[ad_1]

💡

Fascinated with contributing as a group member? Attain out to Mike or Matt through SNX’s Discord.

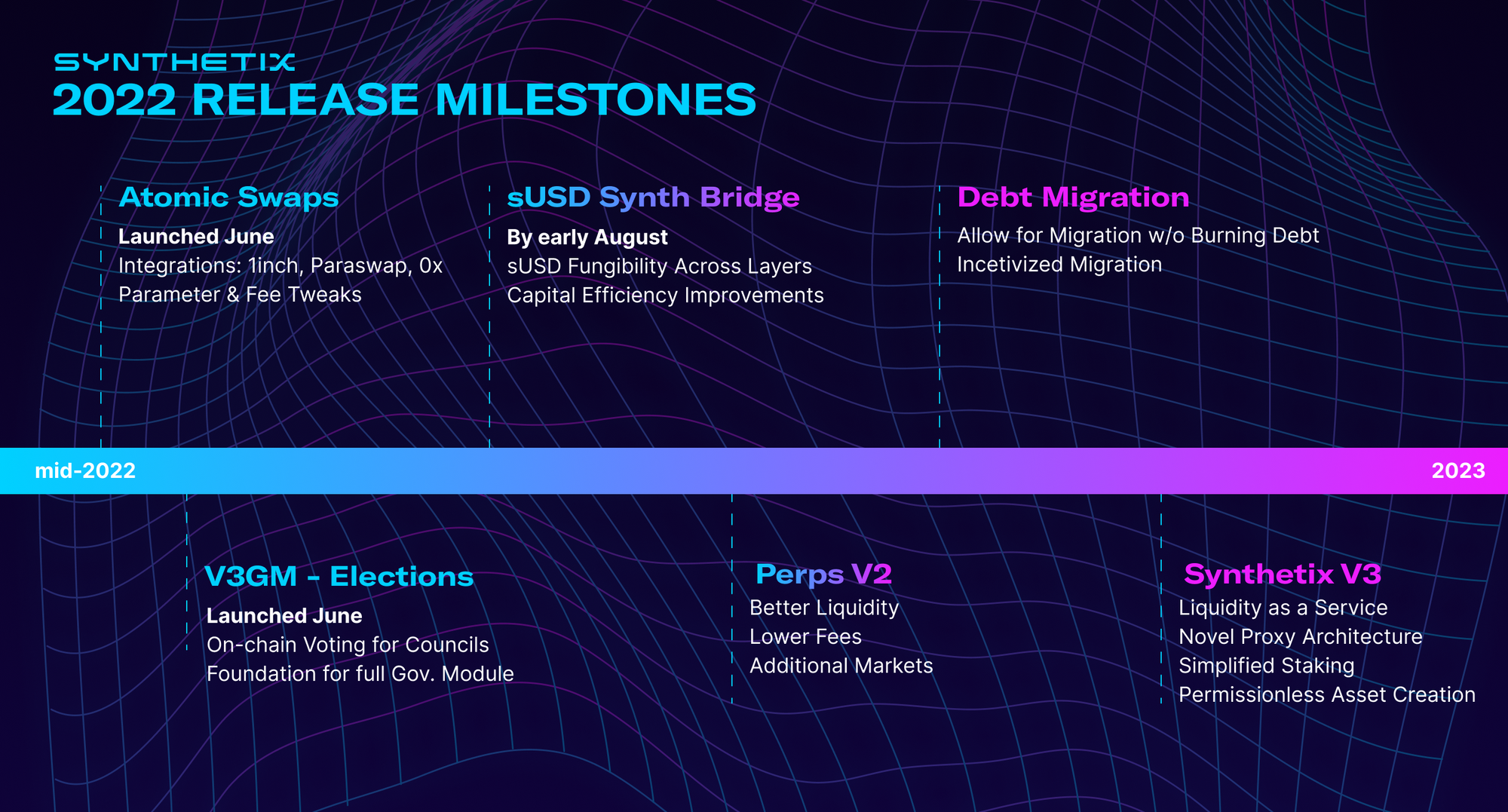

Alright Spartans (and future Spartans) alot has been taking place at Synthetix this 12 months. If you wish to play catch up then that you must checkout this weblog Synthetix just lately launched:

Synthetix 2022 Launch Milestones – Midway Overview and Deep Dive

We’ve reached the 12 months’s midway level, so it’s time to revisit key milestones for 2022. It’s been an thrilling six months up to now with a number of extremely anticipated options hitting mainnet and driving $100-200m in each day buying and selling quantity by way of the Synthetix protocol. As Kain talked about on Twitte…

You now perceive that Perps V2 and Synthetix V3 is coming! These new updates are going to kick protocol price technology into OVERDRIVE whereas enhancing the code and consumer expertise! Making Synthetix the GOLD normal for income sharing tokens!

Lets decelerate for a minute, and study why Synthetix selected Optimism within the first place. Ethereum’s excessive gasoline charges make buying and selling synths on Synthetix costly and compress $SNX staking returns. Creating, redeeming, and buying and selling synths are all complicated transactions, so Synthetix is a gasoline guzzler. Because of this Synthetix selected to deploy its staking code on Optimism January 2021.

The Optimistic Ethereum Transition

With the launch of Optimistic Ethereum (OΞ) mainnet in a number of days we areentering a brand new period for the venture, OΞ presents a chance to scale theprotocol nevertheless it additionally presents various challenges. Probably the most criticalis find out how to gracefully transition from L1 to

The discount in gasoline charges on Optimism has created an enormous flywheel impact for Synthetix and its stakers. Many articles have been put out for find out how to stake $SNX, and its advantages to stakers, however that is the very best one:

Fundamentals of Staking SNX – 2022

💡Staking variables change often primarily based on governance motion. This information has been up to date as of seven/28/22. Present Goal C-Ratio: 400% For extra up to date info, monitor Synthetix governance votes and the SIP/SCCP repo. Synthetix staking is vastly completely different from different DeFi protocols; it allo…

In Abstract for those who stake SNX you get two sorts of rewards you’ll be able to declare every week: sUSD charges generated from merchants (charges collected from Kwenta Futures, Lyra, Kwenta Spot, atomic swaps, Polynomial, and so forth) and SNX inflationary rewards – present APY is 75%

With Optimism incentivizing new customers to come back to the ecosystem, large onboarding is happening. Synthetix and its ecosystem is wanting ripe for large progress and income technology!

OPtimism just lately handed Arbitrum and sits at 1.1 Billion TVL. In 30 days TVL is up 282%. Observe the cash…

Present protocols on Optimism are displaying large will increase in TVL prior to now 30 days. Synthetix is up 77% TVL in a single month!

Analysts at Messari speculate OP will likely be a 9 billion marketcap so let that sink in on protocol TVL and income. This text could be discovered right here:

Checkout this twitter thread to get the TLDR on what Synthetix is as much as, and why protocol income goes to blow up (Perps V2 and V3 child!) for Synthetix over the approaching months:

Wish to know why $SNX @synthetix_io is surviving this bear market, and can come out stronger than the opposite #DEFI tasks?

They been BUILDING

🧵👇

— Mr. Mojo (@mastermojo83) July 17, 2022

9,000,000 $OP tokens have been despatched to Synthetix’s Treasury Council. They’ve simply began distributing them out, with present incentives on Curve and Velodrome!

The Synthetix Optimism Section 0 Distribution continues with incentives on @CurveFinance

10k $OP for sUSD/3CRV

10k $OP for sETH/ETHhttps://t.co/EjWgmTSA3cPresent APY’s 👇 pic.twitter.com/aaQpJJUNst

— Synthetix ⚔️ (@synthetix_io) August 25, 2022

SIP-242 spells out a tough framework on what they plan to do with all of the $OP!

Lets discover the present Synthetix ecosystem in Optimism, and some different protocols which might be nice to have right here:

Kwenta:

Kwenta is a decentralized derivatives buying and selling platform, stay on Optimism, providing real-world and on-chain artificial belongings utilizing the ability of the Synthetix protocol.

Kwenta has two merchandise it gives; Swaps and Futures (as much as x25x leverage). Though Futures would be the flagship providing of Kwenta. Kwenta will help simple swaps of Artificial belongings just like the likes of 1inch and uniswap. With the passage of KIP-21, Kwenta’s Synthswap can allow the alternate of any ERC20 tokens for any synths (and vice versa).

Regardless of being a Beta platform, Kwenta has reached $3.85 billion USD in buying and selling quantity by way of Natural use with no buying and selling incentives.

Congratulations to @kwenta_io and @synthetix_io on reaching 3 Billions USD in buying and selling quantity on #Kwenta decentralized futures buying and selling platform.

No KYC, no geofencing, totally permissionless.

13 stakers making financial institution…#SNX #Synthetix #Kwenta pic.twitter.com/JHJHtCDodd— SynthaMan (@SNXified) July 21, 2022

$SNX Stakers have obtained $13.5 million in buying and selling charges from Kwenta this 12 months; checkout all the most recent Futures analytics right here:

Dune

Blockchain ecosystem analytics by and for the group. Discover and share knowledge from Ethereum, xDai, Polygon, Optimism, BSC and Solana without cost.

What’s coming to Kwenta? When Synthetix comes out with Perps V2 right here quickly it would considerably enhance consumer expertise with decrease charges and extra predictable funding charges, and improve open curiosity limits and help extra markets! It will profit anybody constructing ontop of Synthetix Perps – together with Kwenta.

Kwenta has alot on the roadmap for 2nd half 2022:

What alot of merchants have been ready for is Advance Orders (cease loss, restrict orders, and so forth) and Cross Margin! They’re on the roadmap and will likely be delivered quickly!

Kwenta is receiving 900,000 $OP tokens to onramp new customers and incentivize buying and selling. Here’s a assessment of what they plan to do with them:

The Kwenta $OP Proposal is now formally stay within the @optimismPBC Governance Discussion board.

The 900k $OP breakdown is as follows:

🔸 Migration Incentives 66%

🔸 Competitors Prizes 14%

🔸 DAO Contributor Incentives 20%For the complete proposal go to: https://t.co/N3SsCcG8Co

— Kwenta (@kwenta_io) Could 25, 2022

Lyra:

Lyra is an choices automated market maker (AMM) that permits merchants to purchase and promote choices on cryptocurrencies (at the moment $ETH and $BTC) in opposition to a pool of liquidity. The Lyra protocol has two key consumer teams, liquidity suppliers and choices merchants. Liquidity suppliers (LPs) deposit sUSD (a stablecoin) into one of many asset-specific Lyra Market Maker Vaults (MMVs). This liquidity is used to make two-sided (purchase and promote) choices markets for the asset that the vault specifies (e.g. ETH Market Maker Vault LPs quote choices on ETH). LPs deposit liquidity to the vault to earn the charges paid when choices are traded. Merchants use Lyra to commerce choices. They will both purchase choices from or promote choices to the MMV. Merchants pay charges (within the type of the market-making unfold) to LPs, as compensation for his or her liquidity.

Lyra makes use of the Synthetix Protocol in three other ways:

- As a settlement foreign money (All choices are quoted, paid for, and settled with Artificial USD or sUSD.)

- As collateral for calls (The AMM collateralizes the calls it sells with the related synth. For instance, when the AMM sells an sETH name it would buy 1 sETH from Synthetix. On expiry (or when the choice is offered) the AMM will promote the sETH for sUSD and permit the choice holder to settle.)

- For delta hedging (The protocol goals to maintain the publicity of liquidity suppliers near delta-neutral. It does this both by longing or quick promoting the underlying asset on Synthetix. For instance, if the AMM is lengthy 500 sETH deltas, it could quick promote 500 sETH utilizing Synthetix’s short-selling performance. )

Lyra upgraded the protocol just lately to Avalon. Merchants will now have entry to:

- 100 strike/expiry combos

- Partially collateralized choices promoting (3-4x enhancements in yield)

- Be capable of enter/exit the market maker vaults at any time

- Generate extra charges because of partial collateralization

- Gather the lion’s share of liquidation charges generated on the protocol

Avalon facilities round three large breakthroughs within the protocol:

- Anytime market-maker vault (MMV) entry/exit (LPs will now be capable of deposit and withdraw funds from the market maker vault at any time)

- Rolling expiries out to three months

- Partial collateralization for choices promoting

For the reason that Avalon improve the AMM is performing fantastically even when $Eth was falling or rising.

What’s to come back?

Lyra just lately obtained their 3,000,000 $OP and now plans to SUPERCHARGE the protocol and RAMP up progress. Leap-26 was handed just lately which spells out the framework on how Lyra plans to do that.

LEAP-26: Bridging Tokenomics till xLYRA

At present you’ll be able to take your Lyra and single stake it and obtain $Lyra and $OP. Staking Lyra may even provide you with a boosting impact (as much as 2x) to Market-Maker Vault rewards. MMV rewards are $Lyra and $OP tokens. For more information:

Avalon Incentives are stay!

After a month of unincentivized exercise on the brand new Avalon launch of the Lyra protocol: LPs have generated 2.8% returns on capital deposited on day 1$20m+ notional quantity and $1m+ premiums have been tradedMarket-Maker Vault utilization has been persistently maxed out It’s time so as to add some gas

Merchants will now be eligible for a rebate on charges paid for opening and shutting trades in a mix of each LYRA and OP rewards. The price rebate share will develop logarithmically as much as a most of fifty% primarily based on how a lot LYRA the dealer has staked. For the specifics take a look at LEAP-26 and for those who’ve been ready on the sidelines to stake or commerce now’s the time!

Be sure you keep updated with Lyra with their group ran publication:

It’s time to share our eighth version of The Brief Put.

On this loaded concern we cowl submit Avalon launch, how @lyrafinance plans to SUPERCHARGE the protocol & RAMP up progress, ecosystem information, & far more !

Keep updated 👇https://t.co/JVDDlm0Mna

— The Lyra Brief Put (@lyrashortput) August 1, 2022

Polynomial:

Polynomial automates monetary spinoff methods to create merchandise that ship passive yield on varied belongings, and is constructed on high of Lyra. At present, Polynomial has coated calls, put promote methods on the platform. By means of using a weekly automated coated name technique, the vault generates a return on its deposits. With a view to successfully compound the returns for depositors over time, the vault reinvests the yield gained again into the technique. Vaults solely settle for artificial belongings (sUSD for put/call-selling vaults, sUSD for Gamma vault, and sETH for name promoting Eth vault).

Polynomial just lately upgraded the protocol to V2, the place all vaults upgraded to the Lyra Avalon improve. This offers Polynomial instantaneous deposits (inside 1 hour), a number of strikes will likely be offered to cut back danger, partially collateralized vault, a brief vol vault collateralized by sUSD, a foundation buying and selling vault utilizing Synthetix Futures, and a gamma vault.

🎉 At this time, we’re excited to launch the following technology of Earn Vaults on @optimismFND

💚 Constructed on high of @lyrafinance and @synthetix_io

👉 https://t.co/RBsbg01ATI pic.twitter.com/qXRmfjKbzr

— Polynomial Protocol (@PolynomialFi) August 10, 2022

Polynomial just lately had a group name the place they gave an replace on their OP token distribution, V2 launch, and updates on Gamma and Foundation vault!

You may hearken to this superior name right here:

The Gamma Vault runs a completely on-chain delta impartial technique combing choices and futures powered by Synthetix Futures and Lyra!

At this time we’re excited to announce the Gamma Vault, first of its variety in DeFi.

Gamma Vault runs a completely on-chain delta-neutral technique combining choices and futures powered by @lyrafinance and @synthetix_io.

👇 pic.twitter.com/44CFG3WmRc— Polynomial Protocol (@PolynomialFi) August 19, 2022

Thales:

Thales is a decentralized protocol that permits customers to participate in peer-to-peer Parimutuel Markets on Optimism and Polygon. The straightforward however highly effective sensible contracts on the basis of Thales Market assist you to take part in markets for various crypto belongings. Thales protocol continues to innovate by providing group primarily based video games like Thales Royale and extra superior buying and selling merchandise like Ranged Markets. Merchants can participate in customized markets and speculate on real-world occasions (like timing “The flippening”) in an uncensorable and totally permissionless means utilizing the Unique Markets platform.

What is exclusive in regards to the positional tokens (UP, DOWN, IN or OUT) there are not any liquidations concerned, you’ll be able to solely lose what you danger on every market and no extra!

If you happen to by no means used Thales, checkout this superior market stroll by way of (my favourite market is the $SNX UP):

In contrast to Synthetix the place charges are distributed to stakers, Thales is implementing a buyback and burn function (each 24 hours) utilizing a portion of the charges generated from their protocol and merchandise (Extra time and Unique Markets). That is outlined in TIP-50

thales-improvement-proposals/TIP-50.md at principal · thales-markets/thales-improvement-proposals

Contribute to thales-markets/thales-improvement-proposals improvement by creating an account on GitHub.

Proper now Thales is distributing their 900,000 $OP tokens for utilizing their protocol and merchandise.

This contains UP and DOWN token consumers, Ranged IN or OUT token consumers, Staking, LPing, utilizing Extra time Markets and Unique Markets! This tweet sums it up

All that you must find out about Thales $OP distribution:

Initially, we’re very grateful to obtain the preliminary 900,000 OP by @optimismFND for being an early supporter 🙏

We imagine within the Optimism’ imaginative and prescient and we decide to pretty distribute OP tokens https://t.co/QugeRDz1MI

1/

— Thales (@thalesmarket) July 29, 2022

Dune dashboard:

Dune

Blockchain ecosystem analytics by and for the group. Discover and share knowledge from Ethereum, xDai, Polygon, Optimism, BSC and Solana without cost.

An unimaginable writeup about Thales could be discovered right here:

[SPONSORED] Thales: Unleashing the ability of positional markets – The Defiant

Thales market is each a protocol and a platform the place you’ll be able to take part in numerous positional markets with simple to grasp derivatives.

Extra time Markets: Extra time is the primary totally decentralized sports activities markets platform! Thales AMM mannequin permits Extra time to create instantaneous liquidity round sports activities markets.

They just lately introduced a FPL league with 10,000 Thales in prizes. If you’re into sports activities betting then Extra time is your platform to make use of, who wants draftkings when there’s Extra time Markets! Earn $OP whereas betting in your favourite sports activities group!

At present Extra time has MLB, MLS, NFL, and the MMA. Many extra leagues are to come back, together with the a lot anticipated NBA and NHL.

Sport Positional Markets constructed on Thales

Sports activities Markets AMM

Unique Markets: Unique Markets was constructed by group members on high of Thales sensible contracts, permitting anybody to create customized markets in a decentralized means.

Wish to guess on present politics, sports activities, crypto, finance, or popculture ? Then that you must test this out! My favourite market is that if Optimism can have greater than 1 billion TVL on November 1st, 2022 – all you need to do is select Sure or No, and look forward to the time to move.

Unique markets constructed on Thales protocol

Permisionless on-chain positional markets constructed on high of Thales

Dhedge/Toros: dHEDGE is a platform for managing funding actions on the Ethereum blockchain the place you’ll be able to put your capital to work in numerous methods primarily based on a clear monitor report. On dHEDGE, managers can commerce artificial crypto, fx, commodities, and even equities – each lengthy and quick.

dHEDGE leverages the Synthetix protocol and their zero-slippage mannequin. They’ve risk-adjusted rating of managers which makes it simple for traders to seek out actually the actually good managers. As with most DeFi protocols, dHEDGE is non-custodial in nature, which means that traders stay in management in any respect time and select to enter or exit a pool at any time.

The dHEDGE token, $DHT, serves a number of capabilities:

- Facilitate decentralized governance

- Incentivize traders to pool belongings with top-performing managers

- Incentivize managers to earn larger return

DHT distributed through staking and efficiency mining is finished by growing the circulating provide of DHT (inflation). Tokens distributed through the Protocol Treasury are achieved by liquidating a portion of the charges the protocol captures (protocol income).

Rewards – dHEDGE Docs

Breakdown of rewards distributed to DHT stakers

Wish to see what Dhedge has this 12 months and what their present roadmap is, then test this out!

dHEDGE Q2 2022 Replace

Q2 2022 was sadly notable for some vastly important DeFi catastrophes;resembling Terra/Luna imploding, the insolvency of Three Arrows Capital, Celsiuslocking investor funds, growing FUD across the stability of Tether, andknock-on results to the remainder of the ecosystem attributable to all or any…

Dhedge has been leaking every kind of Alpha on their twitter. It seems managers might quickly be capable of use Lyra and Kwenta !

Very quickly

cc: @lyrafinance pic.twitter.com/EBZdSkzSiu

— dHEDGE (@dHedgeOrg) August 24, 2022

Toros Finance is a dHEDGE incubated protocol integrating Aave and 1inch. Toros Finance goals to simplify entry to complicated spinoff methods, safely, through providing these methods by way of a single token. Toros Finance gives a collection of on-chain tokenized derivatives merchandise. At present Toros is deployed on Polygon and Optimism.

Toros quantity exploded once they launched the Synthetix Debt Hedge token on Optimism.

dHEDGE Debt Mirror Index Token – Reside on Optimism

Synthetix has partnered with dHEDGE to deploy a one-click debt mirror index for SNX stakers on Optimism. Initially, this software was launched onto mainnet, however it’s now stay on Optimism. With this software, every staker can hedge their publicity to the debt pool. Most important article factors: * dHEDGE & Toros Fi…

Beginning quickly you’ll be able to earn $OP whilst you hedge your debt! That is superb for any Synthetix Staker who desires to correctly handle their debt!

Coming quickly: Elevated capital effectivity on $dSNX

➡️ precisely hedge your sUSD debt

➡️ earn Stablecoin Yield on the money part of the debt pool (at the moment about 85%)AND earn $OP on high as technique is totally deposited in @AaveAave

Why are you not hedging anon? https://t.co/3P0CT7EbAJ pic.twitter.com/gp7JiPbVwv

— Torŏs (@torosfinance) August 8, 2022

Most VCs get a foul rep in crypto, and for motive. Aelin plans to repair that, as raises on Aelin have a tendency to assist the group and provides natural growths to protocols. If you happen to didn’t know already Aelin is a protocol that allows the decentralization of the fundraising course of.

As an alternative of getting to depend on a VC to fund your venture and probably not align along with your group and objectives, you’ll be able to promote on to your group and nonetheless see your protocol objectives involves fruition.

A increase with Aelin could be achieved in 4 steps:

- Create a Pool and current deal phrases

- Traders deposit capital

- Trade funding tokens for deal tokens

- Achieved!

At present Aelin obtained 900,000 $OP tokens and is partnering with Velodrome on Optimism to assist distribute these $OP tokens.

After suggestions from the Aelin Group, Optimism, & others the AELIN $OP Distribution has been altered to make the most of these tokens to extend the variety of Aelin swimming pools.

40% to LP Stakers (AELIN/ETH)

60% to a Pool Incentive Program

Learn extra 👇https://t.co/0mUgFCSDmE

— Aelin 👾 (@aelinprotocol) Could 26, 2022

Aelin is distributing voting rewards (additionally referred to as “bribes”) in OP to be able to maximize the VELO rewards emitted to the AELIN/WETH pool. This implies LPs will likely be incomes VELO as a substitute of AELIN. It is very important word that the Velodrome DAO will likely be matching rewards with Aelin treasury making emissions of VELO bigger than the earlier token incentive program.

As described in AELIP-22, the present distribution of OP will observe the plan beneath: 40% to LP stakers (AELIN/ETH), or equal program to take care of liquidity on the AELIN/ETH pair 60% to a pool incentive program OP tokens will likely be taken from the 40% stored to reward LPs. A complete of $16,000 USD in OP will likely be taken from this allocation to run this trial. If outcomes are satisfying on the finish of the 4 weeks, one other AELIP is perhaps offered to increase this program. That is spelled out right here:

Velodrome Aelin/WETH Pool 2 Incentives – Trial Program

With the implementation of AELIP 28 – The Aelin Treasury has simply begun incentivizing AELIN/WETH liquidity suppliers on Velodrome with a trial program of $4,000 USD (paid in Optimism tokens) per week. Please learn extra for those who’re concerned about incomes LP rewards along with your Aelin.

A latest venture utilizing Aelin for a increase is Muse Group:

We’re past excited to have @MuseGroupDao backed by @kaiynne elevating on Aelin.

Wish to study extra about their pool?

Test it out –> https://t.co/AAvqIHBwYk https://t.co/k5Gs0gedyu

— Aelin 👾 (@aelinprotocol) July 23, 2022

That ends the Synthetix ecosystem on Optimism for now, so lets discover another protocols have gotten symbiotic within the OP ecosystem.

Velodrome:

Velodrome is a decentralized alternate and liquidity market on Optimism. Their mission is to be the liquidity base layer of Optimism, permitting customers to commerce digital belongings in a safe means, with very low charges and low slippage.

As an AMM tailored from Solidly, Velodrome shares sure options with AMMs like Uniswap, with sure modifications:

- buying and selling price of 0.02%

- near-zero slippage on uncorrelated or tightly correlated digital belongings

- route trades by way of steady and unstable asset pairs

- no-upkeep, flashloan-proof, 30 minute time-weighted common worth (TWAP) with direct quoting help

It incorporates components of Curve, Solidly and Votium with ve(3,3) tokenomoics.

The venture has been described as a combo between main steady liquidity protocol Curve, Andre Cronje’s notorious Solidy, and Votium (a protocol for incomes bribes on Curve/Convex).

- Velodrome liquidity suppliers earn VELO emissions

- veVELO holders vote on which liquidity swimming pools obtain these VELO rewards, and swimming pools earn in proportion to the voting energy they accrue per epoch, i.e. every week

- veVELO holders then earn from the buying and selling charges generated by the swimming pools they voted for in proportion to their voting energy

Lastly, veVELO holders additionally earn from the bribes paid out to the swimming pools they voted for, in addition to from veVELO rebases that are non-dilutive, which means veVELO holders obtain veVELO from them slightly than VELO

Velodrome is an AMM designed because the central buying and selling and liquidity market on @optimismPBC.

It’s the subsequent evolution of the @solidlyexchange mannequin launched by Andew Cronje.

Launching on Could thirty first with 10+ companions, it would kick begin #OPSummer.

Want a 101?👇🧵 pic.twitter.com/0xgZUedNMN

— Velodrome (🚴,🚴) (@VelodromeFi) Could 29, 2022

There are two sorts of swimming pools on Velodrome:

- “Variable Swimming pools” for uncorrelated belongings, like its SNX/sUSD pair.

- “Steady Swimming pools” for correlated belongings, like its USDC/sUSD stablecoin pair or its WETH/sETH steady asset pair.

Velodrome has a candy $OP distribution plan to their $veVELO lockers!

We have simply airdropped a report breaking $90,000 in bribes to $veVELO lockers.

We have additionally simply airdropped over $460,000 in $OP locking incentives to $veVELO lockers.

Thanks to all of the lockers making a long run guess on @VelodromeFi and @optimismFND ecosystem! pic.twitter.com/p8lU3CFnJT

— Velodrome (🚴,🚴) (@VelodromeFi) July 28, 2022

Checkout their dune dashboard to observe alongside on stats:

Dune

Blockchain ecosystem analytics by and for the group. Discover and share knowledge from Ethereum, xDai, Polygon, Optimism, BSC and Solana without cost.

Aave:

Aave V3 wants no introduction, however having them lastly on Optimism is a blessing! They just lately obtained 5 million $OP tokens from the OP Basis.

The @OptimismFND Liquidity Mining program is stay on Aave V3

This system will run for 90 days with a distribution of 5M OP to the Aave Protocol’s Optimism Market customers

Claiming help for rewards will likely be lively quickly!

Feeling Optimistic 👻

— Aave (@AaveAave) August 4, 2022

As soon as they kicked on incentives the TVL skyrocketed 5000% in 30 days, and now sits at 552 million on Optimism.

Granary: The Granary is a decentralized, user-driven borrowing and lending liquidity market impressed by AAVE V2. What is just not listed on Aave offers Granary their area of interest for lending on Optimism! At present you’ll be able to deposit your $OP tokens and earn 3-25percentAPY, after which borrow $USDC from 1-3% APY

Granary plans to Launch sUSD and SNX deposits right here quickly. The roadmap for Granary could be discovered right here:

Trace: Their token airdrop on Optimism has not occurred but, and can go to protocol customers with extra geared in the direction of of us who borrow.

Pickle Finance:

Pickle Finance is a yield aggregator. They combination and compound yields from different protocols. It saves you money and time in comparison with doing it your self. Yield Aggregators exist for yield farmers (such as you) who wish to make investments cash and maximize income by leveraging completely different DeFi protocols and techniques for elevated returns.

Pickle Finance makes it simple so that you can earn nice compounding yields in your deposits, once you don’t have the time to compound it each day or the gasoline price is simply too excessive for frequent compounding to be achieved.

They got here to Optimism round early February 2022, and just lately obtained 200,000 in $OP tokens to distribute to protocol customers!

And we’re off to the races!🚴🚴

We’ve launched 9️⃣ new Jars, auto-compounding @VelodromeFi LP Pairs on @optimismFND

These new Jars will likely be eligible to obtain duel rewards within the coming weeks off the again of our accepted Optimism Governance Fund proposal.

Try the Jars👇 pic.twitter.com/p0JrppCRfm

— Pickle Finance (🔄,🥒) (@picklefinance) August 7, 2022

Pool Collectively:

Pooltogether is a crypto-powered financial savings protocol primarily based on Premium bonds. Get monetary savings and have an opportunity to win each week!

PoolTogether on Optimism – PoolTogether Consumer Information

Optimism gives quick transactions, low charges, and leverages the safety the Ethereum community offers.

It is a good spot to deposit $USDC you wish to save on Optimism. Present yields for $USDC are 10% APR (3% for USDC and seven% OP tokens), with an opportunity to win each day prizes:

Pool collectively obtained 450,000 $OP tokens to distribute to customers.

https://medium.com/pooltogether/optimism-rewards-soon-️-8b06d6c8bcc8

Pooltogether just lately got here out with a brand new function that permits customers to delegate their yield to different wallets. This implies you are giving one other pockets extra possibilities to win prizes with out dropping custody of the underlying deposit. You share your odds with others however preserve the funds.

That is tremendous highly effective and can provide DAOs the flexibility to deposit treasury funds and delegate to their customers or token-holders, or a person may delegate to family and friends to successfully onboard them to Defi!

Protocols not talked about intimately however deserve a HUGE shoutout: Uniswap, 1inch, Curve With out them Synthetix wouldn’t be the place it’s!

All good issues should come to an finish. I hope you gained one thing from this!

Fellow Spartans, this isn’t monetary recommendation, however I depart you with some extremely dangerous (degen) methods I’ve heard talked about in varied discords:

Cheers!

[ad_2]