[ad_1]

Fast Take

Commonplace Chartered Financial institution’s latest report, dated Jan 8. 2024, offers an analytical perspective on a potential surge in Bitcoin’s value, contingent on the projected approval of spot ETFs by the US Securities and Change Fee (SEC).

The report attracts a major comparability with historic gold value escalations following the approval of gold ETFs, indicating the potential for an accelerated value improve for Bitcoin, given the anticipated speedy maturation of the Bitcoin ETF market.

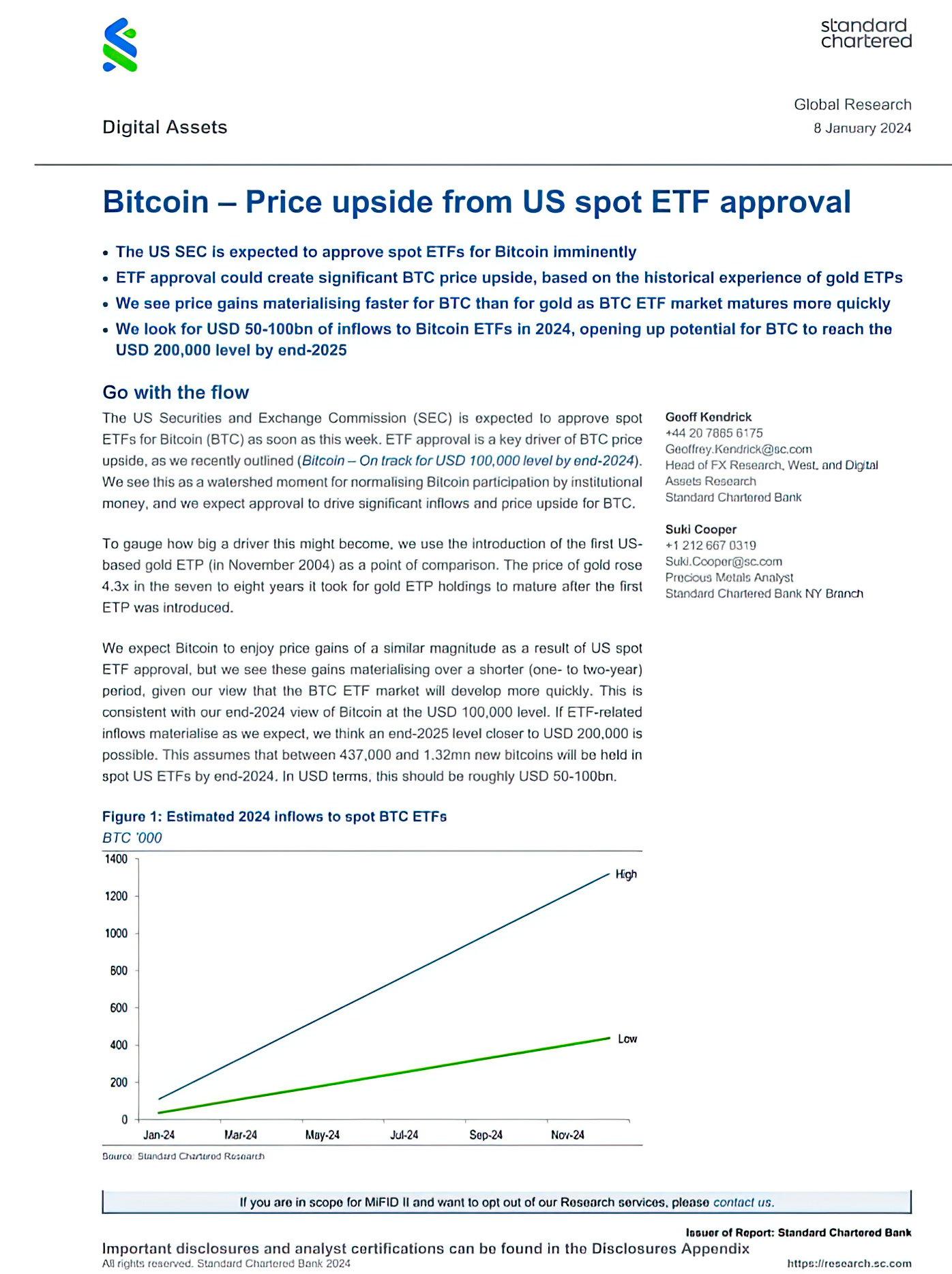

The evaluation contends that Bitcoin ETFs may see inflows starting from $50 to $100 billion by 2024. This inflow is deemed a pivotal issue propelling Bitcoin’s value, presumably driving it to a staggering $200,000 by the top of 2025.

The report tasks that between 437,000 and 1.32 million new bitcoins might be integrated into spot US ETFs by 2024’s finish, equating to roughly $50 to $100 billion of whole inflows. This projection fortifies a bullish stance for Bitcoin’s value trajectory, contingent on the approval and subsequent inflows into the spot ETFs.

The submit Commonplace Chartered: Attainable $200k BTC by 2025 hinges on spot Bitcoin ETF approval appeared first on CryptoSlate.

[ad_2]