[ad_1]

After a bear market decline of almost -50%, the Semiconductor ETF (SMH) has rallied over +60% out of the October low. The long-term image nonetheless seems to be promising with the weekly PMO rising steeply above the zero line. However let’s look in a shorter-term timeframe to see if there any extra fast issues.

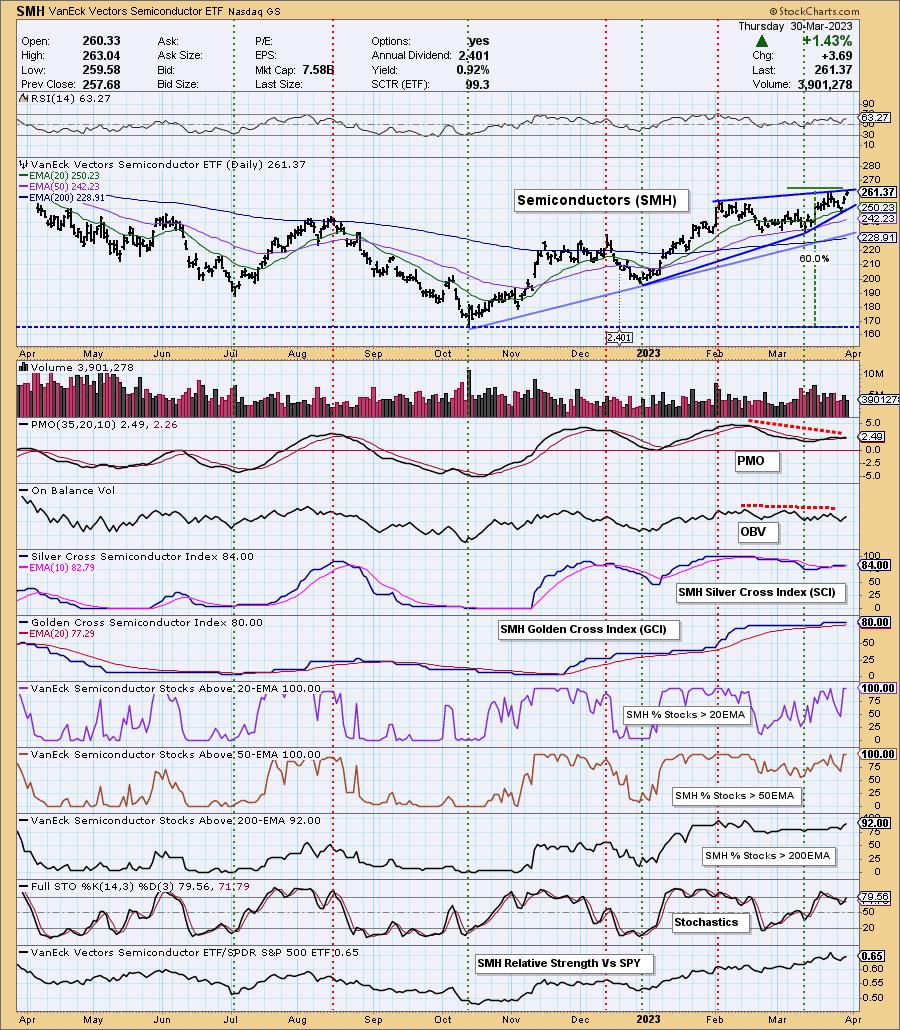

This one-year day by day chart helps us look extra intently on the present technical situations.

(1) To start, value is hitting the highest of a bearish rising wedge sample.

(2) The rising pattern traces from the October low have develop into extra accelerated, making the advance parabolic and topic to a pointy correction.

(3) The PMO and OBV have bearish damaging divergences — they’re falling whereas value is making new 50-week highs.

(4) The Silver Cross Index exhibits that 84% of part SMH shares have the 20EMA above the 50EMA, which could be very bullish.

(5) The Golden Cross Index exhibits that 80% of SMH part shares have the 50EMA above the 200EMA, once more, very bullish.

(6) The % of Shares Above the 20EMA and 50EMA is at 100%. That is pretty much as good because it will get, and presents vulnerability to a pullback.

Conclusion: SMH has a parabolic advance, in addition to some damaging divergences. Participation is superb, however it’s pretty much as good because it will get, which generally leads to participation abating considerably. In my view, SMH is organising for a correction, however this doesn’t rule out a last upside blow-off to cap the parabolic transfer. Now isn’t an excellent time to open new positions, quite it’s a good time to tighten stops.

Watch the most recent episode of DecisionPoint on StockCharts TV’s YouTube channel right here!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Useful DecisionPoint Hyperlinks:

DecisionPoint Alert Chart Checklist

DecisionPoint Golden Cross/Silver Cross Index Chart Checklist

DecisionPoint Sector Chart Checklist

Worth Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

DecisionPoint isn’t a registered funding advisor. Funding and buying and selling selections are solely your accountability. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Carl Swenlin is a veteran technical analyst who has been actively engaged in market evaluation since 1981. A pioneer within the creation of on-line technical assets, he was president and founding father of DecisionPoint.com, one of many premier market timing and technical evaluation web sites on the net. DecisionPoint makes a speciality of inventory market indicators and charting. Since DecisionPoint merged with StockCharts.com in 2013, Carl has served a consulting technical analyst and weblog contributor.

Study Extra

Subscribe to DecisionPoint to be notified at any time when a brand new publish is added to this weblog!

[ad_2]