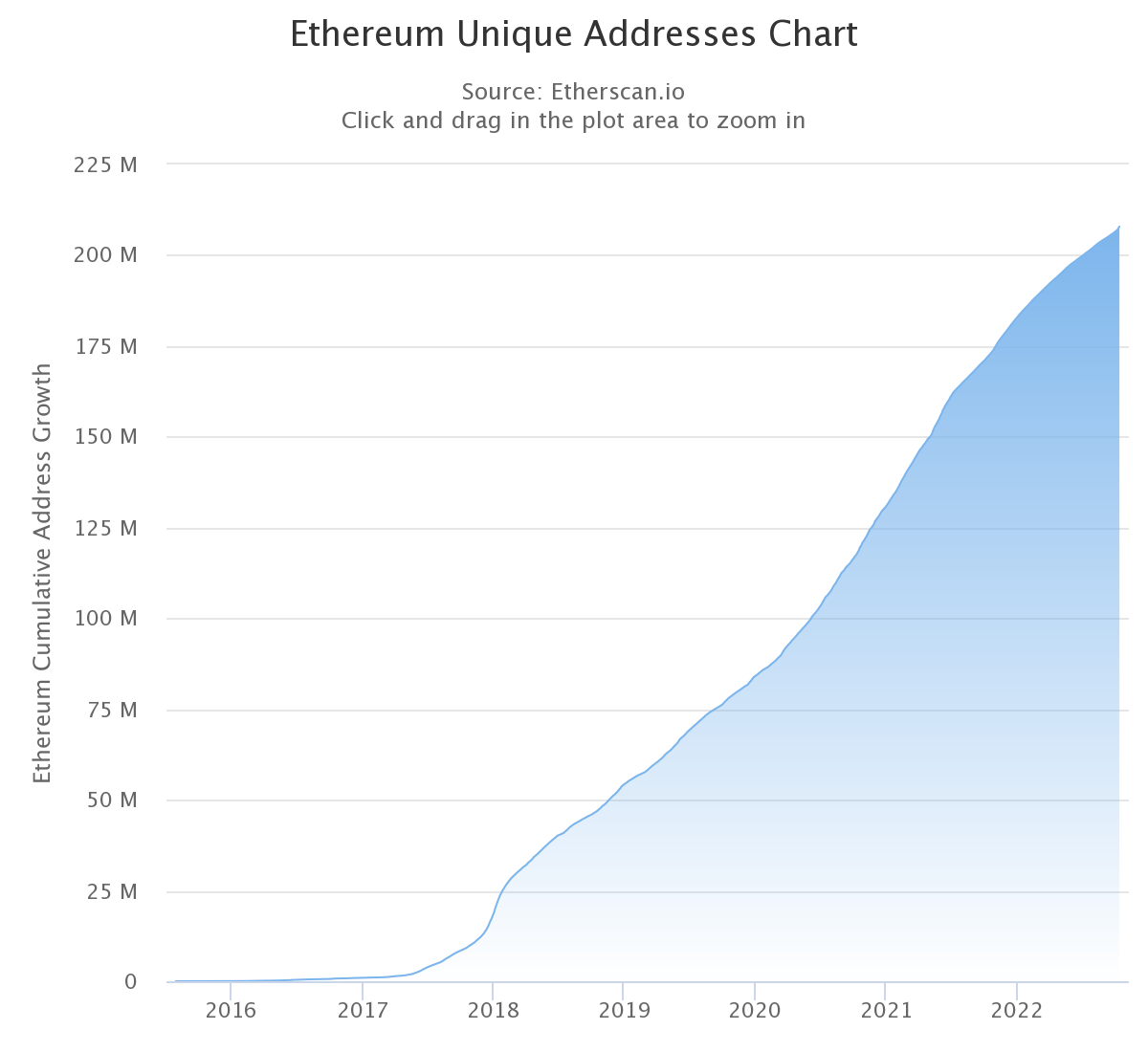

Distinctive Ethereum Addresses

Since many of the DeFi protocols are at the moment constructed on Ethereum, it’s additionally essential to have a look at the variety of distinctive addresses interacting with Ethereum.

The information exhibits a gentle enhance all through the years, which exhibits that individuals nonetheless transact and function inside the ecosystem regardless of the present bearish outlook.

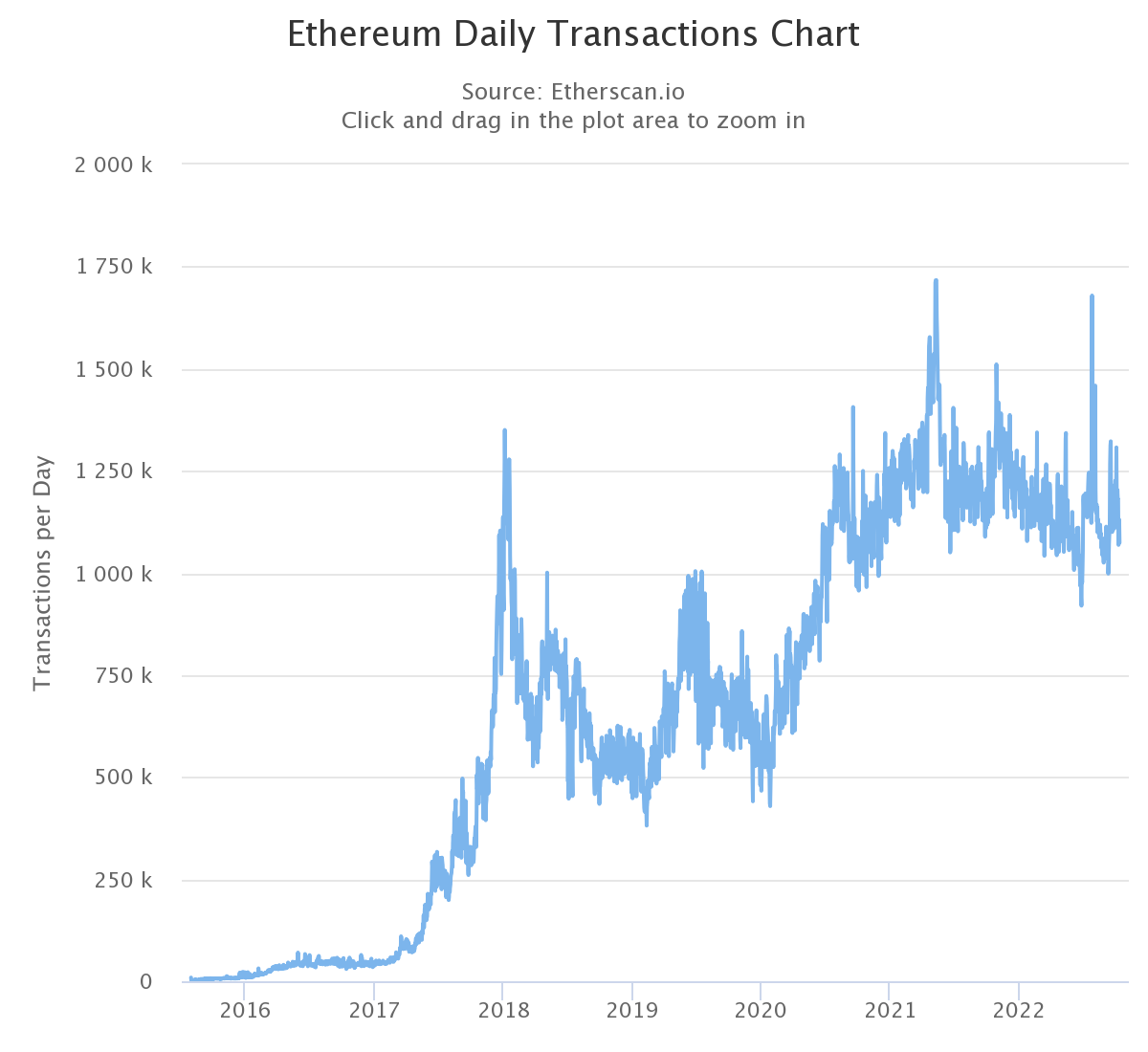

Ethereum Transactions Per Day

If we take a look at the variety of transactions per day on Ethereum, we are able to see that, regardless of some fluctuations, the common has been clearly shifting towards the upside.

That is one other nice indicator that persons are really utilizing the blockchain regardless of its uptrends and downtrends – and a big share of transactions are almost definitely related to the DeFi ecosystem.

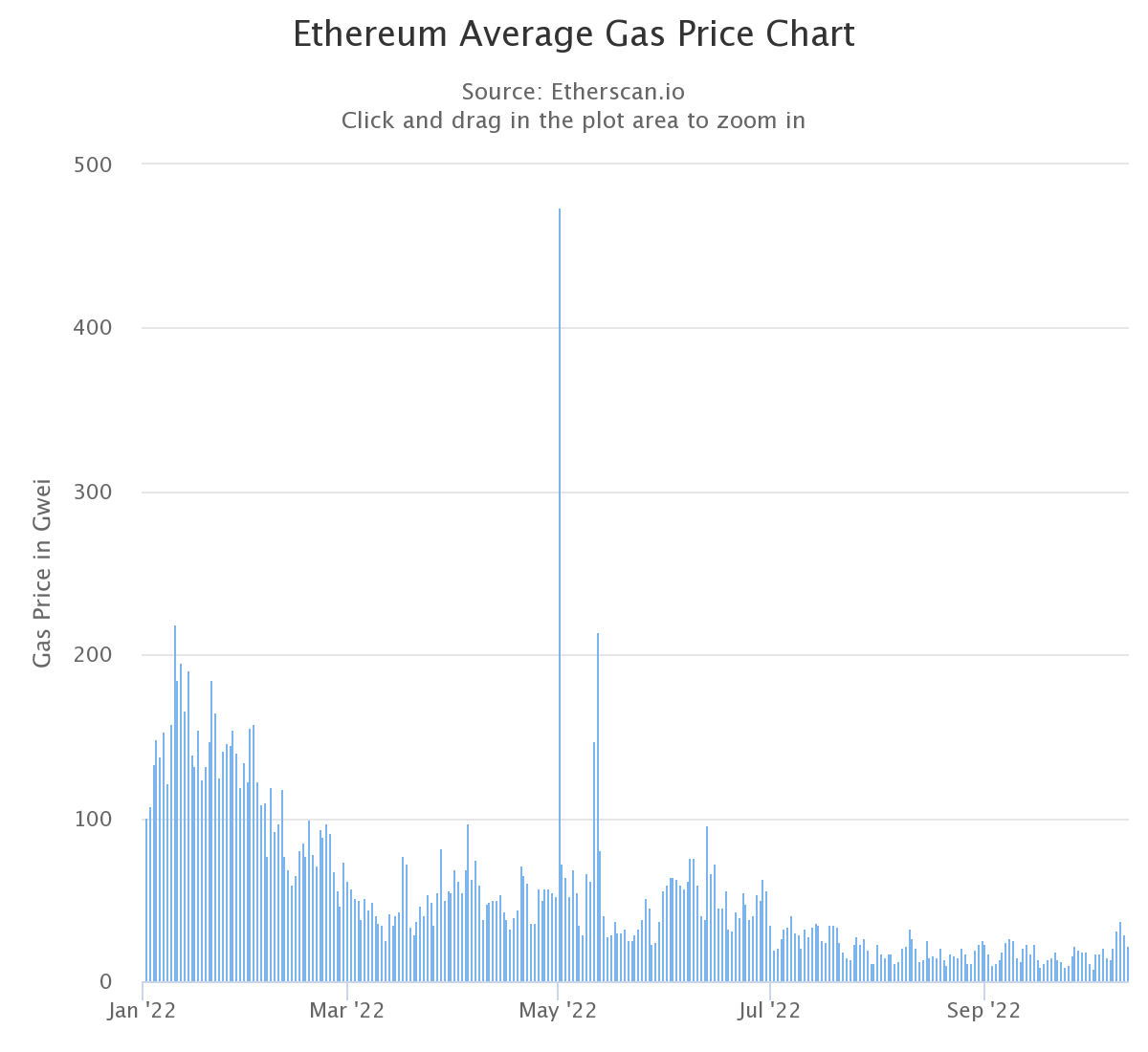

Ethereum Fuel Charges

On the subject of Ethereum’s fuel charges, we are able to see a gentle descent in common fuel costs in 2022. There are quite a few causes for this. A number of the predominant causes embrace the ETH worth drop that resulted in much less ETH shifting round, as individuals shifted extra in the direction of different cryptocurrencies for each day transactions.

The bear market additionally slowed down DeFi barely, which lowered the general fuel charges on Ethereum because of this.

The present common fuel worth at the moment comes as much as 22 Gwei, with the height in 2022 reaching near 500 Gwei.

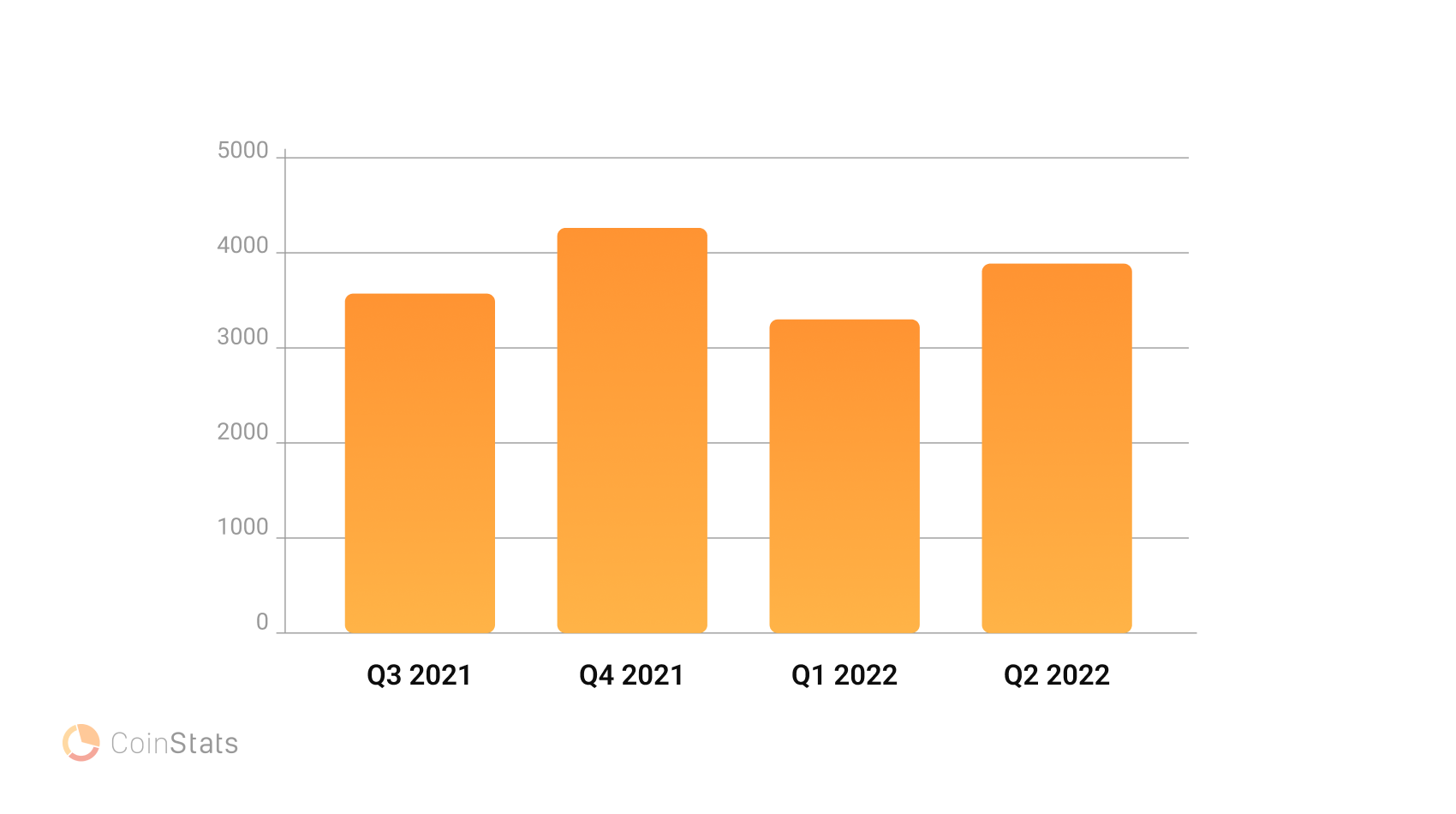

Giant Ethereum Customers

If we check out the variety of Ethereum whales on CoinStats, we are able to see that the numbers between Q3 2021 and Q1 2022 don’t differ an excessive amount of – and the identical goes for This autumn 2021 and Q2 2022.

Because of this, regardless of the market downturn and Ethereum being value much less, the variety of precise whales held up fairly properly, much more so if we take note of that holders would want way more ETH to be thought of whales in greenback worth now.

Ethereum Transfering to Proof-of-Stake

As we all know, Ethereum has moved from its proof-of-work consensus algorithm to a proof-of-stake one. This transition was sluggish and painful, however the transition was pretty seamless.

Whereas this occasion could not have had a direct affect on DeFi protocols and platforms, it’s value noting that it might doubtlessly result in elevated curiosity in Ethereum and, because of this, DeFi protocols constructed on high of it.

It is because, as soon as Ethereum 2.0 is totally operational (and the transition to the PoS consensus algorithm is only one a part of it), the blockchain will help way more transactions, with its creator Vitalik Buterin mentioning a throughput of 100,000 transactions per second. If Ethereum comes even near it, we may even see extra widespread adoption of DeFi due to drastically lowered charges.

Moreover, the barrier to entry for Ethereum’s blockchain validation’s “passive earnings” shall be a lot decrease as customers gained’t be needing to costly mining gear, however quite merely stake their ETH and take part within the community’s consensus. This might result in an inflow of latest customers, in addition to a rise within the worth of ETH (which might, in flip, result in a rise within the worth locked in DeFi protocols).

The Growth of Different Blockchains

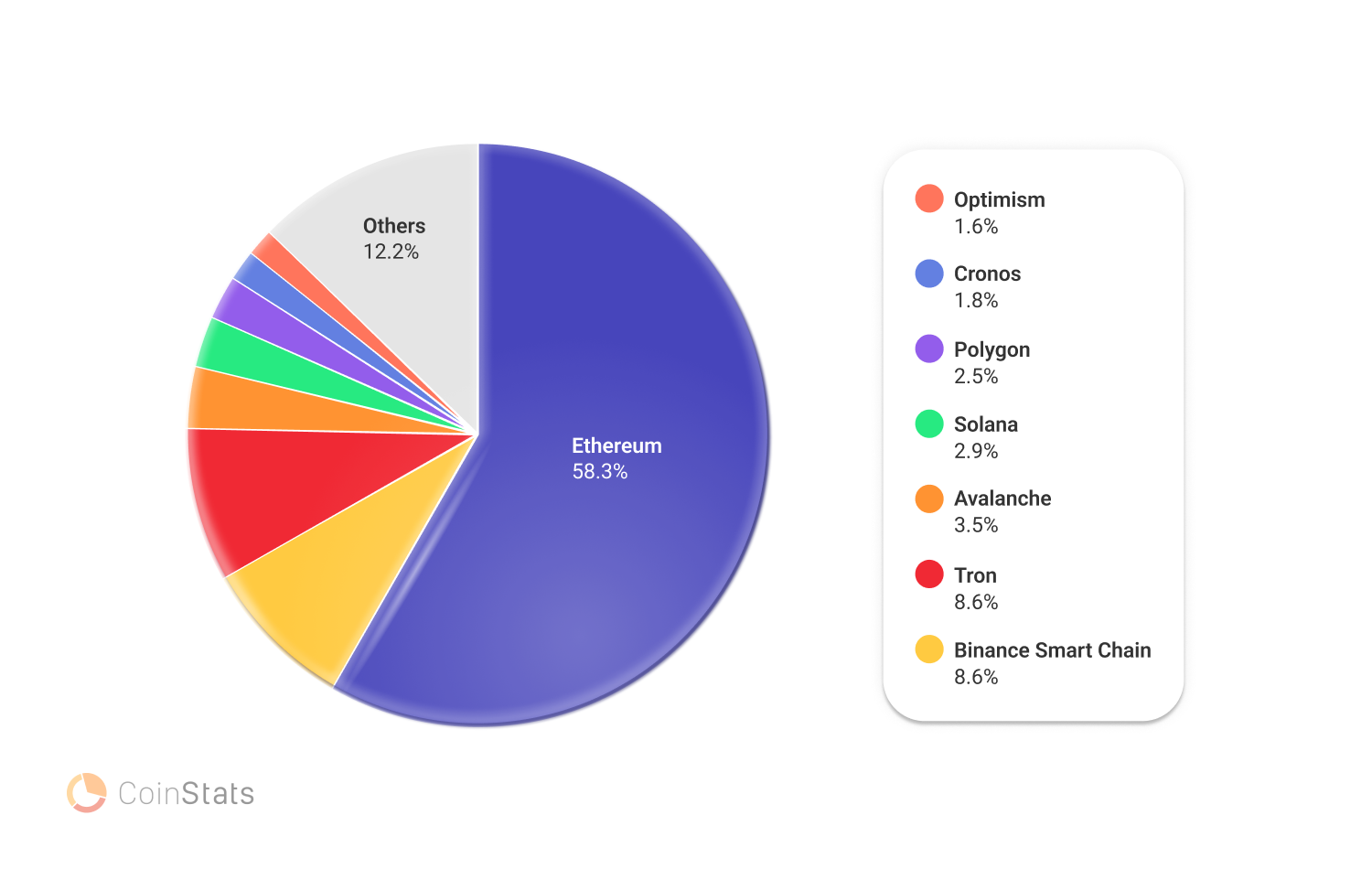

With the immense progress of DeFi protocols comes the necessity for different blockchains to supply related providers. Whereas Ethereum nonetheless stays the go-to blockchain for many DeFi protocols, different chains are slowly however absolutely catching up.

A number of the most notable ones embrace Binance Good Chain, Avalanche, and Solana, in addition to layer 2 options like Polygon or non-EVM blockchains like Cosmos, with the market nonetheless ready for Polkadot and Cardano. These protocols supply related providers to Ethereum, however with considerably decrease charges. This is because of the truth that they use a unique consensus mechanism (PoS vs. PoW), which requires much less computational energy and is thus cheaper to run.

These protocols are additionally capable of deal with extra transactions per second than Ethereum, which is essential for the scalability of DeFi protocols.

As an increasing number of customers are on the lookout for options to Ethereum, we may even see a major shift of DeFi protocols to those different blockchains within the coming months and years.

When having a look on the complete worth locked by blockchain, we are able to see that each Binance Good Chain and Tron are inching nearer to the ten% mark. That is certainly not an insignificant worth, because it exhibits that persons are considering non-Ethereum blockchains.

Notable Blockchain Initiatives

Let’s discover a few of the various kinds of blockchains, and what they’ve to supply to the market.

Various EVM Blockchains

Interoperability between blockchains is likely one of the greatest hurdles that the business is attempting to cross. Ethereum digital machine (EVM) compatibility is an effective place to begin in fixing this subject, with a few of the most notable blockchains at the moment being Avalanche, Binance Good Chain, Fantom, and Polygon.

Avalanche

Avalanche is an EVM-compatible blockchain that makes an attempt to enhance scalability with out compromising pace or decentralization.

The platform consists of three blockchains, particularly:

- The Change Chain (X-Chain) – used for creating and buying and selling property.

- The Contract Chain (C-Chain) – used for sensible contract creation.

- The Platform Chain (P-Chain)- used for coordinating validators and Subnets.

Avalanche implements a Directed Acyclic Graph (DAG) optimized consensus protocol as a substitute of the normal PoW or PoS consensus mechanisms.

The core worth proposition of Avalanche is that it improves and optimizes already-established rules, whereas additionally enabling customers to create custom-made different blockchains referred to as Subnets.

Avalanche’s hottest DeFi platforms are Aave (a multi-chain lending platform), adopted by Benqi, and Dealer Joe.

Binance Good Chain

Binance Good Chain is Binance Change’s model of Ethereum. Its functionalities are precisely the identical, with slight modifications solely seen underneath the hood. It runs on a Proof of Stake Authority (PoSA), making it arguably barely extra centralized, but additionally extra secure by way of fuel charges.

BSC turned well-liked through the Ethereum fuel payment hike, however has maintained relative recognition despite the fact that Ethereum’s fuel charges have been on the decline.

Binance Good Chain’s hottest DeFi platforms are Pancake Swap, adopted by Venus and Alpaca Finance.

Fantom

Like different Ethereum options, Fantom goals to offer extra scalability and decrease prices than Ethereum. Nevertheless, Fantom comes with one distinctive performance: customers can create and deploy their very own impartial networks as a substitute of relying solely on Fantom’s predominant consensus layer. Every software constructed on the Fantom blockchain works as its personal blockchain, whereas additionally having fun with the safety, pace, and finality of the mum or dad Fantom blockchain.

Fantom runs on an Asynchronous Byzantine Fault Tolerant (aBFT) Proof of Stake (PoS) consensus mechanism, which maintains the operational effectivity of your complete community.

Fantom’s hottest DeFi platforms are SpookySwap, adopted by Beefy and Beethoven X.

Polygon

Polygon is a layer-2 community that provides to the Ethereum blockchain. Because of this it goals to assist Ethereum broaden in throughput whereas not altering the unique blockchain layer.

Polygon has introduced quite a few superb partnerships, and has maintained a gentle growth path.

Polygon’s hottest DeFi platforms are Aave, adopted by Quickswap and Curve.

Polkadot

Polkadot is a blockchain community that gives safety and interoperability by shared state.

Because of this the layer of abstraction between Ethereum and Polkadot is remarkably totally different for builders.

In Ethereum, builders write sensible contracts that every one execute on a single digital machine, referred to as the Ethereum Digital Machine (EVM). In Polkadot, nonetheless, builders write their logic into particular person blockchains, the place the interface is a part of the state transition operate of the blockchain itself.

Nevertheless, there shouldn’t be any main variations from the consumer perspective, as Polkadot may very well be thought of an augmentation and scaling resolution for Ethereum, quite than its competitors.

Despite the fact that its core chain won’t have sensible contract performance, Polkadot will help EVM sensible contract blockchains to offer compatibility with current contracts.

Various Non-EVM Blockchains

We even have to say blockchains that aren’t Ethereum-compatible, as they aren’t utilizing the identical programming language. These blockchains are barely totally different from the aforementioned ones as they’ve a bigger distinction in functionalities when in comparison with Ethereum.

Cosmos

Whereas Ethereum has a rollup-centric roadmap, aiming to scale a single, highly-decentralized settlement layer through quite a few of Layer 2’s, Cosmos goals to create an “web of blockchains,” or an interoperable community of sovereign, application-specific blockchains.

Cosmos is very suited to constructing application-specific blockchains which might be optimized for operating just one software. These embrace the biggest Cosmos chain, Osmosis, in addition to dYdX Chain.

Cardano

Cardano is a decentralized PoS blockchain designed to be a extra environment friendly different to PoW networks. Created by Charles Hoskinson, one in all Ethereum’s co-founders, Cardano goals to enhance scalability, interoperability, sustainability, rising prices, power use, and sluggish transaction occasions of present blockchains.

The venture has launched sensible contract performance with its Alonso replace in 2021, however the present infrastructure and an unpopular programming language are placing Cardano on the again foot, not less than till future updates.

DeFi Hacks and Safety Breaches

DeFi hacks have been a rising downside within the cryptocurrency area over the previous few years. Whereas many hacks have been carried out on centralized exchanges, DeFi protocols have additionally turn into a goal for malicious actors.

Quite a few hacks occurred in 2022, with hackers stealing $615.5 million from Ronin, $602.2 from Poly Community, $362 million from Wormhole, $181 million from Beanstalk, $140 million from Vulcan Cast, $570,000 from Curve, and most just lately $100 million from BNB Chain and $100 million from Mango Markets.

This places the whole funds stolen from DeFi protocols to over $3 billion simply in 2022.

Decentralized finance as a complete is definitely different to conventional centralized finance, however it nonetheless has a methods to go by way of security and safety.

What Will DeFi Deliver within the Future?

Conventional monetary programs have been round for hundreds of years, and they’re unlikely to go away anytime quickly. Nevertheless, the rise of decentralized finance protocols constructed on high of blockchains represents a seismic shift in how we work together with monetary providers.

Within the coming years, we’re prone to see much more progress within the DeFi area, as extra protocols are constructed, and extra customers flock to the area searching for higher charges, decrease charges, and elevated safety.

Let’s take a look at the largest contributors to the latest enlargement of DeFi!

Conventional Finance is Getting into DeFi

With the latest increase in DeFi protocols, it’s no shock that conventional finance is beginning to take discover.

One of the vital notable examples is the entry of huge banks into the area. JPMorgan, for example, has been actively concerned in growing Quorum, an Ethereum-based enterprise blockchain platform. The financial institution can be a member of the Enterprise Ethereum Alliance, which is engaged on requirements for companies utilizing Ethereum.

Equally, HSBC has been testing a blockchain platform for commerce finance, whereas ING has been concerned in a number of blockchain-based provide chain financing tasks.

The entry of conventional finance into the DeFi area is an indication that the business is maturing, and that these establishments are recognizing the potential of blockchain-based monetary protocols.

It’s additionally value noting that, as conventional finance enters the area, we’re prone to see an inflow of latest customers and a rise within the quantity of property being locked into DeFi protocols.

Conventional Finance coming into the DeFi area is definitely one factor we should always search for within the coming months and years.

The Rise of Decentralized Exchanges

One of the vital essential parts of the DeFi ecosystem are decentralized exchanges, which permit customers to commerce cryptocurrency with out the necessity for a centralized middleman.

Uniswap, 0x, and Kyber Community are a few of the hottest protocols on this area, they usually have been essential within the latest enlargement of DeFi. It is because they supply customers with a straightforward strategy to commerce crypto property, with out having to undergo a centralized trade.

What’s extra, these protocols are additionally built-in with many DeFi protocols, which permits customers to commerce between totally different property simply.

As an illustration, Kyber Community is built-in with MakerDAO, permitting customers to transform DAI into ETH simply. That is essential as a result of it permits customers to commerce between totally different property with out having to go away the MakerDAO ecosystem.

Equally, Uniswap is built-in with various protocols, together with Compound, Balancer, and Curve. This enables customers to commerce between totally different property simply, with out having to go away the DeFi ecosystem.

The rise of decentralized exchanges is an indication that the DeFi ecosystem is maturing, and that customers have gotten extra comfy with buying and selling in a decentralized surroundings.

What’s extra, it’s probably that we’ll see much more progress on this area within the coming months and years, as extra protocols are constructed, and extra customers flock to the area.

The Development of Governance Tokens

One other signal of the maturity of the DeFi ecosystem is the rise of governance tokens. These tokens give holders a say in how a protocol is run, and they’re an essential a part of the DeFi area.

MakerDAO, for example, has the MKR token, which supplies holders the flexibility to vote on issues just like the rate of interest for the DAI stablecoin. They’ll additionally take part in auditing the protocol. Compound has the COMP token, which operates in a really related manner.

The rise of governance tokens is an indication that customers have gotten extra comfy with decentralized protocols, and that they’re prepared to place their belief in these protocols. What’s extra, it’s probably that we’ll see much more progress on this area within the coming months and years, as extra protocols launch their very own governance tokens, and attempt to push away from centralized governance.

DeFi and Blockchain Gaming

There are greater than 2 billion players worldwide, spending over $159 billion per yr. By 2025, that quantity is predicted to develop to roughly $256 billion. With an increasing number of individuals dedicating hours to this medium of leisure, each gamers and creators would naturally need to monetize the business additional.

A method that sport studios and builders are attempting to monetize the sector could be by blockchain gaming. Within the case of blockchain gaming, the video video games are related to a blockchain, not a central server, with gamers “mining” tokens by performing sure duties within the sport.

Fashionable DeFi protocols shall be wanted to permit for in-game transferability, and game-based cryptocurrency homeowners would in all probability need to earn a return on their property.

A survey by Toptal confirmed that 62% of players and 82% of builders acknowledged they have been serious about creating and investing in digital property which might be transferable between video games. Since then, the crypto world has caught as much as their needs.

In 2019, Ubisoft created HashCraft, the primary blockchain online game printed by a big studio. These days, a number of titles have been launched.

Since then, the area has shifted extra in the direction of the Metaverse, with main gamers like Decentraland and the Sandbox main the sport. Moreover, as NFTs have offered themselves because the spine of the Metaverse area, we might see numerous massive corporations creating their very own NFT tasks, together with Coca-Cola, Pepsi, Adidas, McDonald’s, Nike, Disney, and plenty of extra.

Whereas many understand it as quirky, the area of blockchain gaming (and particularly the Metaverse and NFTs) is definitely one thing we should always look out for within the coming months and years.

Last Phrase

We imagine that the DeFi ecosystem will proceed to develop in each dimension and complexity, providing customers all kinds of choices. Because the area matures, we anticipate to see various protocols emerge as leaders of their respective fields, whereas others shall be compelled to adapt or die.

In the long run, DeFi continues to be in its early days, and it stays to be seen what the long run holds for this revolutionary new sector. Nevertheless, one factor is for positive – decentralized finance is right here to remain.

If you wish to learn extra insightful content material, head over to our weblog or join our e-newsletter.

Thanks for studying!

[ad_2]