[ad_1]

Avalanche worth evaluation exhibits AVAX remains to be caught in a bearish sentiment that’s slicing by way of your entire cryptocurrency market. Regardless of the restoration noticed in Bitcoin and Ethereum, AVAX has didn’t observe go well with and has been buying and selling sideways because the earlier opening of the every day chart.

Avalanche worth evaluation signifies the pair is at the moment buying and selling in a descending channel outlined by $11.0 as short-term help and $12.5 as vital resistance. A breakout above this degree may sign a possible upside potential whereas a breakdown under the $11.0 threshold may result in an additional worth decline.

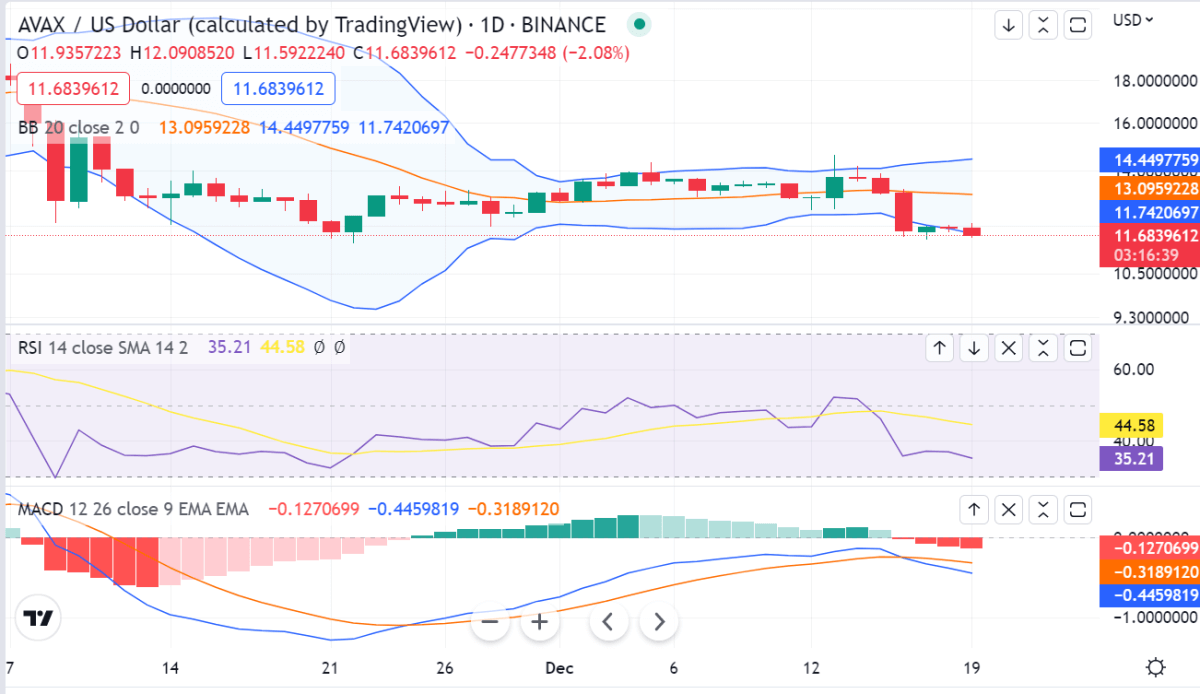

AVAX/USD worth motion on a every day chart: Bearish sentiment stays intact

The AVAX/USD pair is at the moment buying and selling at $11.70, down by 2.04 on the day. Avalanche worth evaluation exhibits the worth motion has been in a channel because the every day opening of the chart and it reached its peak round $14.11 final week. Since then, there was a gradual decline because the bearish sentiment that impacts your entire cryptocurrency market continues to take maintain.

The technical evaluation exhibits AVAX is buying and selling under the 23.6% Fibonacci retracement degree of the current uptrend, indicating that the bearish momentum may proceed and push costs decrease towards $11.0 as short-term help. A breakdown under this degree may open up for additional losses with targets set at $10.30 after which $9.90.

Trying on the transferring averages, the 20-day EMA is at the moment at $11.78, indicating that the general pattern stays bearish and will proceed to push costs decrease within the close to time period. The RSI has dropped under 50, confirming that the downtrend will stay intact except there are main bullish catalysts.

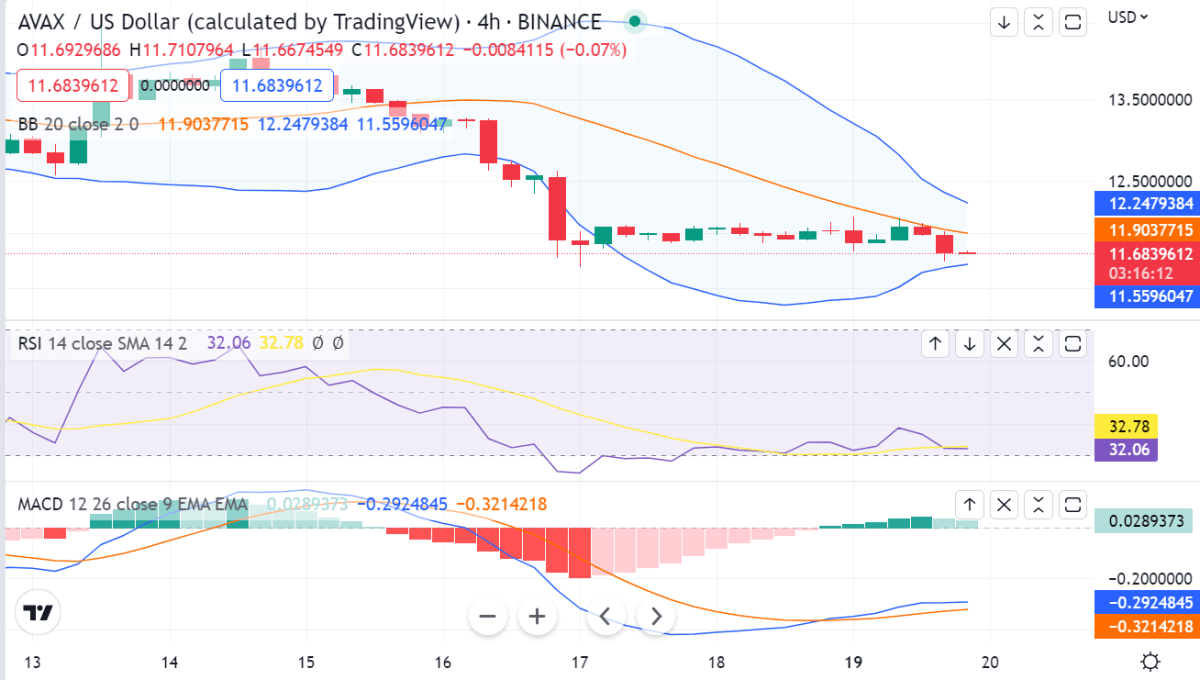

Avalanche worth evaluation on a 4-hour chart: AVAX caught in a bearish channel

On the 4-hour chart, Avalanche worth evaluation signifies AVAX has been dormant in a bearish channel because the opening of the chart. The present help degree is positioned at $11.30 under which costs may slide additional in the direction of $10.90 after which $10.50 as the following goal ranges.

The oscillators are additionally indicating bearish indicators, with the RSI under 40 and MACD declining sharply. This implies that regardless of the current restoration seen in many of the main digital property, AVAX will stay weak except there’s a main surge in shopping for stress.

Avalanche worth evaluation conclusion

In conclusion, Avalanche worth evaluation exhibits AVAX continues to commerce decrease inside a descending channel because the bearish sentiment within the cryptocurrency market persists. Technical indicators, together with the RSI and MACD, are reflecting a bearish pattern and hinting at additional losses in AVAX/USD pair. The speedy help degree is positioned at $11.30 whereas resistance is round $12.50.

[ad_2]