The Commodities Futures Buying and selling Fee (CFTC) submitting in opposition to Binance represented the end result of elevated regulatory strain on the crypto trade.

On March 27, the CFTC sued the corporate, its CEO Changpeng Zhao (CZ), and its compliance lead Samuel Lim for violating commodities rules within the U.S. The market reacted switftly to the submitting, with Bitcoin dropping 5% and sinking to a 10-day low of $26,500.

Within the quick aftermath of the submitting, there was tangible concern of contagion. With Paxos confronted with a Wells discover for its issuance of BUSD, the trade was already on skinny ice with regulators. A bombshell report from FT additional pressured the trade, alleging it lied about its ties to China.

The fears a few broader market downturn have been largely unfounded. Bitcoin cracked $28,000 the day after the submitting, regaining its losses from the day prior to this and creating stable assist.

Nonetheless, rising outflows from Binance apprehensive analysts as many noticed it as an indication of the trade shedding its footing in the marketplace.

A current report from Glassnode dove deep into web coin flows by the trade, discovering that Binance noticed the most important web outflow of stablecoins in historical past on the finish of March.

That is in keeping with the general decline within the USD worth of Binance’s reserves, which decreased by 45% for the reason that collapse of FTX in November 2022.

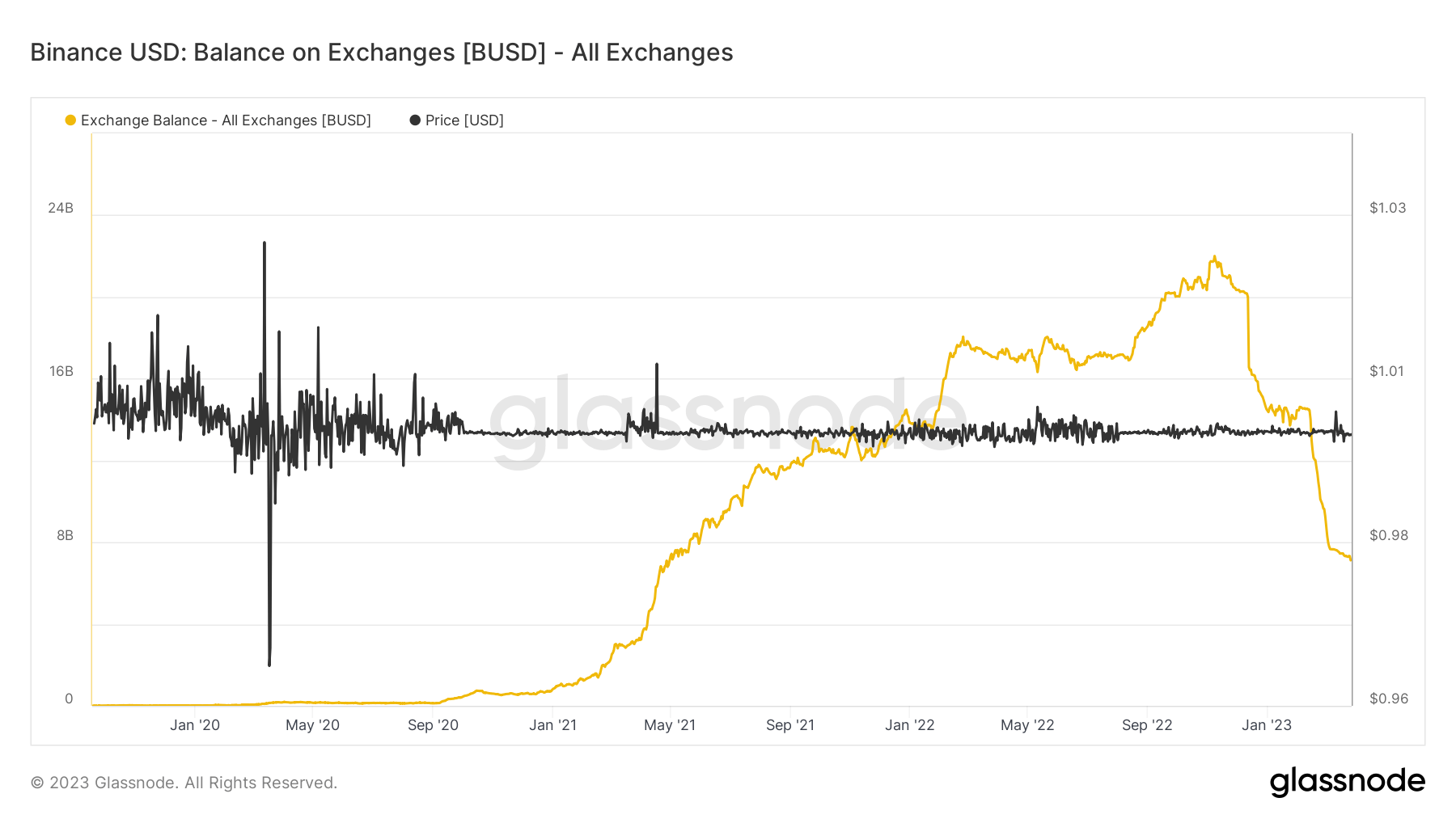

The report additionally notes there was a big outflow of BUSD from Binance. That is in keeping with CryptoSlate’s earlier evaluation, which discovered that roughly $14 billion price of BUSD left exchanges since November 2022.

BUSD outflows brought on the Bitcoin buying and selling quantity on Binance to drop 13%, reaching its lowest stage in over 8 months.

Additional Glassnode analysis discovered that the lower in stablecoin balances hasn’t affected Bitcoin. Analyzing the coin-denominated balances of BTC exhibits that Bitcoin reserves on Binance elevated by 67,930 BTC for the reason that starting of the yr. Then again, ETH reserves on the trade have remained principally flat.

“Regardless of the growing friction between Binance and regulators, the platform seems to be primarily experiencing a stablecoin shuffle, and stays the most important centralized trade out there,” the report concluded.

The large stablecoin outflows are a direct results of the continued banking disaster within the U.S. The domino impact that started with the collapse of Silicon Valley Financial institution erased a superb chunk of investor confidence in stablecoins. Originally of March, 9 out of the highest 10 stablecoins by market cap traded under their peg, revealing the fragility of the asset class that led merchants to hunt stability in Bitcoin.

Regardless of its reducing stablecoin balances, Binance nonetheless stays the most important centralized trade in the marketplace. A rising BTC steadiness on the trade additional confirms this development, exhibiting buyers choose its highly-liquid marketplace for deploying the newly acquired BTC.