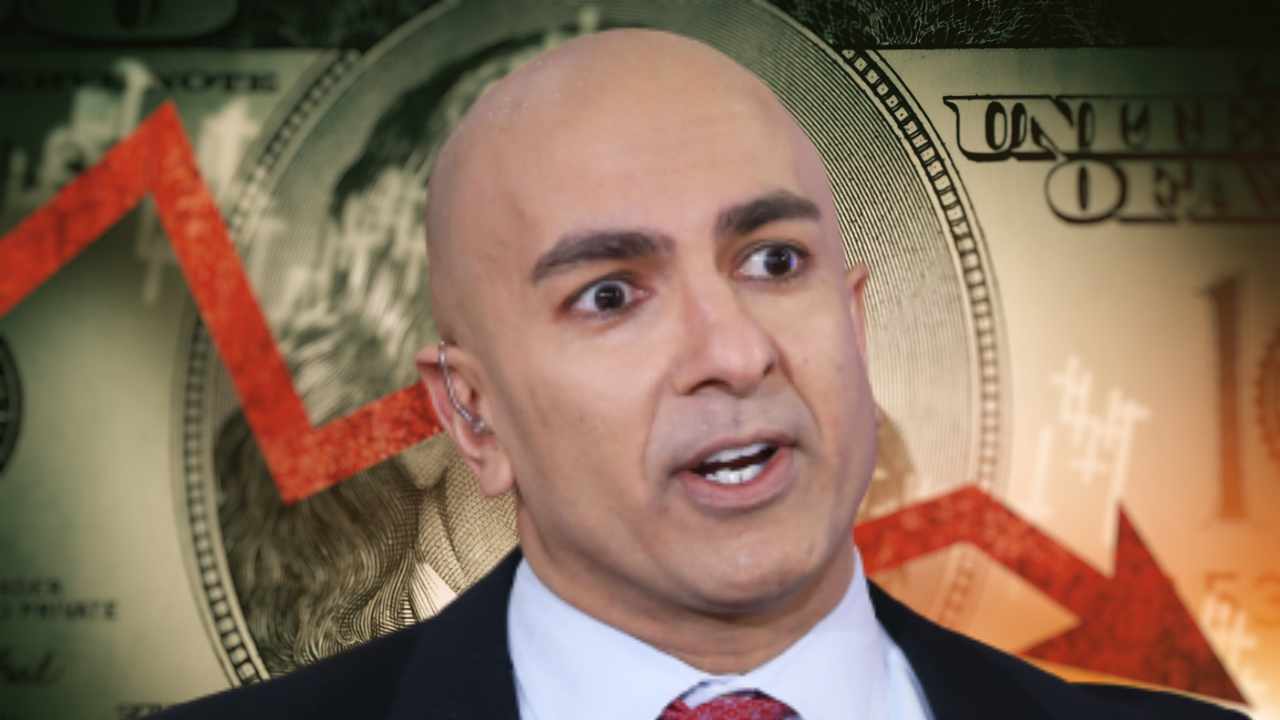

The president of the Federal Reserve Financial institution of Minneapolis, Neel Kashkari, says the present banking disaster has pushed the U.S. financial system nearer to a recession. “We now have elementary points, regulatory points going through our banking system,” the Fed official burdened.

Neel Kashkari on U.S. Economic system, Banking Disaster, Recession

Federal Reserve Financial institution of Minneapolis President Neel Kashkari shared his ideas on the state of the U.S. financial system, the present banking disaster, and whether or not the U.S. is headed towards a recession in an interview with CBS Information Sunday.

Responding to a query about whether or not the current banking disaster has precipitated the U.S. financial system to edge nearer towards a recession, Kashkari stated:

It positively brings us nearer. Proper now, what’s unclear for us is how a lot of those banking stresses are resulting in a widespread credit score crunch.

“That credit score crunch … would then decelerate the financial system,” he cautioned, noting that the Fed is monitoring the state of affairs “very, very carefully.”

“Such strains may then deliver down inflation. So now we have to do much less work with the federal funds fee to deliver the financial system into stability,” Kashkari continued. “However proper now, it’s unclear how a lot of an imprint these banking stresses are going to have on the financial system.”

A number of main banks, together with Silicon Valley Financial institution and Signature Financial institution, failed in current weeks, prompting the Federal Reserve, Treasury Division, and Federal Deposit Insurance coverage Company (FDIC) to step in and shield depositors.

Kashkari was requested whether or not extra laws are wanted to forestall financial institution failures and if the FDIC deposit insurance coverage ought to be raised above $250,000. Moreover, he was questioned whether or not the 2018 rollbacks on the regulation of mid-sized banks ought to be reinstated. The Financial Progress, Regulatory Reduction, and Client Safety Act of 2018 reversed a few of the laws that had been carried out following the 2008 monetary disaster.

The Fed official replied:

Properly, now we have elementary points, regulatory points going through our banking system. I’ve argued for years that the largest banks on the earth are nonetheless too large to fail.

Commenting on deposit outflows from smaller banks to bigger establishments, the Fed financial institution president burdened: “The rationale that deposits are flowing to the large banks, the explanation that Credit score Suisse was bailed out by the Swiss authorities, is as a result of banks have this premium place, and it’s unfair.” He elaborated:

It’s an unfair enjoying area that places monumental strain on regional banks and group banks, and that must be addressed. We want regional banks in America, we’d like group banks in America.

“As soon as we get by means of this stress interval, now we have to give you a regulatory system that each ensures the soundness of our banking system, however it’s additionally honest and even, so the group banks and regional banks can thrive. We would not have that at this time,” Kashkari concluded.

Some individuals have urged the federal government to lengthen their bailout to smaller banks. Billionaire Invoice Ackman not too long ago stated, “We’re heading for a practice wreck,” warning of everlasting harm to smaller banks if the federal government permits the present banking disaster to proceed.

What do you consider the statements by Federal Reserve Financial institution of Minneapolis President Neel Kashkari? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.