[ad_1]

A outstanding analytics agency is revealing that over a million Ethereum (ETH) has been taken out of the staking contract after the good contract platform’s current improve.

IntoTheBlock finds that 1.37 million ETH value over $2.56 billion at time of writing has been unstaked and withdrawn following the Shapella replace.

The Shapella improve, which permits Ethereum stakers to withdraw their staked tokens for the primary time, is a portmanteau of “Shanghai” and “Capella,” two totally different updates that went dwell concurrently. Whereas Shanghai bolstered the protocol’s execution layer, Capella made modifications to its consensus layer.

The main analytics agency additionally says that 650,000 ETH value $1.21 billion has been deposited into the staking contract after Shapella, leading to web withdrawals of 720,000 ETH value $1.34 billion.

Withdrawals from Ethereum’s Shapella improve staking contract have begun this week. 1.37M ETH has already been withdrawn and 650k ETH deposited, leading to web withdrawals of 720k ETH. #Ethereum

— IntoTheBlock (@intotheblock) April 22, 2023

The analytics agency goes on to say that Ethereum’s staking contract is witnessing a surge of ETH deposits from institutional staking suppliers and centralized crypto exchanges after Shapella went dwell.

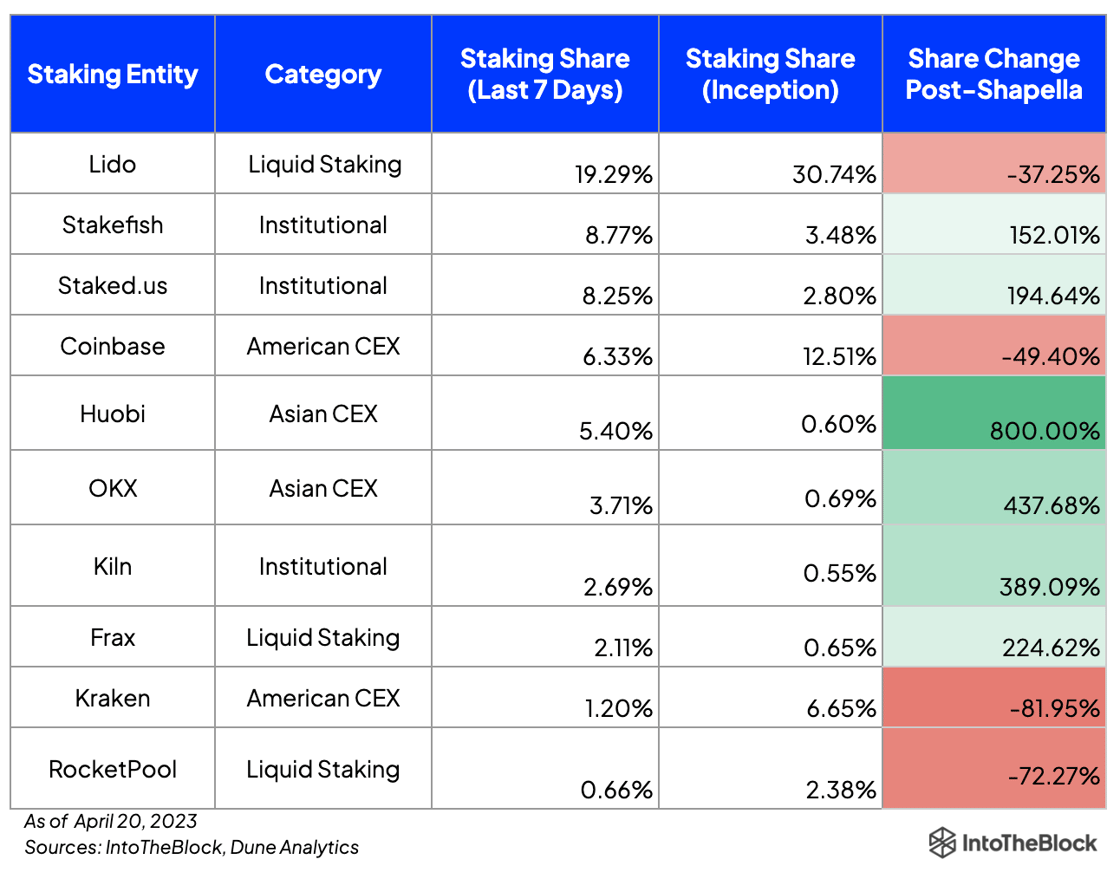

Based on IntoTheBlock, Hong Kong-based crypto alternate Huobi now accounts for five.40% of all staked ETH, an eye-popping 800% improve from 0.60% previous to the improve.

Crypto alternate OKX additionally supersized its staking share from 0.69% earlier than Shapella to three.71%, a rise of over 437%. Staked.us, a staking platform catering to institutional crypto buyers, witnessed its share rise by practically 200% from 2.80% earlier than the replace to eight.25%.

In the meantime, US-based crypto alternate Coinbase noticed its staking share fall by practically 50% after Shapella from 12.51% to six.33%.

Says IntoTheBlock,

“Following the Ethereum Shapella improve, the share of deposits by staking suppliers has modified considerably. Most notably, we see an surprising staking share improve for institutional staking suppliers and Asian centralized exchanges.”

At time of writing, Ethereum is buying and selling for $1,866.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney

[ad_2]