[ad_1]

BNB refers to Binance Coin, which is the token used within the Binance cryptocurrency trade. It’s issued on the Binance cryptocurrency trade, with its buying and selling image being BNB. Having initially run on the Ethereum blockchain, it’s now native to the Binance Good Chain. If you wish to learn to purchase Binance coin or BNB learn on!

Binance coin has a complete of 200 million tokens out there within the community. Right now, it’s the most well-liked and the biggest crypto trade globally, backed up by a really spectacular effectivity fee of over a million transactions each second.

Binance trade makes use of one-fifth of its total income to burn its Binance coin holdings 4 instances yearly, i.e. each quarter. The newest burn happened on the fifteenth of April, 2021 the place 1,099,888 Binance cash have been burned. To place this in perspective, the greenback equal of those tokens is a little bit over half a billion {dollars}.

Observe our step-by-step shopping for information under to purchase BNB tokens:

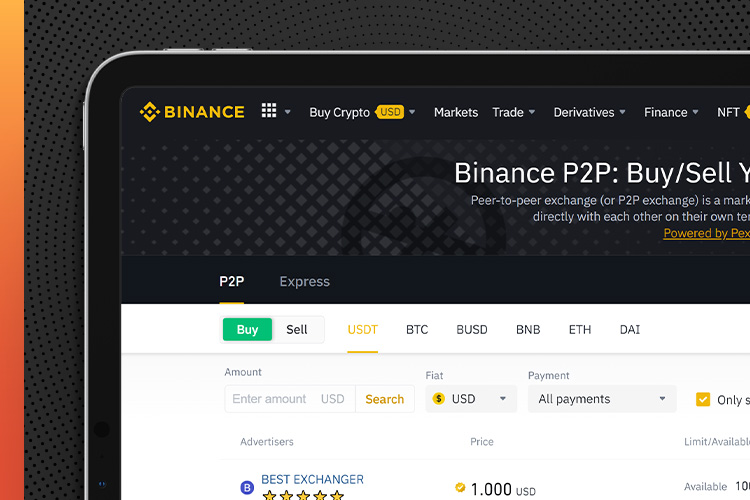

Step #1: Choose a Crypto Change

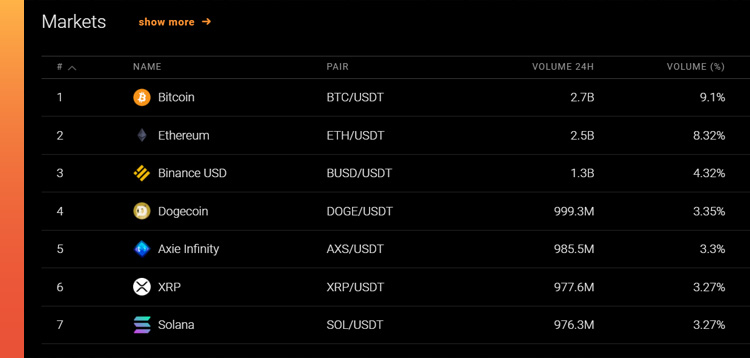

Go to the market web page on CoinStats to view the trade platforms supporting BNB tokens. Evaluate the exchanges’ safety, person expertise, price construction, supported crypto belongings, and so forth., to decide on the one with the options you want, reminiscent of reasonably priced transaction charges, top-notch safety, excessive buying and selling quantity, an intuitive platform, round the clock customer support, and so forth. Additionally, think about whether or not the cryptocurrency trade is regulated by the Monetary Trade Regulatory Authority (FINRA) and means that you can purchase crypto utilizing your most well-liked fee technique.

To commerce cryptocurrencies, you need to use a centralized or decentralized crypto trade, so let’s look into the main points of every kind under.

Centralized Change

A centralized crypto trade or CEX, reminiscent of Coinbase, eToro, Binance, and so forth., features as a intermediary between patrons and sellers and costs particular charges for utilizing their providers. Most crypto transactions are carried out on centralized exchanges, permitting customers to purchase and promote cryptocurrencies for fiat currencies such because the US greenback or digital belongings like BTC and ETH. Centralized exchanges require their customers to observe KYC (know your buyer) and AML (anti-money laundering) guidelines by offering some data and private identification paperwork. Nevertheless, the disadvantage of buying and selling on a CEX is that it’s extremely weak to hacking or cybersecurity threats.

Decentralized Change

However, a decentralized trade (DEX), like Uniswap, SushiSwap, Shibaswap, and so forth., is a non-centralized various to a centralized trade and isn’t ruled by any central authority. As an alternative, it operates over blockchain and costs no price apart from the fuel price relevant on a specific blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use good contracts to let folks commerce crypto belongings without having regulatory authority. They deploy an automatic market maker to take away any intermediaries and provides customers full management over their funds. This technique is safer since no safety breach is feasible. Nevertheless, decentralized exchanges are much less user-friendly by way of interface and forex conversion. As an example, they don’t all the time permit customers to commerce crypto with fiat forex; customers should both already personal crypto or use a centralized trade to get crypto. One other downside of decentralized exchanges is that it has failed to realize liquidity ranges corresponding to centralized exchanges. It additionally takes longer to search out somebody trying to commerce with you as DEX engages in peer-to-peer commerce, and if liquidity is low, you might have to simply accept concessions on worth and rapidly promote or purchase low-volume crypto.

You possibly can listing something on a DEX, which implies you may have entry to new, in-demand belongings whereas additionally taking up extra danger.

Step #2: Create an Account

After you’ve chosen a cryptocurrency trade that fits your funding wants, you need to register with the trade utilizing a sound e mail or cell quantity. A hyperlink will likely be despatched to your handle, and you need to click on it to confirm your account. As soon as the account is activated, you need to create an elaborate password, and also you’re good to go.

Some exchanges have strict KYC and AML necessities, and in an effort to get verified, you need to present private data reminiscent of:

- Full title

- Residential handle

- Date of Delivery

- ID Doc.

In some instances, you may also have to add a selfie or endure video verification to finalize the verification course of.

As soon as your identification verification is full, it’s beneficial to activate two-factor authentication (2FA) for an additional layer of safety.

Step #3: Deposit Funds

The following step is to deposit funds into your account. Many crypto exchanges help fiat currencies like USD, EUR, and so forth. Merely choose your most well-liked deposit technique, reminiscent of a financial institution switch, wire switch, credit score or debit card, e-wallets, PayPal, and so forth., and the forex you want to deposit. Faucet on “Deposit Funds,” enter the quantity you need to deposit and click on “Deposit.”

Some deposit strategies are extraordinarily quick, whereas others, relying on the quantity, require affirmation from authorities. Keep in mind to judge the charges of various deposit strategies since some have bigger charges than others.

Linking your debit card to your crypto account is advantageous because it permits you to make prompt or recurring purchases, however bear in mind that it attracts an extra price.

It’s often free to make a financial institution switch out of your native financial institution accounts, however you must nonetheless double-check together with your trade.

BNB tokens might be traded for an additional cryptocurrency or a stablecoin; the buying and selling pairs fluctuate between exchanges. So, you need to seek for BNB on the spot market to pick out a pair from the listing of obtainable buying and selling pairs.

Step #4: Purchase BNB

Observe the steps under to position a market order to purchase BNB immediately on the present market worth:

- Click on the search bar, enter BNB, and choose “Purchase BNB” or the equal.

- Choose a buying and selling pair you want to purchase BNB towards

- Select the fee technique, the forex you want to use, and enter the quantity of BNB or the fiat quantity to be spent. Most exchanges will routinely convert the quantity to point out you what number of BNB tokens you’ll get.

- Double-check the transaction particulars and click on “Affirm.”

- The BNB tokens will likely be displayed in your steadiness as soon as the transaction is processed.

You may also place a restrict order indicating that you just need to purchase BNB at or under a selected worth level. Your dealer will ask you the variety of cash you want to purchase and the utmost worth you’re able to pay for every when you’ve positioned an order. The cash will solely seem in your pockets in case your dealer fulfills your order at or under your requested pricing. The dealer could cancel your order on the finish of the day or depart it open if the worth will increase over your restrict.

In case you’re planning to maintain your newly bought cash for an prolonged interval, we extremely suggest securely storing them in a {hardware} pockets.

To commerce BNB on spot markets, go to the Commerce web page and seek for the BNB pairs ( BNB/USD or BNB/USDT). Choose the buying and selling pair and verify the worth chart. Click on “Purchase BNB,” choose the “Market,” enter your quantity or select what portion of your deposit you’d prefer to spend by clicking on the proportion buttons. Affirm and click on “Purchase BNB.”

Congratulations on including BNB tokens to your crypto portfolio!

Step #5 (Non-compulsory): Retailer BNB

Whereas your BNB tokens might be saved in your brokerage trade pockets, consultants extremely suggest storing your valuable cash away from trade wallets, as these could be inclined to hacks and interference.

We extremely suggest creating a non-public pockets with your individual set of keys. Relying in your investing preferences, you may select between software program and {hardware} wallets:

Software program Wallets

In case you’re trying to commerce BNB frequently, software program or scorching wallets supplied by your chosen crypto trade will go well with you. The power of software program wallets lies of their flexibility and ease of use. A software program pockets is probably the most easy-to-set-up crypto pockets and allows you to simply work together with a number of decentralized finance (DeFi) functions. Nevertheless, these wallets are weak to safety leaks as a result of they’re hosted on-line. So, if you wish to preserve your non-public keys in a software program pockets, conduct due diligence earlier than selecting one to keep away from safety points. We suggest a platform that provides 2-factor authentication as an additional layer of safety.

Examples of software program wallets embody CoinStats Pockets, MetaMask, Coinbase Pockets, Belief Pockets, and Edge Pockets, amongst others.

{Hardware} Wallets

{Hardware} or chilly wallets are often thought of the most secure approach to retailer your cryptocurrencies as they provide offline storage, thereby considerably decreasing the dangers of a hack. They’re secured by a pin and can erase all data after many failed makes an attempt, stopping bodily theft. {Hardware} wallets additionally allow you to signal and ensure transactions on the blockchain, providing you with an additional layer of safety towards cyber assaults. These are extra appropriate for knowledgeable customers who personal giant quantities of tokens.

Ledger {hardware} wallets are arguably probably the most safe {hardware} wallets letting you securely handle your digital belongings. The Nano X is designed for superior customers and affords extra space for storing and superior options than Ledger Nano S, designed for crypto freshmen.

A {hardware} pockets is costlier than a scorching pockets, with costs ranging between $50 – $200.

Examples of chilly wallets are Trezor Mannequin T, Ledger Nano X, CoolWallet Professional, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

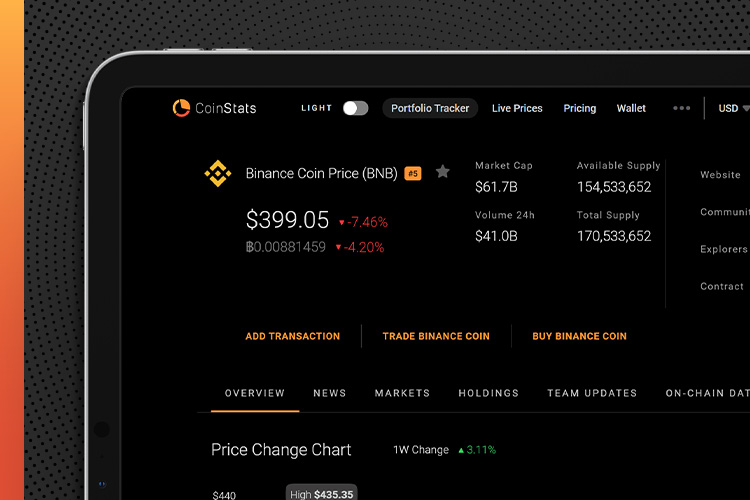

Step #6 (Bonus Step): Monitor BNB Tokens

The crypto market is risky, and managing your portfolio might get tough should you maintain a number of belongings. Using a portfolio tracker will make it easier to preserve monitor of your BNB tokens and all of your crypto investments from one platform always. CoinStats affords among the finest crypto portfolio trackers available in the market; you’ll find extra data right here.

You may also monitor the revenue, loss, and liquidity of BNB throughout a number of exchanges on CoinStats.

CoinStats helps over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It affords charting instruments, analytical information, superior search options, and up-to-date information. Right here you may have the chance to attach a vast variety of portfolios (wallets and exchanges), together with:

- Binance

- MetaMask

- Belief Pockets

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To attach, go to the CoinStats Portfolio Tracker web page and:

- Click on Add Portfolio and Join Pockets.

- Click on the pockets you need to hook up with (e.g., Ethereum Pockets).

- Enter the pockets handle and press Submit.

Historical past and Overview of Binance Coin

The phrase Binance is derived from the 2 phrases Finance and Binary. Right now, Binance is without doubt one of the main cryptocurrency exchanges on the earth, with its Binance coin the popular utility token for the trade. BNB Coin is used within the type of an middleman with trades involving fiat forex and different cryptocurrencies.

The historical past of Binance and its respective Binance Coin might be traced again to 2017 when Chinese language founder ChangPeng Zhao established Beijie Expertise, the corporate managing and operating the Binance crypto trade. The corporate has its headquarters within the Hong Kong province of China.

Within the creation of the trade platform, the founder and his crew of builders created the Binance Coin token, elevating ample funds through an Preliminary Coin Providing (ICO). This ICO lasted for as much as one month, with round fifteen million {dollars} raised because of this. The ensuing funds have been channeled into startup expenditure e.g. paying new builders, advertising, and securing the trade platform’s servers.

A very progressive creation, Binance Cash rapidly grew in recognition thereafter. There was a 50% reward for customers who bought the token, utilizing it as a young for buying and selling charges. On the trade, Binance Cash are burnt periodically, decreasing provide and routinely growing worth.

What Can You Do With Binance Coin

Binance cash are a number of the hottest crypto tokens in existence at present. As a cryptocurrency, it may be used for a wide range of functions:

- Binance Coin can be utilized to finance buying and selling charges on the Binance Good Chain, Binance DEX, and Binance.com

- It may be used to pay transaction charges throughout coin conversion, e.g. changing Bitcoin to Litecoins.

- Binance Coin can be utilized to make funds on Crypto.com, HTC, and Monetha. Funds can be made for the aim of reserving journey lodging on websites like TravelbyBit. As well as, you possibly can entry loans, e.g. through ETHLend.

- You may also purchase Binance Coin and use it to make charitable donations.

How Does Binance Coin Work

It makes use of ERC20 tokens and is created on the Ethereum blockchain. Tokens can’t be mined, nonetheless, as a result of the Preliminary Coin Providing ensures that the entire tokens have been distributed and pre-mined.

Merchants use Binance cash to pay transactions charges on the community, whereas its builders use them to generate computing energy for apps on Binance’s network- Binance Good Chain.

Actually, this Good Chain is what makes Binance Coin distinctive from different buying and selling tokens throughout totally different crypto exchanges.

The community is programmable and executes good contracts, serving as a platform for different cryptocurrencies and apps.

Tips on how to Purchase Binance Coin if You Do Not Have Crypto

In case you would not have crypto in any respect, you’ll have to purchase some earlier than you should purchase precise BNB as a result of the Binance trade doesn’t use fiat currencies such because the greenback. Since it’s your first crypto buy, you’ll do properly to buy a secure one, e.g. Bitcoin and Ethereum.

To do that, nonetheless, you’ll have to purchase it from an trade platform that’s authorized in your nation. An instance of a great one is Coinbase. Coinmama can be excellent. After buying, you possibly can then observe the steps highlighted within the earlier part in an effort to purchase Binance Cash.

Tips on how to Purchase Binance Coin From CoinStats

Coinstats is an app that you should use to analysis cryptocurrencies, trade platforms and monitor their portfolios.

Shopping for BNBs from CoinStats is sort of straightforward. The wyre system has been built-in into the platforms, making it potential so that you can buy cash. Funds might be made through your debit card or Apple Pay. The perform is just out there for customers based mostly within the USA, nonetheless. As well as, you can not make funds of greater than $250 each day.

Nonetheless, there will likely be elevated help for extra nations subsequently.

Why Ought to You buy Binance Coin

Now that you know the way to purchase Binance Cash, there’s a probability that a number of the, ahem, doubting readers are nonetheless not sure whether or not to delve in or not. In case you’re not sure, listed here are 4 the explanation why BNBs are a great funding for you:

- Price: Binance Cash have a low worth in comparison with that of different cash. Buying and selling on the Binance crypto trade can be fairly straightforward.

- Demand and Provide: In any digital trade, what determines the worth and progress of a token is its demand and provide. As its recognition will increase, so does the availability lower, thus growing its worth.

- Status: Most traders favor to subscribe to reliable cash, as they can’t afford to lose cash and make vital losses. Binance is without doubt one of the most trusted cryptos as it’s straightforward to function. The withdrawal threshold of $30,000 can be very interesting.

- Change Versatility: Apart from its apparent use as a invaluable token, its guardian trade platform, Binance, means that you can make forex exchanges with many different tokens, e.g. Cardano, Bitcoin Money, ChainLink, Litecoin, Ethereum, EOS, VeChain and Cosmos.

- Participation in ICOs: Binance Lauchpad hosts the gross sales of recent tokens that may be bought utilizing Binance Cash, previous to when they’re out there to commerce on Binance trade.

Conclusion

Binance Coin is relatively very promising, seeing how its success doesn’t depend on it being an alternate cryptocurrency. As a cryptocurrency, it may be used to energy functions and generate computing energy for the community.

[ad_2]