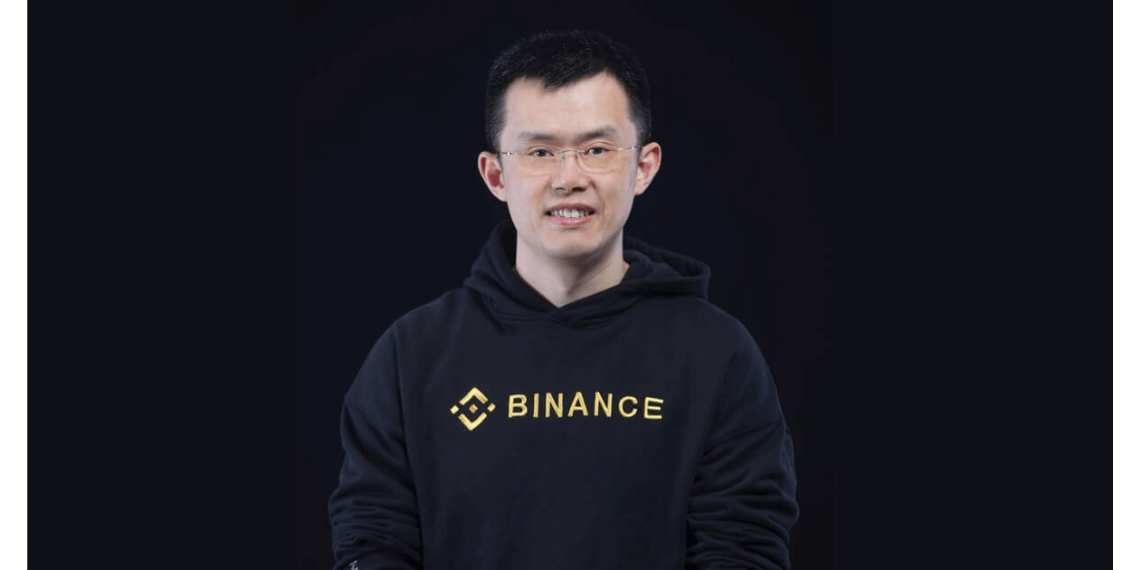

Binance, the world’s largest cryptocurrency alternate, has been hit with a $1 billion lawsuit for selling unregistered securities, alongside its CEO Changpeng “CZ” Zhao and three crypto influencers.

The Moscowitz Regulation Agency and Boies Schiller Flexner filed the lawsuit within the Southern District of Florida, claiming Binance’s involvement in buying and selling unregistered securities and paying influencers for the illegal promotion of such companies.

CZ allegations of selling unregistered securities

The lawsuit alleges that Binance, CZ, and three crypto influencers – NBA Miami Warmth star Jimmy Butler, and YouTubers Graham Stephan and Ben Armstrong (BitBoy Crypto) – promoted unregistered securities, which have induced damages to traders.

The regulation corporations additionally allege that traders should not have any obligation to show that they have been influenced by the ads. Thousands and thousands of individuals could possibly be eligible for damages, in line with the lawsuit. The regulation agency additionally plans to rope in additional Binance influencers to the go well with in future filings.

“It is a basic instance of a centralized alternate, which is selling the sale of an unregistered safety,” the lawsuit learn. The regulation agency beforehand sued Voyager, alleging that influencers selling “unregistered securities” are answerable for buyer losses. Based mostly on comparable claims, Binance and the influencers are challenged with paying $1 billion for the damages induced to traders.

Along with the lawsuit, a Monetary Occasions report claims that CZ and different prime Binance executives have been concealing the crypto alternate’s ties to China.

Nonetheless, Binance confirmed that the corporate “doesn’t function in China nor do now we have any know-how, together with servers or knowledge, based mostly in China.” Binance’s 8,000 full-time workers reside throughout Europe, the Americas, the Center East, Africa and the Asia-Pacific.

The implications of the lawsuit

This lawsuit is the most recent setback for Binance, which is already dealing with a lawsuit filed by america Commodity Futures Buying and selling Fee (CFTC) for alleged buying and selling violations.

Binance’s former chief compliance officer, Samuel Lim, can also be being sued by the CFTC. The regulator alleges that Binance traded in crypto-related derivatives with US-based prospects regardless of not having regulatory permission and regardless of having stated in 2019 that it will not serve US prospects. The CFTC is searching for punishments together with fines and everlasting buying and selling bans.

Binance, which has 128 million prospects and handles $65bn in day by day trades, has business partnerships with high-profile figures corresponding to Cristiano Ronaldo, Italy’s Lazio soccer staff, and TikTok megastar Khaby Lame.

The crypto market is valued at $1tn and Binance is a cornerstone of the trade. This lawsuit and the CFTC lawsuit might harm Binance’s status and have an effect on its future within the crypto market.

Binance, CZ, and the crypto influencers haven’t commented on the lawsuit on the time of writing. The $1 billion lawsuit in opposition to Binance, CZ, and three crypto influencers is the most recent in a collection of setbacks for the alternate.

The allegations of selling unregistered securities and the continued lawsuit with the CFTC might considerably harm the platform’s status and have an effect on its future within the crypto market.

The trade remains to be reeling from the collapse of FTX, and these lawsuits might have important penalties for the market. Binance, CZ, and the crypto influencers haven’t commented on the lawsuit on the time of writing.