[ad_1]

Crypto choices trade Deribit’s forward-looking bitcoin volatility index (DVOL) gives clues concerning the market’s expectations for value turbulence over the following 30 days, simply as CBOE’s volatility index, VIX, does for equities.

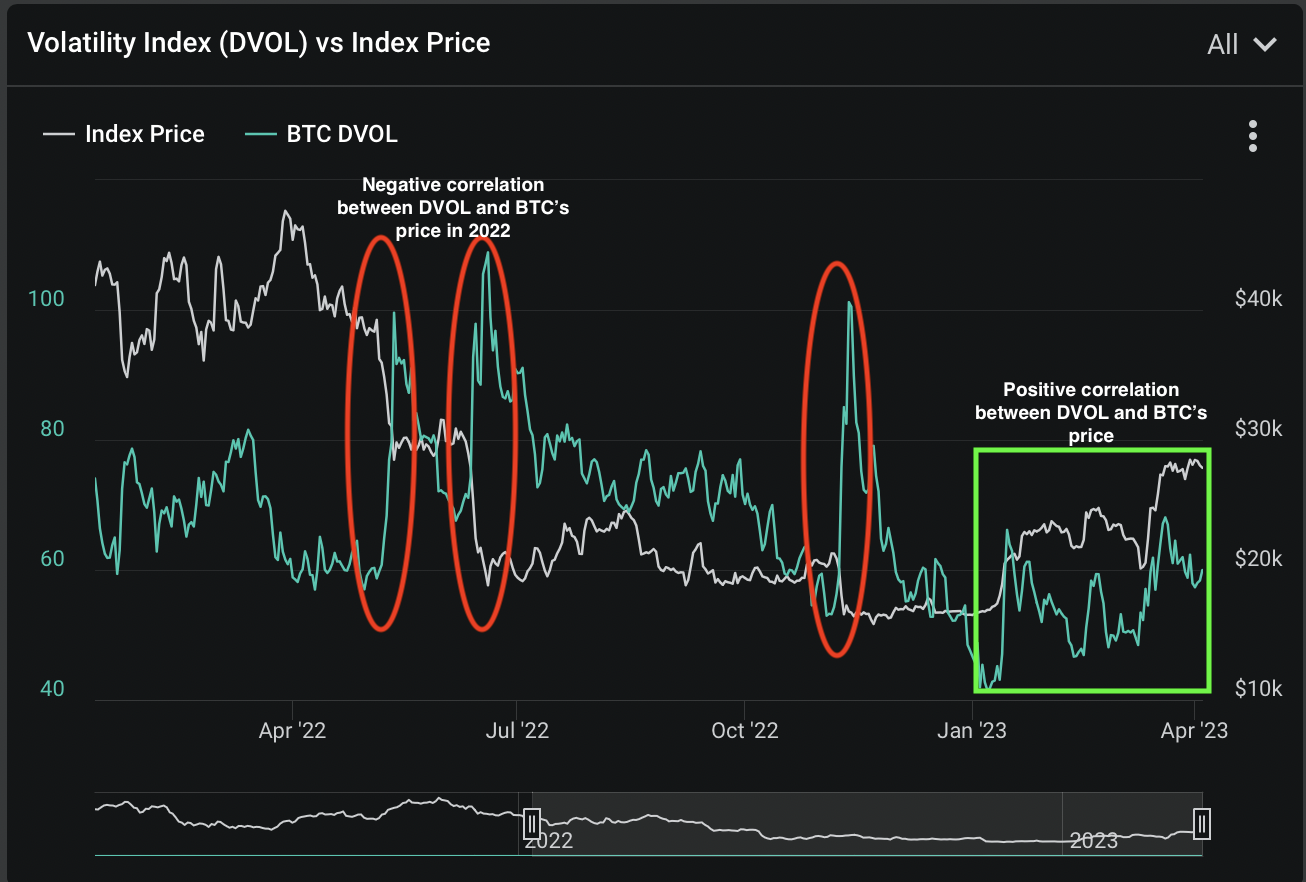

A key distinction has emerged this yr. Whereas the VIX continues to function Wall Road’s worry gauge, rising throughout bouts of danger aversion, the DVOL has developed a constructive correlation with the cryptocurrency’s value. The 30-day correlation coefficient between bitcoin’s value and the DVOL index flipped constructive in early January and rose to a excessive of 0.85 final week. At press time, the coefficient was 0.72. That has made name choices tied to bitcoin extra enticing than ever, in accordance with observers.

“Because the begin of 2023, bitcoin has displayed a powerful spot/implied volatility regime of constructive correlation. That has flipped 2022 on its head,” Greg Magadini, director of derivatives and crypto information supplier Amberdata, advised CoinDesk. “It’s been rewarding name patrons with directional spot good points and rising volatility good points.”

DVOL, launched in early 2021, measures bitcoin’s 30-day implied or anticipated volatility utilizing Deribit’s choices order ebook. The VIX is predicated on the choices costs of the S&P 500 inventory index.

Choices are by-product contracts that give the purchaser the precise, however not the duty, to purchase or promote the underlying asset at a predetermined value on or earlier than a particular date. A name choice offers the precise to purchase, a sign the holder has a bullish stance, whereas a put choice offers the precise to promote. Choices costs are decided by a number of components, together with market course in addition to implied volatility, which is influenced by the availability and demand for choices.

DVOL’s constructive correlation with the cryptocurrency’s value means name choices stand to learn from each favorable directional motion and an uptick in implied volatility. In different phrases, calls are prone to see sooner value appreciation throughout bullish strikes than places throughout bearish strikes.

“Assuming the spot/vol correlation persists, this raises the attraction of proudly owning calls as a name purchaser can hit a ‘double whammy,’ profitable on each Delta [directional gains] and Vega [implied volatility gains] in a sharply rising market,” Spencer Hallarn, an OTC dealer at a crypto buying and selling agency and liquidity supplier GSR, advised CoinDesk.

The constructive correlation is in stark distinction to final yr, when bitcoin’s flip decrease after an 18-month bullish development caught merchants off guard, resulting in panic shopping for of put choices. On the time, DVOL spiked throughout notable value declines and places noticed sooner value appreciation throughout bearish value motion than calls throughout corrective rallies.

CBOE’s VIX index rises throughout bearish market environments and falls or holds regular when the market rallies. That’s as a result of inventory merchants are usually long-term bullish and are fast to snap up places for cover on the primary indicators of weak spot within the equities market. Demand for cover dissipates when the market rallies, resulting in a decline within the VIX. The web impact is that places see sooner appreciation in worth throughout market swoons than calls do throughout risk-on traits.

DVOL acted as a worry gauge in 2022, spiking throughout notable value sell-offs. The state of affairs has modified this yr with implied volatility shifting in lockstep with the cryptocurrency’s value. (Deribit)

Bitcoin rallied virtually 70% within the first three months of the yr, contradicting expectations for a continued market decline. Based on OTC tech platform Paradigm, funds have been piling into topside or bullish merchants by way of choices.

The worry of lacking out, or FOMO, might quickly kick in, driving stronger demand for choices and pushing DVOL greater.

“The crypto market can generally spike up and everyone then needs to be absolutely in it (FOMO, particularly since we got here down from the $68K degree),” Pierino Ursone, head of choices at Deribit, stated whereas explaining DVOL’s constructive correlation with the worth. “When further demand for out-of-the-money greater strike calls kicks in for crypto, one ought to beware it may be actually sturdy and persevering.”

[ad_2]