A newbie’s (and a degen’s) information to navigating tax season

It’s no secret that tax reporting is a difficult drawback for crypto buyers. The pace of the house, excessive technical complexity and lack of steering typically leaves many struggling to calculate their obligations (or avoiding them completely!) come new 12 months. As a CC and Synthetix staker, I’ve but to seek out any “tax calculation” providers that appropriately categorize transactions with Synthetix or any of its accomplice protocols.

Sometimes, the providers simply report all transactions as merely “revenue” or “loss,” when the true tax reporting ought to be extra particular to the precise providers of the protocol. I’ve just lately been grappling with this problem myself, so I believed it will be useful to undergo the train of actually trying to grasp what tax reporting as a Synthetix staker ought to seem like, and hopefully save others in the neighborhood the hassle as properly. This text will largely strategy reporting from a US Tax perspective, nevertheless it’s possible the method ought to be related for different nations. Furthermore, with the staged touchdown of Synthetix V3 aligning with the publication of this text – some elements of this content material could change.

NOTE: I’m a Core Contributor at Synthetix, not a tax advisor nor a consultant of any tax company or accountant. The contents of this information are offered within the hopes that it is going to be helpful, nevertheless there isn’t any declare of accuracy or applicability. You assume full accountability to your personal tax reporting and due to this fact it’s suggested that you simply do your personal analysis. This isn’t tax recommendation.

A assessment

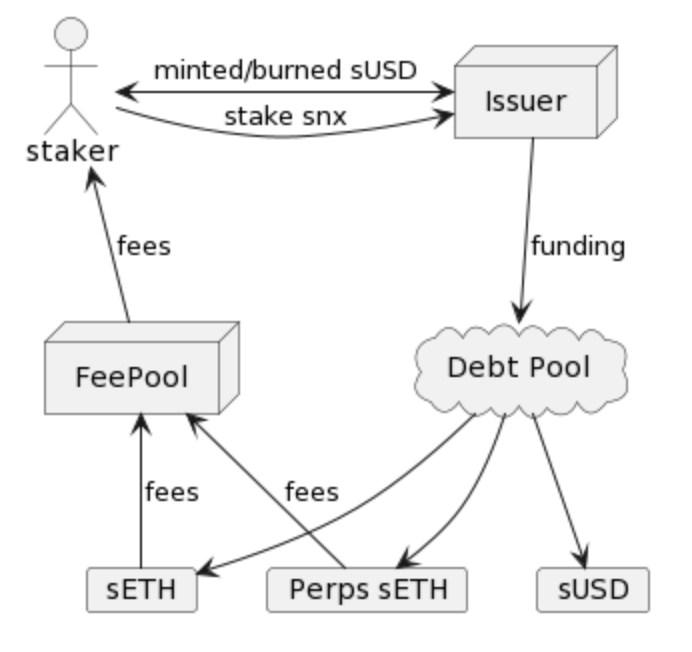

So what does an acceptable tax report for a Synthetix staker seem like? To grasp that, it’s helpful to assessment what is definitely taking place when a consumer stakes with Synthetix.

A staker begins by locking an quantity of SNX by interacting with the net UI. As a part of this course of, the staker receives sUSD in return. The sUSD could be spent elsewhere, nevertheless it have to be paid again sooner or later to unlock your SNX collateral. Some stakers could select to commerce on the merchandise Synthetix liquidity helps to energy (ex. Spot markets, perpetual futures, Lyra, and many others.), others could select to easily maintain it of their account. Different daring of us will promote it for ETH or USDC and maybe purchase actual world merchandise with it! Curiously, the best way that the sUSD is used shouldn’t be necessary, as I’ll clarify later. Subsequent, each week, the consumer shall be required to keep up their collaterization-ratio by minting/burning sUSD to make sure that their collateral is wholesome, sufficiently utilized, and on the goal collateralization ratio to obtain rewards. In return, the consumer receives rewards, each within the type of SNX from protocol inflation and sUSD buying and selling charges collected from customers.

Lastly, a staker’s place ends after they in the end repay their sUSD debt, thereby burning all of the sUSD that they minted (the precise quantity required to burn will depend on how the Synthetix debt pool carried out on the time) and unlocking the SNX that they initially deposited. Alternatively, the account could possibly be liquidated if it fails to keep up its c-ratio, and on this case, the consumer has a portion or all of its debt repaid in return for its collateral to be collected. Though there are extra methods a staker can work together with Synthetix, this text focuses on exploring the tax reporting which may be carried out for a staker, as per the aforementioned course of.

Categorizing Synthetix Transactions

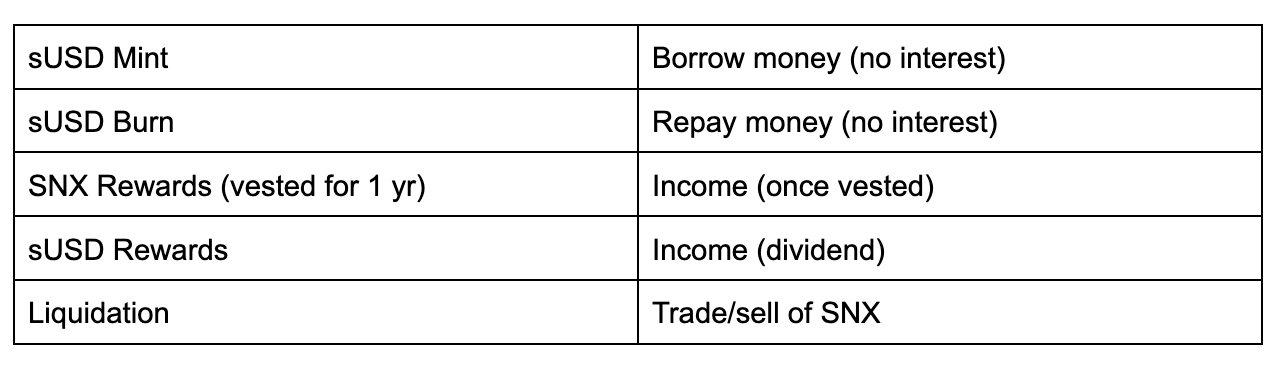

One of many first duties of tax preparation is categorizing the transactions that have to be reported, and with these categorizations, a tax legal responsibility could be decided for every transaction. There are quite a lot of transaction varieties mentioned above, and if we categorize them, we will assemble right into a desk:

Minting sUSD with locked SNX is successfully taking out a mortgage, for the reason that sUSD must be returned sooner or later. Which means no taxes are technically incurred by merely minting or burning sUSD, because it’s not likely (in and of itself) a revenue and a loss. There are some complexities in the case of this as a result of fluctuation of the debt pool, however we are going to get to that shortly 🙂. SNX rewards are revenue as a result of they’re compensation for you locking collateral and minting sUSD to the pool. sUSD rewards play an analogous function. In case your account will get liquidated, nevertheless, you could have basically divested all of the SNX which you misplaced because of the liquidation, and due to this fact, you should report your capital good points (or losses) of the SNX. You additionally must pay taxes on nevertheless a lot sUSD you didn’t must repay.

On this article I’ve but to acknowledge the fluctuation of the debt pool. Whereas the fluctuation tends to be comparatively insignificant in comparison with most tax liabilities, it’s nonetheless required to find out how a lot taxes are due because of the debt pool fluctuation. Furthermore, the debt pool tends to slowly enhance, so there’s truly incentive to report debt pool accountability for debt as a loss to make sure that your taxes are full. When combining this with sUSD rewards, there’s truly a very easy method which could be utilized to calculate your revenue as a consequence of debt pool fluctuation in a given 12 months:

totalSnxIncome = startDebt − endDebt + sUSDminted − sUSDburned

Be aware that, within the equation above, startingDebt is both the quantity of debt you had at Jan 1st of that 12 months, or, if you happen to began staking through the tax 12 months in query, 0. And endDebt is the quantity of debt you had on Dec thirty first, or if you happen to exited your place through the tax 12 months in query, 0. The startDebt – endDebt a part of the equation successfully covers any quantity of debt “left over” from both a previous 12 months, or remaining on the finish of the 12 months, and sUSDMinted – sUSDBurned is essentially the obligations that you’ve got paid/have excellent. For those who full this calculation yearly, and add it as a part of your revenue tax for any given 12 months, you find yourself together with your tax legal responsibility/loss as a consequence of debt pool fluctuation for that 12 months. You would additionally do related calculations for a quarterly/month-to-month foundation, as your tax necessities enable. In 2022, a staker who was staking on the debt pool from the start of the 12 months to the top of the 12 months would have incurred a major internet loss, so it’s positively worthwhile to do that calculation to be sure to are getting the deduction you deserve from losses, as a consequence of fluctuation of the debt pool!

Accumulating Information

So, you now know that you’ve got a certain quantity of revenue to report to your sUSD and SNX earnings considering the debt pool fluctuations. However the query nonetheless stays, how would one collect this information? Many energetic stakers have a whole bunch of transactions per 12 months from merely collaborating within the SNX staking course of – claiming, minting and burning each week, and many others. If the automated tax calculation softwares don’t compute it appropriately, then the place is the most effective place to get the information? Over time, I’ve discovered Zerion to be a superb useful resource for this. For those who go to their web site and plug in your pockets tackle (you don’t must “join” your pockets, simply paste it within the search bar), after which swap to the “historical past” tab, you will note an summary of all your account transactions for all networks. You may then click on “Export CSV” on the highest proper to get this enriched and formatted multiyear overview of your account transactions with information extracted for transfers/trades/revenue/and many others. Whereas it additionally offers its personal tax calculation providers, it’s not crucial to make use of them if you happen to merely export a CSV and apply your personal changes as wanted.

With the intention to simplify the issue of computing these values for myself, I developed a small script which pulls information straight from on-chain and assembles information within the equation shared above. The script could be discovered on a Github Gist. You’ll possible nonetheless must do some handbook calculations, however this script can assist you get 90% of the best way.

Conclusion

When you have made it this far, then hopefully it’s best to have some concepts and instruments that can assist you handle your taxes for Synthetix. Regardless of the daunting activity, with the correct instruments and some hours of bookkeeping, it’s attainable to realize an entire image of your revenue, bills and capital good points with the protocol. Doing the additional effort to calculate your possible losses on the debt pool will enable for larger financial savings, whereas additionally rising the completeness of your report on the identical time. That is sometimes sufficient to report your taxes and transfer on to subsequent 12 months to do all of it once more (wohoo!). Your accountant will thanks, and maybe your pockets too.

I want to thank fellow Core Contributors Bex and Matt for serving to to assessment and supply enhancements for this text.