The newest Bitcoin worth evaluation exhibits a bullish development is rising within the crypto market. The BTC worth has surged above $28,000 as buyers look to capitalize on the robust bullish exercise. This surge comes after a comparatively secure interval available in the market. The present market degree for BTC is at $28,408 and it’s up by 0.45 p.c as of this writing.

The help degree for the cryptocurrency remains to be robust on the $28,155 mark and it seems just like the bulls are able to take cost within the upcoming days. The market can also be displaying indicators of elevated liquidity which could possibly be a sign that extra buyers are getting into the crypto house. Furthermore, the Bitcoin hash fee has additionally been steadily rising over the previous few days, which means that extra shopping for stress is being exerted on the cryptocurrency.

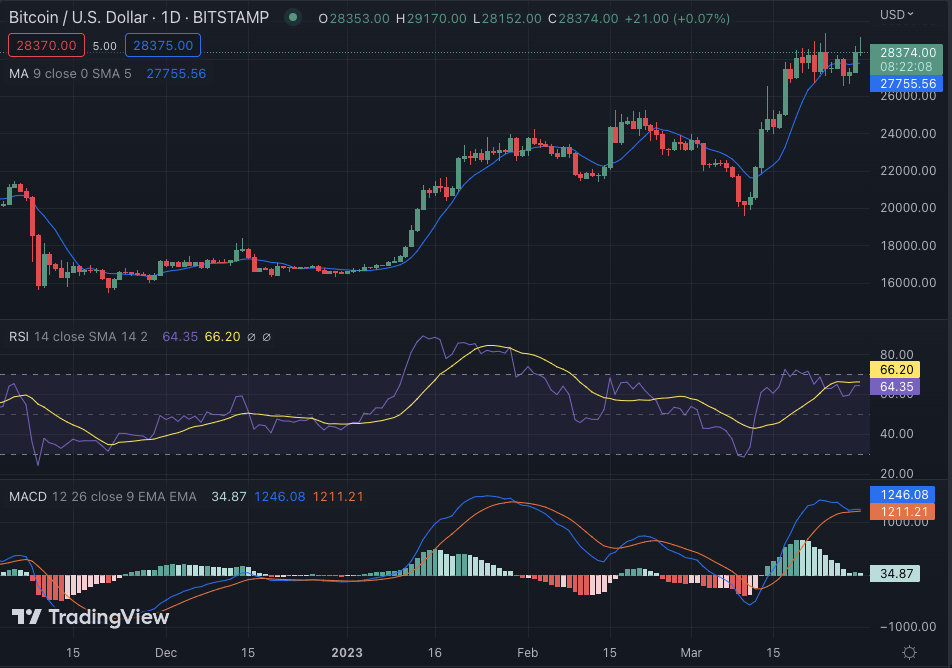

Bitcoin worth evaluation 24-hour worth chart: BTC bounces again to $28,408 as bulls strike again

The 24-hour chart for Bitcoin worth evaluation exhibits a bullish development is slowly rising because the bulls take cost. The 24-hour chart for BTC signifies that the cryptocurrency has surged from $28,155 to its present degree of $28,408 in a span of simply sooner or later. This surge got here in response to rising demand for digital property and means that buyers are getting optimistic about its future prospects.

The 24-hour buying and selling quantity for BTC has additionally been on the rise and presently stands at $20 billion, indicating a robust demand for cryptocurrency. The market capitalization for Bitcoin can also be on the rise and presently stands at $549 billion. The circulating provide for BTC is presently at round 19.33 million cash, in accordance with knowledge from CoinMarketCap.

Moreover, Bitcoin’s Relative Power Index (RSI) has additionally risen to the 64.35 mark, indicating that the asset is presently in a impartial zone. Which means the asset might both go up or down, however the present development suggests a bullish future. Along with this, Bitcoin’s MACD and Stochastic Oscillator indicators have additionally been trending upwards, indicating that bearish exercise has slowed down in current days. The Shifting common (MA) has additionally turned bullish, indicating that the asset is gearing up for an extra uptrend.

Bitcoin worth evaluation 4-hour chart: The resistance degree for BTC is at $29,159

The 4-hour chart for Bitcoin worth evaluation signifies that the asset has been buying and selling in a slim vary over the previous few days. The resistance degree for BTC is presently at round $29,159 and it seems just like the bulls are having a troublesome time breaking via this degree, and if the bull persists, then BTC might see reaching the $30,000 mark within the coming days.

The Shifting Common Convergence Divergence (MACD) for BTC is presently indicating a bullish sentiment because the histograms have moved into the optimistic zone. The MACD line can also be trending above the sign line, indicating a stronger bullish sentiment. Moreover, the Relative Power Index (RSI) is presently at 58 and is transferring towards the overbought zone, which means that there could possibly be additional upside potential for Bitcoin. The 50-day transferring common and 200-day transferring common has additionally turned bullish, indicating that the asset’s development is in an uptrend. The transferring common is presently at $28,433 simply above the present degree.

Bitcoin worth evaluation conclusion

In conclusion, Bitcoin worth evaluation exhibits that the cryptocurrency is presently in a bullish development and will probably attain $30,000 within the coming days. The help degree for BTC remains to be robust on the $28,155 mark and it seems just like the bulls are able to take cost within the upcoming days. Moreover, elevated liquidity and hash fee are additionally indicating that extra buyers are getting into the crypto house, which might push BTC towards new highs.

Whereas ready for Bitcoin to maneuver additional, see our Value Predictions on XDC, Cardano, and Curve