Hedge fund supervisor Jesse Myers believes Bitcoin is on its method to a staggering $10 million per BTC.

In a brand new interview with Coin Tales, Myers breaks down the maths and the timeline behind his massive prediction.

Myers says Bitcoin is rising as a tough and scarce retailer of worth in a world of ever-increasing debt and foreign money devaluation.

“We have now now entered an period the place the worth proposition of holding bonds or holding fiat cash could be very unhealthy, as a result of the nationwide debt and the unfunded liabilities going ahead are going to necessitate a degree of printing that can outpace the nominal yield on holding bonds.

That’s the one approach out we’ve. We now have $31 trillion of nationwide debt, $170 trillion of unfunded liabilities within the US alone.

Then you definitely’re speaking about $3 trillion a yr in curiosity expense after we’re already operating a multi-trillion greenback deficit in our price range. So that you’re speaking about one thing like $4 trillion {dollars} of deficit going ahead that you need to print with the intention to make that up…

In order that’s what Bitcoin is competing with because the lowest hanging fruit, I believe when it comes to the place folks have their worth parked.”

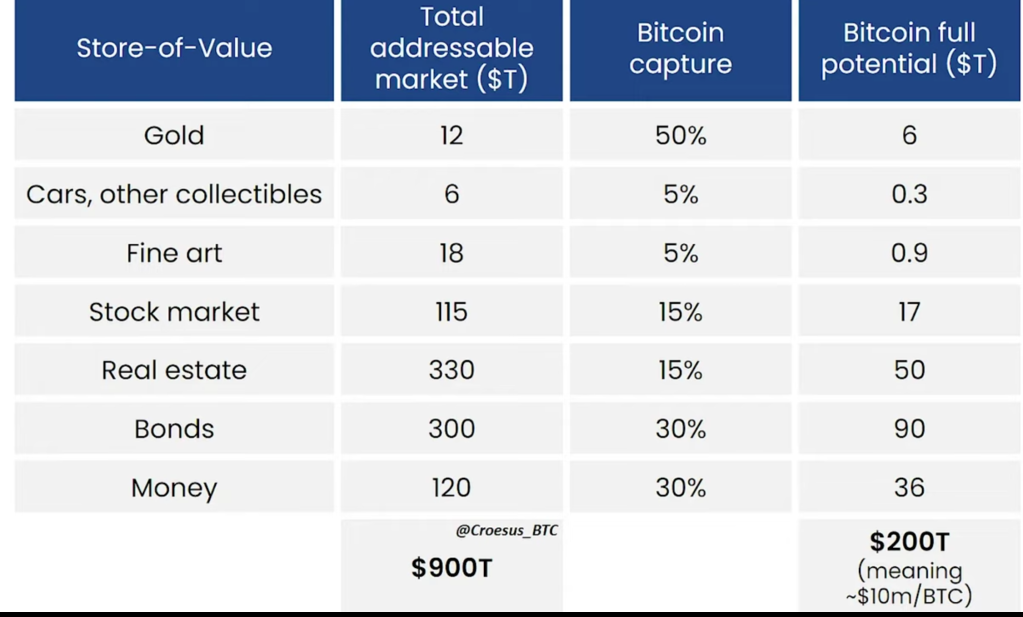

Myers says Bitcoin is competing in an asset world that totals about $900 trillion in measurement, with a present degree of worldwide crypto adoption that’s far lower than some analysts consider.

“It’s a query of how a lot can Bitcoin win, how a lot worth can Bitcoin truly take right here. It’s presently a $400 billion asset in a $900 trillion ocean. Which means it’s 1/2000th of the world’s worth, and meaning collectively the world has a 0.05% p.c allocation to Bitcoin.”

Myers says Bitcoin’s most provide of 21 million BTC will create a large provide shock because the main cryptocurrency’s price of adoption will increase.

He then breaks down the maths that brings him to $10 million per BTC in right now’s greenback phrases, which is centered on Bitcoin capturing half of gold’s market cap in addition to further percentages of the world’s high retailer of worth classes.

As for his timeline, Myers says the important thing issue is how lengthy it should take for most of the people to regularly study extra about Bitcoin and perceive its true worth proposition. He believes his value goal will turn into a actuality inside the subsequent few many years.

“I believe we’ve begun the Bitcoin period, the place having BTC as a serious if not major pillar of your private financial savings technique is the profitable components. And it’ll take a era for folks to actually get the image.

So after I after I say Bitcoin has, I believe, a conservative likelihood of turning into $10 million {dollars} a coin in right now’s {dollars}, meaning going from 0.05% of the world’s worth to 25% of the world’s worth.

Bitcoin is simply going to suck it in, ingest it like a black gap. That’s what I believe we’ve launched into now and it’ll solely be actually clear in hindsight that these are the mechanics that had been enjoying out proper earlier than folks’s eyes whereas everybody was satisfied that this was simply Monopoly cash.”

As for the potential dangers to Bitcoin’s future, Myers says regulatory roadblocks are a high concern.

He additionally believes Bitcoin’s virality is vital to its future, and that it’s crucial for many who perceive its advantages to unfold the phrase and educate the following wave of traders.

You’ll be able to try the complete interview right here.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/ConceptCafe/Chuenmanuse