[ad_1]

Fast Take

The digital asset market has witnessed Bitcoin’s important fall up to now 24 hours, dropping from $45,000 to roughly $40,000, leading to greater than $660 million being liquidated, in accordance with Coinglass.

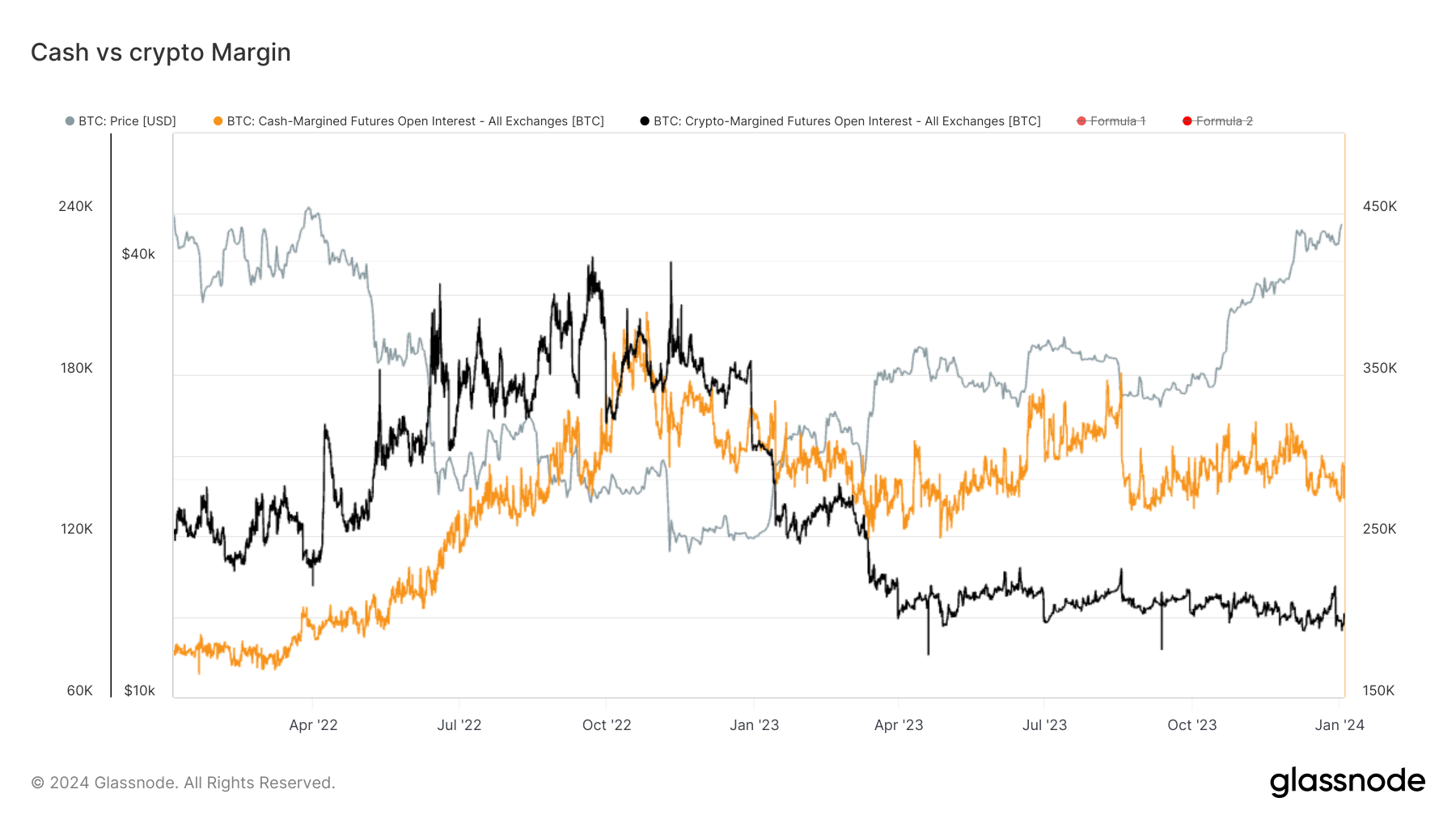

This plunge has introduced into deal with the margin used for the open curiosity in futures contracts. It’s noteworthy that the margin in native cash like Bitcoin, somewhat than USD or stablecoin, has been on a decline. Conversely, money margins, that are employed by platforms like CME for futures, have seen an upward development, marking a distinction from extra retail-focused platforms like Binance, which primarily use extra risky crypto margins.

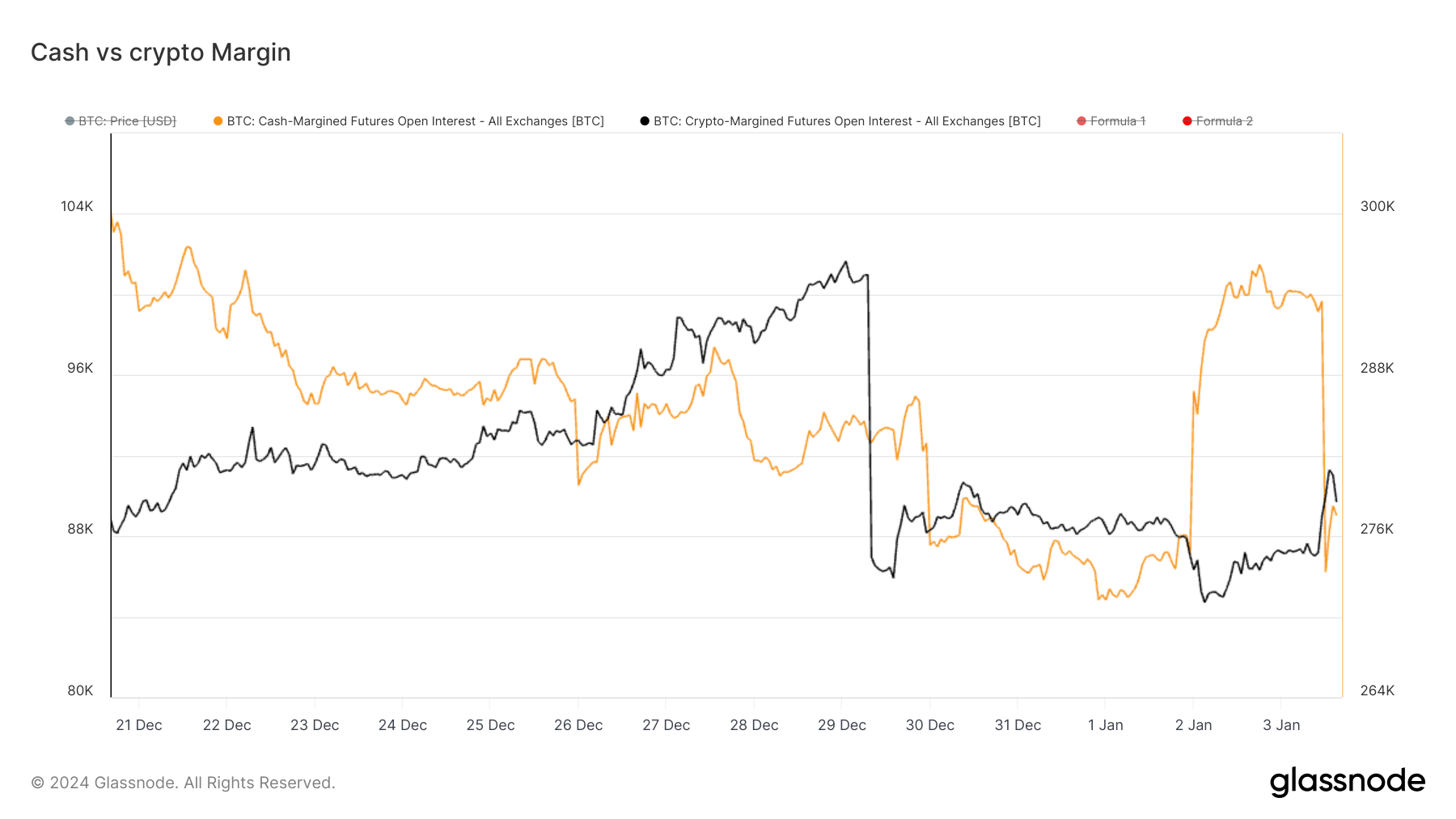

Since Jan 2, there was a exceptional enhance in money margin from 275,000 Bitcoin equal to 295,000, which has now been reset because of the liquidation occasion. That is reflective of the whole quantity of futures contracts open curiosity that’s margined in USD or USD-pegged stablecoins reminiscent of USDT and BUSD.

Regardless of the current value drop, there’s a slight resurgence within the crypto margin, which must be intently noticed for potential implications.

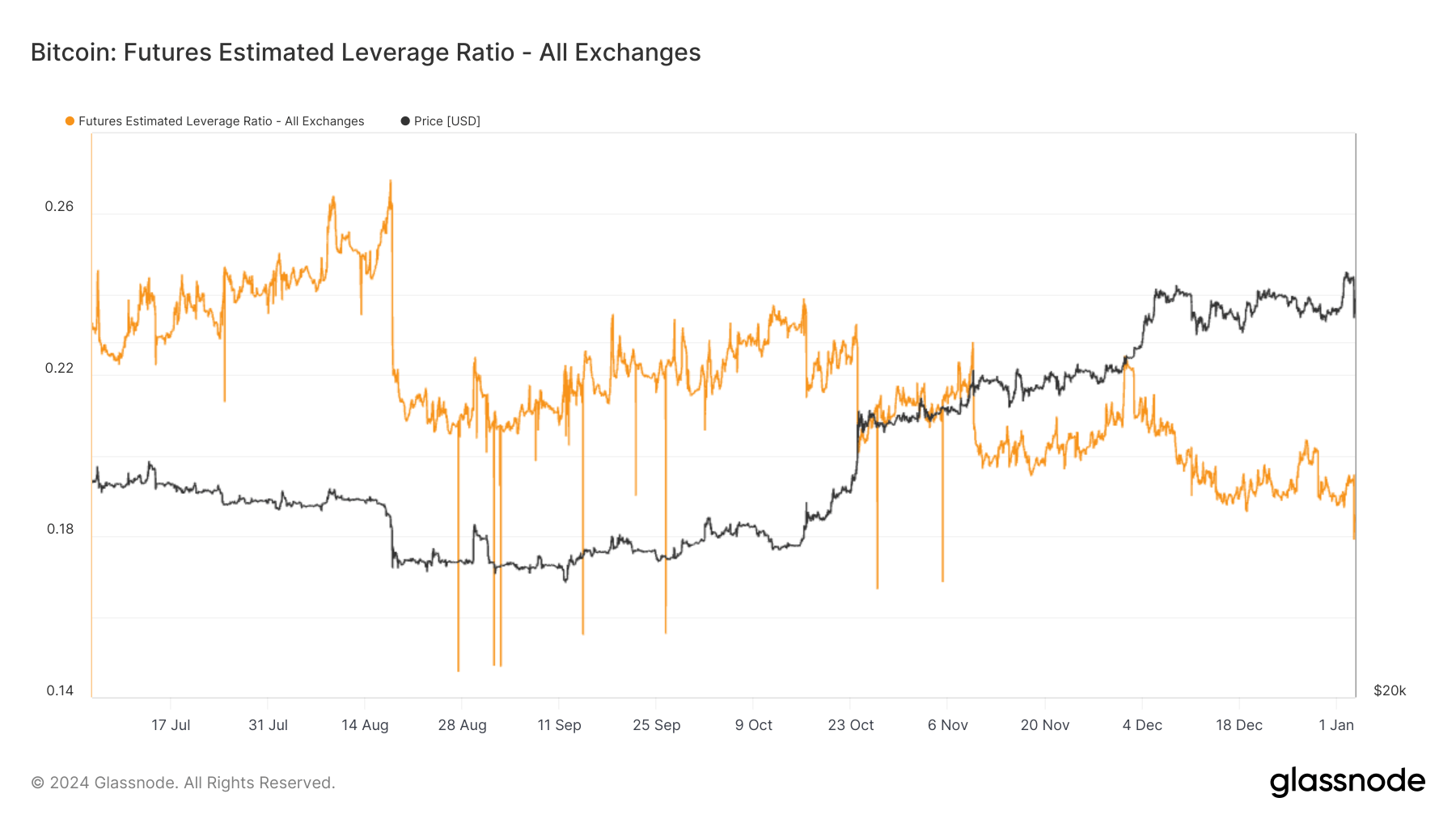

As well as, the Estimated Leverage Ratio, a crucial measure of the open curiosity in futures contracts relative to the trade’s steadiness, has dropped to a brand new low of 0.17, indicating a cleaning of leverage within the system.

The submit Bitcoin’s dive to $40k triggers huge liquidations amid shifting margin tendencies appeared first on CryptoSlate.

[ad_2]