[ad_1]

Argentina’s economic system is between a tough place and a rock. In accordance with studies, Argentina launched its largest-denomination banknote on Monday. In accordance with the out there information, inflation is operating at greater than 100% per yr, forcing the populace to hold ever-increasing quantities of money to pay for day by day bills.

Argentina registers the worst inflation case in historical past

At present, the inflation price within the South American nation is 109 p.c. This is without doubt one of the world’s highest factors. A survey performed by a central financial institution predicts that by the top of this yr, inflation will attain practically 130%. The rates of interest have been dramatically elevated to 97%.

In April, shopper costs elevated on the quickest price since 1991, when Argentina emerged from hyperinflation. The economic system is anticipated to enter a recession earlier than the presidential election later this yr resulting from accelerating worth will increase and a file drought.

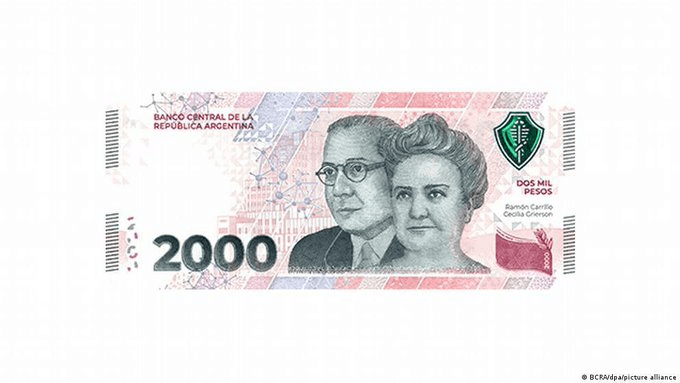

Meet Argentina’s 2,000 Peso banknote

The most important denomination banknote in Argentina, the two,000 peso invoice, went into circulation on Monday (Might 22). Nonetheless, because of the swift depreciation of the nationwide foreign money, two thousand pesos are actually solely value $8.50 on the official trade price. In parallel markets, the value is barely greater than $4.

Compared to the US greenback, the peso has misplaced roughly 1 / 4 of its worth this yr alone. This occurred regardless of the capital controls designed to halt its decline. Nearly all of Argentinians buy {dollars} on the black market. In these markets, the trade price for the greenback is 480 pesos, in comparison with the official price of 235.

Whereas the brand new denomination is an enchancment over the 1,000 peso word, which was beforehand probably the most beneficial foreign money in circulation, personal economists and residents who demanded banknotes of as much as 10,000 pesos have been upset. The foreign money’s fast depreciation has triggered logistical difficulties for patrons, companies, and banks, which have needed to open new vault area to accommodate extra banknotes for ATMs.

Roughly half of all business transactions in Argentina are nonetheless carried out in money. The brand new 2000 peso word is anticipated to alleviate a number of the issues which have led to banks operating out of vault area and locals and vacationers carrying giant quantities of money to pay for items.

The central financial institution stated in a Monday assertion that the upper denomination invoice would enhance the operation of ATMs and optimize the circulation of money. In accordance with the central financial institution, the brand new 2,000 peso banknote incorporates a design commemorating the event of science and drugs in Argentina.

Can crypto assist Argentina combat inflation?

Right here is an fascinating but unhappy story of two international locations in Latin America; El Salvador and Argentina. Two years again – 2021- El Salvador selected Bitcoin whereas Argentina pled its financial standing to the IMF. In March 2022, The Argentine Senate accredited a $45 billion bailout cope with the IMF to avert an imminent default on the nation’s money owed.

Nonetheless, the settlement contained a peculiar provision. Argentina needed to undertake a agency stance towards cryptocurrencies. The settlement outlined Argentina’s efforts to discourage using crypto to forestall cash laundering, informality, and disintermediation to be able to additional shield monetary stability.

Two years later, right this moment, El Salvador’s inflation stands at 7.2%, with a presidential approval of 90%. Then again, Argentina’s inflation sits at 109%, with presidential disapproval of 75%.

Regardless of the introduction of the 2000-peso word by the central financial institution, circumstances for peculiar Argentinians stay tough. Lots of them are exchanging their pesos for US {dollars} as a result of they view the US greenback as their solely safety towards inflation.

Nonetheless, Argentina has imposed restrictions on international foreign money purchases. This has stimulated the casual international trade market. As well as, the drought has exacerbated financial points. It has had a unfavorable influence on the agricultural sector. The sector is indispensable to the nation’s means to acquire international foreign money.

In accordance with the central financial institution, Argentina has misplaced greater than $5.5 billion in worldwide reserves for the reason that starting of the yr, bringing the entire to $33.5 billion. Can crypto assist Argentine residents out of their monetary hurdles? In all probability sure. However the authorities stands towards it.

[ad_2]