[ad_1]

One crypto analyst believes Bitcoin (BTC) nonetheless has extra room to run to the upside regardless of its already spectacular rallies this month.

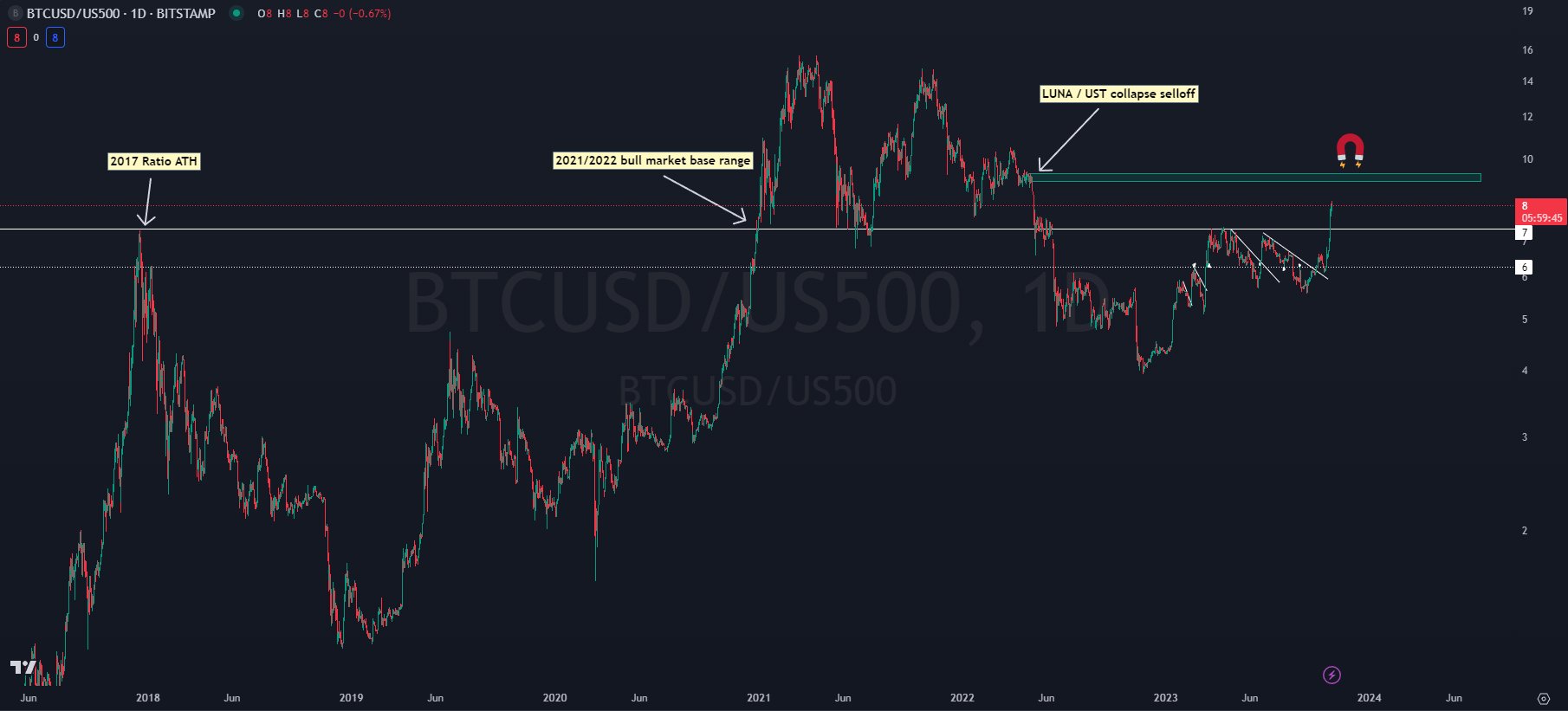

Pseudonymous crypto analyst Kaleo says Bitcoin’s relative efficiency in opposition to the S&P 500 Index (SPX) is a part of a rising stack of proof that BTC has decoupled from the inventory market.

In response to the analyst, BTC has extra gasoline within the tank for an extra transfer to the upside.

Kaleo says that based mostly on BTC’s historic efficiency in opposition to SPX, a transfer to the subsequent primary resistance provide space of $40,000 is now a possible situation.

“Over the course of the previous month, we’ve lastly seen ‘the bullish decoupling’ for BTC from equities that everybody was ready for.

Whereas BTC is up solely 36% vs USD from the September lows, BTC is up 48% vs. SPX.

This chart is likely one of the causes I nonetheless suppose there’s loads of gas left within the tank for a transfer greater to $40,000. The stable white line that marks the 2017 ratio ATH [all-time high] has been a major pivot degree for BTC worth motion the previous a number of years.

It served as stable baseline assist for the 2021/2022 bull market, and when it was lastly damaged, served because the pivot level for the actual momentum shift into the liquidation cascade to the lows we skilled within the second half of 2022 into the early a part of this yr.

Now that we’ve cleared that degree, we’ve acquired clear skies with none main resistance ranges till the extent the place BTC offered off because of the LUNA/UST crash, which correlates to a BTC worth of ~$40,000.”

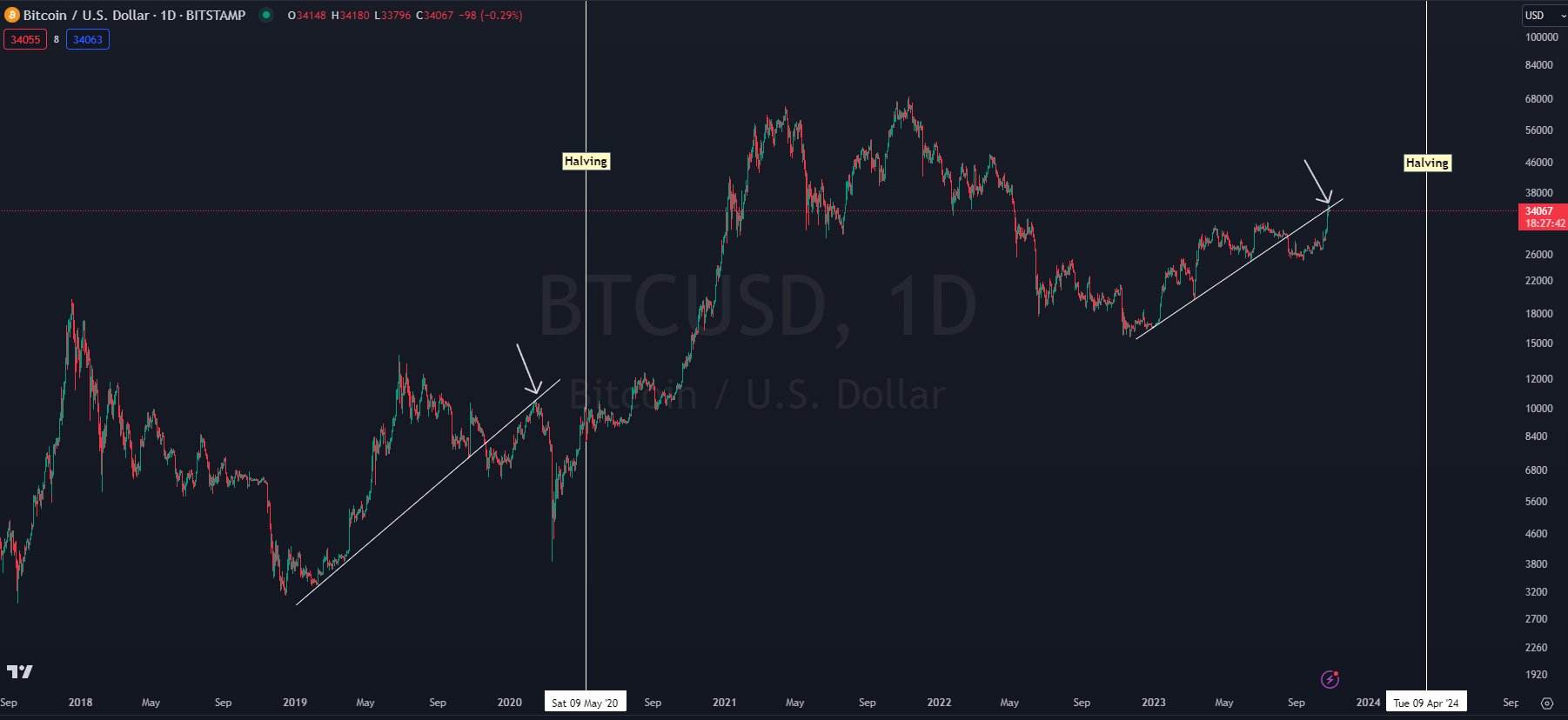

Whereas at the moment a Bitcoin bull, Kaleo says to play satan’s advocate, there’s a bearish situation that he thinks is price being ready for. He says {that a} March 2020-style crash to the draw back that liquidates leveraged merchants remains to be a really actual chance.

In response to the analyst, a time horizon that focuses on a 2024-2025 market high is a safer wager than making an attempt to commerce the shorter-term strikes.

“Though I lean bullish proper now, I’ve infinitely extra confidence in an extended time horizon than I do in a short-term continuation. In order enjoyable as this run is, and as a lot as I hope it continues, I’m ready for the chance that it doesn’t. How? I’m simply stacking the spot.

If we get a nuke like we did in 2020, guess what – I’ll stack extra! I refuse to even give the market the slightest alternative to make me repeat my similar mistake twice. And I’ve a excessive degree of confidence a yr from now – whether or not I purchase right here, $20,000, or $40,000 – they’ll all be stable buys.

2024 / 2025 are gonna be lit. Don’t get shaken out earlier than the enjoyable begins.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: DALLE-3

[ad_2]