[ad_1]

Ethereum worth was within the crimson on Friday, shedding among the beneficial properties made up to now week. On the time of writing, Ethereum was buying and selling 2.24% decrease at $1,763.05. The lead altcoin has added greater than 12% up to now week and 47.40% within the 12 months to this point. Its complete market cap stays 1.60% larger for the day at $212 billion.

Fundamentals

Ethereum worth has recorded vital beneficial properties over the previous week on the again of constructive market sentiment and Bitcoin’s temporary interplay with the essential stage of $35,000. The crypto market has been bullish over the previous week amid BlackRock’s EFT buzz and a rise in danger urge for food. The Crypto Concern and Greed Index, which measures the important thing feelings driving the crypto market, is at a Greed stage of 71, suggesting a rise in shopping for strain.

The crypto market has been on a bullish rally up to now week as BlackRock’s carefully watched spot bitcoin EFT appeared on an inventory maintained by a Nasdaq-operated clearing home for EFTs, the Depository Belief and Clearing Company. The transfer by the DTCC raised hopes that the US Securities and Change Fee (SEC) will approve the buying and selling of the extremely anticipated bitcoin EFT. BlackRock’s EFT software filed earlier in June remains to be pending approval from the SEC.

Bitcoin, the biggest cryptocurrency by market cap, briefly topped $35,000, its highest stage since Could 2022, on the again of BlackRock’s EFT itemizing. BTC’s soar to this stage pushed crypto costs of most altcoins, together with Ethereum, Solana, Cardano, and Dogecoin, larger.

Even so, macroeconomic headwinds have continued to weigh on cryptocurrency costs. The US greenback rose to a close to 1-week excessive on Friday towards a number of main currencies as traders’ urge for food for danger property pale following a collection of lackluster company outcomes that raised worries in regards to the financial outlook.

Moreover, traders have been digesting the newest private consumption expenditures knowledge for September. Core PCE, the Fed’s favourite inflation gauge, inched 0.3% larger in September and three.7% 12 months on 12 months, according to analysts’ estimates. Whereas markets are extensively anticipating a pause in rates of interest in November, traders are carefully waiting for hints from the US Federal Reserve in regards to the financial coverage path.

Ethereum Value Outlook

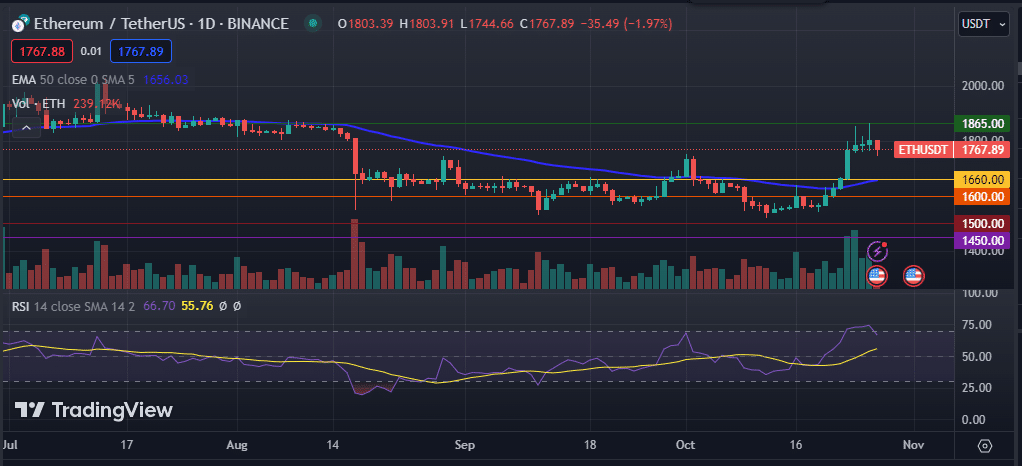

The day by day chart hints at exhaustion in Ethereum ‘s worth latest rally previous $1,800. The altcoin briefly jumped to $1,865 earlier within the week, its highest stage since August. Ethereum stays above the 50-day and 200-day exponential transferring averages. Its Relative Energy Index, in addition to the Transferring Common Convergence Divergence Indicator, sign a bullish outlook.

As such, the Ethereum worth is prone to proceed buying and selling above the $1,700 stage within the ensuing periods because it struggles to recuperate above the essential resistance stage of $1,800. A breach above this stage would possibly result in subsequent beneficial properties in direction of $1,865 and $1,900. Nevertheless, a drop beneath $1,700 will push the worth decrease to the quick assist on the 50-day EMA, invalidating the bullish thesis.

[ad_2]