[ad_1]

There are occasions when technical benefit alone can justify the case for a commerce.

The explanation for that is that many merchants typically stick to a well-recognized listing or class of shares, and for apparent causes: to keep away from buying and selling a inventory that you understand little or no about or to test the basic foundation for every commerce. However there are literally thousands of shares, and sticking to acquainted territory can typically restrict your alternatives. You might wish to commerce shares you are accustomed to, or you could desire buying and selling “patterns” that you just’re accustomed to.

If this matches your fashion, then technical analysis-based scans is perhaps your factor.

Here is one instance: the bullish engulfing candlestick formation.

Scanning for Bullish Engulfing Patterns

Fast word right here (based mostly on Thomas Bulkowski’s candlestick evaluation in his guide Encyclopedia of Candlestick Charts).

So, the bullish engulfing candlestick appears fairly good at first. In spite of everything, it has a 63% reversal fee, which implies the worth goes above the sample’s high about 63% of the time.

However there is a catch: The outcomes after a breakout generally is a little bit of a letdown relying on the context. So, you could have to take a more in-depth look. A extra thorough examination reveals that this sample does higher when the worth goes down. In different phrases, it really works finest in a downtrend or a bear market, in keeping with historic efficiency stats (based mostly on Bulkowski’s research).

Let’s contemplate a scan that appears for engulfing patterns in a downtrend.

1. Hearth-Up the Scan Library

From Your Dashboard, beneath Member Instruments, scroll all the way down to Pattern Scan Library. It’s also possible to entry the scan library from the Charts & Instruments tab. This performance was added in the newest launch and is out there to all StockCharts members.

CHART 1: SAMPLE SCAN LIBRARY. This may be accessed from Your Dashboard or the Charts & Instruments tab.Chart supply: StockCharts.com. For illustrative functions solely.

Right here, you will have entry to numerous scan protocols overlaying a variety of technical standards.

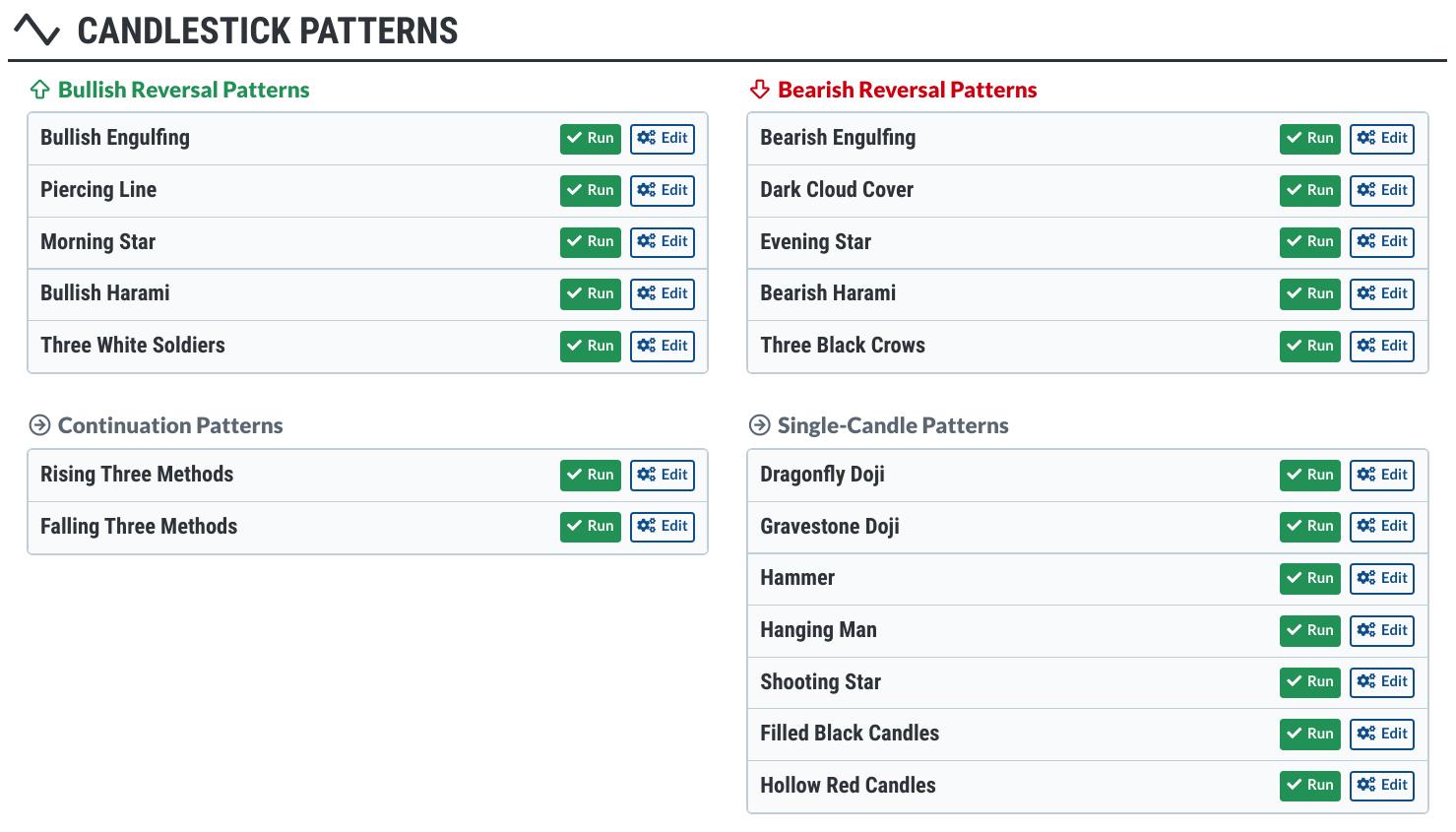

2. Seek for and Run the Bullish Engulfing Scan

This sample is likely one of the built-in fashions on the web page, and it may be discovered within the candlestick patterns part.

CHART 2: CANDLESTICK PATTERNS SECTION OF THE SCAN LIBRARY. There are a number of candlestick patterns to select from.Chart supply: StockCharts.com. For illustrative functions solely.

3. Set up the Outcomes

Each dealer has their very own preferences relating to buying and selling quantity, sector, or every other elementary and technical standards. For the sake of instance, let’s rank the scan outcomes in keeping with StockCharts Technical Rank (STCR) rating. In spite of everything, you are in search of favorable “technical” outcomes, proper?

However there is a caveat with this sample: since bullish engulfing patterns work finest for downtrending shares, the SCTR scores will doubtless be low, contemplating its “potential” restoration from a downtrend.

Once you run the scan, you will get an inventory of a number of shares. For the sake of demonstration, let’s zero-in on a number of shares within the final. The lesson right here is that, irrespective of the sample or technical rating, context is all the time king.

4. Analyze the Context

Word: None of those inventory examples are supposed to be “tradable” examples. They’re meant for academic functions solely and aimed toward demonstrating the StockCharts scan engine, and never essentially the shares.

Primarily based on the Bullish Engulfing stats talked about earlier on this article, there are particular eventualities you wish to keep away from. For the favorable eventualities, you continue to have lots of set-up homework to do.

Hypothetical Scan Instance 1

CHART 3: DOING A DEEPER DIVE INTO THE SCAN RESULTS. Including indicators such because the MACD and Chaikin Cash Circulate can assist verify whether or not a development reversal is probably going.Chart supply: StockCharts.com. For illustrative functions solely.

Possibly not the most effective prospect for a swing commerce. Nonetheless, it is a sketchy commerce prospect.

Hypothetical Scan Instance 2

CHART 4: ANOTHER EXAMPLE OF ANALYZING SCAN CANDIDATES. This candidate might current a extra favorable prospect.

This provides you a distinct image.

- The Chaikin Cash Circulate appears to be like prefer it’s about to tip again over the zero line, having descended from constructive territory.

- The MACD is above the baseline and hints at turning up as nicely.

- The 50-day easy transferring common (SMA) is buying and selling above the 200-day SMA and is rising.

- Worth discovered assist on the Ichimoku cloud (Ok=aka, “kumo”).

- Though the present value motion appears to be reversing the day past’s bullish engulfing sample, the cloud’s place as assist retains the commerce comparatively “legitimate.”

In comparison with the primary instance, this may appear like a extra favorable prospect.

And Here is the Lesson…

Operating a technical scan will current you with a number of buying and selling alternatives. Though it could take some scouring to discover a extra favorable or ultimate buying and selling setup, utilizing the scan will prevent lots of time.

Context is king, and a single technical chart sample can take the type of quite a few buying and selling eventualities. It goes with out saying that pattern-scanning know-how is not a panacea however extra like a “analysis assistant” — you should utilize it to your benefit, or abuse it to your drawback.

The Backside Line

Keep in mind that technical patterns can change based mostly on the context, however should you’re open to exploring technically-based buying and selling alternatives, instruments like StockCharts’ scan library can assist you discover them. Operating a technical scan can shortly reveal quite a few probably tradable eventualities. Though it would take a little bit of effort to pinpoint the right setup, utilizing scans can prevent time and even assist you to uncover a number of alternatives that you just might need missed with out the fitting instruments.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Karl Montevirgen is an expert freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in crucial research/writing and music composition from the California Institute of the Arts.

Be taught Extra

Subscribe to ChartWatchers to be notified at any time when a brand new publish is added to this weblog!

[ad_2]