[ad_1]

EUR/USD: Market, Are You Loopy?

● All through the primary half of the week, EUR/USD moved sideways alongside the 0.9700 horizon as markets waited for the discharge of US inflation information. And it was on Thursday, October 14 that the Division of Labor Statistics of the nation revealed recent values of the Client Worth Index (CPI), which exceeded the forecast values. In month-to-month phrases, the September CPI reached 0.6% in opposition to the forecast of 0.5%, in annual phrases – 6.6% in opposition to the forecast of 6.5% and the earlier worth of 6.3%.

The primary response of the markets was fairly anticipated. The DXY greenback index soared to 113.94 factors (the best worth since September 28, when a 20-year excessive of 114.79 factors was reached), the yield of 10-year treasuries up to date a 14-year excessive, reaching 4.08%, and EUR/USD reached the extent 0.9630. Dangerous asset quotes related to the greenback by reverse correlation went down. The S&P500 index fell by 2.4% and up to date its 2-year low. Dow Jones, Nasdaq and crypto property behaved in an identical means.

However one thing extraordinary occurred in lower than one hour: all of the markets, as if going loopy, turned 180 levels swiftly. Furthermore, for no obvious purpose.

● The greenback started to lose its positions quickly: DXY fell to 112.46, and EUR/USD broke via 0.9800. Quite the opposite, the S&P500 was constructive by the tip of Thursday and grew by 2.6%. Analysts cite the robust oversold inventory market as the principle purpose for this modification in sentiment and the sharp improve in threat appetites. It’s believed that shares lose about 30% throughout recessions. At this stage, the S&P500 is down 27.5% throughout 2022. Subsequently, some traders have determined that the underside has already been reached or shall be reached quickly, and it’s time to begin shopping for. Numerous put choices have lately been purchased within the US market, on which profit-taking came about, and the freed fiat was used to buy dangerous property.

● Regardless of the occasions of the previous week, market opinion concerning the additional improve in rates of interest by the US Federal Reserve has not modified. Billionaire investor Ray Dalio has warned that the US will face a “good storm” of issues: a mixture of debt, political infighting, and battle overseas. However on the identical time, regardless of the specter of a recession, the Fed can have no different option to beat inflation.

The market has no doubts that the important thing price shall be elevated by 75 foundation factors (bp) on the subsequent assembly of the FOMC (Federal Open Market Committee) on November 2. The most important North American monetary derivatives market, CME Group, estimates the likelihood of this at over 90%. Furthermore, it’s potential that the speed can even improve to 75 bp in December (or, alternatively, by 50 bp in December and one other 50 bp in Q1 2023). The height of the rise is predicted on the stage of 4.93-5.00% each year, and this price could stay till 2024.

● As for Europe, the ECB consultant and head of the Slovak Central Financial institution, Peter Kazimir, lately stated that “elevating the speed by 75 bps in October is suitable”. Nonetheless, this had nearly no impression available on the market. Economists at Commerzbank nonetheless anticipate the European regulator to boost the speed to solely 3.0% by March subsequent yr. Thus, it can nonetheless be far behind the USD price.

As well as, the power disaster and the issues related to sanctions in opposition to Russia resulting from its invasion of Ukraine can even proceed to place stress on the frequent European foreign money. In accordance with analysts at Commerzbank, the euro will begin to get well solely when traders wager increasingly on the tip of the disaster subsequent yr. Within the meantime, they write, “a decisive tightening of financial coverage and a remarkably robust US financial system make the US greenback the favourite foreign money of worldwide traders.”

Thus, EUR/USD within the quick time period continues to be aimed south. And in accordance with the forecasts of DBS Financial institution strategists, if it breaks via the necessary help stage slightly below 0.9600, it might fall into the vary of 0.8270-0.9500, which was noticed in 2000-2002.

● Following the discharge of September US Retail Gross sales and the College of Michigan Client Sentiment Index, the EUR/USD pair was buying and selling within the 0.9750 zone on the time of writing the forecast on Friday night, October 14. 55% of analysts help the truth that it can proceed to maneuver south within the close to future, one other 35% anticipate it to maneuver north, and the remaining 10% vote for a sideways pattern. Among the many pattern indicators on D1, 90% are crimson and 10% are inexperienced. The image is sort of totally different among the many oscillators: solely 40% of them advise promoting the pair, 15% are in favor of shopping for, and 55% have taken a impartial place.

The fast help for the EUR/USD is at 0.9700, adopted by 0.9670, 0.9630, 0.9580 and eventually the September 28 low at 0.9535. The following goal of the bears is 0.9500. The resistance ranges and targets of the bulls seem like this: 0.9800-0.9825, 0.9900, the fast process is to return to the vary of 0.9950-1.0020, the following goal space is 1.0130-1.0200.

● The upcoming week’s calendar highlights Tuesday October 18, when the German ZEW Financial Sentiment Index is launched. The Client Worth Index (CPI) of the Eurozone shall be identified. And there shall be information on manufacturing exercise and the housing market within the US on Thursday, October 20.

GBP/USD: UK Adjustments Course

● Basically, the GBP/USD chart was just like the EUR/USD chart final week, apart from the volatility. The native minimal was fastened on the stage of 1.0922, the utmost – 1.1380, thus the vary of fluctuations for the five-day interval amounted to greater than 450 factors.

● The statistics on the UK financial system launched this week appeared blended. Friday, October 14, was the important thing day, when Prime Minister Liz Truss fired Treasury Secretary Quasi Kwarteng. Now, after this occasion, the markets are awaiting particulars concerning the nation’s upcoming mini funds. Former British Overseas Secretary Jeremy Hunt has been appointed as the brand new Chancellor of the Exchequer, and Liz Truss has introduced a dramatic change in fiscal coverage. Nonetheless, this has not helped the British foreign money a lot up to now: it was within the 1.1200 space on the finish of the working week.

● As for the median forecast, right here nearly all of analysts (75%) facet with the bears, 25% have taken a impartial place, whereas the variety of supporters of the strengthening of the pound is 0. Among the many oscillators on D1, the ratio is 60% to 40% in favor of the reds. Among the many pattern indicators, solely 15% are coloured crimson, 40% are inexperienced, and the remaining 45% are impartial grey.

The closest ranges and help zones are 1.1100, 1.1055, 1.0985-1.1000, 1.0925. That is adopted by 1.0500-1.0740 and the September 26 low of 1.0350. When the pair strikes north, the bulls will meet resistance on the ranges of 1.1300, 1.1350, 1.1400, 1.1470, 1.1500, 1.1610, 1.1720, 1.1800 and 1.1960.

● Relating to the discharge of UK macro statistics, the Client Worth Index (CPI) shall be launched on Wednesday, October 19, as within the Eurozone, and UK retail gross sales for September shall be introduced on Friday, October 21.

CRYPTOCURRENCIES: How A lot Will BTC Be Value on October 9, 2024?

● The crypto market was comparatively quiet till Thursday October 13. The BTC/USD pair, regardless of the downward stress, appeared fairly steady, holding positions round $19,000. Nonetheless, it flew down after the values of the US Client Worth Index (CPI) grew to become identified, following the inventory indices S&P500, Dow Jones and Nasdaq. Nonetheless, it by no means reached the June 19 low of $17,940, and having discovered a neighborhood backside at $18,155, it then went up sharply, following the inventory indices. On the time of penning this assessment, on the night of Friday, October 14, the pair is buying and selling within the $19.375 zone.

● In accordance with Amsterdam Inventory Trade dealer Michael van de Poppe, bitcoin worth volatility will improve within the second half of October. The US inflation information, together with the newest information on retail gross sales and labor market dynamics, can have a robust affect on each Wall Road and the cryptocurrency market. The following necessary level shall be early November, when the Fed is more likely to elevate the benchmark rate of interest by 0.75%. Primarily based on this, JP Morgan strategists predict a brand new collapse of the S&P500 index, by about one other 20%. Thus, the unrealized lack of those that invested within the shares of the five hundred largest US firms firstly of 2022 may exceed 44%. Nonetheless, many crypto traders hope that, as within the case of the latest disaster within the UK, bitcoin will play the function of digital gold this time and won’t collapse after different property. It should turn out to be clear within the foreseeable future whether or not these hopes will come true.

● If we have a look at the newest analysts’ forecasts by coloration, the palette is as follows: short-term forecasts are darkish black, medium-term forecasts are grey, and long-term forecasts are sky blue.

Among the many darkish blacks, this time, let’s spotlight the state of affairs of Zack Voell, who’s a mining analyst at Braiins. He has lately shared a mannequin that displays BTC’s worth efficiency in earlier bearish cycles. Zach Voell studied the habits of quotes in all previous intervals between highs and lows, on the idea of which he predicted a fall within the BTC price to $13,800.

The analyst emphasised that he studied the habits of the bitcoin worth in 2011, then in 2013-2015 and 2017-2018, in addition to throughout the present cycle, which started in November 2021. In accordance with him, the worth of the cryptocurrency misplaced greater than 80% of its peak values the final two occasions. If historical past repeats, the speed will fall to a minimum of this mark and will even go decrease. He famous amongst different issues that the bearish cycle of 2011 led to a drop within the worth of BTC by as a lot as 95%. Nonetheless, this occurred when the cryptocurrency was virtually unknown to anybody and was not on the best way to mass adoption.

Voell additionally famous that regardless of the unfavorable sentiment, bitcoin was probably the most worthwhile asset in Q3 2022. Digital gold has proven excessive stability prior to now months. (Other than BTC, in accordance with statistics revealed by NYDIG, solely treasured metals and fiat USD turned out to be worthwhile in Q3).

● Now let’s discuss what could occur within the final, This fall 2022. Mike McGlone, senior strategist at Bloomberg Intelligence, predicted an increase within the bitcoin worth by the tip of 2022. Digital gold and ethereum are likely to outperform most main property throughout financial downturns. Subsequently, McGlone referred to as the rise in rates of interest by Central banks “a robust tailwind.” He famous that October has been one of the best month for bitcoin since 2014. On the identical time, the analyst believes that ethereum’s transition to the Proof-of-Stake consensus algorithm may also help ETH and BTC acquire a foothold above the $1,000 and $20,000 ranges, respectively.

● Such ranges for ethereum and bitcoin will definitely not impress traders. Subsequently, this forecast of the Bloomberg Intelligence strategist could be categorized as impartial grey. Then transfer on to sky blue eventualities.

Paul Tudor Jones, a dealer and founding father of the Tudor Funding Hedge Fund, stated in an interview with CNBC that he continues to carry a place within the first cryptocurrency. In accordance with the influencer, the primary and second most capitalized cryptocurrencies shall be useful “in some unspecified time in the future” due to an excessive amount of cash.

● That second, in accordance with Raoul Pal, may come when the Fed retreats from its plans to battle inflation by tightening financial coverage. This Actual Imaginative and prescient founder and former Goldman Sachs chief govt stated that the macroeconomic background is starting to look engaging for investing in cryptocurrencies. Many traders at the moment are in a state of utmost concern, fearing that the worldwide monetary system will quickly collapse. And this may very well be a development catalyst for dangerous property like bitcoin and altcoins.

In accordance with the businessman, traders are very unfavorable and are taking part in it secure. Beforehand, the market had extremely excessive quantities of investments, however the market doesn’t work now, as sellers predominate over patrons. This case could encourage the Fed to loosen up its financial coverage.

“There’s presently no liquidity available on the market, as solely sellers are left there. I feel this may trigger enormous issues sooner or later. Finally, companies will demand more cash to be issued and the state of affairs available on the market to be modified,” stated Raul Pal. So as soon as Central banks begin printing cash once more, property like bitcoin and altcoins will rise. “This can be a unhappy state of affairs, however that is the true state of affairs,” says the financier. “It is possible for you to to see when the shift comes and use it to your benefit by investing in cryptocurrencies.”.

● A well-liked crypto analyst often known as Dave the Wave precisely predicted the bitcoin crash in Could 2021. He believes now that if bitcoin equals gold in the long run in market capitalization, this shall be equal to a rise in its worth by about 40 occasions. In accordance with the professional, this international purpose could be achieved inside 20 years.

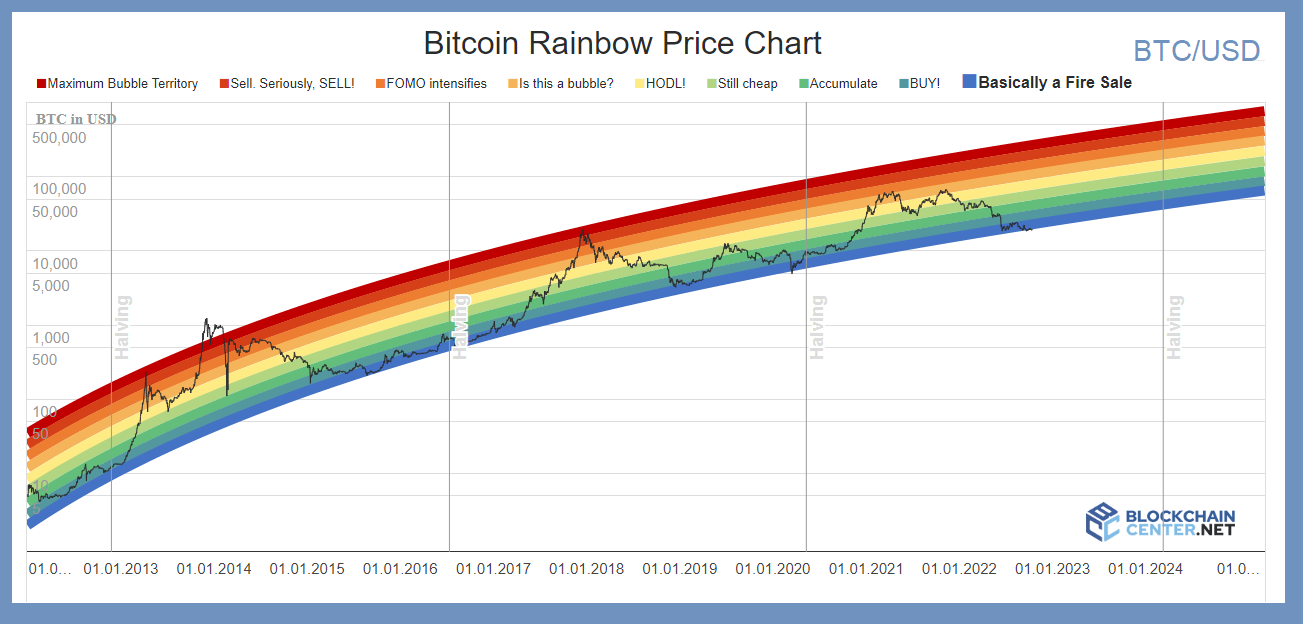

The rainbow worth chart of the Blockchain Heart appears no much less optimistic. (It differs considerably from our forecast). It reveals how previous worth statistics may also help predict the long run habits of an asset. In the long run, the graph signifies that bitcoin may attain a six-figure worth of $626,383 by October 9, 2024. The flagship cryptocurrency will attain the “most bubble territory” then, marked in darkish crimson.

Moreover, the chart signifies that the present crypto winter could have bottomed out. It’s noteworthy that bitcoin’s present worth is estimated to be within the “Foremost Sale” zone (marked in blue). Forward of one other bull run, the rainbow chart additionally reveals that bitcoin’s “HODL” standing will take impact on the finish of the yr when the asset trades at $86,151.

The colour bars comply with a purely logarithmic regression, which has no scientific foundation. As well as, the bands have been adjusted to match previous intervals within the higher means. Nonetheless, the chart creators observe that that is a minimum of an fascinating means to take a look at the potential future profitability of the principle cryptocurrency.

● On the time of writing, the overall crypto market capitalization is $0.927 trillion ($0.946 trillion per week in the past). The Crypto Worry & Greed Index has climbed 1 level in seven days from 23 to 24 and continues to be within the Excessive Worry zone.

NordFX Analytical Group

Discover: These supplies should not funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]