[ad_1]

Analyzing the value of cryptocurrencies on Coinbase, particularly in contrast with different world exchanges, is important for understanding its influence on world market developments. Though the U.S. market could not all the time lead by way of buying and selling quantity or liquidity, the pricing on Coinbase usually units a pattern that resonates throughout the worldwide cryptocurrency market, underscoring the significance of monitoring and analyzing its value actions.

Coinbase’s predominantly retail investor base makes it a really helpful gauge of retail sentiment within the U.S. Being a regulated trade within the U.S., Coinbase’s pricing can be considerably influenced by regulatory developments, which is why value volatility on the trade could be a proxy for political or regulatory occasions within the nation.

The time period ‘premium’ refers back to the value distinction of an asset throughout completely different markets or exchanges. For cryptocurrencies, a premium on Coinbase implies that the value of a cryptocurrency, on this case Bitcoin, is increased on Coinbase in comparison with one other trade akin to Binance. This premium or premium hole is quantified by subtracting the value of Bitcoin on one other trade from the value on Coinbase. A extra comparative method entails calculating the share distinction or the premium index, which offers a clearer view of the premium in relation to the market.

The actions of the premium are important in understanding market situations. An growing premium on Coinbase can recommend a surge in shopping for exercise on the platform, probably as a result of an inflow of retail buyers, or it might be indicative of decrease liquidity on Coinbase in comparison with different exchanges. Geographic elements, akin to regulatory information or fiat forex fluctuations affecting Coinbase’s predominantly U.S. consumer base, may also contribute to an elevated premium. Conversely, a reducing premium could signify a rise in promote orders on Coinbase, probably by retail buyers, or an enchancment in liquidity or aggressive pricing from different exchanges. It may additionally point out market arbitrage, the place merchants purchase on different exchanges and promote on Coinbase, thus narrowing the value hole.

Analyzing these premium actions will help gauge market sentiment and habits. For instance, a constant premium may recommend sturdy retail confidence amongst Coinbase customers, whereas a diminishing premium would possibly mirror a bearish sentiment or a shift towards promoting. These actions are sometimes interpreted as main indicators of market developments and arbitrage alternatives.

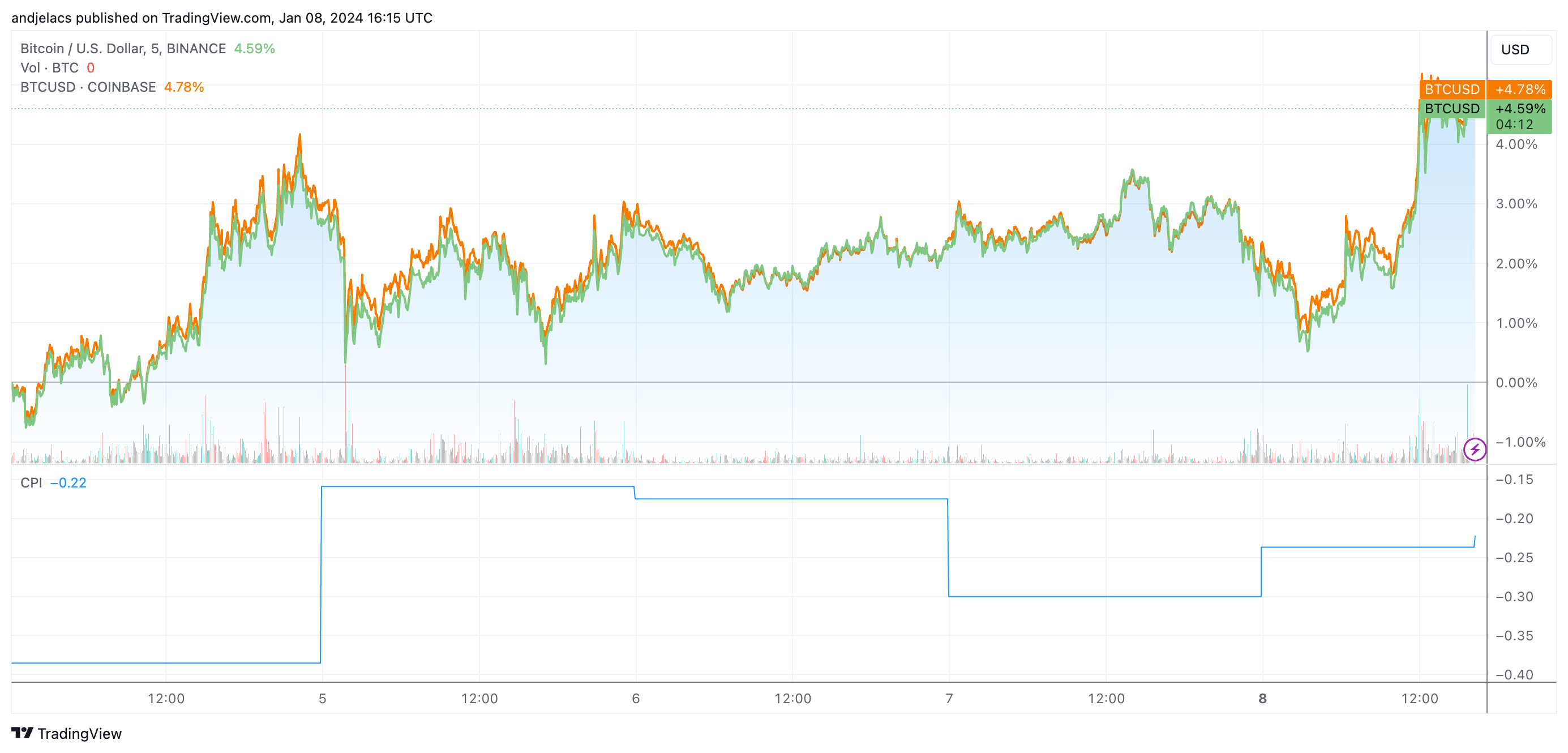

Analyzing Bitcoin’s value motion on Coinbase and Binance exhibits that BTC/USD posted a 5-day improve of 4.78% on Coinbase and 4.59% on Binance on Jan. 8. The marginally increased improve on Coinbase in comparison with Binance suggests a barely stronger shopping for stress coming from Coinbase customers. This distinction, although refined, may point out heightened expectations amongst U.S. buyers (Coinbase’s main consumer base) concerning the potential approval of the spot Bitcoin ETF this week.

The Coinbase premium has been adverse all through the final quarter and has remained adverse into 2024 as properly. The adverse premium values point out that Bitcoin is buying and selling at a barely lower cost on Coinbase in comparison with Binance. That is uncommon given the overall expectation of a optimistic premium on U.S.-based exchanges as a result of regulatory compliance and investor profile. Nonetheless, a more in-depth take a look at the premium pattern exhibits a notable lower, with the premium shifting from -0.37 to -0.22 over a day and a half. This means the value hole between the exchanges is closing, most definitely as a result of a rising shopping for curiosity on Coibase or lowered promoting stress in comparison with Binance.

The general improve within the value of Bitcoin on each exchanges is probably going reflecting market optimism and speculative curiosity, notably as a result of SEC’s upcoming determination on the spot Bitcoin ETF. A optimistic determination is probably going perceived as a legitimizing issue for Bitcoin, because the market expects it to extend institutional participation.

The gradual lower within the adverse premium means that Coinbase’s costs are slowly aligning extra carefully with Binance’s. This might imply that U.S. buyers are cautiously optimistic, shopping for extra Bitcoin in anticipation however not as aggressively as worldwide markets (probably as a result of regulatory issues). It may additionally imply that there’s a discount in promoting stress on Coinbase, probably as a result of holders ready for the end result of the SEC determination.

If the ETF will get authorised, there may be a sudden shift on this pattern, probably triggering a surge in shopping for on Coinbase and resulting in a optimistic premium. Conversely, a rejection may widen the adverse premium as a result of a possible sell-off by disillusioned buyers.

The publish The Coinbase premium is growing forward of the ETF appeared first on CryptoSlate.

[ad_2]