Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will talk about growing crypto-linked funding merchandise in a bear market, the temper amongst her purchasers and her lon…

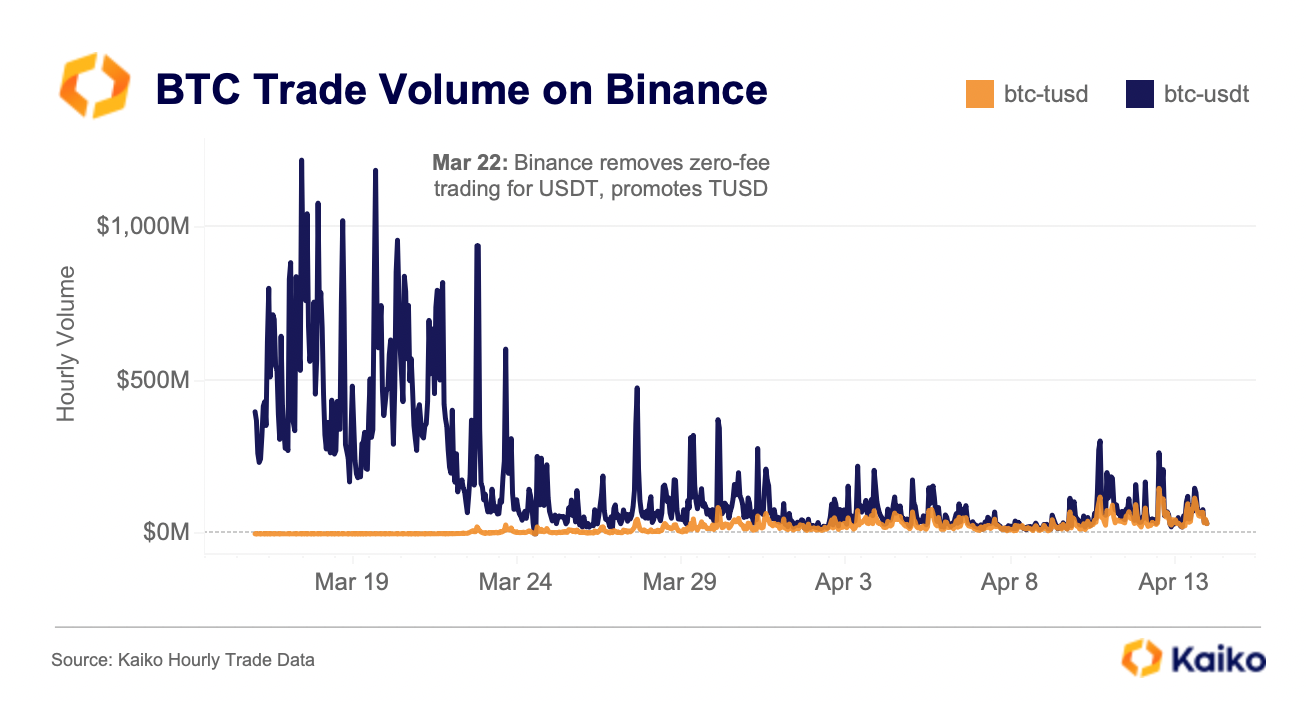

The TrueUSD (TUSD) stablecoin’s market share in bitcoin (BTC) buying and selling quantity on Binance is catching as much as Tether’s USDT following the trade’s zero charge buying and selling low cost, however information exhibits merchants are nonetheless reluctant to make use of TUSD, in keeping with crypto information agency Kaiko.

Between Binance’s BTC-TUSD and BTC-USDT buying and selling pairs, TUSD’s market share rose to 49%, nearly equalling Tether’s.

“This can be a large improve over just some weeks,” Clara Medalie, head of analysis at Kaiko, stated.

Nevertheless, TUSD’s development couldn’t offset the speedy decline within the BTC-USDT pair’s buying and selling quantity after Binance waived its zero charge low cost for Tether, in keeping with Kaiko information. Furthermore, bigger purchase and promote orders are nonetheless positioned for the USDT pair, per Kaiko.“This means that merchants are nonetheless reluctant to make use of TUSD regardless of zero charges,” Medalie added.

(Kaiko)

TUSD’s rise has come as Binance, the world’s largest crypto trade by buying and selling quantity, picked the token as inheritor of its most popular Binance USD (BUSD) stablecoin issued by Paxos Belief.

The trade restored buying and selling with TUSD after a six-month pause after Paxos’ determination to cease issuing BUSD and assigned its zero-fee buying and selling low cost to the BTC-TUSD pair and waived the promotion from BUSD and USDT beginning on March 22.

The $132 billion stablecoin market is present process a significant upheaval stemming from a regulatory crackdown and a banking disaster within the U.S. In February, the New York Division of Monetary Providers (NYFDS), the state’s high monetary regulator, compelled Paxos to stop minting BUSD, the third largest stablecoin with a $16 billion market cap. Final month, the collapse of crypto-friendly Silicon Valley Financial institution, reserve companion of the second largest stablecoin USDC, despatched shockwaves via the market. Within the aftermath, USDC suffered greater than $10 billion in outflows.

Tether’s USDT and TUSD have emerged as clear winners of the disaster. TUSD has turn out to be the crypto market’s fifth largest stablecoin with a $2 billion market cap. USDT’s circulating provide has grown $10 billion up to now months and is closing in on its all-time excessive.

Stablecoins are a vital aspect within the crypto ecosystem, facilitating buying and selling on exchanges and serving as a bridge between government-issued fiat cash and digital belongings.

TUSD is a dollar-pegged stablecoin issued by crypto agency ArchBlock, beforehand often known as TrustToken. Its worth is totally backed by fiat belongings, in keeping with blockchain information supplier ChainLink’s proof-of-reserve monitoring instrument. In 2020, a little-known Asian conglomerate Techteryx acquired TUSD’s mental property rights, TrustToken stated on the time.